Normalizing The Fed Rate: This Time Is Different

One hears that the Federal Reserve would like to normalize the Fed rate. What does that mean? How can we conceptualize that?

Well, there are many ways to conceptualize it, but here is a simple way using measures of the growth of nominal GDP (NGDP). In normalization, the Fed rate will rise to the growth rate of NGDP by the end of the business cycle.

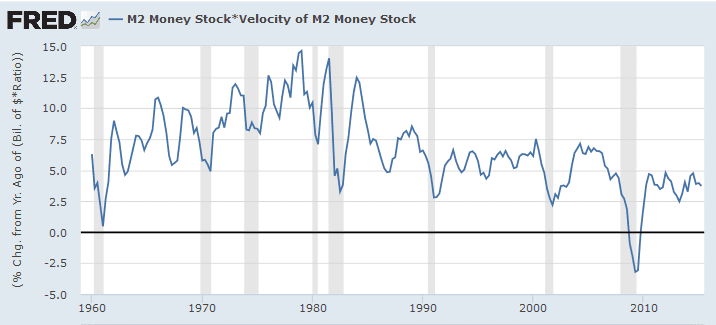

First, we measure NGDP growth by multiplying M2 money stock by the velocity of the M2 money stock. Then take the annual percentage change of that multiplication. (link to FRED graph)

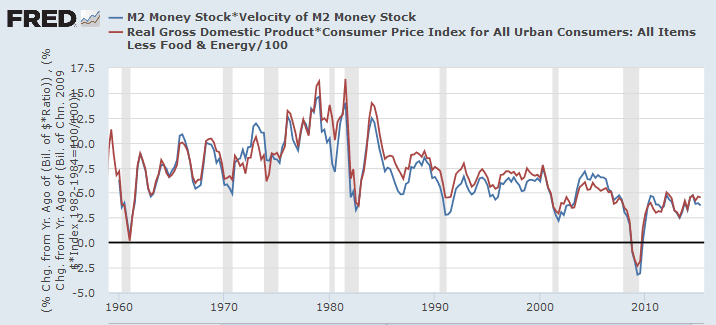

The other way to measure the growth in nominal GDP is by multiplying real GDP by the price level, then taking the annual percentage change. I will add this measure to the previous graph.

They are close.

Note that the current growth in NGDP is around 4% which is a level only seen around times of recession in the past.

Note the slow general decline since the 1980′s.

Normalization of Fed Rate

Now, how does the normalization of the Fed rate fit into this picture?

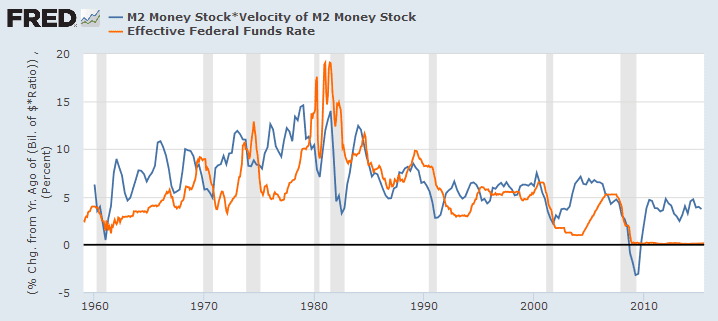

Let me add the effective Fed rate to the first graph, and make some comments.

Generally, the Fed rate will fall during a recession. Then after a recession, the Fed rate will climb below the growth rate of NGDP in order to heat up the economy toward full employment. Normalization is when the Fed rate rises up to or above the level at which NGDP has been tracking. This is a signal that full employment has been reached and that the desire to heat up the economy must stop. If the Fed rate goes above the NGDP growth rate, a recession is likely to form.

Note that before the crisis, NGDP was tracking around 7%. The Fed must had thought that they could raise the Fed rate safely to about 5%. But when the Fed rate reached 5%, NGDP growth fell to below 5% at the same time. The consequence may have triggered the formation of the recession.

Formula

What is the rate at which the Fed rate will normalize to NGDP?

Normalized Fed rate = natural real rate + inflation target

Natural real rate is related to the growth rate of real GDP. Inflation target is related to the current core inflation.

Another formula could be used.

Normalized Fed rate = % change in M2 stock + % change in M2 velocity

This Time is Different

Obviously the current business cycle shows a different pattern than seen in all previous business cycles. The Fed rate has fallen and can’t get up. Even though the Fed rate “would” normalize at a lower rate this time than seen since the 1950s, around 3%, it cannot even get started toward this low level.

NGDP is growing slow in spite of massive Federal Bank reserves. Money will just not accelerate through the economy… The weak momentum gives the Fed fragile reasons to raise the Fed rate.

Some causes that have contributed to the strangeness of this business cycle are… low labor share, higher debt levels, global disinflation, weak fiscal policy, lack of identifiable bubbles and weak domestic productive investment.

One might think that a recession is just not possible with the Fed rate so far below the NGDP growth rate.

Still, the economy currently is really very sick… in ways that we may not have seen before.

Disclosure: None.