SPX & G6 Prices For The Week Of May 14th

Below is a brief recap of last week’s price projections and the price targets for next week.

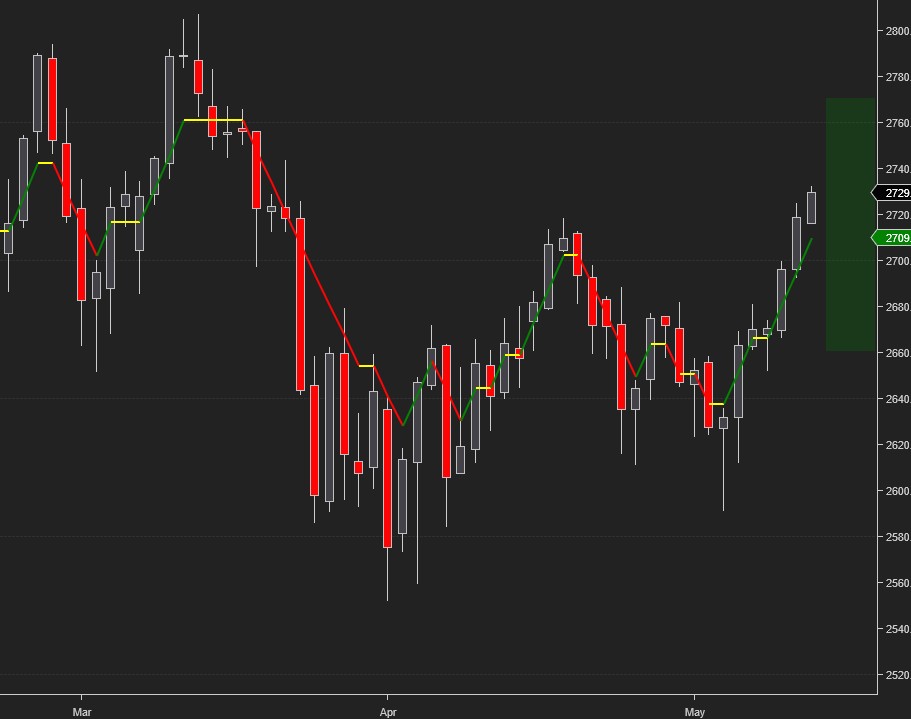

After some hesitation in the no-man’s-land between the bullish and bearish channel mentioned last week, the SPX regained its strength and sliced through several resistance levels to finish the week just below the 6 day CIT Angle target.

Angles, and their application to trading, were popularized by W.D.Gann more than half a century ago. Angles have several advantages over moving averages and trend lines in that they are a forward looking indicator and can be drawn from a single point on the chart. Angles show where price and time are in balance, revealing immediately whether price/trend is in a strong or weak position (above/below the angle). And just like CIT Channels, CIT Angles can be used to determine future price and time targets:

Since CIT Angles can be drawn automatically from CIT (change-in-trend) points on the chart, their interaction in and of itself is a useful tool for monitoring and managing trades. This is done by the CIT SAR indicator:

The projected price range for next week for the E-Mini is 2660 – 2770.

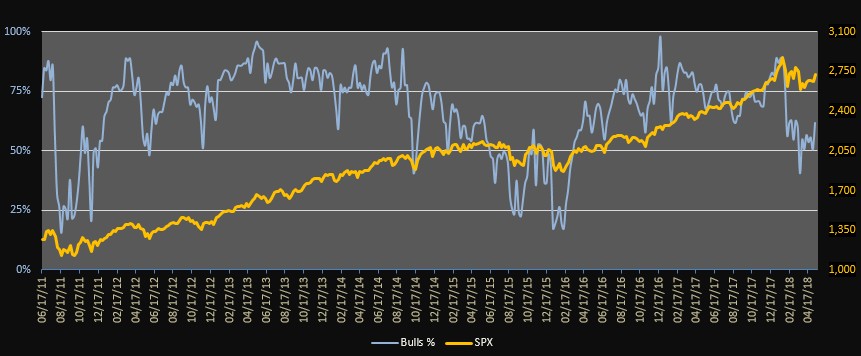

Weekly bullish sentiment readings increased to 61%, reflecting improved market sentiment following a week of strong market action:

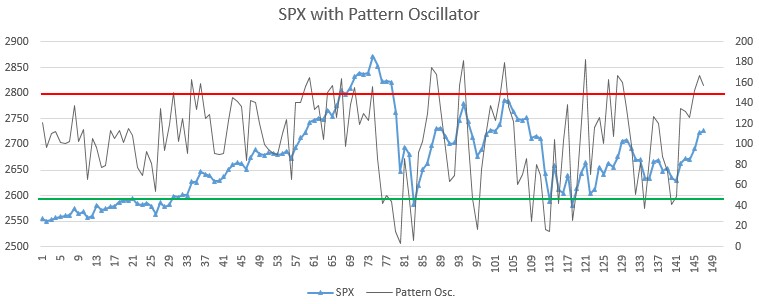

This was accompanied by an overbought Pattern Oscillator, suggesting that the daily uptrend is nearing exhaustion and is due for a pause:

You can keep track of our daily and intraday market observations here.

Following weeks of strong gains we were expecting the USD to consolidate against the G6 currencies. This proved to be the case as, although most of our upside/downside targets were met, the USD finished the week mostly flat against the G6.

The Euro found support at our projected down target to finish the week with a small loss.

The projected price range for next week for EURUSD is 1.18 - 1.202:

The Pound completely flat-lined during the week and finds itself in the middle of next week’s projected range of 1.336 – 1.37:

USD hit its upside target against the JPY, but continued consolidating at the highs.

The projected trading range for next week for USDJPY is 108.4 – 110.5:

The USDCAD had a rather sharp reaction to both our upside and downside target levels, and a subtle change in trend seems to be taking place.

The projected trading range for next week for USDCAD has been adjusted downwards to 1.2676 – 1.292:

While the bullish trend of the USD against the CHF remains in place, momentum is slowing down and, as we expected, the USD traded all week long in the middle of the projected price range.

The projected range for next week for USDCHF is 0.992 – 1.012:

The AUD found support at our downside target and finished the week strong. It couldn’t reach the upper channel, however, and we expect the consolidation to continue.

Projected range for next week for AUDUSD remains 0.745 – 0.76:

Charts and data courtesy of NinjaTrader 8, Kinetick, and CIT for NT8

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more