Stock Exchange: The Most Costly Trading Mistakes To Avoid

Summary

The Stock Exchange is all about trading. Each week we do the following:

- Discuss an important issue for traders;

- highlight several technical trading methods, including current ideas;

- feature advice from top traders and writers; and,

- provide a few (minority) reactions from fundamental analysts.

We also have some fun. We welcome comments, links, and ideas to help us improve this resource for traders. If you have some ideas, please join in!

Review: Are Your Trading Rules Too Rigid?

Our previous Stock Exchange featured guest expert, Brian Gilmartin, and asked the question: Are Your Trading Rules Too Rigid? The article acknowledged that rule-based trading is an excellent framework, but some flexibility is needed. Leading trading experts each have a method — as do our trading models. And a glance at your news feed will show that the key points remain relevant.

This Week: The Most Costly Trading Mistakes To Avoid

“Investing is the only business I know that when things go on sale, people run out of the store.”

–Mark Yusko, Morgan Creek Capital Management.

Investors and traders alike, do a lot of silly things, and doing the wrong thing at the wrong time is certainly one of them. But before we get into the specific do’s and don’ts of “trading mistakes,” here are some humorous do’s from the always insightful, Ben Carlson.

Allowing yourself to get pulled in too many different directions, as described in Ben’s “more-than-28-hour-per-day” tweet, can certainly be a costly trading mistake and a sure fire recipe for failure, as we described in a previous issue of the Stock Exchange. It’s important to have a disciplined trading strategy that works for you. We describe ours later in this report.

Returning to Mark Yusko’s early quote about what to do when prices go on sale, here is a very insightful piece from Vivian Ning at S&P Global Market Intelligence about “Buying the Dip: Did Your Portfolio Holding Go On Sale?”

One of the things Vivian explains, in a very insightful and data-driven fashion, is that “dip buying” is not only a strategy that has worked, but it can be improved upon by combining it with short-term technical indicators such as a form of price momentum. Specifically, she examined the 4-week to 52-week Price Oscillator (which is defined as the ratio of the 4-week exponential moving average of weekly closing price to the 52-week exponential moving average), and found a higher value of this ratio indicates a more attractive buying opportunity. And as we’ll cover more later in this report, this is not dissimilar to the trading strategy used by our Road Runner trading model.

Finally, in the conclusion of this report, we share a list of some of “The Most Common Mistakes Of Amateurs” from legendary trader Charles Kirk included in this week’s issue of The Kirk Report.

Model Performance:

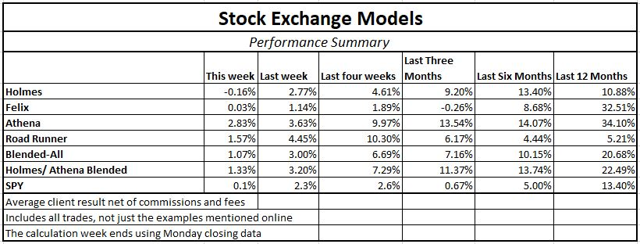

Per reader feedback, we’re continuing to share the performance of our trading models. Our trading models have shown excellent performance in recent weeks as you can see below:

We find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

And for these reasons, I am changing the “Trade with Jeff” offer at Seeking Alpha to include a 50-50 split between Holmes and Athena. Current participants have already agreed to this. Since our costs on Athena are lower, we have also lowered the fees for the combination.

If you have been thinking about giving it a try, click through at the bottom of this post for more information. Also, readers are invited to write to main at newarc dot com for our free, brief description of how we created the Stock Exchange models.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger; (Blue Harbinger is a source for independent investment ideas).

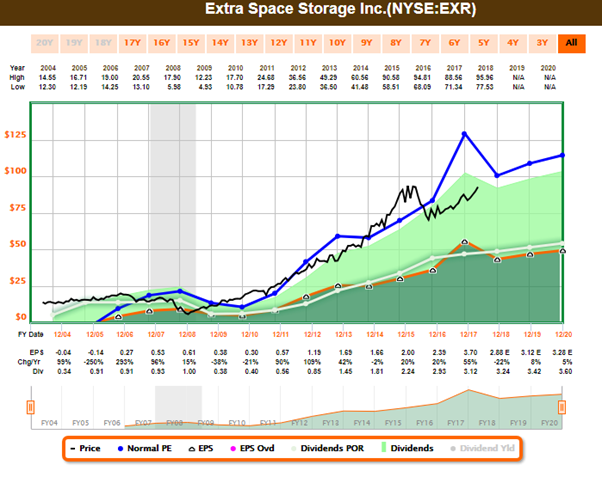

Road Runner: I purchased Extra Space Storage (EXR) on 5/17. What do you know about this stock?

Blue Harbinger: I know EXR is a self-storage REIT, it offers an attractive dividend yield of 3.4%, and it’s one of those rare REITs that is actually performing well (it’s up 11% this year, while the real estate sector (XLRE) is down 5.2%).

Road Runner: That’s correct. And as was alluded to earlier in this report, I like to buy stocks in the lower-end of a rising channel. My strategy combines dip-buying elements with momentum qualities. My strategy is not entirely dissimilar to what Vivian Ning described earlier in this report. Here is a chart to help you visualize the “buying-a-dip-within-a-momentum-channel” strategy.

BH: Interesting trade, Road Runner. How long will you hold?

Road Runner: My typical holding period is 4-weeks.

BH: Well—as we saw in the earlier performance chart, your strategy has been working well in recent weeks. I know you are a shorter-term technicals-based trader, but here is a look at the FastGraph (below) in case you decided to consider fundamentals. I’ll check back with you on EXR in 3-weeks (you bought it a week ago, now) to see how you did.

BH: Anyway, how about you, Felix—any trades this week?

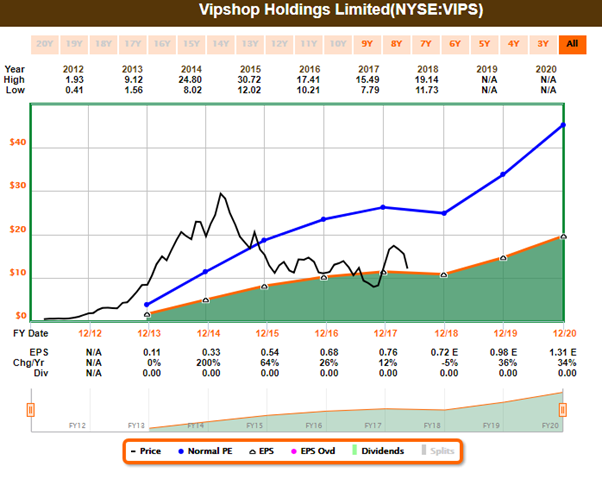

Felix: This week I sold my Vipshop (VIPS) shares. If you recall, I purchased these in February, and the trade didn’t work out as I had hoped—I sold at a lower price than I purchased.

BH: Sorry for your loss. Are you sad?

Felix: No. I am not sad. I am a trading model, not a human. And even though I am not a human, I am still smart enough to know that:

“placing far too much importance on any one trade instead of the last 30 in aggregate”

…is a terrible trading mistake (it’s also one of the costly trading mistakes to avoid, per Charles Kirk, as described in the conclusion of this article). And if you look at my six and 12 month performance track record (in the table earlier in this report), I am doing very well for myself, thank you very much!

BH: Got it. Thanks Felix. Did you consider the fundamentals on Vipshop? Here is a look at the FastGraph.

Felix: Thanks for that information, I know it is extremely valuable to many, but I am a technical trader. More specifically, I am a momentum trader, and I typically hold for about 66 weeks (much longer than our other trading models). But I also consider macro factors and use dynamic stop orders to control risks. No one wins all of their trades. And “always trying to hit home runs in very high-risk trades” is another amateur mistake as described in the conclusion of this report.

BH: Alrightly then. Thanks for those tips, Felix. Anything else?

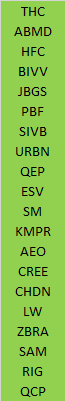

Felix: Yes. I ran the entire S&P 400 Midcap Index through my model this week, and I’ve included the top 20 rankings below.

BH: I do appreciate those rankings, Felix—so thanks! And I see you like Tenet Healthcare (THC) and ABIOMED, Inc (ABMD). Those are a couple of healthcare stocks that have been exhibiting some strong price momentum. Anyway, how about you, Oscar—Do you have anything to share this week?

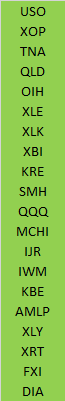

Oscar: This week I ran the High Liquidity ETFs with price volume multiple of over $100 million per day. The top 20 are shown in the following ranking.

BH: Interesting. Remind us, Oscar—what is your trading style?

Oscar: I take positions in ETFs based on momentum. And I usually hold for about 6-weeks before rotating into another sector. As you can see based on my top rankings, I like energy (oil in particular) right now (USO) (XOP).

Conclusion:

Trading isn’t easy, and many people shouldn’t even try it (at least not with real money right off the bat). Some of the most costly trading mistakes include “running out of the store when things go on sale,” allowing yourself to get pulled in too many different directions, not having a disciplined approach, and allowing your emotions to get the best of you. For added perspective, here are twenty-five specific mistakes that amateurs commonly make, per legendary trader, Charles Kirk of The Kirk Report.

The Most Common Mistakes Of Amateurs

- selling out because of fear

- putting money to work out of FOMO

- having ONLY a very short-term focus

- always trying to hit home runs in very high-risk trades

- trying to trade the news and especially your political bias

- trading against the overall trend and the price action often

- attempting to prove how smart you are in the markets by making challenging contrarian-type trades without any price action support

- placing far too much importance on any one trade instead of the last 30 in aggregate

- risking capital that you cannot afford to lose or by using extensive amounts of leverage

- fail to employ multiple trading and investing strategies as a path toward greater diversification

- not consistently planning out your trades in advance in writing down justifications in addition to exits and reentries

- overtrading in challenging, choppy, trading range markets instead of reducing position sizing and increasing selectivity

- failing to properly track, review, evaluate, and learn from your past trades

- refusing to take a loss because it hurts your ego and because you have a tough time admitting your mistakes

- focusing far too much on the precise entry of a new position rather than proper risk management after a trade is made

- failing to track and to take overall expenses into account including taxes when evaluating strategies

- attempting to make another person’s strategy their own

- use quant and sentiment data to justify bias and current positioning instead of to directly challenge positioning

- succumbing to the temptation to make it more complex

- searching for news-based narratives to justify your bias

- not having a comprehensive portfolio strategy and trading positions randomly without any big picture plan

- constantly changing and tweaking successful strategies in continued search for “perfect system”

- lack of humility during the good times and the lack of courage during the bad times

- refusing to utilize passive, low-cost long-term strategies as a path to long-term financial success

- allowing past, hurtful mistakes to negatively influence the your future perspective and strategy by making your self-worth entirely dependent upon your current performance

Per Kirk:

“Understanding what you are doing wrong, is far more challenging that you think, which is why doing well requires so much intensive self-evaluation and study.”

Background On The Stock Exchange:

Each week, Felix and Oscar host a poker game for some of their friends. Since they are all traders, they love to discuss their best current ideas before the game starts. They like to call this their “Stock Exchange.” (Check out Background on the Stock Exchange for more background). Their methods are excellent, as you know if you have been following the series. Since the time frames and risk profiles differ, so do the stock ideas. You get to be a fly on the wall from my report. I am usually the only human present and the only one using any fundamental analysis.

The result? Several expert ideas each week from traders, and a brief comment on the fundamentals from the human investor. The models are named to make it easy to remember their trading personalities.

Stock Exchange Character Guide:

| Character | Universe | Style | Average Holding Period | Exit Method | Risk Control |

| Felix | NewArc Stocks | Momentum | 66 weeks | Price target | Macro and stops |

| Oscar | “Empirical” Sectors | Momentum | Six weeks | Rotation | Stops |

| Athena | NewArc Stocks | Momentum | 17 weeks | Price target | Stops |

| Holmes | NewArc Stocks | Dip-buying Mean reversion | Six weeks | Price target | Macro and stops |

| RoadRunner | NewArc Stocks | Stocks at bottom of rising range | Four weeks | Time | Time |

| Jeff | Everything | Value | Long term | Risk signals | Recession risk, financial stress, Macro |

We have a new (free) service to subscribers to our Felix/Oscar update list. You can suggest three favorite stocks and sectors. We report regularly on the “favorite fifteen” in each ...

more