Therapix Biosciences: Small IPO With Big League Potential

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

A small biotech by the name of Therapix Biosciences (TRPX) completed an IPO on Tuesday night to little fanfare. The company has a promising synthetic cannabinoid headed towards late stage clinical trials.

The sector has several comparable stocks that provide attractive valuation comparisons. The lack of details and buzz on this IPO might provide an opportunity to scoop up a bargain before the market figures out the story.

IPO Details

Therapix Bio sold 2 million shares at an IPO price of $6 per share. The company previously traded over-the-counter (OTC) under THXBY and will now trade on the NASDAQ under the ticker TRPX. The new listing will provide more exposure for the stock.

In total, the company raised gross proceeds of $12 million in the public offering. The small biotech will only have 3.1 million shares outstanding after the IPO with insiders controlling 60% of the stock. An over-allotment of 300,000 shares could add additional gross proceeds of $1.8 million. At the IPO price, the market valuation is only roughly $18 million. As discussed below, other cannabinoid stocks trade at significantly higher valuations.

Promising Drug Pipeline

The benefits of medicinal use of cannabis and derivatives is well established now. Therapix Bio proposes using synthetically sourced cannabinoids over the complexities of botanically derived sources. As well, the biotech will utilize an FDA-approved synthetic THC, the main active ingredient in marijuana, called dronabinol.

The initial indications are that treatments for Tourette Syndrome (TS) and mild cognitive impairment (MCI) such as Alzheimer's offer the most promising therapy options. Tourette Syndrome has limited approved drugs and the existing ones have horrible side effects while MCI has no FDA approved treatment despite a large population impacted by the disease.

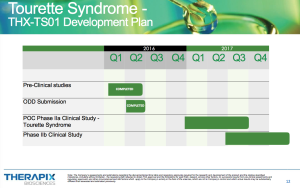

The primary focus is on the development of THX-TS01 to treat TS that recently entered Phase IIa clinical trials. Back in December, Therapix Bio started enrolling patients in the single-arm, open-label trial. Each subject will receive one daily treatment of the drug via oral administration and is followed-up for approximately 3 months. The plan is for 18 patients in the trail administered at the medical center at Yale University. The goal naturally is to prove the safety, tolerance and efficacy of the drug while assessing the performance in adult patients.

The company plans to have data on the Phase IIa study by Q3 and move forward with further late-stage trials after that point. Therapix Bio has already filed an application with the FDA for orphan drug designation that provides more drug protection and pricing power. The application is pending a request for additional information from the small biotech. The company plans to use the 505 (b)(2) regulatory strategy for FDA approval taking advantage of prior studies of dronabinol that was approved by the FDA back in the 1980s.

Source: Therapix Bio IPO presentation

The TS treatment uses a cannabinoid formulation using the "Entourage Effect" where two compounds work synergistically for an enhanced effect. Therapix Bio proposes using the FDA approved synthetic analog of THC called dronabinol with PEA that is naturally occurring in food sources such as egg yolks and milk. PEA is a compound approved for sale in Europe as "medical food".

In addition, Therapix Bio expects to initiate a Phase I trial for a MCI therapy called THX-ULD01 based on pre-clinical research demonstrating ultra-low doses of THC can prevent cognitive impairment. The plan is to start a quick trial to demonstrate safety and quickly move to a Phase II clinical trial to demonstrate efficacy prior to year end.

As the world population ages, the prevalence of MCI is growing at a rapid rate. An estimated 46.8 million people have dementia worldwide and the amount is expected to surge to 74.7 million by 2030. The large unmet need provides a significant opportunity for Therapix Bio.

Crazy Valuation To Peers

What makes the story interesting is the valuation of sector stocks. The likes of GW Pharma (GWPH) and Zynerba Pharma (ZYNE) make snatching up this stock compelling. Especially considering, these stocks have rallied substantially from the early 2016 lows to large valuations proving the interest in the sector.

GW Pharma is worth an incredible $3 billion, but already has positive Phase III trial results for Epidiolex that treats child epilepsy could. The market expects FDA approval this year. The company has a solid pipeline making this stock more of proof of concept that cannabinoid based stocks offer real possibilities for investors.

Zynerba Pharma is probably the better direct compare to Therapix Bio and has a market valuation of $250 million. The biotech recently completed a secondary for $58 million and is the process of a couple of Phase II studies regarding epilepsy. Investors will definitely favor the scale and scope of the trials currently undertaken by Zynerba with hundreds of patients along with the new sizable cash balance, but the initial valuation discrepancy will be very large for two stocks in Phase II studies.

Other small cannabinoid stocks such as OWC Pharmaceutical Research (OWCP) and Cannabics Pharma (CNBX) have valuations of $175 million and $310 million, respectively. Both stocks trading OTC have seen incredible gains this year leaving one to wonder if a Nasdaq listed Therapix Bio will stay under the radar for long.

Normal Biotech Risks

The small biotech maintains the normal risks of any biotech without an FDA approved drug. The process to an FDA approved drug is difficult and requires significant amounts of cash.

In addition, larger biotechs with significant financial resources will be attracted to the sector and possibly compete against Therapix BIo. As well, other drugs for TS and MCI could gain FDA approval making an approved therapy from Therapix Bio difficult to secure significant market share.

These risks are standard and may or may not represent the actual position facing Therapix Bio if the company quickly proves the efficacy and performance of these drugs in the pipeline.

Takeaway

The key investor takeaway is that the cannabinoid sector has been one of the hottest in the market over the last year. Several high-profile stocks have gained significant market values and are making progress towards FDA approved drugs.

The IPO of Therapix Bio brings another stock into the sector. The stock though has a minimal valuation remaining under the radar during the IPO process. Considering the normal biotech risks, the stock makes for an interesting play in a diversified portfolio willing to accept the normal risks of a small biotech.

Disclosure: No position.

Additional disclosure: Please consult your financial advisor before making any investment decisions.