SPX, Gold, Oil And G6 Targets For The Week Of November 12

You can always count on the media to explain after the fact why something happened. The explanations for Friday’s sell-off were wide ranging, from oil to the Fed, to economic data, etc. For us, the reasons were of a technical nature and the clues were there well before the sell-off started. First, price had advanced well above the weekly upside target and on Friday it simply retreated back within the projected trading range. Second, just ahead of the FED decision we alerted readers of our blog that buying pressure in the SPX had reached peak levels. And, although it is possible for price to keep grinding higher while some of that pressure is being relieved, this possibility is normally associated with the early stages of very strong bull markets.

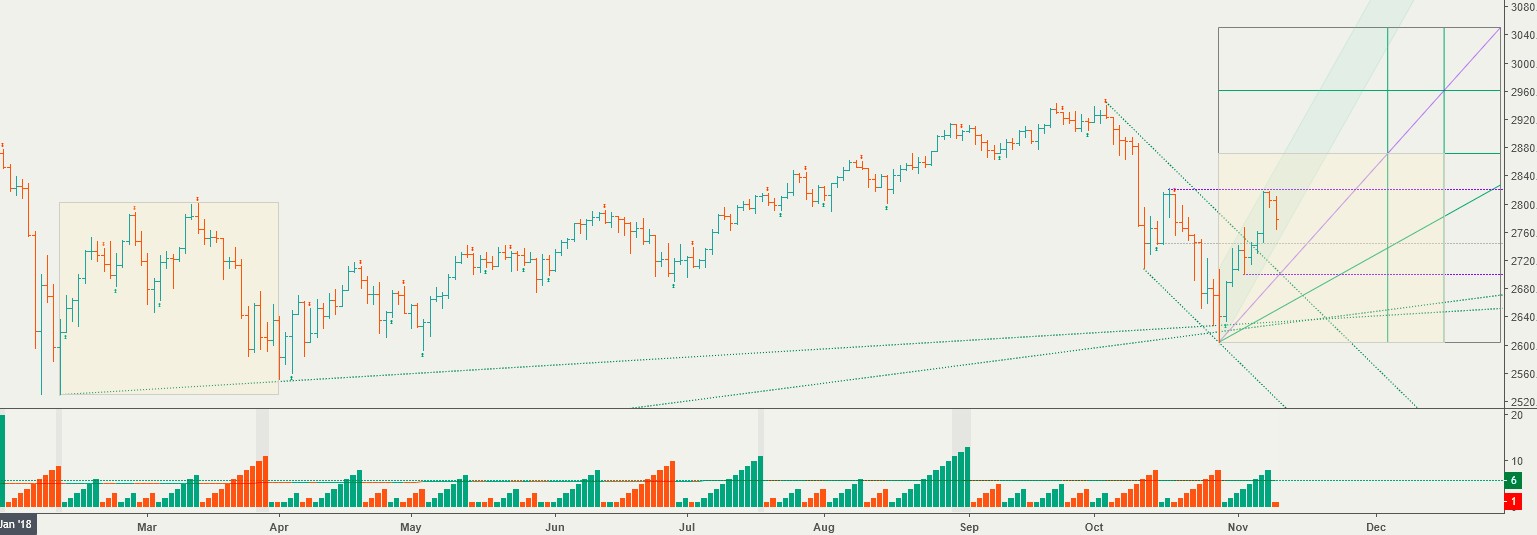

Last week we started tracking the count-down to our year-end targets. For reader’s convenience, we are making it possible to follow the action live and in real time here. Previous declines have taught us that a retest of the October lows is a possibility. To make sure the SPX remains on target, we need to keep an eye on resistance at 2822, and support at 2745 and 2700:

Current signals: Daily Sell, Weekly Buy, Monthly Sell

Daily Buy pivot for Monday at 2790.

The projected trading range for next week for SPX is 2740-2840.

Oil has been a lot in the news lately, and remains on track to reach our downside target next week.

Current signals: Daily Sell, Weekly Sell.

Daily Buy pivot for Monday at 62

The projected trading range for oil for next week is 58 – 63.5:

Gold couldn’t hold onto the gains from last week, switched to a sell signal mid-week, and reached our downside target on Wednesday. It also dropped below 1220, which we consider a key bullish reversal level.

Current signals: Daily Sell, Weekly Sell

Daily Buy pivot for Monday at 1220.

The projected trading range for Gold for next week is 1200 – 1240:

All G6 targets were reached, and the target hit rate this year remains above 85%.

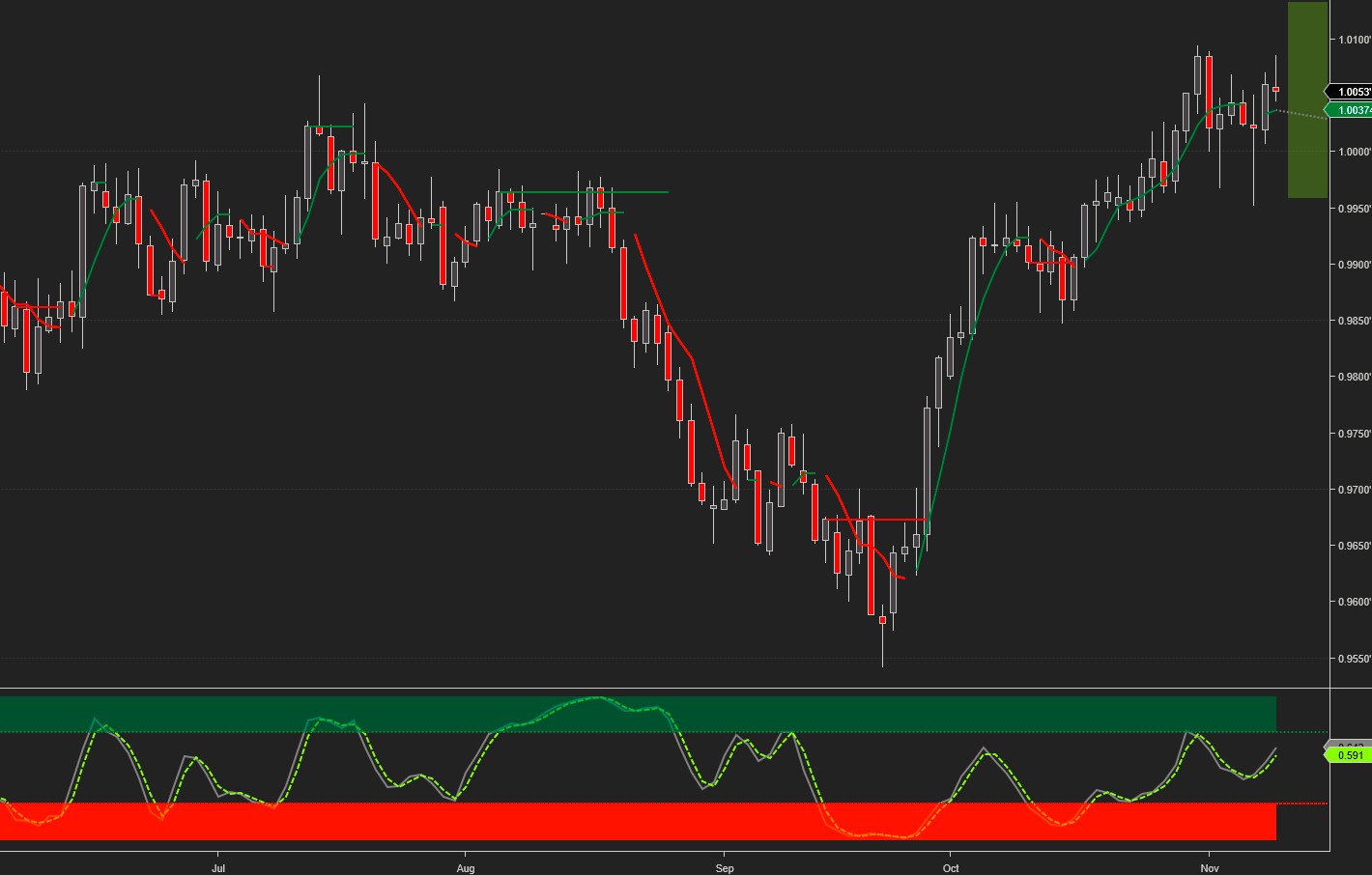

USDCHF dropped to our downside target mid-week and staged a sharp reversal.

Current signals: Daily Buy, Weekly Buy

Daily Sell pivot at 1.00

The projected trading range for USDCHF for next week is 0.996 – 1.014:

USDJPY kept its buy signal and tested the upside target twice before breaking out and finishing the week a few pips above it.

Current signals: Daily Buy, Weekly Buy/Hold

Daily Sell pivot for Monday at 113.6

The projected trading range for USDJPY for next week is 112.8 – 114.7:

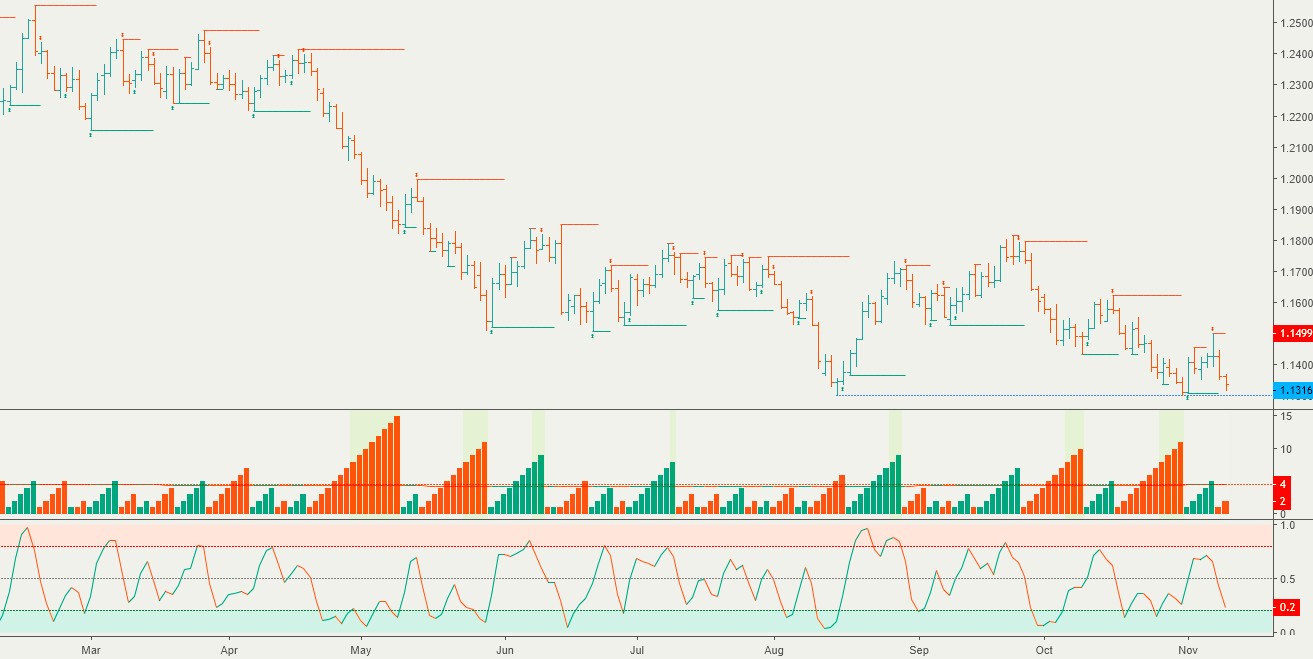

EURUSD managed to tag our upside weekly target on Wednesday, then reversed sharply and remains on a Sell signal.

Current signals: Daily Sell, Weekly Sell

Daily Buy pivot for Monday at 1.136

The projected trading range for EURUSD for next week is 1.126 – 1.15:

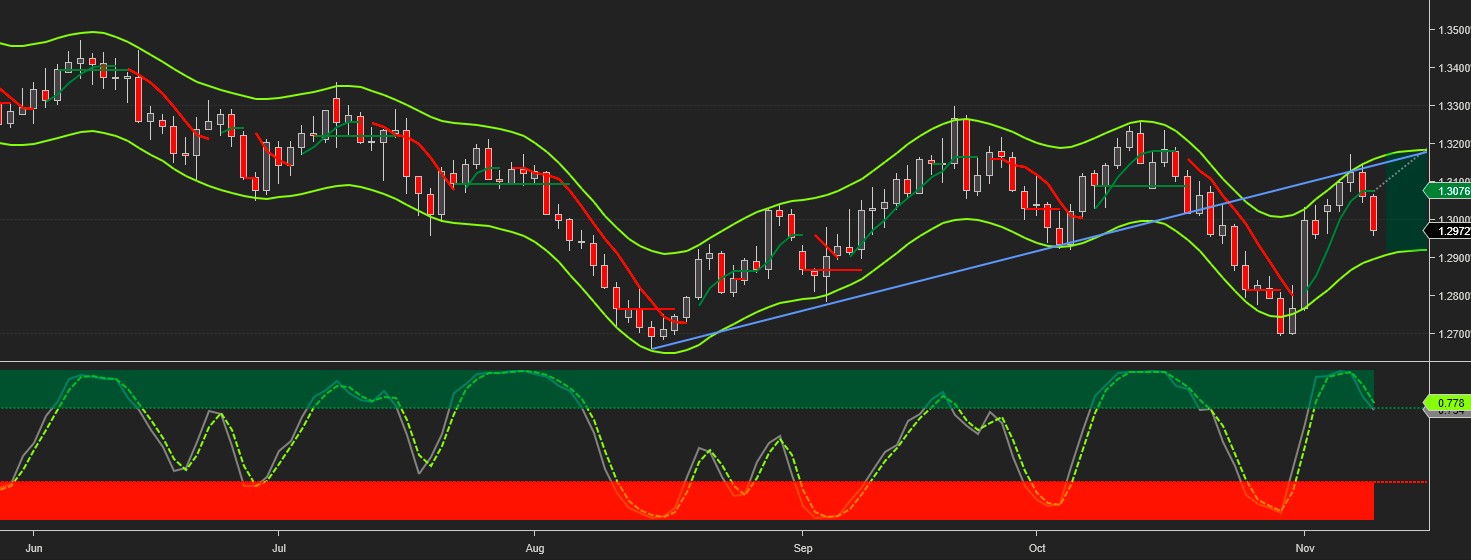

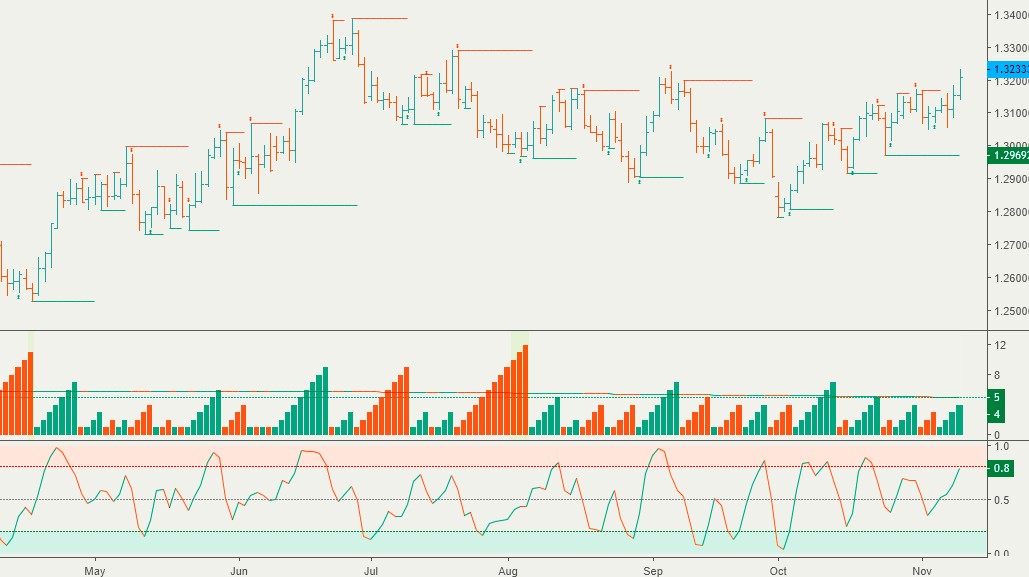

GBPUSD continues to dance to the Brexit tune. It broke above the weekly upside target mid-week on false hopes and news, but couldn’t hold onto the gains and closed on Friday within the range.

Current signals: Daily Sell, Weekly Sell/Hold

Daily Sell pivot for Monday at 1.307

The projected trading range for GBPUSD for next week is 1.29 – 1.32:

USDCAD finally broke out above the three week upside target, but barely.

Current signals: Daily Buy, Weekly Buy

Daily Sell pivot for Monday at 1.317

The projected trading range for USDCAD for next week is 1.302 – 1.33:

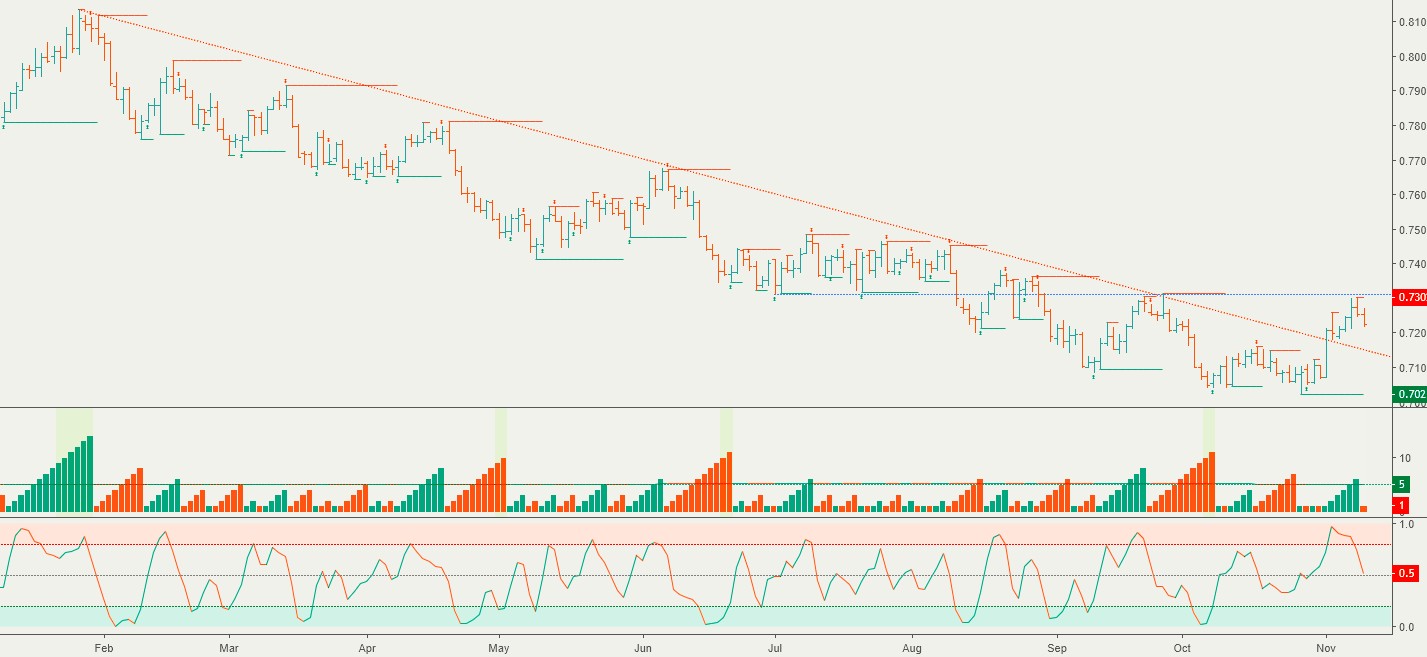

AUDUSD broke above our upside target briefly but couldn’t hold onto the gains and finished the week a few pips below it. This adds to the long list of failed rallies and, as we’ve said before, a break above the previous swing high at .73 is needed to confirm that a change in trend is in place.

Current signals: Daily Buy, Weekly Buy

Daily Sell pivot for Monday at 0.73

The projected trading range for AUDUSD for next week is 0.715 – 0.735:

*Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more