Of Banks, Europe, Euros, And Eurodollars

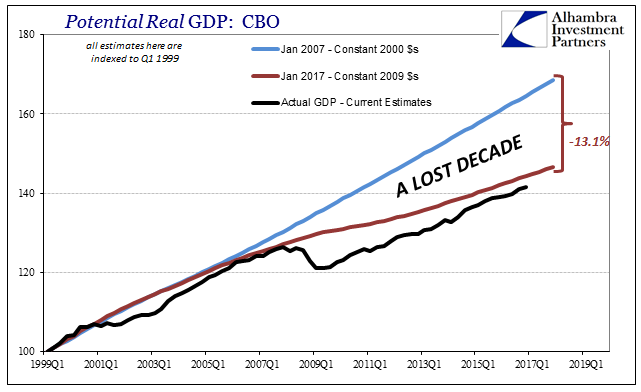

Rather than bury this chart in my earlier discussion of liquidity preferences, I felt it deserved its own piece to highlight what it shows. By all traditional and orthodox Economics, this just should not be possible. Yet, there it is and it’s not the only example of violation. For very different markets as robust as each one is, there should not be this high level of blatantly obvious symmetry. Just should not be.

Because it’s there, of course, it leaves only one possible explanation. Though many confuse the eurodollar for the euro, they are both actually very similar in their common element. A credit-based currency system means all currencies connected to that system are subject to that which creates, or destroys, credit: bank balance sheet capacity.

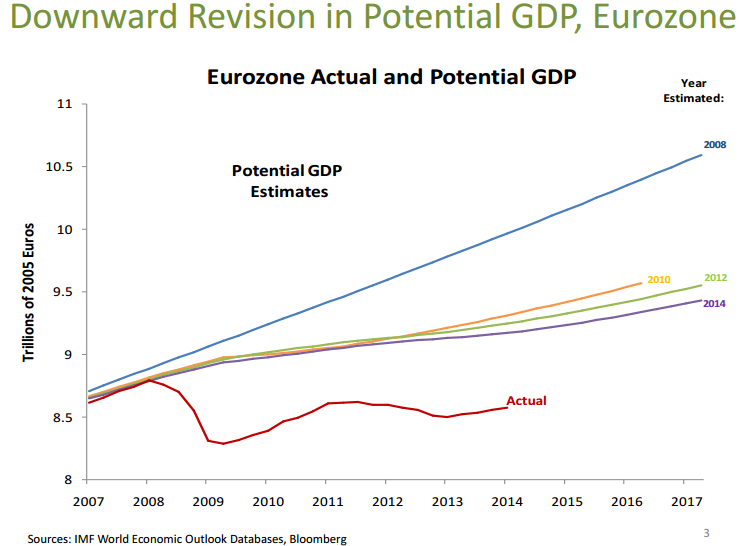

And its global effects:

Disclosure: This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more