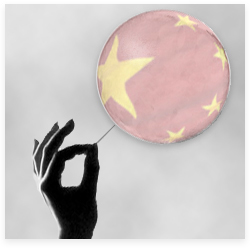

Bloomberg Analyst Returned From China 'Terrified For The Economy'

Economists are forecasting 7% growth in China for this year, according to the Bloomberg consensus median, in line with government targets. Although it is lower than the historical growth trend of China, any country (U.S. included) in the world right now would kill for a 7% GDP.

So does this mean all's well in China? A Bloomberg Intelligence analyst who just completed a tour of the country reported what he saw:

".... idle cranes, empty construction sites and half-finished, abandoned buildings in several cities. Conversations with executives reinforced the “gloomy” outlook....It’s as bad as the data looks, if not worse.”

You may have guessed, this guy is a a metals specialist. Although it is a valid observation, but what he saw is quite inevitable as China transitioning into a more consumer economy and government slowing its infrastructure stimulus. Although

The biggest problem in my view is that, unlike the U.S., China' massive population and overall lower education level almost guarantee that the current income from Chinese consumer middle class is incapable of fueling growth of the Middle Kingdom.

The weakening economic data have led some to speculate PBOC may take more easing actions to revive growth. I think Beijing's biggest risk right now would be a widespread civil unrest by poverty and hunger-stricken citizens.

Mao assumed power and overtook the government by promising a good life and an abundance of food to gain support from the massive under-privileged class almost 70 years ago. Failure by the Communist China to keep that promise would almost certainly shake or even destroy the fundamental power structure, QE or no QE from PBOC.

All of the content on EconMatters is provided without assurance or warranty of any kind. The opinions expressed here are personal views only, and no warranty of fitness for any particular use, ...

moreComments

No Thumbs up yet!

No Thumbs up yet!