SPX & G6 Prices For The Week Of May 7th

Below is a brief recap of last week’s price projections and the price targets for next week.

Once again the SPX hit all key numbers. First it got rejected at resistance at 2676 on Monday, then it bounced off the low range target at 2600, to finish the week a few points below where it started. The index finds itself at an important inflection point, at the crossroads of the April uptrend channel and the current downtrend channel. There continues to be strong resistance just above Friday’s close at 2676, and the 50 dma is at 2681:

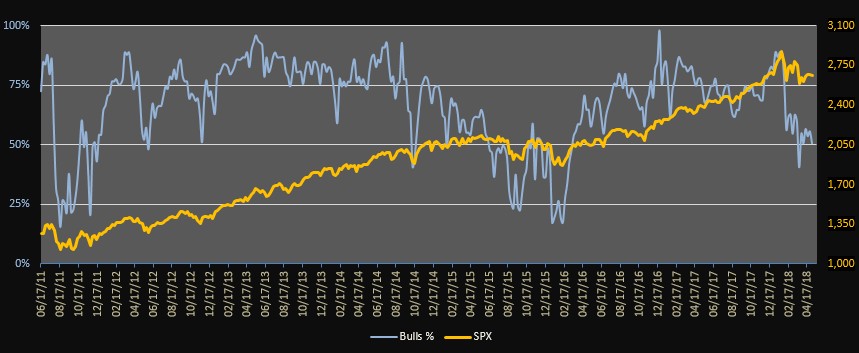

Weekly sentiment readings are at 50% reflecting market participants’ uncertainty about future market direction:

Which begs the question of how to incorporate the range price projections into one’s trading strategy.

There are several options. One option is to book your profits as soon as price reaches the upside/downside target, then reverse or wait for the next set-up. This was the better strategy for the major indices and corresponding ETFs. Another approach would be to tighten your stop/loss once the target is hit and wait for reversal confirmation with the hope that momentum may carry the trend even further. That was the better strategy for most currency pairs (see below). The CIT Cloud, Pivot Lines, Angles and Signals are designed to help you manage your trade under either scenario.

By the way, market breadth and liquidity for the US and major European markets can be tracked here during the day.

The projected price range for next week for the E-Mini is 2580 – 2710:

The USD rally against the major currencies continued for a second week, and all upside projections were hit.

The Euro’s decline continued, and in the second half of the week our downside projected target became resistance. The current decline outlasted the majority of previous declines. The shift in market sentiment can easily be detected by checking the swing price gain/loss at the bottom of the chart.

The projected price range for next week for EURUSD is 1.185 - 1.21:

The Pound continued to weaken and, just like with the Euro, our downside projection from last week now becomes resistance.

The CIT Channels projected trading range for next week for GBPUSD is 1.34 - 1.37:

The USD hit its upside target against the JPY, and began retracing immediately.

The projected trading range for next week for USDJPY is 108.2 – 110:

The USDCAD found resistance at our upside weekly target, and started consolidating in a narrow range.

The projected trading range for next week for USDCAD is 1.2725 – 1.2975:

As we expected, the USD reached the top of the target zone and started consolidating, finishing the week at our upside projection. Our expectation is that the USD will continue to consolidate within the .98 – 1.00 range.

Projected range for next week for USDCHF is 0.9875 – 1.007:

After reaching our downside projection, the AUD started consolidating against the USD. We expect that consolidation to continue and for the AUD to trade in a narrow range.

Projected range for next week for AUDUSD is 0.745 – 0.76:

Charts and data courtesy of NinjaTrader 8, Kinetick and CIT for NT8.

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more