Surge Holdings: The Unknown Story Of High Potential Growth

Surge Holdings (SURG) is an almost unknown company with an interesting story to tell. They are rolling out their plan in 2019. If their plan is well received by consumers and corner markets – the upside potential over the next few years is very high. I estimate that the share price could be as high as $11 by 2021. I feel that the market does not yet understand this opportunity which is why the upside potential is so large.

Granted, this is a highly speculative stock where we are investing exclusively on future potential. But during 2019, we should see strong indications as to how successful Surge Holdings will be in executing their plan.

If you follow me on Seeking Alpha, you know me to be a dispassionate and analytical model designer. I create multi-factor ‘smart-beta’ models for family offices in addition to working as a part-time research consultant for a global quantitative asset management firm. What is it about the Surge Holdings story that has me thinking the upside potential is so big?

Who Or What Is Surge?

Surge Holdings is a merger between KSIX and True Wireless that completed in April 2018. KSIX was a digital media company and True Wireless provides government-subsidized wireless services in 5 states. Although elements from both companies play a role in what later became Surge Holdings - the opportunity cannot be found by analyzing these two firms. That is probably the biggest reason why this opportunity is still undiscovered.

What is the opportunity here?

Surge hopes to become the key player in a nationwide supply and distribution channel to corner stores. This network will sell partner products as well as various Surge-branded products and services. Surge has a couple of interesting twists on some common services that may resonate well with the target demographic. It takes a bit to tell the story, so let's start with the target market.

Surge Holdings' Target Demographic

Surge Holdings focuses on providing products and services to a group that is largely ignored and under-served. This group includes:

- The bottom one-third of income earners in the USA

- Individuals who are unbanked or under-served

- 51% of the population with invisible or sub-prime credit

- 77 million cellphone users without a contract

- Any price-conscious consumer

- Under-privileged teenagers with limited access to the Internet

- 71% of people (in this study) who shop 5 times or more a week at local corner stores

Access to basic services that we take for granted every day, such as having a smartphone plan or a bank account, can be a challenge if you live paycheck to paycheck with bad or invisible credit.

What are these products and services that Surge has developed? And how does Surge intend to get them into the hands of those who need them?

Surge Holdings' Products And Services

Three products and services will be discussed in this article. But Surge has additional ones.

- SurgePhone Wireless offers free (and subsidized) wireless smartphone plans in the US

- SurgeVolt 5XL Android Smartphone

- SurgePays Visa – A pre-paid Visa (NYSE:V) card

Free Smartphone Plans That Generate Revenue

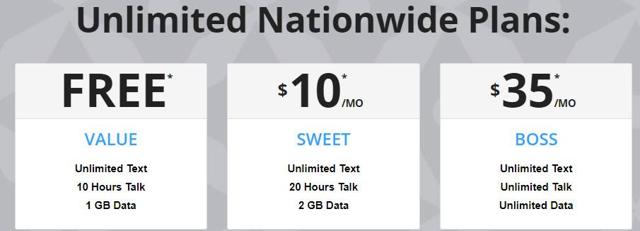

Let’s focus on the wireless market for a moment. You start with a $79 SurgeVolt smartphone or you can use your own GSM unlocked smartphone. You pick up a free SIM card at your local convenience store and get a free monthly cell-phone plan with the following:

- Unlimited texting

- 10 hours of talking

- 1 GB of data

I can see the free phone plan as having wide appeal. Free unlimited texting is a major perk even when the monthly cellular data cap is reached. You neither need a credit check nor a contract to get this free plan. This service is not government subsidized. This service is available right now through the SurgePhone Wireless website and later through local corner markets.

Now I have seen other free plans which are not really free. There is another company that offers a free plan. The following is according to information found on the Internet.

- On a GSM phone you get only 200mb of data, roughly 3.5 hours of talking and 500 texts.

Not bad right? Well, if you go over 200mb of data, you are charged $20 and are delivered 1 GB of data. You may also need to pay up to $50 for the SIM, activation fees and to move your existing phone number to the network. What initially seems free… isn’t. In truth, their freemium model is not sustainable as their profitability relies on getting you to pay high prices for the data you receive.

This is not the business model of SurgePhone Wireless. Free is free and they found a way to make money off this - but not from the consumer. How do they achieve this?

How Does Surge Make Money By Offering A Free Plan?

Is this a profitable venture? Let’s look at one hypothetical scenario.

- Charities give out 1 million donated used smartphones to underprivileged teenagers and families across America

- These phones are pre-loaded with a ‘forever free’ monthly smartphone plan

- According to this Surge news release, $10 in revenue is generated off every subscriber

- Assume a gross margin of 35–40% or $3.50-$4.00 in gross profit per sub every month

- $42-$48 million in gross profit per year

The gross profit potential on just 1 million customers is ever greater than that. The Mulaah app continues to drive ads and revenue via the unlimited texting plan even after the 1 GB is used up.

If Surge Holdings can get 1 million free subscribers – what would this be worth in market cap?

- Consider that the KBW Nasdaq Financial Technology Index has a median price-to-gross profit ratio 9.55

- Assume Surge could retain $42 million in gross profit annually

- $42 million x 9.55 = $401.1 million market cap

- Current market cap is less than $50 million

What are the risks?

I downloaded the Mulaah app on my Xiaomi (XI) Mi A1 smartphone. The app changes the appearance of your home screen. Ads randomly pop up which are very small in the bottom of the screen and there are surveys you can take for extra points. Would I use this service? For a free cellular plan - absolutely! To knock $10 off my plan? I am not so sure.

- Will consumers embrace this ad-supported network or will they gravitate toward another low-cost option?

- Will the ad-supported cellular service be copied by a larger company with an existing customer base?

- Will advertisers restrict where their ads are shown? There might be little conversion in advertising a new Tesla (NASDAQ:TSLA) car to someone using the free cellular plan. Of course, this also allows advertisers to target this specific demographic. Think Walmart (WMT) and McDonald's (MCD) vouchers?

SurgePays Visa

Another life-enhancing product for the un-banked or under-banked is the SurgePays Visa card. This is an $11 billion industry.

SurgePays Visa is a re-loadable Visa card. You load the card with money and use the Visa network even if you don’t have a bank account or a credit rating. Most people are familiar with re-loadable cards but this one comes with a twist.

The card acts more like a checking account than a traditional re-loadable card. For example, you can access your account through an app and even transfer funds to family or friends. You can also upload your paycheck with a simple click of your cellphone camera.

These services are taken for granted by most of us who have a bank account. But consider what life is like for the estimated 8.4 million who are unbanked in the USA. Or the 18.7 million under-banked, who have a bank account, but still seek services such as check cashing from outside the banking system.

- No more waiting in long lines to cash your check at Walmart

- Not having to pay the $4-$8 check cashing fee

Surge will earn revenue from this model in multiple ways including interchange portions of the merchant transaction fees, nominal monthly fees, ATM withdrawal fees, convenience fees and interest from monies on deposit. I don't know how much they will make but 1% seems like a reasonable fee by my 'back of the napkin' estimation method.

What sort of profit potential does this have? Let’s look at one scenario.

- Assume 1 million cards are used as an alternative checking account

- Assume a paycheck of $2000 every month

- $2,000/month x 1 million = $2 billion in transaction value

- 1% of that could be retained through the various fees

- $240 million per year in gross profit

If this scenario should play out, the 9.55x multiplier on gross profit would add $2.3 billion of market cap to the company. That is a staggering amount that is 50x the current share price. One million people using the cards in this fashion would add $25 per share to the price. And these products are not just for the unbanked or under-served. I can imagine the younger generation adopting these services since the fees are not that much different than a traditional bank.

What are the risks?

- Surge’s profitability is directly tied to people using these cards more like a checking account and less like a gift card

- If that happens, the features of this pre-paid Visa might be copied by other cards

- The success of these cards depends on educating people about how to use the cards as an alternative checking account as well as distribution

Speaking of distribution, how does Surge intend to sell the products directly to the target demographic?

Penetrating The Market

A company can have great products but all of that is moot unless you can advertise and distribute effectively. This is where I believe the big potential lies with Surge Holdings. The distribution network provides the technological backbone and distribution channel for current services and any future products they develop or acquire. The company cannot, and should not, rely on the success or failure of their pre-paid debit cards and cellphone service plans.

Think about the corner store market and how they do business today:

- In December 2017, there were 154,958 convenience stores across the US as well as tens of thousands of corner stores and bodegas

- It is estimated that 63% of convenience stores are single-store operators

- They are more likely to get their products at a cash-and-carry outlet

- This takes a lot of time and has other issues such as a lack of tracking and no formal liability coverage or insurance

And what about national companies wanting distribution through convenience stores? They send their sales team to the store, make a sale and then send trucks to deliver the goods across multiple stores… for a single product. Not an efficient way to do business that involves a lot of time and driving around.

Surge Holdings intends to change the corner market supply and distribution channel. What is that potential disruption and how does Surge break into this market and control the distribution chain? To answer that we need to talk about the SurgePays Portal.

SurgePays Portal

SurgePays Portal is a nationwide e-commerce platform that allows the convenience store owner to order products directly from his computer or cell-phone. The owner can purchase and have delivered any of the traditional products on a curated inventory list formed by Surge Holdings as well as the various Surge-branded fin-tech products, such as SurgePays Visa and SurgePhone Wireless. I think of it as being like a blend of Amazon (AMZN), PayPal (PYPL) and Google (GOOG) (GOOGL). But how does SurgePays Portal work its way into each store?

Surge Holdings has a few products and services which I have already discussed. I imagine that Surge Holdings already has strong connections in the wireless ‘top-off’ business since the CEO, Brian Cox, has already built and sold a wireless ‘top-off’ company. These connections may get him access into numerous corner markets for Surge smartphones and wireless plans. Once these products are in the store, the store operator now has the SurgePays Portal. Just as multiple computers connect to form the Internet, each convenience store that sells even one of Surge Holdings' products becomes a valuable link in the Surge distribution chain.

This is the big technology play that has the potential of keeping the company relevant beyond the success and lifespan of a couple of products and services. A single product can be replicated. A service can become a dying trend. If you focus on controlling the supply and distribution network, you can create an Amazon-like network for corner markets.

How will growth be rolled out? The first logical step would be for Brian Cox to leverage his existing contacts. I will place the value of that between 5,000 and 15,000 stores. The 40,000 store target will be discussed under the heading ‘Manufacturers and Strategic Partners’. If Surge can secure additional locations and work their way into an additional 10,000 stores, their network becomes increasingly valuable to big brand manufacturers. Large manufacturers will be eager to make distribution agreements with Surge in order to get nationwide exposure. Getting into those initial 20,000 or so locations is vital in order to gain enough critical mass to attract larger manufacturers.

But why will store owners be so willing and eager to adopt this new technology?

The Store Owner Advantage

Why would the convenience store owner want to adopt SurgePays Portal? The advantage boils down to two items:

- Time

- Money

The store owner can order new items directly from his phone and doesn’t need to waste time driving around town trying to source these items locally. The store owner doesn't need to spend time talking to national sales teams trying to pitch their products. That's the time factor.

The store owner also shares in the revenue with Surge Holdings. They earn profit simply by using the network on all available products. And the upside potential for promoting Surge fin-tech products results in commissions that are likely 5–10x higher than the competition. And it is monthly-recurring. The store owners not only distribute the products, they are partners with a financial incentive. That makes store owners important advertisers and promoters of Surge products and services.

Manufacturers Are Strategic Partners

Then there are the Surge partnerships with companies wanting to distribute their products such as Pastime Foods. Pastime Foods has provided an MOU commitment of $720 million in top-line sales ($1,500 per store across 40,000 stores) per year. I spoke with the President and CEO of Pastime Foods, Tim Riedel, to get a better understanding of what this Memorandum Of Understanding really means. This is what I took from that phone conversation.

- Pastime Foods has a relationship with a convenience story buying group/trade organization. Pastime Foods would introduce Surge into this arrangement giving the potential for Surge to be placed in tens of thousands of locations. Why would Pastime be willing to do this? The reason is simple – these trade organizations need a minimum order per store to bring in vendors. By becoming co-sponsors with Surge, Pastime Foods can gain wide distribution while lowering their initial set-up costs.

Here is a hypothetical example. If you are rolling your product out across a proposed 40,000 store locations and if the minimum order is between $300-$500 per store, that can be an overwhelming start-up cost for a smaller sized company. But by having 2 or more firms band together when approaching the buying group, this will allow each company to split the initial set-up costs while gaining the same nationwide distribution.

But an MOU is not legally binding. 40,000 stores would be huge, but what if that plan falls through? MOU is like a letter of good intentions. Investors should watch for any potential announcement of a definitive signed agreement to replace the MOU. A binding contract would have infinitely more value than an MOU. And that agreement does not explicitly mean that those 40,000 stores are forced to place Surge products inside each location. It is my understanding that the buying group endorses and makes available through their own channel the Surge products and services. The next step is to see how many store owners order in Surge-branded and partner products.

Let’s assume that a definitive agreement gets signed and announced. Let’s further assume that 40,000 stores are rolled out in 2019. If the $1,500 in revenue per store is reached across 40,000 stores starting in 2020 – what sort of profit might this generate?

- I will use a 2% gross profit margin

- This will result in $14.4 million gross profit

- The 9.55x multiplier results in a market cap of $137.5 million or 3.2x the current size

Again, keep a close eye for any potential announcement that the MOU has been replaced by a signed contract with the trade organization. Keep a close eye on how many stores sell Surge products. And finally, keep an eye on how the products and services are received.

Are They Able To Scale?

One issue that high-growth companies typically have is difficulty when trying to scale. The needed infrastructure to grow from $10 million in sales to $10 billion is massive. They suddenly need to increase the size of the manufacturing plants, train additional support staff and dozens of other things that will impede growth. Or you can try to cut corners and deliver a service that makes a poor first impression.

Is Surge Holdings set up to scale? Here are a few items to think about:

- Brian Cox, Surge Holdings CEO, has already built (and in some cases sold) telecom businesses

- Surge sells cellphones but they do not manufacture them

- Surge provides a banking service without needing to be a bank

- Manufacturers will advertise their own products which in turn promotes the SurgePays portal at no cost to Surge

- Store owners are revenue-sharing partners that also promote Surge products and services at no additional cost to Surge

- Cellphone users are delivered ads featuring new Surge products and services without a costly advertising budget

What about the on-boarding process for 40,000 stores? That is roughly 110 stores per day or over 3,000 per month. In an interview with MoneyTV, the CEO of Surge discusses how they have simplified the digital on-boarding process. The CEO indicates that they will on-board 3,000 stores a month. You might want to watch the 5-minute interview in its entirety.

What about the necessary support staff to promote and onboard?

Surge Holdings recently acquired a 40% stake in Centercom Global which provides the necessary human capital to scale. Centercom Global is a BPO, or Business Process Outsourcing, company. They have the following objectives to support rapid growth:

- Assisting in on-boarding SurgePays Portal into over 40,000 retail locations (in 2019) and subsequent ongoing white glove support

- Aggressively marketing new “Free Wireless Service” program to substantially grow customer base while beefing up customer service

- Launch SurgePays Re-loadable Visa Card by the end of 1st quarter

- Support IT infrastructure including database management

- Up-sell related fin-tech products to the existing customer base to increase revenue

Estimating The Future Value Of The Company

The story always comes back to this – how high (or low) could the price go? With a speculative company such as Surge Holdings, and particularly since they are pivoting from their past businesses, it is very difficult to assess. The upside potential is very large. But the hard numbers have not come in yet, so I am just speculating.

On one hand, the risk with any venture can be a complete loss of all investment capital. There are various pieces to the puzzle and they all have to work in a coordinated fashion to make Surge Holdings a high-growth opportunity. Please do not ignore the risks involved with smaller firms who plan big.

On the other hand, big companies start out as small companies. Don’t discredit the small firm just because it is small. The upside potential is much greater for smaller companies with higher risk.

The following will try to estimate a value of the company assuming that the roll-out takes place on at least 40,000 stores and that the products and services gain some momentum. I will apply a 9.55x multiplier to my personal forecast of gross profit. This will give a market cap projection for each opportunity. My estimate is based on Surge rolling out and executing according to plan over the next 24 months:

- 1 million subscribers of the basic free cell service plan = $42 million gross profit = $400 million market cap

This assumes $10 in revenue from ads per user per month. Assume 35% gross margin for $3.5 million per month in gross profit or $42 million per year. Apply a 9.55x multiplier for $400 million market cap.

- 200,000 working people using SurgePays Visa as an alternative bank account = $48 million gross profit = $458 million market cap

This assumes 200,000 people who earn $2,000 per month using the card as their bank account. $400 million of cash throughput per month works out to $4.8 billion per year. Assume 1% gross margin for a gross profit of $48 million annually. Apply the 9.55x multiplier for a value of $458 million in market cap.

- SurgePays Portal profit on 3rd party products across 40,000 stores = $14.4 million gross profit = $137 million market cap

This assumes 40,000 stores (by 2020) each doing $1,500 worth of sales per month through the portal. This equates to $720 million per year by the end of 2020. If 2% of that is captured as gross profit, we have $14.4 million annually. Apply a 9.55x multiplier for a market cap of $137 million.

Assuming no dilution, this $45 million market cap company has the potential to trade around $1 billion. That is 22.2x higher than the current price. This provides a share price target of around $11 assuming no dilution.

This is what I am not including in that projection:

- Current revenues which will likely be around $15-$17 million for 2018

- Profit from selling physical cellphones

- The paid cellphone plans

- The IP value of the block-chain powered nationwide portal

There are more opportunities that are open to the company such as the following:

- Buying out Mulaah to keep more of the revenue in Surge

- Integrating their own cryptocurrency (they already have one)

- Integrating many other products and services

Is this valuation out to lunch? One point to consider is how the other ‘not-so-free' telecom company had a valuation that was likely close to $1 billion as of 3 years ago. It is hard to get solid numbers but it seems that they have 2 million subscribers. If Surge can execute on their plan, $1 billion market cap is not unrealistic.

What Do The Financials Tell (Or Not Tell) Us?

Can’t we just analyze past financials and quickly come up with what this stock is worth today? You might think that you can just use a price-to-earnings ratio or a price-to-sales ratio to discover what fair valuation is. But you do not typically use trailing P/E or P/S ratios with speculation stocks. The very nature of a speculation stock is that you are betting (or speculating) on futureprospects. Revenues are typically small compared to the future forecast. Should you just wait it out for a couple of years until they have high trailing growth under their belt? That would be the lower risk and lower potential return option… but consider an alternative way:

- Invest in tranches. You can always add more investment dollars as they roll out their plan effectively. If they are hitting their growth targets over the next 3–6 months, you can add more to your investment. You may choose to break your investment into 4 chunks. Invest every 3 or 6 months provided they are executing according to plan.

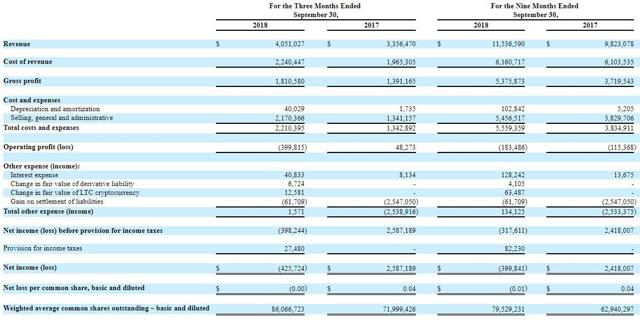

With the disclaimer that past financials are not the key elements we want to focus on, let’s look at a few reported figures for Surge Holdings:

Based on the above, I estimate that revenue for 2018 should be $16 million or more. Now, assume that we use the Nasdaq Financial Technology Index median price-to-sales ratio of 4.72. The stock should be trading at 87 cents while discounting much of the future growth potential.

Based on the numbers above, I estimate gross profit to be around $7.2 million for 2018. This also gives a current share price valuation of 80 cents when using a 9.55x multiplier.

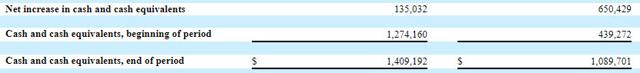

The first numbered column below is trailing 3 months and the next is trailing 9 months. Both periods end in September 30th, 2018. The company is cash flow positive when combining flows from all sources, and they had expected to be cash flow positive operationally by the end of 2018 according to this quote found in the last quarterly report of 2018.

The Company projects that it should be cash flow positive by the end of fiscal year 2018 from ongoing operations by the combination of increased cash flow from its current subsidiaries, as well as restructuring our current debt burden.

While this doesn’t provide us with share price valuation, being cash flow positive is an important factor that I look for in companies. It means they currently have a sustainable business model. But Surge has no interest in staying dormant. They want to rapidly grow, and they have already laid the groundwork to do so. But all that preparation work comes at a cost. Feasibility surveys and expanding operations before the high potential growth of 2019 costs money that isn’t supported by an increase in revenue…yet.

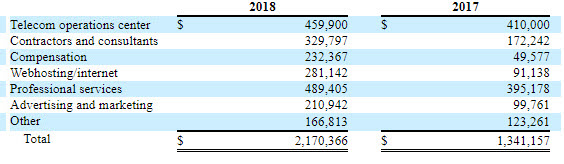

An example of this is found with an increase in Selling, General and Administrative costs. Total selling, general and administrative expense (SG&A) increased $829,208 from $1,341,157 in 2017 to $2,170,365 in 2018. The big items were related to an increase in consultant fees, web-hosting and internet costs, professional fees associated with the merger and advertising costs.

What is my personal opinion as to what the share price is worth based on future prospects? With the high-growth potential and the risks involved, I feel that a share price between $1.00-$2.00 is not unreasonable. That price should go up or down as more announcements are made and as their milestone targets are hit or missed. But that is me. You do what is best for you.

The big number that I want to track is not revenue or gross profit. That will come later. The big number that I am focusing on is the number of stores which adopt the SurgePays Portal. Remember that getting into the stores is the first step. Yes, revenues will increase as stores come online. As the number of stores using the portal go past the point of critical mass – the SurgePays Portal will be incredibly valuable as discussed earlier. Watch the number of stores using SurgePays very carefully!

Of course, each person will need to calculate their own risk to reward scenario and price it accordingly. But these are the numbers that I feel comfortable with based on my knowledge today.

What About The Risks?

Pretty much all smaller sized firms rolling out new services and products face the challenge of funding growth. Outside investments are typically needed to scale operations and to market products. For Surge Holdings to rapidly grow, they will require outside investments. If any Venture Capital firms are reading this, I would seriously contemplate the opportunity this presents. Surge Holdings should hopefully have no issue accessing that capital given the upside potential. Getting access to investment capital is a risk common to most high-growth companies of very small market cap.

But why isn’t Surge spending their time building up True Wireless, which contributed over 85% of Surge's revenues in 2018 (first 9 months), and simply fund themselves? True Wireless will likely be replaced by the non-government subsidized SurgePhone Wireless. Thus, it makes little sense for Surge to focus on building up their current main revenue driver of True Wireless when it will likely be transitioned out with a better service later. Diverting their attention from future growth would be a grave mistake in my opinion.

It is worth noting that the company is cash flow positive. This means that any institutional investment can be used to directly fuel future growth prospects. Investors must also keep in mind that some dilution will be necessary as investment capital is taken in.

There are other risks that I have already highlighted such as if consumers do not embrace these products. There is always risk. You should know and accept these and other risks before investing. How do you minimize these risks?

- Monitor the stock closely.

You should absolutely be keyed into the stock and follow press releases to see if they are hitting their milestones and if growth is inline with expectations. What sort of milestones are we talking about?

- Target of 40,000 stores by end of 2019

- Track the wireless subscriber growth (scaled by # of locations offering plans)

- Average sales per store (will likely take 6-8 months to start seeing bigger numbers as larger manufacturers have more incentive to approach Surge with a presence in 20,000 stores versus 1,500 stores)

Another way to mitigate risk is to scale your investment size accordingly. Even if you think that this is the next Amazon, it would be unwise to go ‘all in’. Some suggest investing 5–10% of your overall portfolio in speculative investments. And you might further break that up between a few speculative stocks.

Summary

Surge Holdings is a virtually undiscovered company with high growth potential. They have designed a distribution portal that will hopefully be deployed across the US in a potential 40,000+ stores by the end of 2019. Their products serve the ignored, under-privileged and credit challenged. The SurgePays Portal will be the technological backbone allowing corner markets to order traditional and fin-tech products while letting store owners share in the revenue and save time.

Three interesting products that are poised for big growth are the following:

- A low-cost Android phone

- Free monthly no-contract, no-credit cellphone plan (and paid ones)

- Re-loadable Visa that acts more like a bank account

The phone and the cellular plans are available now while the re-loadable Visa is due out the 1st quarter of 2019.

It is difficult for me to estimate the future share price. Share prices could reach $11 in 24 months assuming no dilution and if the products sell even modestly well. The upside is much greater than that if the products are really embraced. In a scenario of very high growth, I would imagine a buyout would be the most logical way to absorb the network and existing customer base instead of trying to compete.

Remember, this is a high-growth speculative stock so scale your investment size accordingly if you choose to invest at all.

Disclosure:

I/we have no positions in any stocks mentioned, but may initiate a long position in SURG over the next 72 hours.

I wrote this article myself, ...

more

Enjoyed this article, thanks.

Good find!