Property Flipping Or Rental?

When it comes to investing in the property market, ordinary people often do so with two things in mind. The most common reason is, of course, to own a house and avoid paying rent while the other is to turn it into a fixed income generator. That is, buy a house or commercial property and rent it out for periodic returns.

However, there is a third option that is more popular with sophisticated investors. Have you ever heard of flipping property? Well, most people have, but very few understand what it means let alone why investors would be interested in it. For those unfamiliar with the term, flipping property means buying property and then selling it at a profit after doing some renovation and reconditioning works.

This practice is generally associated with residential properties but based on recent property reports, most profits are garnered from properties that are located within business centers. This is because of the strong relationship a distance creates between residence and offices. For instance, according to reports flipping property within New York business centers can results in profits of anything between 40% to 200% depending on the proximity of the property to the business center and the market season.

In fact, the NY post published a report that highlighted one “flipster” who made 165% in profits after picking up a property for $150,000 before selling it for $400,000 nine months later.

So, flipping property results in massive one-time profits, which could be appealing to investors seeking to invest those profits in other assets.

On the other hand, converting your property into a rental result in periodic payments, which also attract various costs along the way including maintenance costs and management fees for those using an agent to manage their property. Let’s take an in-depth look at how the two option stack against each other.

So, flipping property?

As noted in the brief description above, house-flipping entails buying a somewhat out-of-condition house and selling it for a profit after doing some renovation and reconditioning. People that are involved in this type of business are mainly seeking quick profits. The idea is to buy, renovate/recondition, then sell, and move on quickly to the next available property.

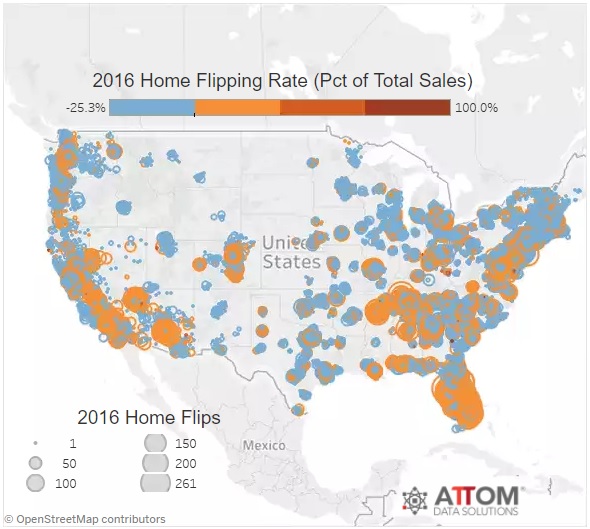

Therefore, if you are an investor engaged in this business you are likely to seek out for the most efficient way to sell your newly acquired property after enhancing its market value through home improvement. This is because the quicker you sell it, the quicker you receive finances to target the next property. Frequency is the key in this case as this dictates the level of income you make at the end of the year. As seen in the example cited above, it should ideally take less than a year to turn your profits. This is probably why most home-flips are concentrated in busy business regions as these tend to find customers quicker.

Investors targeting these types of investments do so to capitalize on the highly discounted prices that out-of-condition properties trade at. This helps them to increase their profit margins on the total amount invested including renovation costs. Investors can also boost the value of their renovated homes by adding modern features including smart home technology. Controlling reconditioning and renovation costs can also help to improve the return on investment.

Or maybe rentals are a better choice?

Investing in real estate is often seen as a perfect way to save for retirement due to the predictability of the periodic payments.

Unlike in house-flipping, investors know beforehand what they can expect to receive in rental payments for the foreseeable future. This type of investments requires roughly the same amount of capital as in the case of house-flipping. There is the initial amount required to buy the house, and another amount required to renovate it to make it more appealing to potential customers looking to rent property.

However, when it comes to receiving the income, as compared to the one-time lump sum for the fix and flip investors, the payments are gradual and can increase with time depending on house prices. In this case, investors can make more from the investment than is the case of flipping the house.

In addition, they can also invest in other properties by taking a mortgage, which can be serviced with the rental payments received from the current property.

Conclusion

House-flipping is often associated with rising housing prices but investors also engage in it via what is popularly known as fix and flip.

Alternatively, investors can choose to rent the property thereby turning it into a fixed income generator.

While the fix and flip analogy results in substantial one-time payments, the ownership, and rental option appeals more to investors looking for stable long-term periodic payments.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more