$21 Trillion And Counting: Why Deficits Didn't Matter During The Age Of Monetization, 1987-2017 (Part 2)

<< Read Part 1: $21 Trillion And Counting: Why This Time The Fiscal Wolf Is Really At The Door

For the past 30 years fiscal deficits have been a big financial nothingburger because the Fed and other central banks gutted their sting. So doing, they drastically and dangerously falsified the market for government finance by weaning politicians of the one element that kept modern Big Government fiscally contained.

We are referring to the historical fear among politicians that fiscal deficits cause "crowding out" of private investment and rising interest rates. Indeed, that proposition was universally understood during your editor's sojourn in the Imperial City between 1970 and 1985 as a staffer, Congressman, and budget director.

As it has turned out, however, there was implicitly a crucial qualifier. To wit, it was naturally assumed that fiscal deficits would be financed in honest capital markets and that yields in the bond pits were free market prices which cleared the balance between the supply of private long-term savings and the demand for term debt.

The very notion that it could be otherwise----that the central banking branch of governments could swoop into capital markets to scoop up and sequester in their trillions the debt emissions of the fiscal branches--- was scarcely imaginable among anyone reasonably educated and minimally informed.

After all, had Lyndon Johnson, Tricky Dick, Jimmy Carter or even Ronald Reagan suggested that the Federal Reserve buy government debt at rates which exceeded annual issuance by the US Treasury, as was the case during the peak years of QE, they would have been severely attacked---if not subjected to impeachment----for advocating rank financial fraud.

Nor is that mere conjecture. For instance, after his "guns and butter" deficits had breached an unheard of 3% of GDP (outside of world war), LBJ essentially concluded he had no choice except to commit political hara-kiri by forcing a 10% surtax through the Congress in the 1968 election year.

Likewise, upon inheriting the Oval Office in August 1974, Jerry Ford famously attempted to curtail excessive fiscal stimulus with a "WIN" tax, and Jimmy Carter never let his deficits get above 2.5% of GDP----even though he had a big spending domestic agenda.

But the most dispositive case of all was that of Ronald Reagan. Notwithstanding his reputation as the scourge of taxes, the Gipper signed three consecutive tax increase bills in 1982, 1983 and 1984 after the deficit exploded to 6% of GDP owing to the original Reagan tax cut and huge defense build-up.

Nor were those increases window dressing. On a combined basis, they rolled back fully 40% of the 1981 tax bill and amounted to 2.7% of GDP or $500 billion per year in today's economy; and they were enacted with little resistance by deficit-fearing politicians from both parties on Capitol Hill.

Even as late as 1986, the fear of "crowding out" was fully operative in the Imperial City. In fact, Ronald Reagan's signature tax bill---the reform act of 1986----was strictly deficit neutral.

Although it lowered the top tax rate to just 28%---including wages, salaries, dividends and capital gains---it was paid for 100 cents on the dollar with a massive reduction in loopholes and passive tax shelters; and that was done at the insistence of a strong bipartisan coalition on Capitol Hill that had to fend off the lobbyist hordes of Gucci Gulch to get it done.

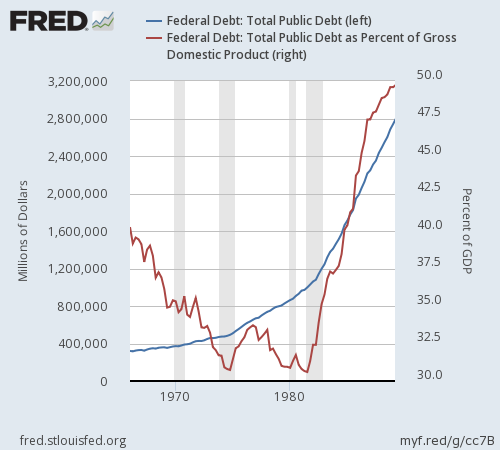

Moreover, the Congressional guardians of the old-time fiscal religion were fully vindicated the very next year when the residual Reagan deficits---which still weighed in at 4.4% of GDP in 1986----began to cause severe "crowding out" effects. By then, the US economy's post-recession resurgence had gathered a considerable head of steam as it approached the zone of full employment.

Accordingly, during the first 10 months of 1987 interest rates on government bonds soared by 40%and were heading back toward double digits. As it happened, the "yield shock" pictured below triggered the stock market crash of October 1987, which over a four week period took the S&P down by 30%.

The US economy, in fact, was on the road to a severe recessionary relapse---meaning that the Reagan economic legacy would have been far different.

Rather than an alleged triumph of tax-cutting, it would have ended-up in fiscal calamity---with the Gipper ignominiously shuffling out of town in the middle of an economic crisis every bit as bad as the one he inherited.

What happened, of course, is that the new Fed Chairman, who was a partisan Republican and eager seeker of power and praise, saved the day. By opening up the monetary spigots at the Fed, he averted the very credit crunch that Ronald Reagan's giant fiscal deficits would have otherwise generated.

With the passage of time and relentless revisionism, in fact, the fiscal "near-miss" of the Reagan era was falsely transformed into a triumph of tax-cutting and bastardized supply-side economics.

The picture below depicts what actually happened. That is, the last outbreak of crowding out and soaring bond yields ended up being airbrushed out of history.

Instead, then and there Greenspan commenced the age of monetary central planning. During the next 30 years, fiscal deficits were massively monetized and politicians steadily lost their fear of them.

At length, both ends of the Acela Corridor came to discount their salience entirely. By 2001, Dick Cheney pronounced the "all clear", speciously insisting that Ronald Reagan proved deficits don't matter.

Worse still, Wall Street came to embrace them rather than be petrified by them as it was upon the unveiling of the Reagan fiscal program in the spring of 1981.

Thereafter, in the eyes of Wall Street budget deficits became just another tool in Washington's kit of "whatever it takes". That is, anything that could fuel even the appearance of short-term economic growth was embraced unthinkingly because "growth" of any shape, form or quality became the predicate for endless increases in the stock market averages.

To be sure, the age of monetization did not explicitly embrace central bank financing of government deficits as a good thing or even the main objective.

Instead, the whole regime was cloaked in the garb of macroeconomic management. The latter encompassed flattening or even abolishing the business cycle to the point of an endless Great Moderation; and the conceit that 12 members of the FOMC had the capacity to make capitalism work better than capitalists in their millions.

Still, it was as much a giant fraud as would have been evident had the macro-economic cover story not been invented. That is, if the massive expansion of the Fed's balance sheet after August 1987----from $200 billion when Greenspan took office to $4.5 trillion at the peak of Bernanke's money printing madness---had been justified as an expedient way to fund Big Government without the inconvenience of raising taxes or crowding out private borrowers in the capital markets.

So "something for nothing" was always the essence of the post-1987 Keynesian central banking regime. Yet since the resulting massive suppression of interest rates and falsification of financial asset prices was purportedly being done for the greater good of higher GDP and employment, the politicians were astute enough not to look a gift horse in the mouth.

The Republicans most of the time, and the Dems when the GOP was in power, continued to occasionally genuflect to the fiscal verities. But as time passed, the chorus increasingly lapsed into mere ritual incantation.

As the Greenspan version of monetary central planning got its sea-legs in the 1990s, however, the Fed's monetization campaign turned even more insidious. That's because monetary central planning soon spread from the Eccles building to the far corners of the global economy.

As we have frequently documented, the mercantilist and statist regimes of East Asia and the petro-states, in particular, could not abide the flood of dollar liabilities the Fed was pumping into the global financial system. So in order to keep their exchange rates from soaring and crippling their export industries, they massively intervened in the FX markets, buying dollars with local currency and sequestering these greenbacks in their pliant central bank vaults as they did.

At length, the world's central banks (and their affiliates) acquired trillions of UST and GSE liabilities, as well as like and similar holdings of other so-called FX reserves.

But in a world of floating exchange rates and no settlement of current account imbalances with universally agreed to monetary assets (i.e. gold) these balance sheet build-ups had nothing to do with the management of monetary reserves in the pre-1971 manner. Instead, the graph below represents a massive central bank bond-buying spree that amounted to nothing less than an unprecedented Age of Monetization.

Accordingly, the central banks have had their Big Fat Thumb on the supply and demand scales in the money and capital markets so forcefully and so persistently that the reaction function of politicians has been decisively and destructively anesthetized.

Like money managers scrambling into harm's way of risk in their desperate search for yield, democratic politicians have lost all knowledge of and regard for the "crowding out" effect that historically kept their forebears on a reasonably straight and narrow fiscal path during peacetime.

The key to understanding the "yield shock" coming down the pike, therefore, is to recognize the profound truth that what was taken for granted prior to 1987 by players on both ends of the Acela Corridor is not even recognized in either venue---let alone comprehended----in 2018

So as the Fed pivots to quantitative tightening (QT) for the first time in decades----and at a scale that has never before been imagined because the Fed's balance sheet had never previously approached anything like a quintupling in just six years----the level of complacency on Wall Street and in Washington is staggering.

As we will show in Part 3, the age of monetization is now over and done. The Fed's balance sheet shrinkage campaign is now on an auto-pilot and is far more important than its meaningless dickering with its so-called funds rate.

Accordingly, its bond dumping campaign will reach $600 billion per year by October, and ultimately cause upwards of a $2 trillion downsizing of it balance sheet

Moreover, our Keynesian monetary planners in the Eccles Building will not desist from their bond dumping program until it is too late.

That is, until after the "yield shock" gathers unstoppable momentum and brings the stock market crashing down, and the kind of C-suite triggered labor and asset liquidation campaign that now passes for what used to be called recessions.

At length, the Fed's balance sheet shrinkage campaign will surely elicit a road to Damascus experience on Wall Street. Like in the story of Saul of Tarsus, the scales which have accumulated over its eyes during the last decades of massive debt monetization by the Fed and other central banks are about ready to fall away.

Then, look out below. The fact is, a Fiscal Doomsday machine has now enveloped Washington in the form of a resurgent Warfare State, the demographically driven Welfare State, the fiscal madness of the current Trumpite/GOP ruling party and the outbreak of outright political warfare between the hinterlands and the Deep State.

Accordingly, there is not a snowball's chance in the hot place that the mother of all yield shocks can be avoided.

After being AWOL for three decades during the central bank Age of Monetization, "crowding out" is coming back with a vengeance.