Materials Stocks To Lead In 2018

Materials equities look ready to gain as inflation pressures build.

The Candidate Pool

|

2017 Status |

P/E |

PEG (5 yr) |

PPB |

PPS |

|

|

Ecolab (ECL) |

Base |

29.38 |

2.33 |

5.37 |

2.87 |

|

DowDupont (DWDP) |

Base |

24.99 |

2.83 |

1.62 |

2.12 |

|

FMC Corp (FMC) |

Breakout |

38.96 |

2.08 |

5.99 |

4.59 |

|

International Paper (IP) |

Base |

19.86 |

1.48 |

4.87 |

1.06 |

|

PPG Industries (PPG) |

Base |

19.81 |

2.07 |

5.04 |

2.06 |

|

Vulcan Materials (VMC) |

Accumulator |

45.94 |

2.47 |

3.62 |

4.45 |

|

Bemis Co. (BMS) |

Accumulator |

19.51 |

3.94 |

3.40 |

1.08 |

|

2017 Status |

Debt/Equity |

5-yr Yield |

Payout Ratio |

|

|

Ecolab |

Base |

103.54 |

1.08% |

33.41% |

|

DowDupont |

Base |

35.30 |

3.19% |

91.09% |

|

FMC Corp |

Breakout |

79.95 |

1.05% |

31.13% |

|

International Paper |

Base |

249.97 |

3.20% |

85.28% |

|

PPG Industries |

Base |

78.29 |

1.41% |

32.04% |

|

Vulcan Materials |

Accumulator |

60.08 |

0.37% |

34.30% |

|

Bemis Co. |

Accumulator |

121.60 |

2.51% |

56.67% |

Since Donald Trump’s election there has been a sharp divergence in the performance of S&P equities relative to commodity prices. Traditionally, profitable companies sell more goods and services and enjoy higher equity prices; increased production of goods and services drive higher commodity prices as demand on finite resources increases. However, commodity prices have struggled to return to levels 20 years ago despite the S&P trading at new multi-year highs and at multiples it traded at 20 years ago. The divergence between commodity and equity prices since Trump’s election has been driven by the removal and weakening of environmental standards by the current Administration following the appointment of climate-change skeptic and industrial fave, Scott Pruitt, to the EPA. But as with any legislative change, real change comes slowly and it’s unlikely the current commodity discount and divergence can continue without some form of re-alignment.

Given the greater difficulty in finding 'value’ in the market at these inflated prices it becomes necessary to focus in on what sectors are likely to benefit from an environment which looks set to bring inflationary pressures. Iranian instability has put pressure on oil prices and with the Fed scheduled to make three rate hikes in 2018 which has already started to impinge on auto sector equities, how will this road map for inflation play out for other equities?

Aside from Energy stocks, the other big winner for 2018 could be Materials.

The constituents of the Materials Sector SPDR (NYSE:XLB) of which DowDupont is the largest holding at 23% has a number of prospects worth considering.

Status Breakout Leader

What’s a status Breakout? A stock leading its peers in relative price gain over the last 12 months.

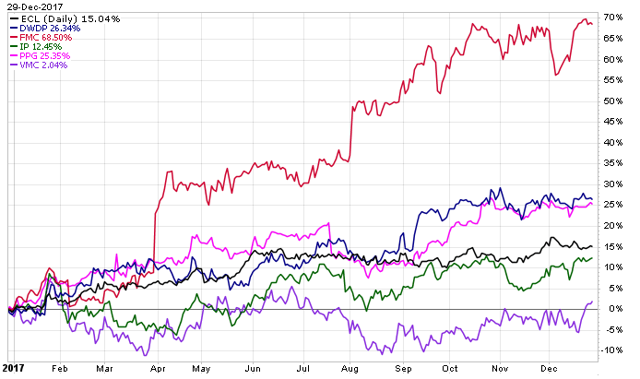

One of the sector leaders in 2017 was Agricultural Solutions and Lithium producer FMC Corp. The stock made its move in March as it accelerated away from its Materials sector peers. Over the course of 2017 it gained over 65%, although it has spent the past three months bumping up against $95.

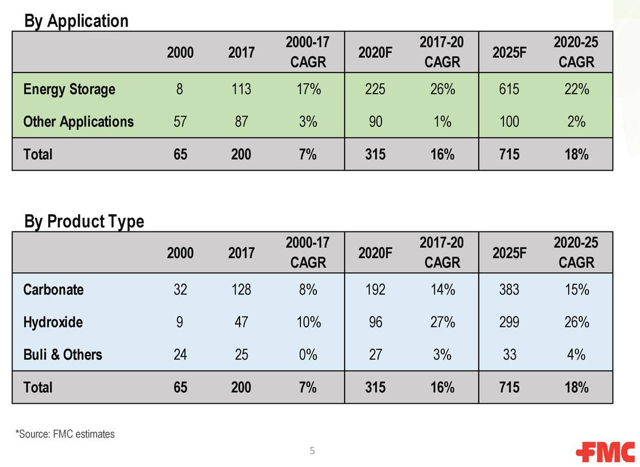

As a Lithium provider it has the benefit of a diverse coverage of consumer from housing, auto motor, technology and consumer discretionary – effectively any sector utilizing rechargeable batteries. This diversity protects it from weakness in any one sector and makes it an attractive play. Projections for Lithium battery usage is to grow six or seven times by 2026 although FMC Corp has opted for a more conservative forecast of less than four times demand by 2025.

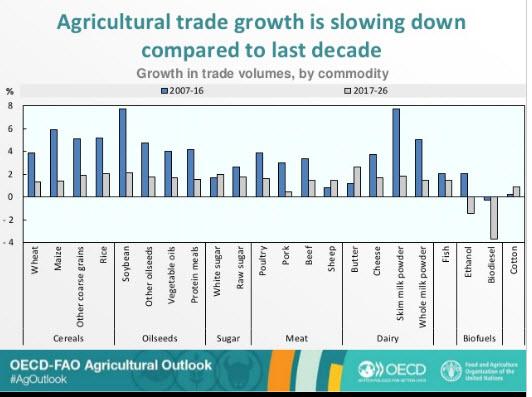

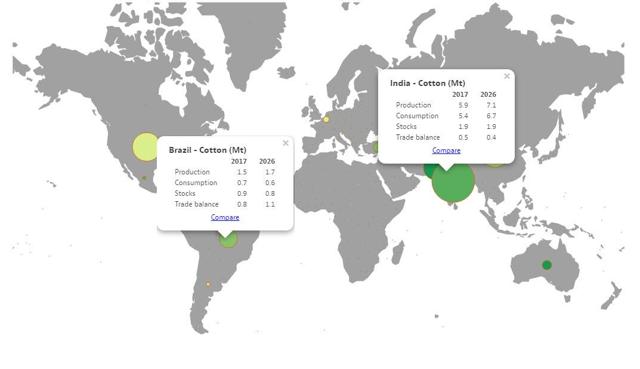

The core revenue stream remains in Agricultural solutions division. The DowDupont Crop Protection acquisition contributed to revenue in the third quarter. Latin America delivered a 12% growth in earnings with Brazilian cotton and sugarcane market a key contributor. Brazilian sugarcane production reached 635 million tonnes in 2017/2018 although the rapid production gains obtained in the latter part of the twentieth century are no longer possible. However, Brazilian cotton production for 2017/18 is forecast to rise by 11% according to the USDA, albeit at a fraction of total sugarcane production. And the OECD-FAO lists Cotton as one of the few crops to see a marginal improvement in trade growth for the coming decade. Improved inventory management and higher sales make Brazil a key revenue focus for FMC and leave the company well positioned for the upcoming year.

India, the largest cotton producer in the world, is forecast to have a 9% yield gain for the coming year, although this forecast was revised downwards slightly from November. FMC struggled in India despite a 9% gain in FMC volume across Asia, although the DowDupont acquisition is expected to significantly increase profitability in the Indian market. According to the OECD-FAO, India will double the production of cotton to North America in 2026.

Between its Agricultural and Lithium division, FMC’s Ag Solutions generates 87% of the company revenue but only 77% of its earnings; Lithium earnings doubled year-on-year. While prospects for Ag Solution are favorable, the real gains will come from its Lithium division. Factor in FMC Group’s conservative outlook for Lithium suggests the company has undersold its prospects.

FMC Corp is best viewed as a growth stock. While supporting a modest payout ratio it only offers an uninspiring 5-year dividend yield of just over 1%.

Status Basing

What’s a status Base? A stock which has posted relative gains over the last 12 months, outperformed the S&P but hasn’t significantly outperformed its sector peers.

For this example it’s hard to look beyond the behemoth in the sector, DowDupont. While it sold part of its crop protection division to FMC Corp it got in exchange FMC Corp’s health and nutrition business. However, it’s the Materials and Speciality Product divisions which are of interest here. Net sales rose despite a drop in volumes due to price increases. Profit margins may be impinged by future rises in raw material costs but given commodity prices are near historic lows these impacts should be minimal in the immediate future.

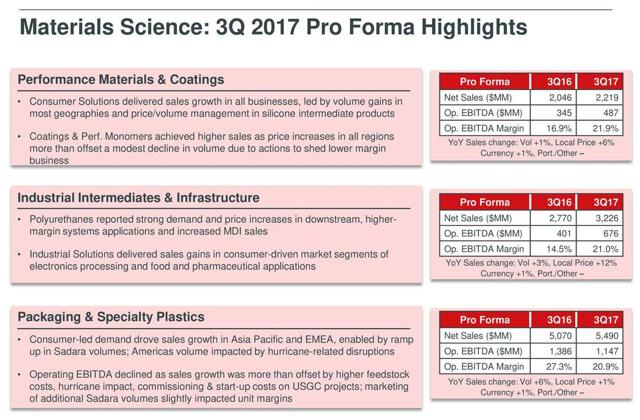

As with FMC Corp, DowDupont has been hurt by its exposure to Brazil in its Agricultural division but the year-on-year 3Q operating EBITDA loss of $61 million was offset by the $142 million gain in its Materials & Coatings division and $275 million gain in its Industrial Intermediates and Infrastructure divisions with margins of over 20% for each; the latter delivered the highest absolute gain across all of its divisions. These gains were delivered despite higher raw material costs (and costs attributed to Hurricane repair and lost production in North America).

While it may appear counter-intuitive for a company dependent on commodities to benefit from higher prices in raw materials but as Marc Doyle, COO of Material Science, Agriculture & Specialty Products, stated in the most recent earnings call:

…we've got some raw material headwinds when oil increases but we also sell a substantial number of products into that market segment. So net-net, we're pretty well balanced…

Status Accumulator

What’s a status Accumulator? A stock which has traded relatively unchanged for the last 12 months and has underperformed to its peers during this time but has outperformed the S&P.

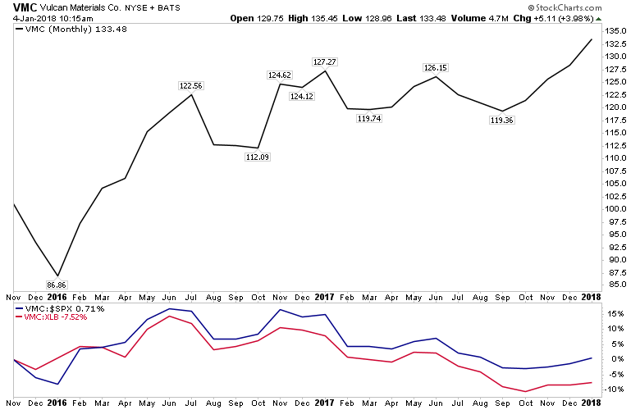

Vulcan Materials has had a slow-but-steady 2017 following stellar gains from its 2011 low. The election of Trump had suggested the company would benefit from Trump’s $1 trillion infrastructure plan, and while Trump’s election delivered a relative surge against the S&P, this outperformance faded to a par performance as his administration lurched from one crisis to another. Vulcan Materials was left coming into 2018 underperforming against the Materials SPDR. However, with the gloss off the stock now may be the time to revisit.

While Trump’s infrastructure plan pushes financial pressures back on States and private sector, there is still a substantial pot of federal money available and infrastructure pressures remain, not just in repairing roads and bridges but in addressing the significant problem in housing supply. As Robert Dietz of the NAHB outlined, a contributing factor to the housing problem was the lack of suitable lots for developers to build on. City planners may now have to become more flexible in permitting residential construction, which in turn will bring in matching funds from the private sector to build the roads and services to support new developments but also improve existing infrastructure feeding into these developments. States and cities which are prepared to take a lead on this will have a ready supply of buyers for these properties which in turn will bring in commercial and retail opportunities that will benefit State incomes; incomes which themselves are under pressure because of Trump’s new Tax law in limiting the state-tax deduction.

In a roundabout way, Trump’s two key Acts may now be the boon Vulcan Material investors had looked for on his election.