Unresolved: Nine Years Later Still No ‘Dollars’

The fact that we are still discussing illiquidity in “dollar” markets everywhere shows just how little has changed despite so much time and effort. It is August 9 again, the ninth anniversary of the day that changed everything. Even though it has been almost a decade, it’s as if “we” learned nothing from the experience. There are indications in 2016 that we are more repeating it than putting economically-required distance to the chaos and disorder of that day.

It all starts and started with money markets, fundamental places where order and hierarchy are supposed to reign more so than anywhere else. By the very nature of liquidity, if it isn’t liquid then it is axiomatically a change in risk. That was August 9, 2007. Before that date, Bernanke’s plea that subprime was contained was at least plausible (it was still, however, highly debatable). Afterward, what happened then showed that rather than being an imbalance in one isolated sector, the spreading questions were actually of a systemic, paradigm altering nature.

One of those was the geographic divide between onshore/offshore, from dollar to “dollar.” Before that day nine years ago, it was believed to be a seamless market easily transited by mere accounting, Milton Friedman’s bookkeeper’s pen. Any out-of-the-ordinary distance between LIBOR and federal funds would be easily bridged by balance sheet capacity moving between NYC and primarily London; if LIBOR was thought to be high, firms (domestic US) could borrow from their headquarters in NYC at around effective federal funds and transfer the “money” to eurodollar markets. Arbitrage, it was believed, was deep and continuous.

All that activity was governed by determined money market hierarchy which suggested risks involved in any part. There had never been any market-based reason to suspect there were any in that geographical “dollar” gap.

The exact chain of events are more for historical curiosity, but in short the specific sparks started with Countrywide issuing a press release finally admitting to short-term liquidity issues. That was significant not because the company had been denying it up to that point, but more so confirmation that this was far more than just subprime to so penetrate into serious wholesale funding woes. Whether related or as a separate matter, BNP then declared a halt to withdrawals in three investment funds, and then further separate disclosures that money market funds were pulling out of European funding markets (“dollars” to “euros”).

The effect of this chain reaction was immediate, and it was the CEO of Northern Rock who said it best after his bank became the first ignominious, major casualty:

The world stopped on August 9. It’s been astonishing, gobsmacking. Look across the full range of financial products, across the full geography of the world, the entire system has frozen.

It wasn’t just plain, bland illiquidity, though, that made what followed August 9 so catastrophically permanent. The entire eurodollar system essentially broke into its constituent pieces, no longer operating in a seamless capacity among repo, federal funds, eurodollar deposits, credit default swaps, interest rate swaps, and any other balance sheet capacity that used to flow freely and openly. It was the Titanic sealing up its watertight compartments in the vain hopes that segmentation would allow the system to save enough parts to remain overall afloat.

Both LIBOR and federal funds jumped on August 9 as the shock of illiquidity spread in all directions. That included, again, Europe and euro funding since wholesale banks in “dollars” also provide wholesale balance sheet capacity in all euro-currencies (from euroyen to euroeuros). Since this offshore funding mechanism, more akin to computer and network protocols than actual currency, is primarily dollars, the eurodollar majority took center stage. Recounting the tremors of that day just doesn’t do it justice, as I described on the occasion of its seventh anniversary:

To dryly observe what happened understates the severity of the event, as London trading for “dollars” saw an inordinate discrepancy that cannot be fully comprehended by mere factual recollection. On August 9, 2007, 3-month LIBOR rose from 5.38% to 5.50%; a trivial number at first glance. But in the context of global dollar flow, it was an immense tremor that kicked off the spate of “emergency” monetary measures that ultimately followed.

The so far permanent downward trajectory of the entire global money system was initiated by +12 bps in 3-month LIBOR, perhaps on par in historical terms with the assassination of Archduke Ferdinand in Sarajevo that everyone ignored until it “somehow” triggered the worldwide catastrophe of WWI. The visibility of August 9, 2007, as a demarcation, however, proves that it was despite its modest description very, very noticeable:

And Europe:

The real problem, in my view, became fully apparent the next day, August 10. The Federal Reserve had set a target rate of 5.25% for federal funds fully expecting that to apply to the eurodollar hierarchy and LIBOR through NYC/London arbitrage. While both EFF and LIBOR rose on August 9 to signal the start of illiquidity, it escalated to impassable when the next day EFF dropped to 4.68% while 3-month LIBOR remained hugely elevated at now 5.575% – the once-unified global “dollar” market split wide open. And while we often think of these rates as monoliths, they are actually and usually averages or weighted averages; effective federal funds being no different. On August 10, 2007, seeing the dramatic events of the day before, someone or several someone’s actually placed funding in NYC federal funds at 0.00% despite the 5.25% promise by the Federal Reserve (though that applies to maintenance periods rather than specific days, but that myth had never been challenged, either).

The 0.00% lower bound continued the next day, August 11. On and off, in phases, that would be the operative condition all the way into the panic; “too much” money in NYC and not nearly enough in London.

One of the very few, small silver linings of the crash and systemic break in eurodollars is that it provided an actual view into operations that were to that point, and have become again, totally hidden and unseen. I often describe it as akin to the Large Hadron Collider at CERN in Switzerland, where it takes enormous energy and pressure in order to tear apart matter to reveal its true nature and basic construction. Such was the events following August 9, 2007.

Unfortunately, as I wrote above, very few people and no policymakers that I am aware of anywhere in the world took advantage of the opportunity. That leaves us still vulnerable to a world that doesn’t fit with their descriptions. For years they have been saying there is nothing more to worry about, and for years we have been experiencing increasing tremors again – some of which are familiar to this past shock, and some that are new. Even in decay, the eurodollar does not stand still, constantly evolving.

There is so much noise now that it is often difficult to unpack what is significant. Among the signal variations is regulatory changes, and 2016 is no different. Whenever an economist or “expert” gets to actually discussing the state of money markets particularly since October 15, 2014, (though never directly addressing the events of thatday), it is always couched in the benign intention of prudent regulatory updates.

On July 23, 2014, for example, the SEC fully adopted recommendations for money market “reform” (under Section 2a7 of the Investment Company Act of 1940) among which required institutional prime money market funds to disconnect from the “buck.” Recall that prime money funds were a serious element of dread in the days leading up to the October 2008 panic, as several prime funds were in danger of “breaking the buck”, unable to redeem paper assets sufficiently at predictable prices while also supplying necessary liquidity to their investors flooding out of them. In 2010, the SEC study of this problem decided that floating NAV’s would provide an answer to the “buck” problem should it ever happen again.

The rules, however, don’t apply to government money market funds. The final rule was adopted in October 2014 with a “two-year transition period”, meaning that this October it will become effective. And it has become the go-to excuse for everything that we find wrong in money markets today – starting with once again rising LIBOR deviating sharply from federal funds and violating hierarchy.

I don’t doubt at all that there are effects of this new floating NAV regulation being felt in money markets, but you’ll forgive me if I remain quite unconvinced that is the full story. There is certainly some relationship in LIBOR, particularly 3-month LIBOR, as you can see above. Since the end of June, 3-month LIBOR has surged which might be related to the October regulation coming into that 3-month maturity window. And it might not be.

Among the anticipated changes to money market operations is that there are expected conversions of prime money market funds that invest in money market instruments like eurodollar deposits, repurchase agreements, and commercial paper into government portfolios that consist primarily of T-bills and shorter agencies. Thus, if the rise in LIBOR were related to this regulatory-driven shift we should find it at least in commercial paper volumes.

In fact, volume in especially financial CP has declined of late, but as you can plainly see above it doesn’t appear significant at all, falling easily within the same range as has been traded almost the entire “recovery” period. If there is a relationship to LIBOR, it isn’t immediately apparent.

Perhaps that relates, then, not to actual conversion of money market funds to this point and instead reflects money market expectations of same at some future point before October. If that is the case, and it is still arguable, then it still leaves us in the same general vicinity as August 9, 2007. I don’t mean by that statement that a panic is the inevitable result, only that systemic capacity remains so deteriorated and shrunken that it cannot absorb changes. If 2a7 is to blame, then the chart above proves that repeated systemic assertion.

The rise in 12-month LIBOR, as 3-month LIBOR, is out of all proportion. It is more than double what we saw during the whole 2011 crisis that started with a mini-crash in global stocks (late July/early August 2011). It is far more than anyone expects of so-called rate hikes over the next year, perhaps even two. In my view, the most important aspect is where it all began, marked just to the right of center on the chart immediately above.

Rather than regulations, the change in LIBOR takes place in concert with events; in this case the introduction of NIRP in Europe. That was significant both as a potential disruption to banking but more so as direct refutation of everything that had been said by officials about the “recovery” to that point. The escalation of 12-month LIBOR then followed after December 1, 2014, which had nothing at all to do with 2a7 and everything to do with “dollars”, particularly oil, junk bonds, and at that time rubles. In short, it was the first global burst of renewed crisis, an open warning about money supply.

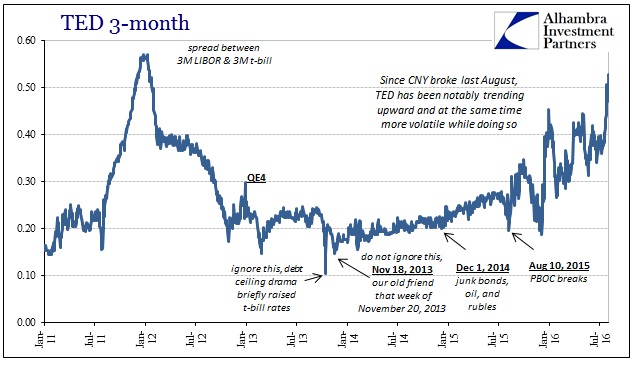

We find the same all fitted out in the TED spread, a measure of interbank risk starting with 3-month LIBOR and then subtracting the risk-free 3-month T-bill rate. From the start of December 2014 forward, there was the Russian crisis and then the Swiss National Bank in January 2015 being moved off its euro peg by “dollars.” The rise in TED spread continued if gently all the way into August 2015, culminating with the PBOC being the next central bank victim and then global liquidations that immediately followed.

Since that point, encompassing both liquidation waves in August and then January and February 2016, the TED spread has been on a more determined upward track as well as being more much, much more volatile as it increases. If someone can make a persuasive case that is due to 2a7 then I will quit my job and join a monastery.

Conventionally, the TED spread is believed an indication of interbank credit risk or even counterparty risk. What the events after August 9, 2007, showed, especially for those like Countrywide and Northern Rock, was that those risks also contain the element of liquidity risk. Thus, TED was not just indicating the growing interbank revulsion on the basis of solvency but rather the more immediate concern of liquidity. Both Bear Stearns and Lehman might have been insolvent, but they were never going to get that far and by the end it really didn’t matter. As Gordon Gekko tells Bud Fox near the end of the movie Wall Street, in the end it’s all about bucks.

The rising TED spread in 2015 and 2016, as 2007 and 2008, is all about bucks and who doesn’t have them. What we find here nine years later indicates the sudden return to general realization of the true native state of the eurodollar – nobody does.

Interjecting Charles Dickens, he recalled Dickens’ apt description of insurance, “A person who can’t pay, gets another person who can’t pay, to guarantee that he can pay.” But where Fisher only uses that simplified truth in limited circumstances as he saw them then, it counts for the entire monetary basis that we see both then and now. In other words, what Dickens admonished of insurance had been turned into the very basis for the world’s reserve currency. As China’s PBOC Governor Zhou Xiaochuan correctly pointed out at almost the same time, the world had been not on a dollar standard but a credit-based dollar standard; everything of the past decades is contained within that single distinction. Or, paraphrasing Dickens, a bank that has no dollars, gets another bank that has no dollars, to guarantee that everyone has dollars. [emphasis added]

If money market reform is totally responsible for the rise in money market rates including LIBOR since June, it is only because there are clear systemic, liquidity issues that remain even nine years after they first appeared. At best, this indicates that 2a7 “reform” is a change which the sapped eurodollar system cannot seem to manage, thus indicating gross systemic deficiency. And if this is almost totally unrelated to 2a7, it still amounts to the same thing; systemic deficiency which cannot handle the dramatic events of the past more than two years.

This is the “rising dollar” that doesn’t match dollar indices, the more hidden menace of the fatal break that criminally remains unresolved all these years later. The amount of time is just about unthinkable at this stage, especially as the cost in terms of time is now itself beyond comprehension. It is the fitting paradox to modern central banking; a world since flooded with bank reserves is still desperately short of money and getting more so. Even so-called solutions are a problem.

Disclosure: None.