Sell And Hold

Trading colleagues online are a surprisingly disloyal bunch. After Friday’s mega-reversal, the cat-calls and chortling began anew. Even BDI was declaring that the “President’s working committee” would “teach me a lesson.” So I guess I’m on my own again. The last bear standing.

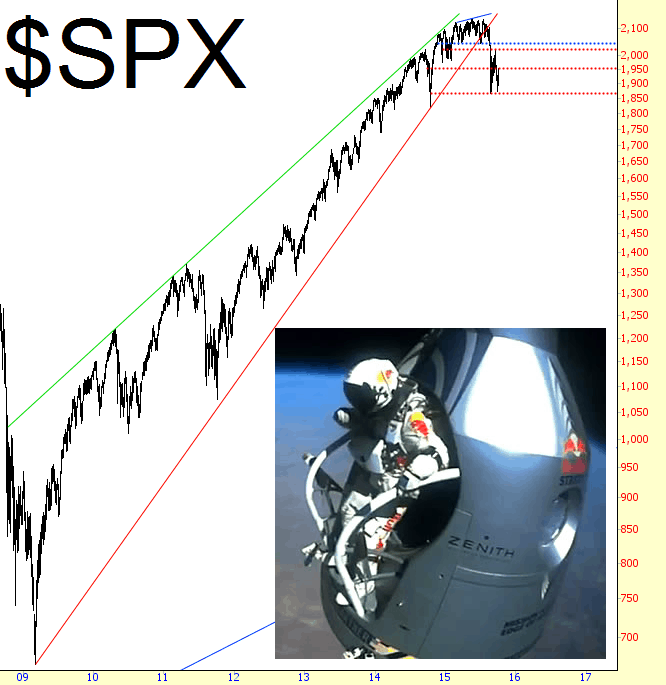

I wanted to make a point beyond my own lonely role, however. I offer this chart, with some commentary beneath:

It has to do with timeline. Specifically, what I call “sell and hold.”

Everyone knows “buy and hold.” Normally, for a short seller, there’s only an eye for a brief opportunity to sell high and buy low some time shortly thereafter. That’s where the notion of “picking up dimes in front of a steamroller” comes from. It’s dangerous if you don’t move swiftly.

From 2009-2014, it was even more hazardous than normal. Profitable short opportunities were few and far between, and holding periods were measured in minutes, hours, or – at best – days.

Looking at my own short positions, however, these are keepers. These are not quickie intraday opportunities. These, ideally, are positions I’d like to hold on to for months, which is a statement that would have been sheer lunacy until recently.

A day like Friday isn’t going to shut someone like me down. Purported friends may turn their backs on me, but I am steadfast. The charts are more meaningful than the fickle, fragile nature of human emotion.

This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more