Nike, Inc. Reports Fiscal 2017 Second Quarter Results

BEAVERTON, Ore.--(BUSINESS WIRE)--NIKE, Inc. (NYSE:NKE) today reported financial results for its fiscal 2017 second quarter ended November 30, 2016. Global consumer demand drove revenue growth across the NIKE Brand portfolio. Diluted earnings per share were up 11 percent and grew faster than revenue, primarily due to selling and administrative expense leverage and a lower average share count.

“NIKE’s ability to attack the opportunities that consistently drive growth over the near and long term is what sets us apart,” said Mark Parker, Chairman, President and CEO, NIKE, Inc. “With industry-defining innovation platforms, highly anticipated signature basketball styles and more personalized retail experiences on the horizon, we are well-positioned to carry our momentum into the back half of the fiscal year and beyond.”**

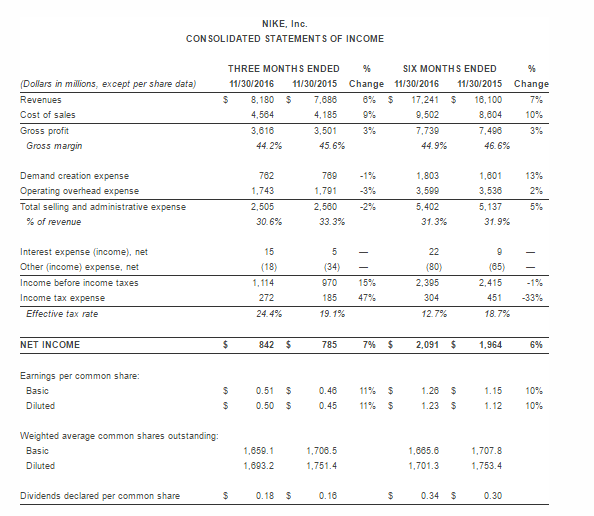

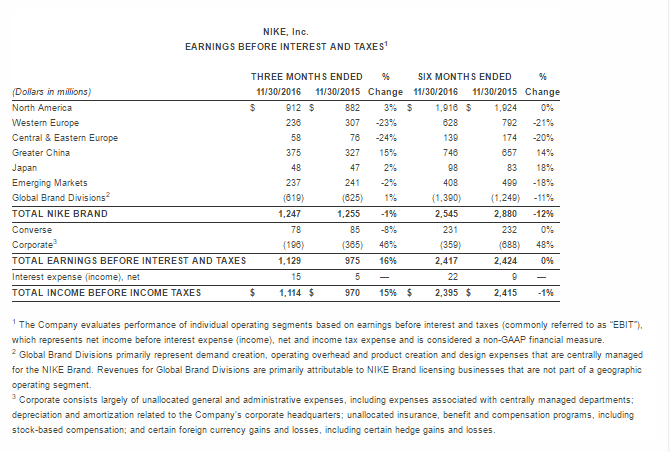

Second Quarter Income Statement Review

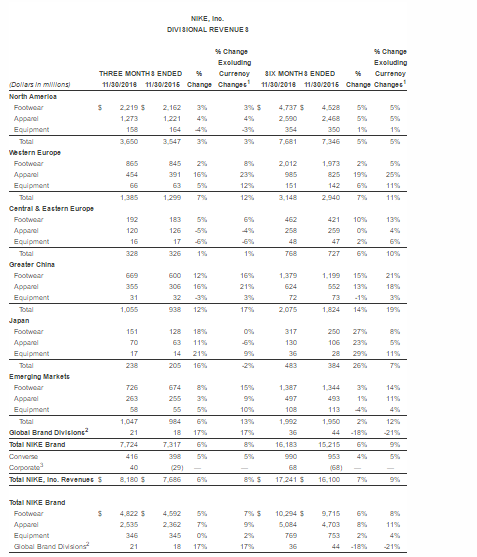

- Revenues for NIKE, Inc. increased 6 percent to $8.2 billion, up 8 percent on a currency neutral basis.

- Revenues for the NIKE Brand were $7.7 billion, up 8 percent on a constant currency basis, driven by double-digit currency neutral growth in Western Europe, Greater China and the Emerging Markets as well as the Sportswear and Running categories.

- Revenues for Converse were $416 million, up 5 percent on a currency neutral basis, driven by strong growth in North America.

- Gross margin contracted 140 basis points to 44.2 percent, as higher average selling prices were more than offset by higher product costs, unfavorable changes in foreign exchange rates and the impact of higher off-price sales.

- Selling and administrative expense declined 2 percent to $2.5 billion. Demand creation expense was $762 million, relatively unchanged from the prior year. Operating overhead expense decreased 3 percent to $1.7 billion, as continued investments in Direct-to-Consumer (DTC) were offset by productivity gains compared to the prior year.

- Other income, net was $18 million comprised primarily of non-operating items, and to a lesser extent, net foreign exchange gains. For the quarter, the Company estimates the year-over-year change in foreign currency related gains and losses included in other income, net, combined with the impact of changes in currency exchange rates on the translation of foreign currency-denominated profits, decreased pretax income by approximately $29 million.

- The effective tax rate was 24.4 percent, compared to 19.1 percent for the same period last year, primarily due to an increased mix of U.S. earnings, which are generally subject to a higher tax rate.

- Net income increased 7 percent to $842 million, while diluted earnings per share increased 11 percent to $0.50, reflecting revenue growth, selling and administrative expense leverage and a three percent decline in the weighted average diluted common shares outstanding, partially offset by lower gross margin.

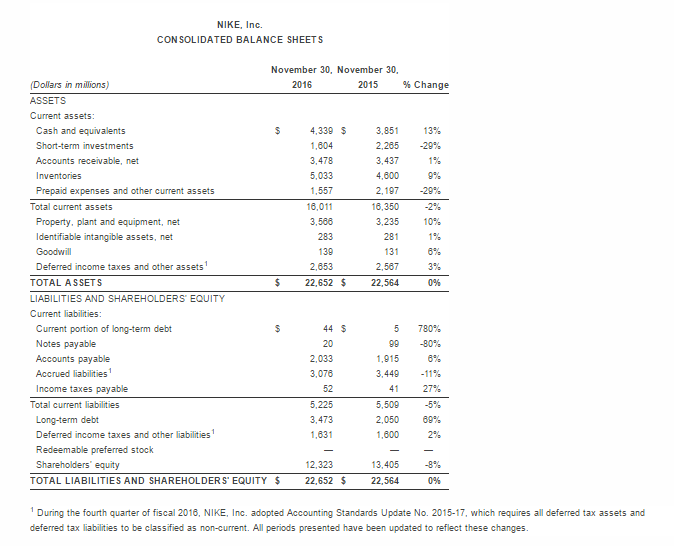

November 30, 2016 Balance Sheet Review

- Inventories for NIKE, Inc. were $5.0 billion, up 9 percent from November 30, 2015, due to a one percent increase in NIKE Brand wholesale unit inventories and increases in average product costs per unit primarily due to product mix, as well as higher inventories associated with growth in DTC.

- Cash and short-term investments were $5.9 billion, $173 million lower than November 30, 2015 as growth in net income and proceeds from the issuance of debt in the second quarter of fiscal 2017 were more than offset by share repurchases, higher dividends, investments in infrastructure and a reduction in collateral received from counterparties to foreign currency hedging instruments.

Share Repurchases

During the second quarter, NIKE, Inc. repurchased a total of 17.0 million shares for approximately $900 million as part of the four-year, $12 billion program approved by the Board of Directors in November 2015. As of November 30, 2016, a total of 56.0 million shares had been repurchased under this program for approximately $3.1 billion.

Futures Orders

Worldwide futures orders for the NIKE Brand will be referenced on our earnings conference calls as deemed appropriate. NIKE Brand and geography Futures Orders growth versus the prior year will be posted on the NIKE, Inc. Investor Relations website at http://investors.nike.com following the call.

Conference Call

NIKE, Inc. management will host a conference call beginning at approximately 2:00 p.m. PT on December 20, 2016, to review fiscal second quarter results. The conference call will be broadcast live over the Internet and can be accessed at http://investors.NIKE.com. For those unable to listen to the live broadcast, an archived version will be available at the same location through 9:00 p.m. PT, December 27, 2016.

About NIKE, Inc.

NIKE, Inc., based near Beaverton, Oregon, is the world's leading designer, marketer and distributor of authentic athletic footwear, apparel, equipment and accessories for a wide variety of sports and fitness activities. Wholly-owned NIKE, Inc. subsidiary brands include Converse, which designs, markets and distributes athletic lifestyle footwear, apparel and accessories; and Hurley, which designs, markets and distributes surf and youth lifestyle footwear, apparel and accessories. For more information, NIKE, Inc.’s earnings releases and other financial information are available on the Internet at http://investors.NIKE.com and individuals can follow @NIKE.

* See additional information in the accompanying Divisional Revenues table regarding this non-GAAP financial measure.

** The marked paragraphs contain forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties are detailed from time to time in reports filed by NIKE with the Securities and Exchange Commission (SEC), including Forms 8-K, 10-Q, and 10-K.

1 Fiscal 2017 results have been restated using fiscal 2016 exchange rates for the comparative period to enhance the visibility of the underlying business trends excluding the impact of translation arising from foreign currency exchange rate fluctuations, which is considered a non-GAAP financial measure.

2 Global Brand Divisions revenues are primarily attributable to NIKE Brand licensing businesses that are not part of a geographic operating segment.

3 Corporate revenues primarily consist of foreign currency hedge gains and losses related to revenues generated by entities within the NIKE Brand geographic operating segments and Converse but managed through our central foreign exchange risk management program.

Contacts

NIKE, Inc.

Investor Contact:

Nitesh Sharan, 503-532-2828

or

Media Contact:

Kellie Leonard, 503-671-6171

Disclosure: None

Comments

No Thumbs up yet!

No Thumbs up yet!