Stock Exchange: How Do You React To A Tough Day In The Market?

If you are a passive long-term investor, you might not react at all to a big down day in the market, if you even notice the market is down; and that type of reaction can be a perfectly fine strategy for many investors. However, if you are generating alpha and diversifying away some of your risks with a lower correlation active trading strategy then you might react in a different way. For example, Seth Freudberg at the SMB Training Blog notes in this recent video that he’s never met an emotionless trader. Specifically, he explains how some traders have great theoretical strategies, but they don’t work in real life because of the real life emotional reactions from traders.

Brett Steenbarger recently explained in an excellent post that traders can improve their outcomes by reframing their outlook. For example, rather than worry about missing out on a big market move, traders should have a fear of trading poorly—this simple attitude adjustment can have significantly positive results.

Also, being sensitive to market volatility regime changes can help traders improve, as described in this write-up from Qutopian. For example, when volatility spikes, all of a sudden strategies that used to work may not. For own trading models, we have adjustments that are made (to stop orders, for example), that account for dynamic market volatility conditions.

Further still, our own models are designed to avoid emotional reactions. And this objectivity is very important following our poor performance from last week (even though our long-term results continue to be strong). Specifically, one of the big advantages of having a trading system is that it helps you avoid many of the common emotional and psychological mistakes that many human traders often make.

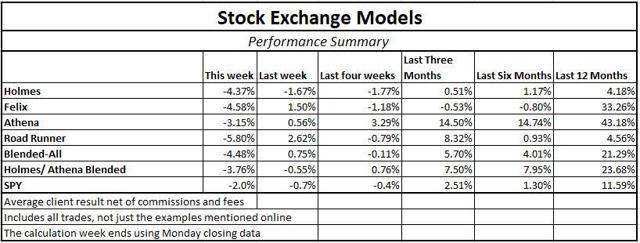

Model Performance:

Per reader feedback, we’re continuing to share the performance of our trading models, as shown in the following table:

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

And for these reasons, I am changing the “Trade with Jeff” offer at Seeking Alpha to include a 50-50 split between Holmes and Athena. Current participants have already agreed to this. Since our costs on Athena are lower, we have also lowered the fees for the combination.

If you have been thinking about giving it a try, click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger; (Blue Harbinger is a source for independent investment ideas).

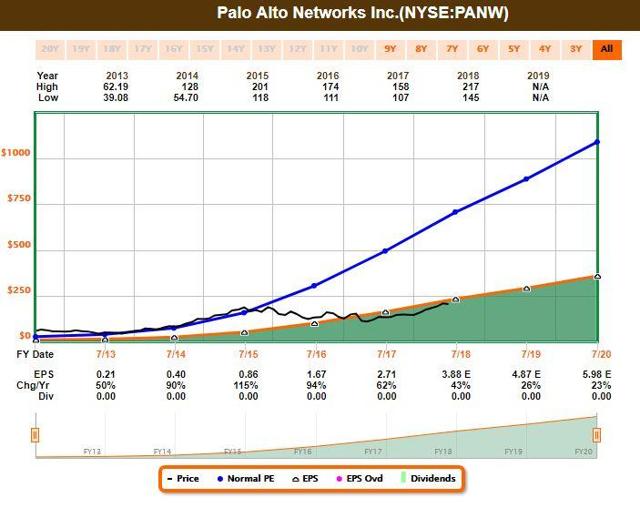

Holmes: I bought shares of Palo Alto Networks (PANW) on Monday. Are you familiar with this stock?

Blue Harbinger: Yes, Holmes—Palo Alto is a technology company that focuses on network security software. Why’d you buy?

Holmes: As you know, I am a dip buyer, and as you can see in the following chart, I bought on the dip.

BH: You mean you bought on Mondays sell-off? Interesting pick Holmes. So what you are basically telling me is that you reacted to Monday’s tough day in the market (i.e. the sell-off) by being opportunistic. That takes guts to buy when others are selling.

Holmes: I am a technical trading model, not a human, so there were no guts involved, unless you count my technical programming which is totally objective, but certainly does have style.

BH: So I assume you’re excited about PANW’s earnings beat earlier this month? What’s you long-term forecast for this company? Here is a look at some fundamentals, via the following FastGraph.

Holmes: Thanks for the data, and it looks like you’re expecting continuing strong EPS growth. However, I am a technical trading model, and my typical holding period is only about six weeks, so I am not interested in your long-term fundamentals forecast.

BH: Fair enough, I’ll check back with you in 6-weeks on this one. And how about you, Road Runner—any trades this week?

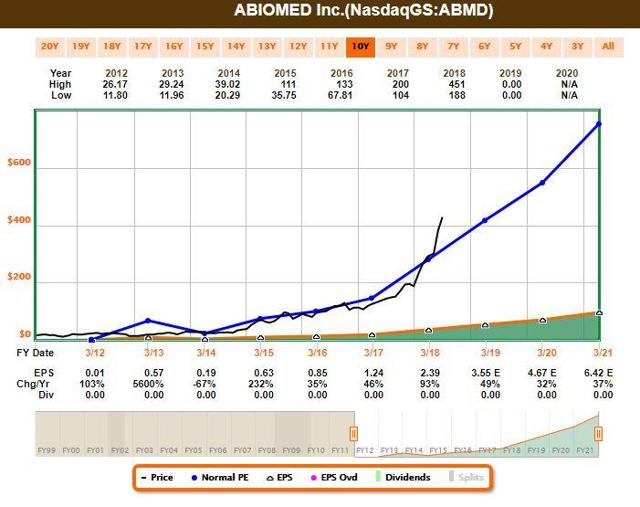

Roadrunner: I purchased shares of ABIOMED (ABMD) on Tuesday. I like to buy shares when they’re in the lower end of a rising channel, as you can see in the following chart.

BH: Road Runner, you do realize that Athena and Felix also own ABIOMED now. This is the first time three of our models have ever held the same stock at the same time. Athena bought on 6/4, and Felix purchased it last week (on 6/18).

RR: I’d tell you that gives me added confidence in the trade, but I am not a human, I am a trading model, and I was already very confident in my process. Besides, the other models hold for different time periods. My typical holding period is only 4-weeks.

BH: Since you mention time periods, here is a look at the longer 1-year chart for ABIOIMED. I can still see the dip in the rising channel that you like.

Also, here is a look at the Fast Graph. From a fundamentals standpoint, this stock has more upside, especially considering it beat earnings estimates significantly last month, and raised guidance. This company’s heart pump revenue has been accelerating rapidly.

RR: Thanks for that info. Anyway, how about you, Felix—anything to share this week?

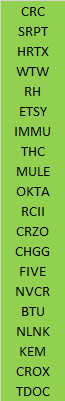

Felix: I ranked the stocks of the Russell 2000 Small Cap index using my system, and I have included the top 20 rankings in the following list.

BH: I know you are a momentum trader, and you typically hold for about 66-weeks. I see California Resources Corp (CRC) at the top of your list. This is an oil and natural gas E&P company that was formed from an Occidental Petroleum spin-off. The company serves California, and I like this pick too. The recent rise in oil prices helps the business, and the fundamentals are looking better.

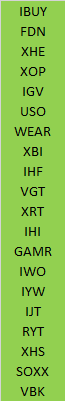

Oscar: This week I ranked the Comprehensive and Diverse ETFs universe. The top 20 are shown in the list.

BH: Thanks, Oscar. I see a couple energy names on your list, such as the oil and gas ETF (XOP) and the oil ETF (USO). I’m sure Felix appreciates your bullishness on oil considering his top CRC ranking. I see you also still like the global online retail ETF (IBUY). I think that’s probably a good pick too considering online retail trends, even after the Supreme Court’s recent ruling that states can tax online retailers. I also realize you are a momentum trader, and you typically hold for about 6-weeks. Thank you for sharing these ideas.

Conclusion:

The market has been down over the last week, and our models have been down as well. However, we are reacting to the sell-off objectively rather than panicking. Our well-defined trading processes help us avoid making any rash decisions after short-term volatility, and they also help us deliver strong long-term results. How are we reacting to a tough patch in the markets? By sticking to our normal, disciplined and proven trading approach.

Background On The Stock Exchange:

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check out Background on the Stock Exchange for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Stock Exchange Character Guide:

| Character | Universe | Style | Average Holding Period | Exit Method | Risk Control |

| Felix | NewArc Stocks | Momentum | 66 weeks | Price target | Macro and stops |

| Oscar | “Empirical” Sectors | Momentum | Six weeks | Rotation | Stops |

| Athena | NewArc Stocks | Momentum | 17 weeks | Price target | Stops |

| Holmes | NewArc Stocks | Dip-buying Mean reversion | Six weeks | Price target | Macro and stops |

| RoadRunner | NewArc Stocks | Stocks at bottom of rising range | Four weeks | Time | Time |

| Jeff | Everything | Value | Long term | Risk signals | Recession risk, financial stress, Macro |

Guest post by Blue Harbiner.

We have a new (free) service to subscribers to our Felix/Oscar update list. You can ...

more