Populism: The Danger? What About Debt?

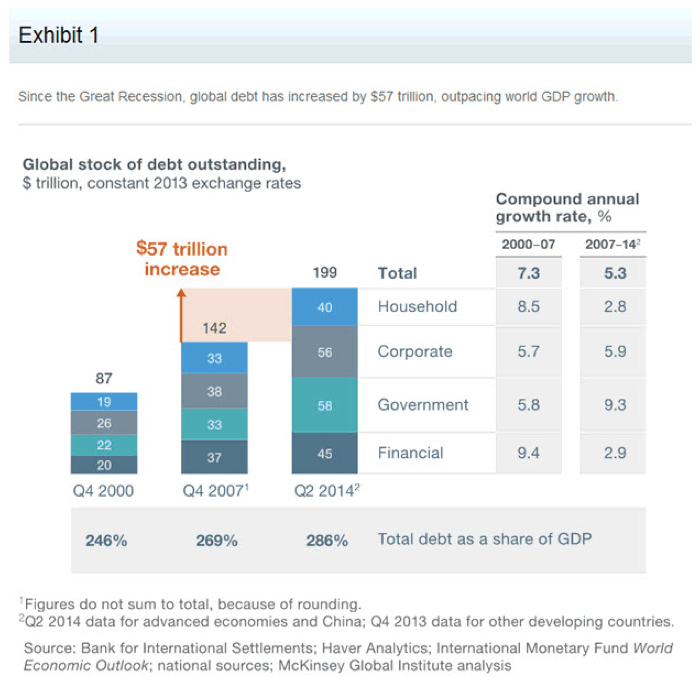

In the spring of 2015, I placed the chart below on global debt levels at the opening of the article. Notice the value of global debt in 2000, 2007 and then halfway through 2014.

Now jump forward to last fall, when the following statement was made by the International Monetary Fund.

“The world is awash with $152 trillion dollars of debt, according to the IMF, an all-time high which sits at more than double the balance at the start of this century.” [ Global Debt Balloons to All-Time High of $152 trillion, IMF Warns, CNBC, Oct 6 ‘16]

You may think this article will challenge the substantial difference between the figure reported by the McKinsey Global Institute after Q2 2014 and the International Monetary Fund number from Q4 2015. It is not.

Instead the focus will be on why the media headlines and global elites have become so focused recently on populism being the great risk to markets, instead of the record debt levels, recent record losses in global bonds, and US stocks at record highs.

With commercial hedgers holding their largest net LONG position on record in 5 year US Treasuries this month, and their largest net SHORT position on record in the Russell 2000 right before the second-rate hike by the Federal Reserve (Dec 14), I believe traders and investors should be more focused on these extremes rather than what appears to be the “narrative” being fed to the public as “the reason” the global financial bubble was hit with a “correction”.

Populists Key Risk to Globalism; Discussed at Globalist Club

If you did not receive your invitation to the exclusive World Economic Forum, don’t worry. This is a very select club for those at the highest levels of the global politics and finance.

In David Rothkopf’s book, Superclass: The Global Power Elite and the World They Are Making (2008), we learn that this small group is certainly at the “top of the global game” for influencing the global economy. Jeff Faux of the Washington Economic Policy Institute states, “Davos is the most visible symbol of the virtual political network that governs the global market in the absence of a world government.” (pg 266)

Rothkopf, clearly a supporter of global power clubs, states that the World Economic forum is the "biggest of the world's elite clubs."

Since the WEF is meeting at Davos, Switzerland between January 17th- 20th as Trump is sworn in as the next US President on January 20th, it seems a good time to ask, “Why all the emphasis on populism being a huge negative to the global economy?” There have been huge risks across global markets discussed by the IMF, OECD, World Bank, BIS, and others for more than 2 years, so why the increased attention to the “populism risk” right now? From watching recent comments and headlines, it is clear someone wants the public to see populism as a huge risk to the most complacent US equity markets floating at record levels.

Davos Elite Seeks Fixes to Defend the System from Populists, Bloomberg, Jan 18 ‘17

“Squeezed and Angry: How To Fix the Middle Class Crisis” – A panel led by IMF Chief Christine Lagarde at Davos.

"Populism is the No. 1 economic issue that market participants should be watching, more important than central banks. I want to be loud and clear—populism scares me." – Ray Dalio, Head of the world’s largest hedge fund at Davos.

World Economic Forum: Inequality, Divisions Are Primary Risk to Global Economy, WSJ, Jan 11 ‘17

The problem the retail investor has with being the least bit concerned about a change from globalism to nationalism from Brexit to Trump to Italy and across many areas of the world in 2017, is that without constant “assistance” to world equity and risk on trades, the is no experience with anything remotely telling them to prepare for a large sea change.

So ask yourself, when the stock bubble pops again like 2008, was it the "middle class" who flooded trillions of debt across the global financial system at the lowest interest rates on record? Will global central planners and elites finally admit their ideas are what brought us to the top of the latest bubble, and lead to the next major bust?

One thing is for certain whether populist or globalist. To ignore rising risk for so long, the tens of trillions lost in capital during the next bust phase is not going to be popular.

Do you have a plan for the next big shift? more

Supply side "populism" is not really populism. It is the elite's fake response to populism. It is status quo and fools everyone into thinking that the elite are working to fix things for the regular guy. Your article is correct, the bailouts of the busts are mainly for the elite and they will never say their ideas are wrong. Same for the Great Depression. Trickle up didn't work then either.

Gary. To me this is the most sobering aspect of QE. The global planners of markets and economies must create a narrative to move blame away from their own experiments in constantly assisting with tens of trillions in debt since 2008. To talk of "bulls go on longer than you think" without addressing the fact that at the end of the bubble a narrative has to be told the public in order to shift blame from these elite planners, it is not only horribly misleading, but Orwellian. Thanks for your comments. Keep talking to anyone who will listen to you.