A Premier Dividend Growth Stock

Walt Disney (DIS) is the type of business we like to own in our Top 20 Dividend Stocks portfolio. The company has some of the highest scores for Dividend Safety (96) and Dividend Growth (99) in our entire database, and we think Disney's future is bright.

Despite its portfolio of extremely well-known consumer brands and hard-to-replicate assets, the stock has traded down from $120 per share in late 2015 to roughly $95 per share today.

Is it time to buy some shares, or is more downside likely ahead? Let's take a closer look at the business.

Business Overview

Disney was founded in 1923 and has grown into a diversified worldwide entertainment company with a number of cable TV networks (e.g. ESPN, The Disney Channel, ABC Family), amusement parks and resorts (e.g. Disneyworld), motion pictures (e.g. Star Wars), and consumer products. Just over half of Disney's total profits were generated from its Media Networks segment in 2015, with another 21% from Parks and Resorts, 13% from Studio Entertainment, and 12% from Consumer Products.

Business Analysis

Disney is arguably the most effective storyteller in the world. Humans love stories and have been telling them for literally thousands of years. As an article in The Atlantic notes, "Humans are inclined to see narratives where there are none because it can afford meaning to our lives, a form of existential problem-solving."

Not surprisingly, forming a business around this existential human need has worked out very well for Disney over the years - the company is one of the most iconic consumer brands and was named the world's 13th most valuable brand in 2015. Star Wars, Snow White, Mickey Mouse, Cinderella, Thor, and Frozen are just a few of Disney's well-loved storytelling assets.

The crux of the company's success lies in its ability to consistently identify and create high quality branded content. The company has demonstrated excellent skill in developing its own content, as well as making strategic acquisitions, which include Pixar (2006), Marvel (2009), and Lucasfilm (2012).

Once Disney has created a new favorite character, movie, or show, it can leverage that content across almost all of its businesses and technology platforms, reinforcing their recognition with consumers and creating a long, diversified tail of income. It's amazing to think how much money a character like Mickey Mouse is still making for Disney nearly 90 years after its initial launch despite constantly evolving consumer tastes. Disney clearly has a knack for developing timeless content and stories that appeal to our foundational human traits.

Many of the company's assets are also nearly impossible for competitors to replicate because of their dependence on Disney's trademarked brands (e.g. Disneyworld). As a result, the company is able to create strong emotional attachment with consumers and command strong pricing power given its scarcity value (where else can you watch SportsCenter or visit Magic Kingdom?).

With an ability to develop memorable content for practically any demographic, geographic region, and technology medium, Disney has a long runway for growth.

Disney's Key Risks

Like most consumer-focused businesses, Disney must deal with consumer tastes that are constantly evolving. As a content company, Disney needs to produce relevant programs that consumers want. Given the company's track record for producing timeless brands, we are less concerned with this risk.

The greater concern investors have with the stock is how changes in content consumption could impact the profitability of Disney's media networks, which generate roughly half of the company's total profits and include crown jewel ESPN.

It's no secret that consumers have an ever-increasing number of choices when it comes to consuming content. We can now watch TV on our iPads, rent movies online, and even cut our cable cords altogether and use cheaper alternatives like Netflix and Hulu.

The risk is that traditional pay TV packages, which bundle ESPN and other Disney networks together with other channels, move to more of an a la carte system. Many TV watchers have to pay for ESPN as part of their current bill (ESPN costs roughly $8 per month) regardless of whether or not they like sports, so the fear is that Disney could see some of its easy profits disappear depending on how the cable landscape evolves.

The company reported more ESPN subscriber losses during its fourth quarter of 2015, bringing its total lost subscribers to roughly seven million over the last two years combined. As a result, Disney's Media Networks segment saw its operating income fall by 6%. Higher programming costs also dinged profit as Disney has to pay for rights to air sporting events.

We believe Disney will successfully evolve its content distribution however it needs to over the long run, but we are less certain what will happen with its media profits over the near-term. They have driven much of the company's growth in recent years, and investors could be in for a surprise if trends flatten out or even decline for a period of time. If this were to play out, it would seem to be a buying opportunity for long-term dividend growth investors - sports will remain an extremely popular category, and Disney's content is no less valuable than it was before.

In addition to uncertainty in Media Networks, the company can also experience volatility in its Studio Entertainment business, which primarily produces movies. Production costs are very expensive and are incurred before Disney recognizes revenue - in other words, a lot of money is spent before knowing if it will result in a big hit with consumers or fizzle out for a sizeable loss. This segment has delivered record profits for two straight years, but there is always risk of a dud if Disney gets it wrong. Once again, we would view this as a buying opportunity.

Dividend Analysis: Disney

We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

Dividend Safety Score

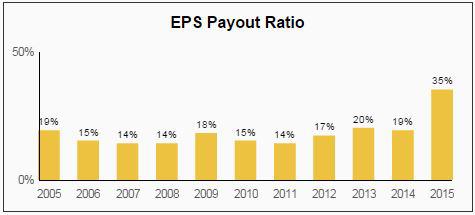

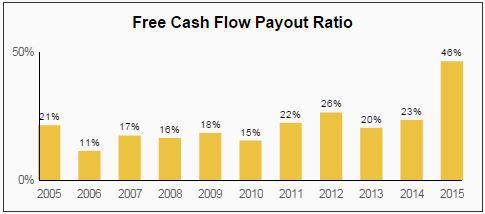

Our Safety Score answers the question, "Is the current dividend payment safe?" We look at factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Disney has one of the safest dividends that investors can find. The company's earnings and free cash flow payout ratios have averaged less than 20% over the last decade and sit in the mid-20% range over the last 12 months. This is a very low and healthy payout ratio for any business, especially one like Disney's that is growing earnings at a double-digit clip.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

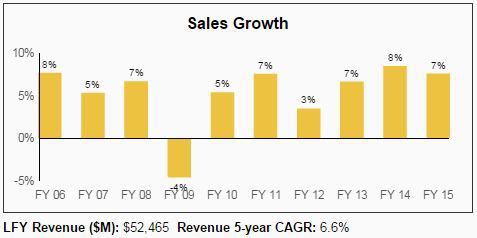

In addition to low payout ratios, Disney's business held up fairly well during the last recession. During the financial crisis, Disney's sales fell by 4% and its earnings per share declined by 23%. The company's powerful brands helped it weather the recession better than most consumer-driven stocks, and DIS's stock was able to outperform the S&P 500 by about 8% in 2008.

Source: Simply Safe Dividends

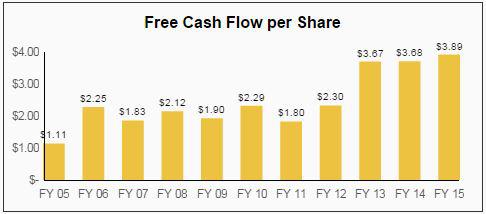

Disney's strong brands, timeless content, pricing power, and massive distribution have resulted in excellent free cash flow generation. As seen below, Disney's free cash flow per share has more than tripled since fiscal year 2005, fueling generous dividend growth along the way.

Source: Simply Safe Dividends

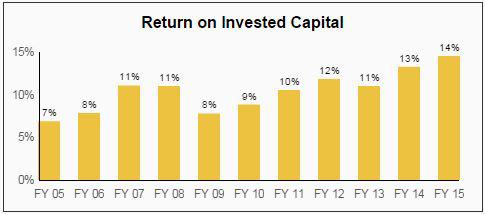

Not surprisingly, Disney has earned a nice return on invested capital each of the last 10 years. Businesses that earn double-digit returns often have an economic moat, and Disney is no exception.

Source: Simply Safe Dividends

Looking at Disney's balance sheet, we can see that the company has about $4.3 billion in cash on hand compared to debt of $18.9 billion. Importantly, the company's entire debt could be covered with its cash and just 1.1 years of earnings before interest and taxes (EBIT). Furthermore, the company generates very reliable free cash flow, which provides excellent dividend coverage. Overall, Disney's balance sheet looks good.

Source: Simply Safe Dividends

To summarize, Disney scored extremely well for Dividend Safety because of its low payout ratios, strong free cash flow generation, decent performance during the last recession, and relatively clean balance sheet.

Dividend Growth Score

Our Growth Score answers the question, "How fast is the dividend likely to grow?" It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth and payout ratios. Scores of 50 are average, 75 or higher is very good, and 25 or lower is considered weak.

Disney's dividend growth prospects are excellent, prompting its 99 Dividend Growth score. While the company is far from becoming a dividend aristocrat any time soon, Disney has paid uninterrupted dividends since the 1980s and grown its dividend by approximately 18% per year over the last 10 calendar years.

Disney paid its dividend on an annual basis until last year when it moved to a semi-annual payment schedule and raised its dividend by 19%. With low payout ratios, a healthy balance sheet, and above-average earnings growth prospects, we expect Disney to continue rewarding shareholders with double-digit dividend increases for years to come.

Valuation

DIS's stock trades at roughly 15x forward earnings and has a dividend yield of 1.5%, which is in line with its five year average dividend yield.

While evolving pay TV trends have created some near-term uncertainty regarding Disney's earnings growth rate, we believe this is a business that can continue achieving mid-single digit sales growth and near double-digit earnings growth over at least the medium-term.

If our expectations are met, the company appears poised to deliver a double-digit annual total return with excellent dividend growth prospects. However, we feel much less certain about Disney's earnings growth over the next 1-2 years given the negative subscriber trends in Media Networks and the tough comps in Studio Animation.

If it turns out that the market has overestimated profit growth in these businesses and the stock pulls back further, we would really start to get interested.

Conclusion

Disney is a wonderful business with a portfolio of brands unlike any other. While concern about profit growth in Disney's Media Networks segment has us on the sidelines right now, we would really like to own this blue chip dividend stock in our portfolio. Disney is on our watch list, and we would like to revisit the stock if it trades into the mid-$80s.

Disclosure: the author has no position in any of the stocks mentioned.