Small Gains On Accumulation

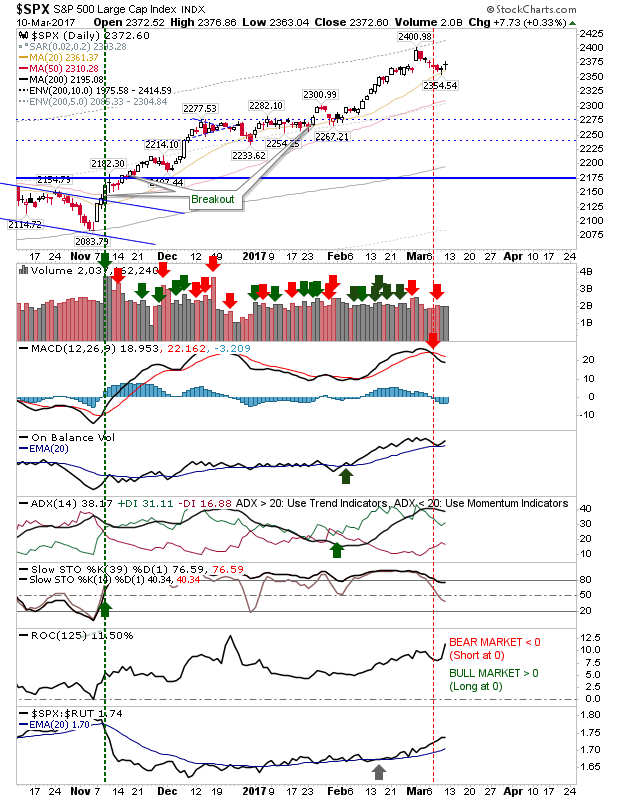

Markets finished the week with an accumulation day on Friday, with bulls coming in at 20-day MAs for the S&P and Nasdaq. The Russell 2000 also dug in, although buyers worked with no clear support level, but Friday's finish may offer an opportunity for a swing low to develop if there is some upside on Monday.

The S&P worked a rally off its 20-day MA, but did so in the absence of accumulation. The 'sell' trigger in the MACD hasn't been reversed, but other technicals are still healthy.

The Nasdaq experienced a similar bounce as the S&P, but it was able to do so on higher volume accumulation.

The Russell 2000 is working a potential swing low with support pinned to a minor support level from February.

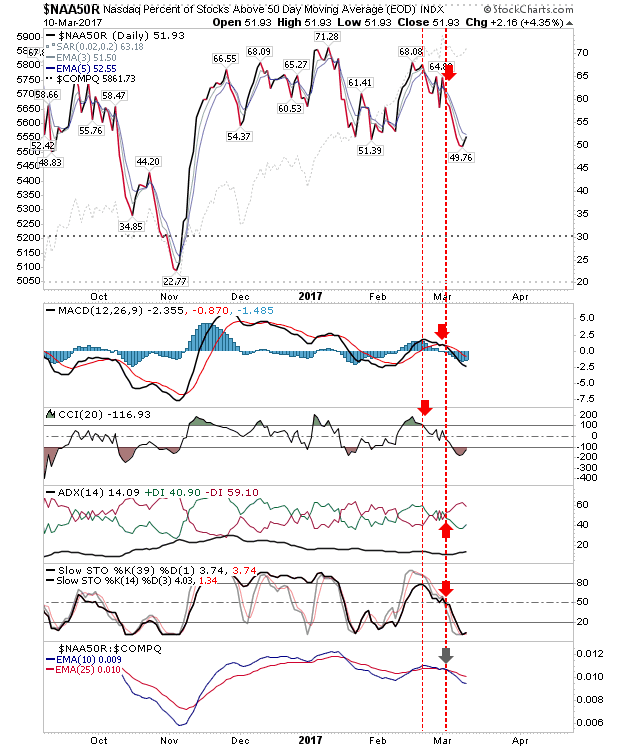

However, all Nasdaq breadth metrics are net bearish, which would suggest further weakness for the parent Nasdaq is a strong possibility. This could mean Friday's gain is a 'bull' trap of its own.

As for shorting opportunities, the Semiconductor Index may offer the best risk/reward opportunity. The doji finished just above the last high of 991, but it also closed at former channel support - now resistance. A move to the slower rising trendline is a potential target.

For Monday, shorts can take a look at the Semiconductor Index, while longs can wait and see if there is a further advance for the S&P and Nasdaq from the bounce off its 20-day MA. With Brexit due to start next week there may be other distractions.

Disclosure: None.