2018: The Collateral Case

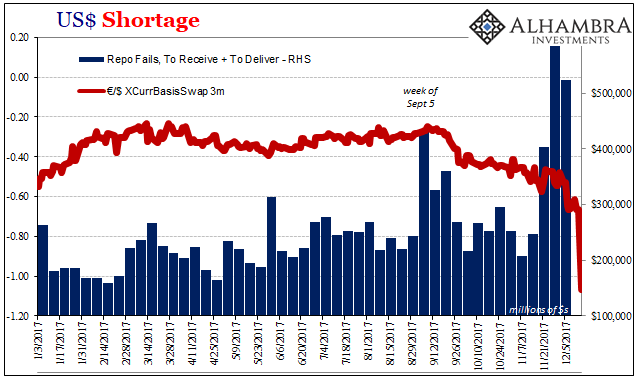

Last December, something clearly broke. The global basis had swept far under zero again, an ominous sign that eurodollar banks were having trouble creating, finding, and redistributing global funding. A cross-currency basis swap is one way to do it, the negative basis indicating a desperate shortage of dollars offshore (eurodollars).

The negative basis wasn’t the only thing suggesting dramatic distress. Concurrently, the domestic repo market had exploded. Repo fails for the week of December 13, 2017, were an astounding $832 billion, the very same moment the cross currency basis (especially against euros) fell off a cliff. Our Chart of the Week for that same week essentially predicted what FRBNY would report for fails:

When the Fed a week later published the data from primary dealer call reports, the updated chart looked like this:

It all went back to earlier in September 2017. But if that was when it started, December was when it got serious. I wrote:

Just as raging wildfires have a horrific tendency to jump fire-lines and even whole valleys given enough energy, funding issues can jump markets. The global “dollar” market is not a monolithic whole and never has been. It may be (very likely is) more fragmented today than at any point in the past owing to persistent balance sheet capacity problems. It would be a clear point of magnification, then, to find serious problems in one part of the eurodollar system spilling over into another one.

On its balance sheet, a separate series, the Fed also showed that starting the week of December 13 UST’s began to disappear from its custody. The US central bank holds more than $3 trillion in such securities on behalf of overseas official and commercial institutions. These do not register within its inner workings for the Fed’s monetary purposes, merely a courtesy that gets reported to the public.

In a matter of just four weeks, by the first week in January, more than $36 billion of UST’s vanished from Fed custody. We don’t know for sure where they went, but we can reasonably assume that such a massive “silo” of the most pristine collateral (for US$ purposes) owned by foreign central banks and banks might’ve been in high demand during that time. Not for inflation hysteria and a world heading in the right direction but as collateral in short-term funding liabilities of all kinds as the global monetary system reset toward the dark side.

Another outbreak of repo fails and at the tail end of January global liquidations. It’s been much more of the same ever since – except for repo fails as reported by FRBNY.

The repo market is more hidden than you might think. Practically invisible all along especially in mainstream discourse, and it doesn’t appear in any Economics courses, to suggest there’s even more out there in the shadows might not seem an important distinction.

What gets included within FRBNY’s tallies is only what the Primary Dealers report. By and large, that’s only a fraction of what actually goes on. Most funding transactions, repo or not, take place where only the counterparties doing them know it. Repo as FX is most often bilateral and bespoke. I have UST’s, you have “cash”, and we get together on our own terms.

In actual practice this can be more complicated, it’s even more bespoke and no longer simply bilateral. You have cash but I don’t have UST’s even though I want to receive repo borrowing terms as if I did. To get them, I would simply engage in a collateral transformation with another party, a money dealer, who can obtain them on my behalf.

So, I have junk bonds, you have cash, a money dealer this securities lender can find UST’s from otherwise inert silos, and the bilateral repo carried out under pristine collateral is really a trilateral double bespoke transaction where junk forms the basis of everything. I give the money dealer the junk, he gives me the UST’s, I give you those for cash as if I owned them, and the smallest sliver of the wider world knows only about that last part of the transaction.

Fortunately for me, there is a robust Eurobond market where various flavors and varieties of junk exist all in dollar denominations. Depending on the credit, the terms of collateral transformation could be more or less favorable (the spread paid to the money dealer to “borrow” securities on my behalf and relend them to me). If I wished to use, say, a Eurobond from Argentina then I should expect a relatively large haircut for the money dealer’s protection.

But, Argentina has been an absolute darling, a media frenzy, and Wall Street hero. Since 2016, the Eurobond market had embraced this long-shunned section of South America. Where before this poor country couldn’t sell one single dollar in securities no matter how high the coupon attached, in 2017, in particular, the world couldn’t get enough Argentine paper at any price.

In the context of securities lending, that would’ve meant right around the end of 2017 Argentine debt almost certainly was given more favorable terms (in securities lending) than it should have ever been afforded. I don’t know for sure if it was subprime MBS-like friendly, but undoubtedly way too far in the same direction. Argentina bonds were great because everyone loved Argentina.

Then they didn’t.

Bonds that had been issued only a month or so before, the prospectus didn’t really come out until November 2017 on a lot of them, were in January 2018 suddenly plummeting in value. These same debentures that had been so oversubscribed, so fatuously loved, they were trading at huge premiums one day and a few weeks later way underwater.

Dealers, any who may have accepted them at the start of the trilateral repo described above would’ve been forced to immediately and substantially alter the terms of the collateral transformation. I might have pledged previously $110 in Argentinian Eurobonds to get $100 in UST’s for $99 in repo, now I’ve got to pledge $120 in Eurobonds for the same funding (these numbers are just for illustration purposes).

Or sell a significant fraction of them so as to get back to a matched dollar book.

Argentina was a more extreme example, to be sure, but the entire Eurobond market which had been thriving (bubbling, you might say) suddenly hit a wall of reality in January 2018 – all just before the first wave of global liquidations. It wasn’t just Argentina’s new issues that were being repudiated, they weren’t alone in floating as many bonds as they could get away with in 2017 under “globally synchronized growth.”

Even longstanding Eurobonds fell off a cliff. Here’s one example of a South African Eurobond which for several years traded in a steady range around 95 plus or minus only a point or two:

The first plunge in January was the shock, the currency crisis in April was the hammer. Eurobond prices continued lower across-the-board, and as they did between mid-April and mid-May, EM risk skyrocketed (perception) as the dollar did. Anyone trying to use these things for the trilateral repo (or as collateral in trilateral FX) would’ve been increasingly at risk for being shut out (or, hat in hand, paying unreasonable terms just to stay afloat).

Some of those unreasonable terms may mean I have to buy and obtain pristine collateral no matter what, UST’s or German bunds as a replacement for EM Eurobonds increasingly shunned and non-negotiable where just months even weeks before they were universally celebrated.

It doesn’t fully explain May 29, but I think it gives us a sense of what was actually going on in some parts of these disturbed shadows. Not just any sense, but an important window into what’s gone wrong this year.

The distortion in the eurodollar futures curve (above), for example, doesn’t show us any of this, it merely registers that markets noticed what was going on in collateral appreciating the situation for what it represented (central bankers don’t know what they are doing; where’s this globally synchronized growth thing they all promised last year?)

That the FOMC had to much later refer to the “strong worldwide demand for safe assets” simply demonstrates their clueless nature. It wasn’t, and isn’t, demand for safe assets it was, and is, the breakdown of collateral chains, claims, and flows. These aren’t trivial matters, it is in many ways the backbone of how things really work in the modern monetary age.

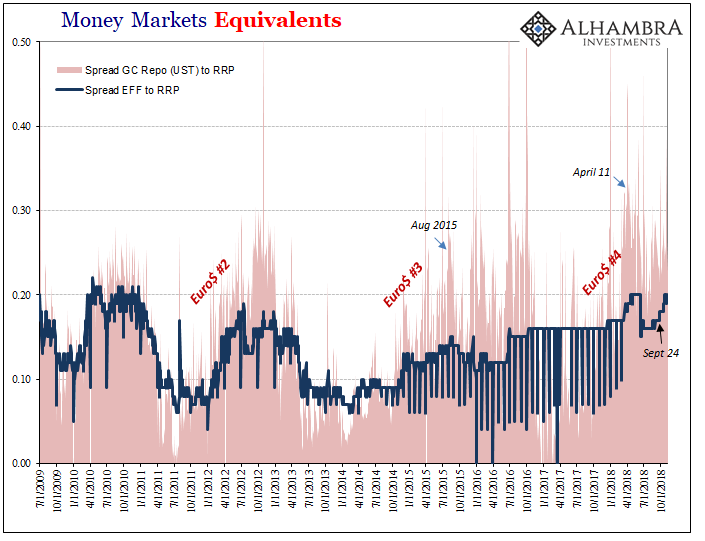

These difficulties and their effects both direct and indirect are the very stuff of 2018. There can be no doubt that collateral in repo and outside of it is the primary symptom of what has gone wrong and is still going wrong right at this very moment:

This isn’t to say that collateral disruption is causing stock markets to liquidate; no, those are symptoms of the same general problem. Stocks are an outlier anyway meaning that they aren’t directly monetary assets. But if you have funding issues for whatever reason and need to sell US$ or German€ assets in a hurry, stocks will do in a pinch. These are different outlets of the same underlying problem.

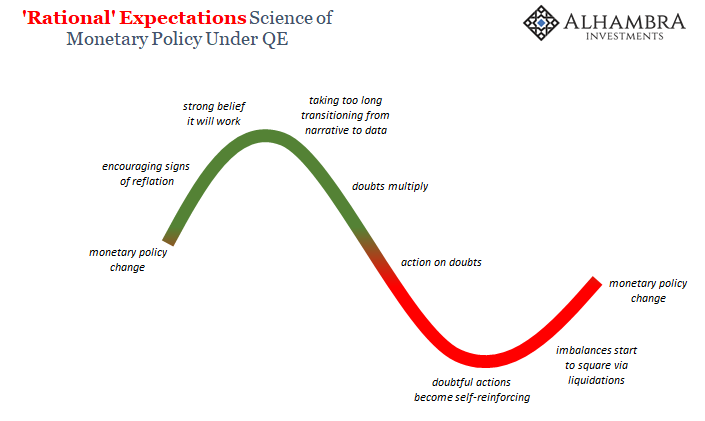

What problem? A eurodollar system experiencing its fourth, not first, setback. Each time it generally follows the same pattern. Cautious optimism spreads in the aftermath of the last one, aided and supported by bewildering belief in central bankers with and without monetary policies that never actually work. Reflation #3 was the work of the ridiculous “globally synchronized growth” that perpetuated a collateral process as stupid as subprime MBS. AIG nearly failed a decade ago not because of CDS but because it was transforming collateral.

I’d write in conclusion that “they” will never learn, an obvious truth for nothing more than the fact that this is the fourth time at it. The system is broken, and it really doesn’t take much to go from “it seems like things are working” to “no they ain’t” at the flip of a switch. It’s not really that fast, these turns and inflections are deep, complex processes that take time to get where they are going.

And where is that? It’s always hard to say, impossible to predict for certain, but the one thing for sure right now is that we are closer to the beginning than the end and the overall general direction is the bad one. Again.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more