Tighten Those Hatches Further

Eventually, it comes for everyone. They say that the only sure things in life are death and taxes. While true, over the last eleven years we’ve come to depend on another “d”, dollar. Sure, the US economy can decouple, but only for a while. To this point, the eurodollar is undefeated.

There seems to be a lot of surprise about China’s predicament. It’s pretty standard stuff, really. For more than a year all we heard was globally synchronized growth. A recovery had been written about as a foregone worldwide conclusion.

Because of this bias, what’s been going on over there over the last year or so might have appeared far out of place. For an economic system poised for a big rebound, why the political retrenching? The latest bit of naked authoritarianism was described last week by the New York Times:

China has long made it clear that reporting on politics, civil society and sensitive historical events is forbidden. Increasingly, it wants to keep negative news about the economy under control, too.

A government directive sent to journalists in China on Friday named six economic topics to be “managed,” according to a copy of the order that was reviewed by The New York Times.

Right at the top of the soft censorship list is, “Worse-than-expected data that could show the economy is slowing.” In the West, this is being taken as a sign that Chinese leaders and the Communist government is afraid of what may happen if it turns out to be true.

“It’s possible that the situation is more serious than previously thought or that they want to prevent a panic,” said Zhang Ming, a retired political science professor from Renmin University in Beijing.

I think this is all backwards. “More serious than previously thought” is the insinuation of Western economic expectations. Rather than being surprised by what’s going on in their economy, and therefore the global economy, it seems more likely this is exactly what they have been expecting all along. They’ve been preparing for this kind of slowdown (and worse) for a long time.

While everyone in Europe, Japan, and the US was gripped last year by inflation hysteria, really recovery hysteria with rising inflation as its key symptom, Communist China was battening down the hatches. It made for an incredibly stark juxtaposition, the idea that the global economy was soon going to be running at full strength but where the government inside the engine of that growth was preparing more and more for the opposite case.

This is not a new development.

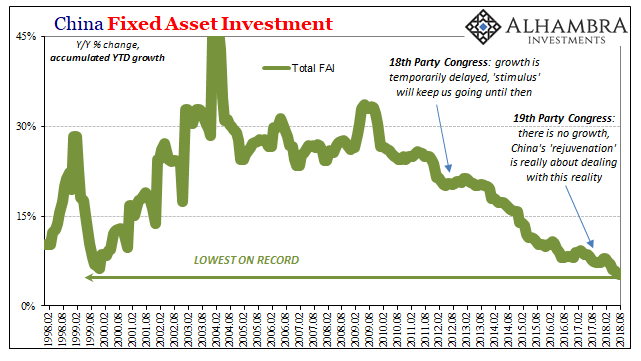

It started, in the open anyway, at the 19th Communist Party Congress. Xi Jinping’s name was inscribed upon the Party’s constitution alongside only Mao’s. Political opposition to Xi was therefore made illegal in every sense. Why take such an extreme measure?

I wrote last October when that was announced:

Thus, if faced with only bad and worse options, at least preparing for all possible fractures from a deteriorating situation is prudent. Economic risk in the form of prolonged stagnation is huge political risk. If you can’t do much about the former, then you better start to think and act as to the latter.

This was October 2017, long before the trade war stuff or Korea, Italy, and the bevy of increasingly desperate excuses that have been made to try and otherwise explain this “unexpected” economic cooling. Yet, the unofficial mantra of last year’s Communist gathering was a new “harmonious” society, one where quality of growth would be prioritized over quantity.

They very nearly spelled it all out, not that you would have known from the glowing economic commentary. Whose media is actually being censored?

In February, Xi effectively made his position permanent as head of the Chinese state. It seemed very much in the same line heading still in that same direction. I wrote:

My own view is rather simple. The Communist Party apparatus really appears to be gearing up for what the final end of the economic miracle might really mean. You crack down on opposition before the opposition becomes trouble. It’s hard not to guess that in looking at China’s future political and social state absent the growth many have become accustomed to, Communist officials sit aghast at the very real possibilities. Their economic options have run out on them.

And now, here they are. Government officials have been preparing for the consequences of an economic “L”, one that really began, for China, during that fateful summer of 2011. By the end of 2013, it was already too late.

Despite the hoopla and hysteria over 2017, in truth, there was never much behind Reflation #3. Indeed, by the end of last year, it was already in trouble (Hong Kong, T-bills on September 5, etc.). I doubt, however, the Chinese people were told the truth.

They had, right or wrong, come to believe vast economic growth was the tradeoff for a whole range of social and political deficiencies. The Communists may be authoritarian, the environment increasingly a literal cesspool in far too many places, but the very idea of taking 250 to 500 million peasants out of poverty and handing them a middle class (or nearly so) lifestyle made it a palatable if still objectionable framework.

Parents will put up with a lot, a lot, if it means their children will be far better off. Take away economic growth and, what will really shock Western Economists and the media, any chance at getting back to it, how will the Chinese people respond to losing their only upside?

The Communists appear to have come to the one conclusion, about the economy and are preparing to find out how the people will eventually answer that very question. Not in the internet news, media sense of reporting economic statistics. But as the actual economy slows on the ground, China’s vast population is going to notice even if the local news article censors the clear drop in nominal GDP, retail sales, or whatever other number.

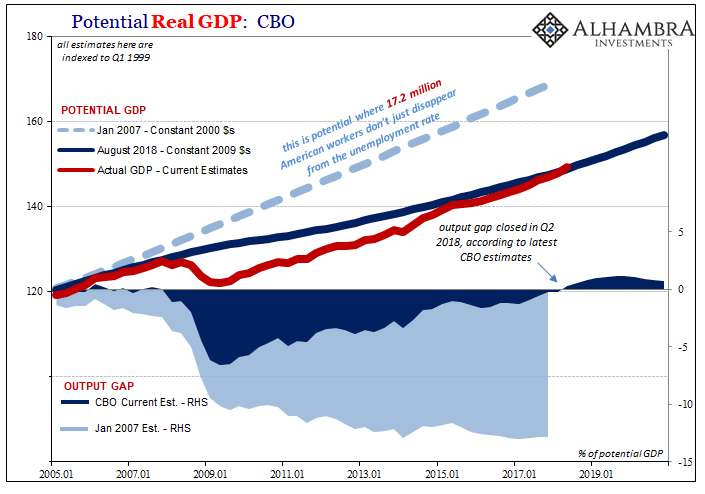

This is not a purely a Chinese problem nor has it been a purely Chinese phenomenon. In many ways, it has been worse here. Economists have all but abandoned any sense of recovery, too, they’ve simply redefined it. Where the Communists are miles ahead of Western Economists is that the former don’t simplistically expect people not to notice the difference.

The global economy is all moving in the same direction regardless. In China, the government knows what this may mean. In the West, Economists have managed to fool themselves, and anyone who listens, into thinking it’s all nothing. They are the only ones who are surprised by the events of the last few years.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more

As China enters a new normal, any hope of serious world recovery diminishes.