Viewray Powers Up - Our Top Pick For Balance Of 2017

Company overview

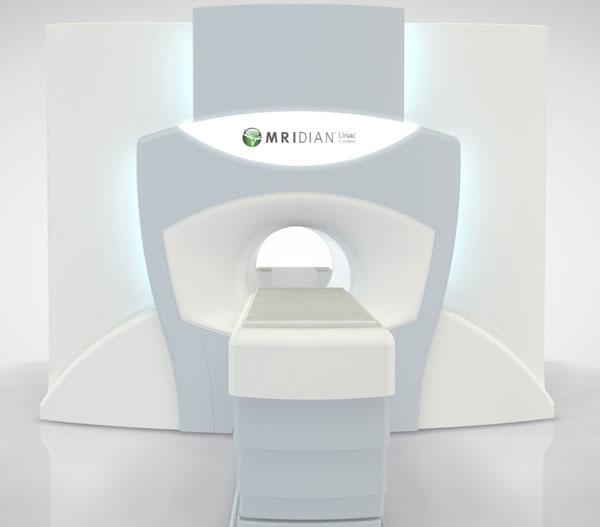

Viewray Inc. (Nasdaq: VRAY) is a medical technology company that designs, manufactures and sells the MRIdian linac system. It received FDA approval for its system in Feb. 2017. The system provides a MRI imaging system while doctors are administering radiation treatment for patients who have inoperable cancer. This allows the doctors to precisely administer adequate doses while minimizing the damage to surrounding tissues.

MRI-guided radiation therapy was developed by company founder and current chief scientific officer, James F. Dempsey, PhD, in 2004. Its core technology received patents in the US and Europe, covering both the medical instrument and its method of implementation.

(Source: Company Website)

We view the linac system as a game changer in the field of radiation oncology. Many physicians and hospitals have strongly endorsed the system, as well. By combining MRI imaging and radiation the system expands the amount of treatable tumors by 20%.

The technology allows physicians to see the tumor while treatment occurs. Additionally, treatment sessions are reduced from an average of between 20-40 to just 1-5, dramatically reducing patient suffering in many cases.

Highly Experienced Management Team

As noted above, James F. Dempsey, Ph.D. serves as the chief scientific officer of Viewray and is its founder and the inventor of the technology. Dempsey oversees the technical and scientific aspects of the MRIdian system's developments. He holds a Ph.D. in nuclear chemistry from Washington University and is board-certified as a medical physicist.

Chris A. Raanes is the chief executive officer and president of ViewRay. He has previously worked in executive roles at PerkinElmer Optoelectronics and Accuray and has extensive experience in the medical device industry. When he served as the chief operating officer and executive vice president at Accuray, he helped to transform it from a start-up company into the third-largest vendor in the radiation therapy industry. He holds a Master of Science in electrical engineering from the Massachusetts Institute of Technology.

Notable on the board for the past year is Hank McKinnell. Mr. McKinnell was CEO and Chairman of the Board of Pfizer until 2006.

Data on the use of MRIdian Technology

Data from the on-table adaptive use of the MRIdian technology at the VU University Medical Center in Amsterdam showed that 96 percent of the patients were treated for cancers including pancreatic, prostate, lung and liver cancers that had metastasized. The data indicated that surrounding tissues were better protected from damage using the technology, while still allowing the doctors to use an adequate radiation volume.

Recent FDA approval and process

On Feb. 27, 2017, ViewRay announced that it had received FDA approval to market its MRIdian Linac technology to hospitals and doctors. It combines MRI imaging with linac radiation so that oncologists can see tumors and their movements during treatment for more precise delivery of the radiation. The first two systems were set to be installed at Barnes-Jewish Hospital at Washington University in St. Louis and at Henry Ford Hospital in Detroit.

The company had previously received Shonin approval from the Japanese Ministry of Health, Labor and Welfare to market its MRIdian system in mid-August. In September the company announced the first sale in Japan to the National Cancer Center (NCC), followed by Edogawa Hospital in Tokyo Japan in January.

Treatment Centers Using MRIndian

Oncologists have long been waiting for a technology that integrates linac radiation with MRI technology and MRIndian fits this criteria. In September, five leading centers highlighted their experience using the MRIndian systems at the Annual Meeting of the American Society for Radiation Oncology (ASTRO). Presentations were given by: Washington University and Siteman Cancer Center at Barnes-Jewish Hospital (Washington University); University of California, Los Angeles Health System and Jonsson Comprehensive Cancer Center (UCLA); and The University of Wisconsin Carbone Cancer Center (University of Wisconsin).

Recent Results Underscore Future Potential

Viewray generated $22.2M in revenue in 2016, compared to $10.4M in 2015. During the year, it received thirteen new orders for its MRIdian Systems, comprising total order revenue of $77.0M. This is nearly double the seven new orders in 2015, totaling $40.1Min revenue.

Cost of revenue for year stayed relatively consistent as a percentage of revenue. Cost of product revenue was $23.9M in 2016 versus $12.7M in 2015. Gross loss was ($1.2M) in 2016 and ($2.2M) in 2015.

Systems are sold at an average selling price of $6.5M with a gross margin of 40-50% on products. Given high product costs and gross margins, the number of systems sold annual in order to breakeven is between 20-25 systems. If Viewray continues its current pace for order growth, it should reach profitability by 2018.

|

(in millions) |

2016 |

2015 |

2014 |

|

Total Revenue |

22.2 |

10.4 |

6.4 |

|

Cost of Revenue |

25.9 |

14.5 |

9.2 |

|

Gross Profit |

-3.6 |

-4.2 |

-2.8 |

|

General and Administrative Expense |

23.5 |

21.7 |

14.7 |

|

Selling and Marketing |

5.6 |

5.1 |

4.7 |

|

Selling, General and Administrative Expenses |

29.1 |

26.8 |

19.4 |

|

Research and Development |

11.4 |

10.4 |

9.4 |

|

Total Expenses |

66.4 |

51.8 |

38 |

|

Operating Income |

-44.2 |

-41.4 |

-31.6 |

|

Net Income |

-50.6 |

-45 |

-33.8 |

Q1 Report: Significant Uptick In Orders

On 5.15.17, ViewRay reported first quarter 2017 results, highlighting its continued growth. The company received new orders for its MRIdian Linac Systems, totaling $12.3 million, versus new orders of $11.2 million in Q1 2016. It also provided revenue guidance in the range of $45-$50M for the year 2017, through the sale of 7 to 8 MRIdian Linac Systems.

The company ended the quarter with cash and cash equivalents of $49.3M. It raised $26.1 million and $21.5 million, through a private placement and through sale of common stock, respectively. The company also recently expanded its CRG loan by $15M.

At the same time, total backlog grew to $144.9 million, versus $89.6 million during the same period in 2016. The significant rise in backlog indicates strong demand for its systems and expectations for future revenue through the completion of these sales.

Over the past year, share price has ranged from a low of $2.64 up to a high of $10.39. It was trading at $6.22 per share as of midmorning trading on May 30, 2017. Current share price is $6.67 (pre-market session 6.5).

Market share of competitors versus MRIdian

The top competitors for Viewray include Accuray (ARAY), Varian Medical Systems (VAR), and Elekta. All offer radiation therapy solutions and treatments. Its closest competitor Elekta, is a Swedish company and offers radiation therapy through its Unity system. The company has not yet received EU or US regulatory approval, but is targeting the second half of 2017 for CE-mark. Its Unity system offers real-time MRI-guided imaging.

|

Ticker |

Market Cap |

Enterprise Value |

Sales (NYSE:TTM) |

|

VRAY |

$370M |

$358M |

$18M |

|

ARAY |

$340M |

$426M |

$366M |

|

VAR |

$8,851M |

$8,692M |

$2,656M |

(Google)

Conclusion: Buying Opportunity

If Viewray continues growing order volume at its current rate, we expect it to be profitable by year 2018.

Given the system has significant benefits relative to peers and a growing backlog, we don't expect growth to slow.

Additionally, the company has sufficient capital to fund operation needs in the interim.

We believe its small-cap size has led it to be overlooked by most institutional investors and recommend investors consider purchasing shares while it's still under the radar.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more