Apple Vs. Microsoft: A Comparison Of 2 Dividend Stocks In The Same Line Of Business

Written by DividendMGR

We recently published a comparative article called Dividends in Focus: AT&T vs. Verizon (read on TM here). This type of content is great for investors as it helps someone who is interested in a specific industry to compare two similar companies. For these two companies, however, there is a lot more to consider. These are not two similar yielding dividend stocks. Apple (Nasdaq: AAPL) and Microsoft (Nasdaq: MSFT) are companies that are in the same line of business but have much different stories.

Apple vs. Microsoft: Stock Performance

The chart below illustrates the 12-month share performance of Apple and Microsoft. Apple has outperformed Microsoft, but performance has been mostly in-line.

The next chart shows the ten-year stock performance of Apple and Microsoft. The difference is growth is incredible, with Apple's nearly 1000% increase.

Stock performance winner: Apple

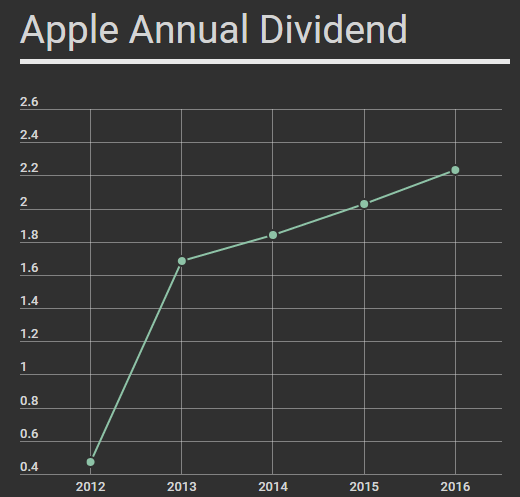

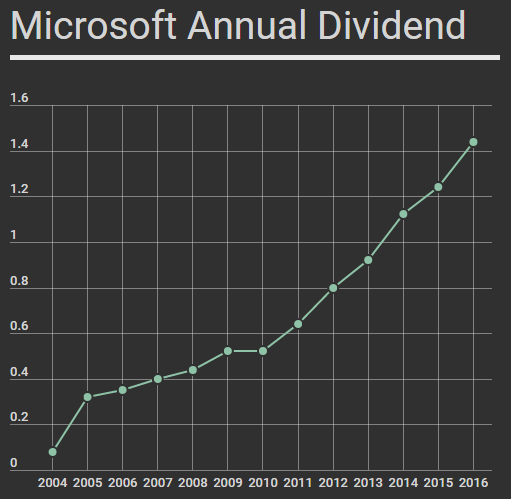

Dividend History: Apple vs. Microsoft

If you have been a dividend investor for a couple years, you probably remember when Apple re-initiated its dividend in 2012. The stock suspended its dividend in 1995 after experiencing a cash shortage.

In this category, Microsoft clearly has Apple beat. It has been paying its dividend since 2004.

Both companies have increased dividends since they were initiated (or re-initiated in Apple's case). Apple, on average, has increased dividends by 10% annually. Microsoft, increases its annual payout by an average of 22% each year.

Dividend history winner: Microsoft

To be fair, the expectation for technology stocks is to grow and invest cash back into the business. Therefore, dividends are typically not a priority for most technology companies, especially in the early stages.

Dividend Yield: Apple vs. Microsoft

One of the major differences between Apple and Microsoft for dividend investors is their dividend yields. Apple's dividend alone isn't very attractive for investors. Microsoft's dividend is pretty good for the technology industry, though. On average, technology stocks offer a dividend yield of 1.4%.

| Yield | Payout Ratio | Stock Price | Annual Payout | |

| Apple | 1.58% | 25.50% | $143.93 | $2.28 |

| Microsoft | 2.37% | 52.70% | $65.71 | $1.56 |

Dividend yield winner: Microsoft

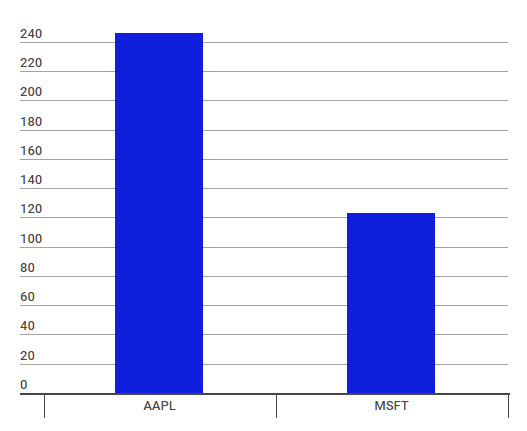

Cash: Apple vs. Microsoft

This category is probably pretty obvious for anyone that has done research on Apple. Apple is currently sitting on more than $246 billion (yes, billion) in cash. On the other hand, Microsoft currently has approximately $123 billion in cash.

The interesting thing about the cash situation is, Microsoft actually had to bail Apple out in the 1990's when it was low on cash.

The cash loads for most of these companies is great news for dividend investors, as cash can often turn into higher dividend payouts.

Cash Hoards (in billions)

Cash winner: Apple

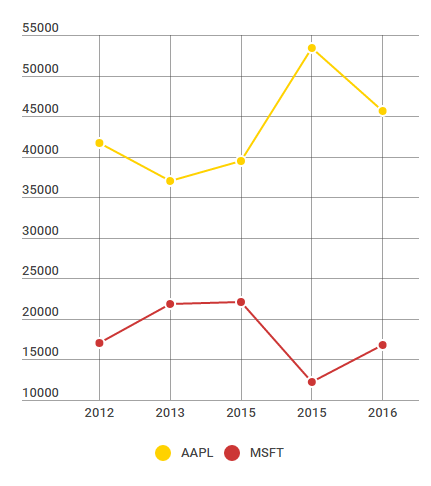

Earnings: Apple vs. Microsoft

For the tiebreaker, we looked at the earnings of Apple and Microsoft since 2012. Apple, being a much larger company naturally has higher earnings than Microsoft.

Since 2012, Microsoft earnings have been pretty flat, down just 1%. Apple, however, has increased earnings 9.5% during the same time period.

What really counts is future earnings. This year, Apple is expected to increase earnings by 7%. Microsoft is expected to increase earnings by 6%.

Annual Earnings (in millions)

Earnings winner: Apple

This article may have been edited ([ ]), abridged (...) and reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a ...

more