Pay Attention To What BoJ Did Do

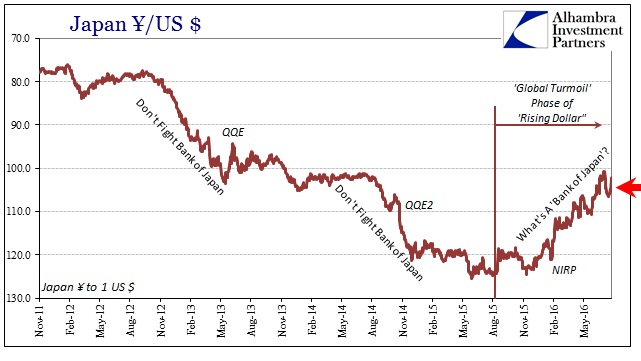

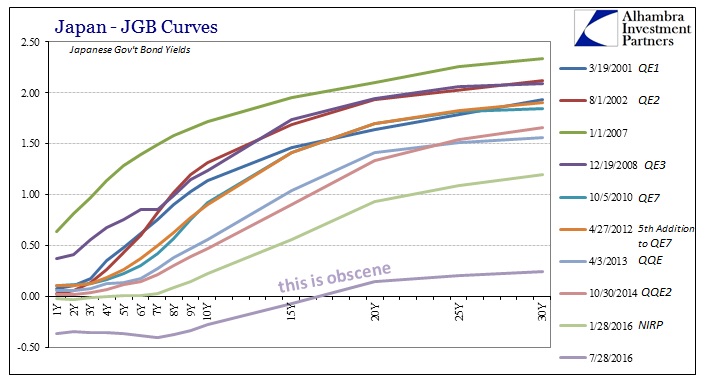

As if a mirror of the Federal Reserve, what is more important from the Bank of Japan flop today is what it did do rather than what it did not. Everyone was looking for at the very least an even quicker pace to QQE if not the full-blown “helicopter” of momentum dreams. Instead, BoJ offered what appears tepidity. As widely expected, their ETF buying program was expanded to ¥2.7 trillion annually, but that wasn’t the end of the submission. The only other change was to double a “dollar lending” program that few knew existed.

In April 2012, the Bank of Japan policy statement included the official approval of a plan to extend dollar loans from its supply of dollar “reserves” to eligible Japanese companies obtaining overseas finance.

The goal of overcoming deflation will be achieved both through efforts to strengthen the economy’s growth potential and support from the financial side. With this in mind, the Bank will pursue powerful monetary easing, and will support private financial institutions in their efforts to strengthen the foundations for Japan’s economic growth via the fund-provisioning measure to support strengthening the foundations for economic growth. At today’s meeting, as shown in the Attachment, the Bank established detailed rules for a new U.S. dollar lending arrangement equivalent to 1 trillion yen, of which a preliminary outline was released at the previous meeting in March.

“Eligible” counterparties are narrowed specifically in the technical terms to only those firms who have accounts at FRBNY or have accounts at banks with settlement recourse to FRBNY (where BoJ’s assets are mostly in custody). All loans are in US dollars posted by eligible collateral with 1-year duration (and 3 available one-year rollovers, for a total of four years) at 6-month LIBOR refreshed every six months. The maximum loan per counterparty is $1 billion, with a total balance capped at $12 billion (those amounts were today doubled).

Initially the program was designated for its last disbursements scheduled to take place on June 30, 2014 (of all times), but it was extended in early 2014. The purpose of the program and its renewal and increase today eludes the general public, but offers some pretty stark evidence of what BoJ might actually be witnessing. The Wall Street Journal, for example, appeared perplexed if not outright perturbed:

The Bank of Japan was reaching deep when it decided to double its U.S. dollar lending facility. If only the program was more meaningful…

The dollar loan program was set up in April 2012 when there was a global shortage of dollars due to fears about the breakup of the euro. It was to help companies easily tap foreign funding and push them to invest abroad. It came with a whisker of hitting the limit two years later.

From that passage, you can understand the author’s misconceptions about not just Japan but really “dollars.” First, causation is backward as the “global shortage of dollars” by 2012 came first, a fact that I rehashed just this week:

This year, 2011, has seen this lack of interbank currency progress far further than anyone imagined possible. Those past European guarantees are a distant memory, as interbank lending has essentially broken down completely – again. This has created a crazy dance of accounting tricks to guarantee debt without really guaranteeing debt. The EFSF was supposed to be the successful end of the crisis, as it would take a pool of “money” from various European countries and leverage it into a kind of old-school CDO. But there is something discomfiting about a guarantee where the guarantors are very much unwilling to directly participate in it, and where a sizable portion of those guarantees come directly from those needing the bailout in the first place. As the EFSF finally fell apart, and European talks changed to outright treaty changes, suddenly euros became short in supply right along with dollars.

From that condition it suggests the other half of the Japanese necessity, again not quite what the WSJ is suggesting. In other words, the BoJ program or any other like it is not meant to “push them to invest abroad” as they are already doing that. It is instead meant to help them rollover the “dollar short” that already exists but might be far more trouble and disruptive than might outwardly appear.

The Japanese more than even the Europeans have been involved in eurodollars going back to the beginning. It is a forgotten part of the Asian flu, but the Bank of Japan begged for dollar swaps from the Fed in November 1997. As early as the 1960’s, the Japanese were dealing with the whims of offshore, international “dollar” finance as a necessary component to Japanese economic policy.

And so began the first definitive links between “dollar” behavior and UST’s – whether or not “selling UST’s” is actually selling at all (and in some cases forgoing either selling or buying). At the end of 1963 due to events partially related to Italy and Switzerland, Japanese banks found themselves “short” by some $200 million in denied eurodollar rollovers. The Bank of Japan responded by “selling” ~$200 million in US Treasury bills which was then only reflected in NYC money markets despite origination all over the place and across many seemingly unrelated formats.

There is much less justification, however, for being unaware of these parameters in 2016. One of the primary difficulties facing Japan, spilling over undoubtedly, in my view, into China and elsewhere, has been the ascension of “dollar” problems at Japanese banks. Perhaps because this renewed “shortage” doesn’t show up in any traditional accounting that it is being dismissed as not “more meaningful”, but financial market conditions particularly not that long ago were screaming of “dollar” difficulties – and they may be still, as there are definite links between Japanese banks, Chinese banks, and US$ repo. It may be swaps, and thus complex, but still quite visible:

The cross currency basis swap is somewhat unique in that by fixing exchange values at both the outset and back end, it reveals purely financial perceptions in its values and changing values about the differences in interest payments. For example, in the 1990’s the basis swap for Japanese banks (again, not companies) was structurally negative, meaning that they had to pay a premium to swap into dollar funding because of negative perceptions of creditworthiness. This is the legacy of the downside of the “global dollar short”, as Japanese banks had accumulated large dollar asset positions (long US$ assets, short US$ funding) leaving them susceptible to such vagaries in dollar funding, whether repo or basis swaps or anything else someone on Wall Street or in London might dream up that wasn’t gold or actual cash…

The negative yen basis swap acts like leverage where even yields on the interim “investment” are negative. Any speculator or bank with spare “dollars” could lend them in a yen basis swap meaning an exchange into yen. Because you end up with yen you are forced into some really bad investment choices such as slightly negative 5-year government bonds, but that is just part of the cost of keeping risk on your yen side low. Instead, the real money is made in the basis swap itself since it now trades so highly negative. The very fact of that basis swap spread means a huge premium on spare dollars; which is another way of saying there is a “dollar” shortage. Because of the shortage and its premium, you can swap into yen and invest in negative yielding JGB’s in size and still make out handsomely. There has been, in fact, a rush of foreign “money” into Japan to take advantage of this dollar shortage; the fact that there has been such enthusiasm and it still has not alleviated the imbalance proves scale and intractability.

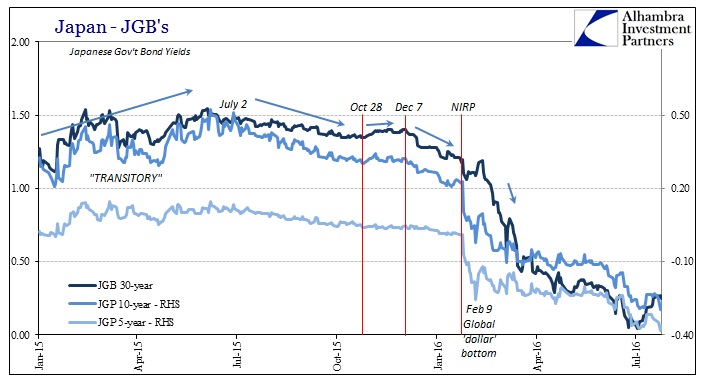

It is that last sentence that applies here. Rarely do you find a nice tidy package, one of the few that are even fleetingly possible, whereby Japan’s “dollar” problem announces itself by corroborating yen appreciation and JGB yield collapse.

The fact that BoJ is addressing it at all is significant, not the amount by which they are intending to do so. Japan is fickle in that way, as outside of upfront QQE there is a reluctance to act but in only the most immediate of circumstances. That was surely the case in 2012 when the program was first proposed (a broad sketch was outlined at the March 2012 meeting, just as the ECB had concluded its second massive LTRO), belated as it was given the “dollar’s” dramatic global tightening had intensified almost a full year prior before.

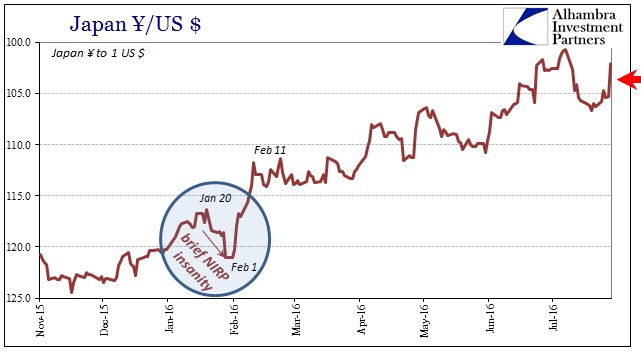

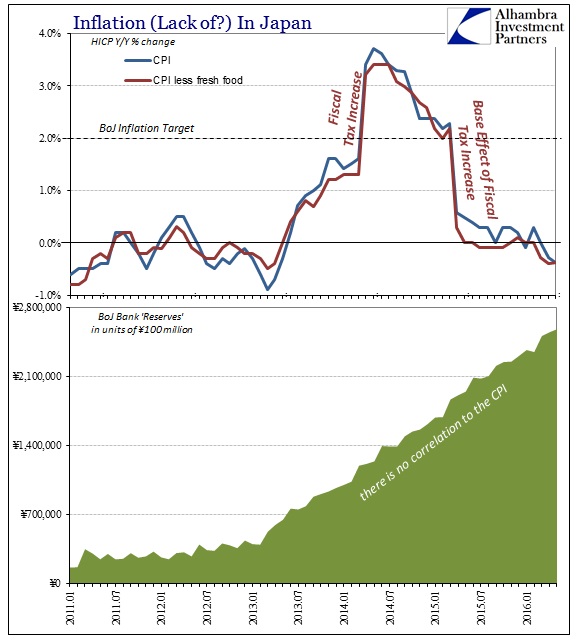

What BoJ is, in fact, addressing is the yen which, dating back to November (and JGB’s to early December), has been openly and significantly defying their stated goals; going so far as to disregard NIRP entirely. Therefore, what might be most telling here is that they chose not more QQE to try to tame JPY but dollar. It recognizes, I think, that NIRP was a huge mistake as it still isn’t appreciated just how much it messed up Japan’s money markets and even liquidity supply. The downside or at least ineffectiveness of QQE is pretty well-established even for the most ideologically committed (see below). So far, JPY hasn’t responded (kneejerk) but that was likely the case no matter what, short of a multi-trillion helicopter that was necessary in whispers just to get JPY to 106 again.

I don’t want to make too much in comparison to their reluctance to add to QQE, but it isn’t nothing that when the entire world expected them to act they did so where they did. It is an acknowledgement, I believe, that one of Japan’s most pressing issues is “dollar” and not just its own economic disaster. After all, Japanese companies that have been for decades upon decades financing in “dollars” have done so via Japanese banks. For the BoJ to step in for them at all confirms a great deal about what we long suspected with regard to the world’s biggest problem.

Disclosure: None.

Its not just for QE anymore

And helicopter money sounds too verbish and a technical manual could be involved.

Presto change(o).

Enough with the glib titles unless you are about to add

Fiscal stimulus alternative into the mix and blame congress for not doing enough!

Which brings us back to dough ray me.

If I owned the Fed or the BOJ my website would be donothingbuttalk.com Or would that be giving away too much?