Overview Of Emerald Health Therapeutics, A Growing Cannabis Producer In Canada

As many of you know, Canada’s move towards legalization started a few years ago and next year should be one of the most exciting times to be an investor in the cannabis industry. In the past year, the Canadian cannabis sector has seen some tremendous gains and that trend should continue into 2018 as recreational cannabis will become legal all across the country.

While the valuations for many of the licensed producers who are publicly trading may still seem high, the recent pullback in stock prices from the peak earlier this year was warranted. After any strong move up in valuations, a period of consolidation is needed and is very healthy price action. It allows the stock price to find a natural level that the market sets during a basing period before the next move up or down.

Given that 2018 will be the year for Canadian cannabis, the market will be paying attention to the sector and the licensed producers (LP) in Canada who are publicly trading. By the summer of 2018, the demand for recreational cannabis should set in and sales from licensed producers in Canada will start to see strong numbers. As this happens, the share price for the LPs could see a rise as more investment demand comes into Canada.

While there are over 50 LPs in Canada, not all of them are publicly traded and there are many factors to consider when comparing them and their valuations. However, size of the facility does play an important factor and growing in a greenhouse can greatly reduce the cost to produce a gram.

One of the companies we recently spoke with was Emerald Health Therapeutics, the 8th company in Canada to be to be issued a licensed producer status. Being an early LP that is planning on huge expansions, they could become one of the world's largest producing facilities of cannabis. With the potential of up to 5 million square feet that could yield more than 1 billion dollars in sales, you may want to add Emerald Health Therapeutics (TSX:V EMH; OTC: EMHTF) to your watch list.

Overview of Emerald Health Therapeutics

As early pioneers of medical cannabis in Canada, the company prides itself on providing safe, efficacious, and clinically proven, high-value cannabis products that enhance the health of Canadians across the country. Emerald is a vertically integrated, seed to sale enterprise that combines competencies from decades of experience in pharmaceutical development with expertise in large-scale greenhouse growing.

When looking at any company, an investor should look at the management team to see if they have the experience and expertise to build and manage a large scale company. Emerald’s leadership team is experienced with pharmaceutical drug discovery, development, production and distribution. You can view the company’s board and management team online, but for now we will look at the executive chairman and president.

Having Avtar Dhillon, MD as executive chairman for Emerald brings a level of confidence and credibility to the company which many licensed producers in Canada don’t have. As a life sciences entrepreneur with more than 20 years of experience building public companies, he is experienced in mergers and acquisitions, leading innovation in scientific, engineering and farming enterprises.

Securing government grants and NGO funding in excess of $75 million, he also oversaw raising over $250 million for Inovio (Nasdaq:INO) during his tenure as its President and CEO. He led the company turnaround from $10 million to $1 billion, and also during that time Inovio completed several licensing deals with global pharma leaders Merck (MRK), Wyeth (now Pfizer) (PFE) and Roche (RHHBY). Before joining Inovio he was Vice President of MDS Capital Corp. (now Lumira Capital Corp.), one of North American’s leading healthcare venture capital organizations. Dhillon practiced family medicine for over 12 years. He has a BSc (Honours) in Human Physiology and an MD from the University of British Columbia.

Bin Huang, PhD, MBA, Emerald's President and CEO, is an executive leader with over 30 years of experience in life sciences. Her career began with Allelix Crop Technologies, where she spent six years as a plant research scientist. For a number of years Huang was the President and CEO of Cytovax Biotechnologies, a Canadian biotechnology company. Following that, she led WEX Pharmaceuticals, a subsidiary of publicly listed CK Life Sciences International (Holdings) Inc. (HKG: 0775), as President and CEO. Bin has a PhD in Plant Cell Biology from the University of East Anglia, UK, and an MBA from the University of Toronto.

A dedicated and experienced team will make help any licensed producer excel as a leader in the cannabis industry, especially one that is well versed in life sciences and growing. While the company does have a great amount of pharma experience, more studies and clinical trials have to be done by all companies before they can claim making a particular drug for a specific ailment; this is usually a requirement by Health Canada and for FDA approval. Emerald intends on running human studies to observe certain outcomes and prepare scientific papers that may provide defendable observations. This may help medical practitioners become much more comfortable in prescribing an Emerald product that has consistent dosing and displays certain characteristics that they think today may be beneficial for conditions like pain, insomnia, anxiety, etc.

Located in British Colombia, Emerald already has a license to produce and sell both dry herbs and oils; this puts them ahead of many LPs who are at various stages of licensing. The proof-of-concept facility they operate at is already at full capacity and is producing dried cannabis and oils for 1,000 registered patients and there is a waiting list. Demand for cannabis products will only increase over the coming year, so their need to expand is significantly important if they wish to compete on scale with many of the other LPs. Their expansion plans and JV outlined below will be paramount in the company’s success over the coming years.

Future Expansion Plans

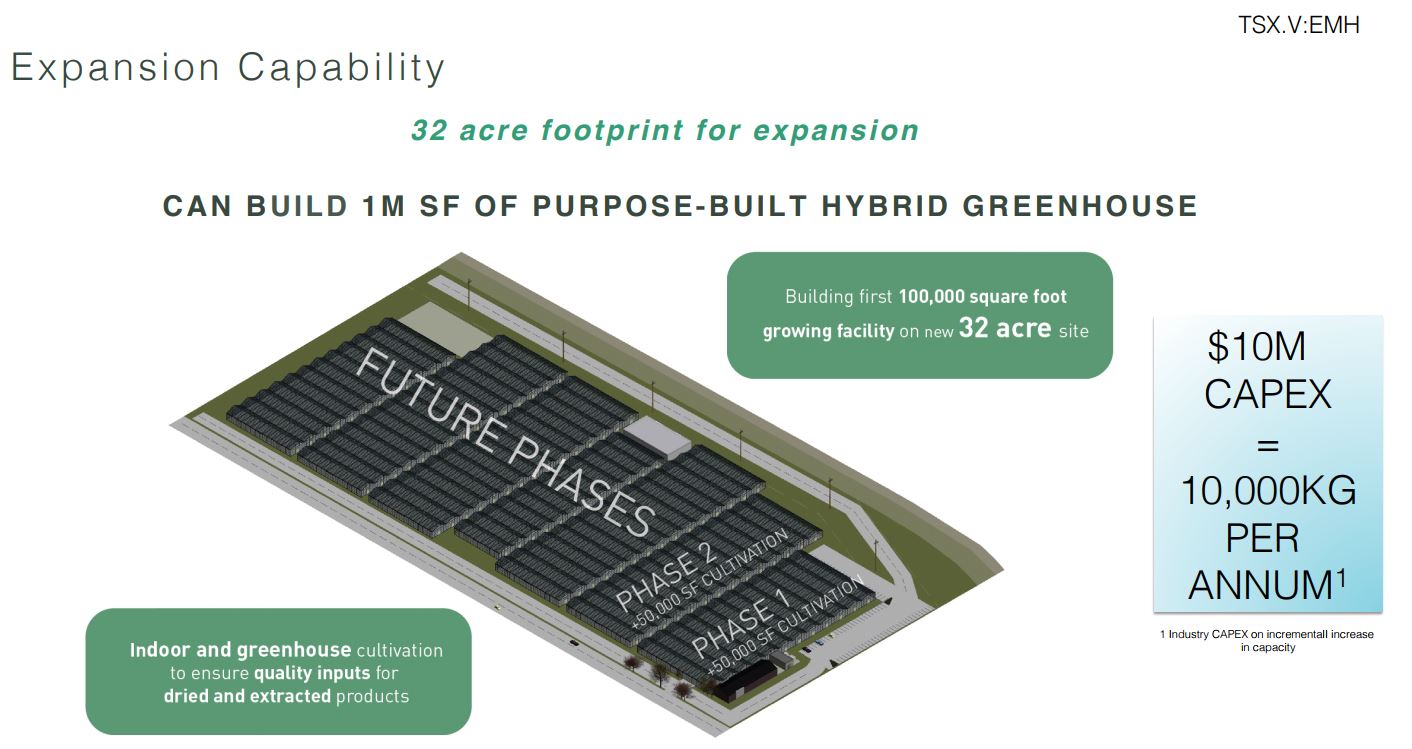

While there are many licensed producers in Canada, not all of them have plans to scale production like Emerald plans on doing over the coming year. In anticipation of the recreational market, the company plans to have a multi-phase expansion rollout which includes a 32-acre site located in metro Vancouver. The plan includes modular expansion of the purpose-build greenhouse facilities; for now, phase 1 and phase 2 will contribute 50000 sq. ft. each of hybrid greenhouse grow. Emerald plans to complete the first 2 phases of expansion prior to legalization which would add a total of 100,000 sq. ft. of grow space; phase 1 is expected to be constructed by Q1 2018. From the picture below, we can see they have still have room to expand on this property.

One would think the planned expansion above is significant enough compared to many of the other LP’s, but Emerald recently announced a joint venture with Village Farms and that is what makes the potential scale of this company tremendous.

The definitive agreement announced this summer to form a joint venture will allow the JV to form large-scale, high-quality, low-cost cannabis production. Village Farms (TSX:VFF; OTC:VFFIF) will contribute a 50-acre property with a 1.1 million square foot (25 acre) greenhouse facility in Delta, BC. Each party will have a 50% stake in the JV and is based on several milestones.

While nothing is written in stone, the JV is very strategic for rapid expansion since the 1.1 million square feet of greenhouses are already built and Village Farms is very experienced in operating large-scale greenhouses for produce production. Also, the value of this JV and expansion possibility is highly dependent on obtaining the necessary licensing from Health Canada and converting it to an ACMPR (Access to Cannabis for Medical Purposes Regulations) compliant production facility, and if permitted by applicable law and stock exchange requirements.

The JV will allow for rapid expansion and positioning it for the expected future recreational market. With 1.1 million square feet of potential greenhouse cannabis production, it is estimated this facility will yield 75,000 kg of production annually.

The joint venture has options to acquire from Village Farms up to 4.8 million square feet of greenhouse capacity; this would yield more than 300,000 kg of cannabis and could supply a considerable portion of the expected demand of cannabis in Canada and for export abroad.

The JV will also help Emerald with raw material supply and costs for downstream product development, specifically extraction-based products like oils which are expected to be highly profitable and a significant segment of the cannabis market.

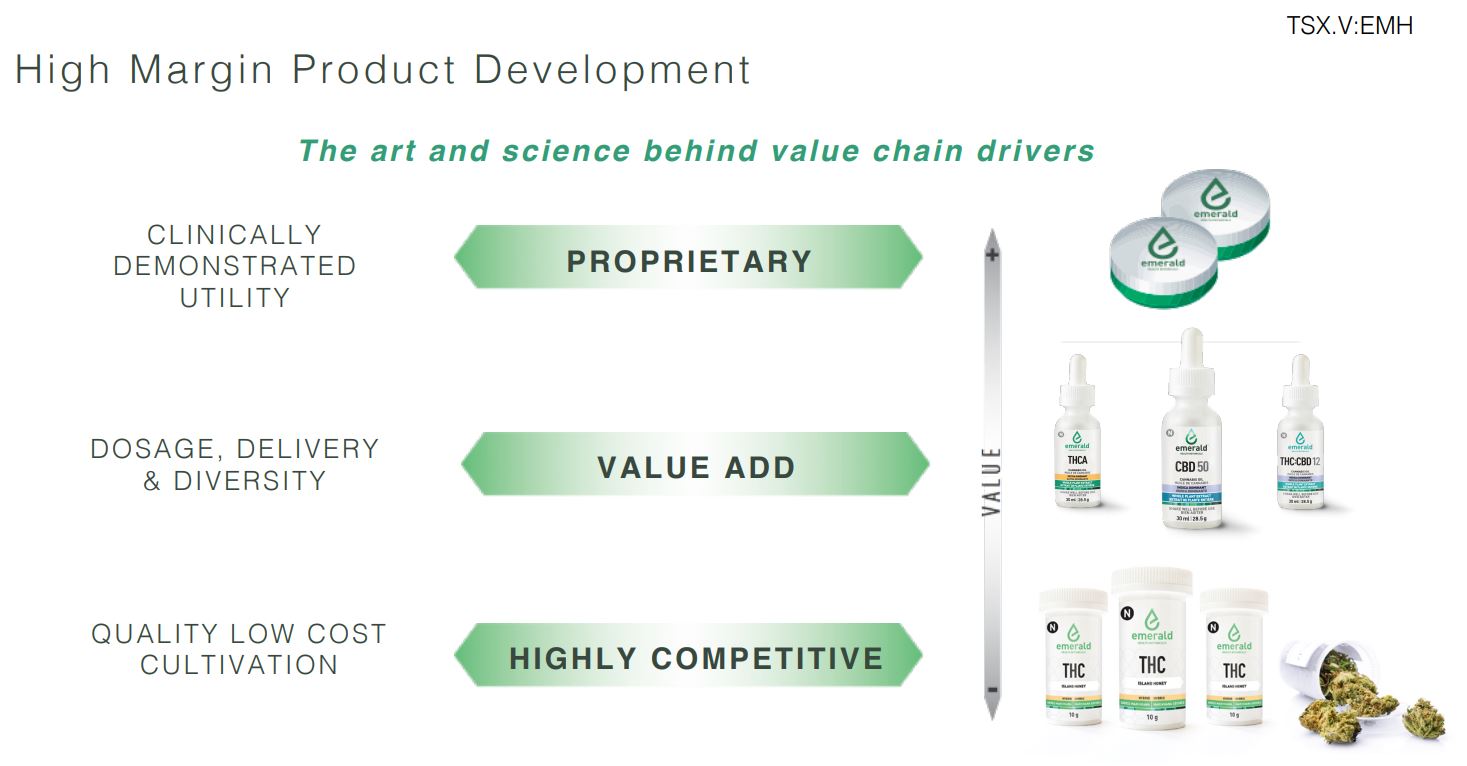

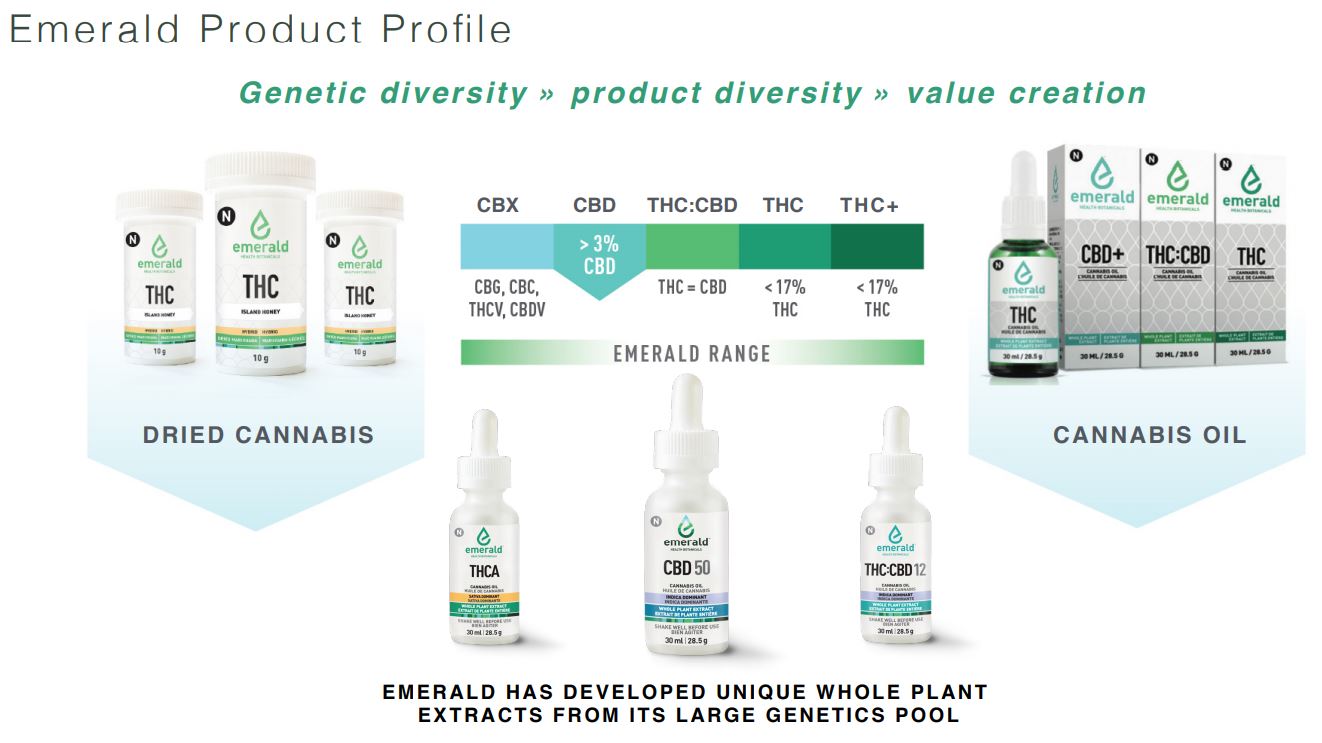

The products

With a strong life science and pharmaceutical team, and now the addition of experienced greenhouse growers, we can expect Emerald to produce high-quality products. With experience in developing pharmaceutical drugs, the company plans on using cannabis to bring high-value products to market. While producing products for specific ailments using cannabis is not unique to Emerald, they have the potential to become one of the leaders given the management and directors' background. They have hands-on experience in clinical research, GMP production practices, regulatory approval process and intellectual property creation. While this level of experience in the pharmaceutical industry may not be relevant for the highly competitive recreational cannabis market, it will be invaluable for developing products for the medical side of this industry.

Emerald and other LPs - Comparables

There are so many factors to consider when evaluating a cannabis company that comparing cannabis producers can be a challenge. Each LP uses “proprietary” methods of growing or they cite confidential information about their company; many of them are reluctant to provide details, which make it difficult to assess them on many different metrics.

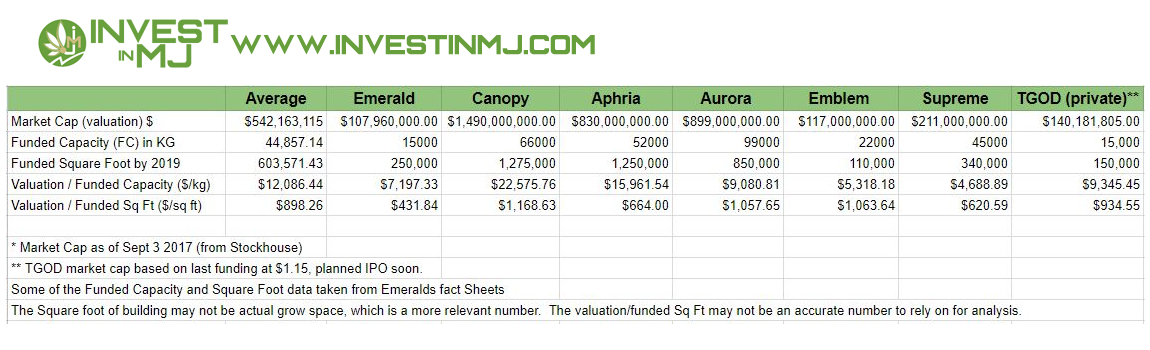

For now, we will look at some basic information like market cap, funded capacity in KG and planned square footage. So how does Emerald compare to other licensed producers in Canada when it comes to company valuation and planned capacity?

(Click on image to enlarge)

The information in the chart above was taken on a specific date and valuations will change on a daily basis when using market capitalization as one of the metrics. Also, company info like funded capacity in KG and building square footage will also change over time; please keep that in mind when making a comparison of the licensed producers.

We can see that Emerald has one of the lowest valuations when looking at their market cap divided by their funded square footage. The company mentions funded capacity of 15,000 kg, but the wheels are in motion for advancing the JV which will add 1.1M square feet of greenhouse grow space. After the retrofit and production starts in the greenhouse, it could add 75,000 kg to which Emerald has the first right to 100% of its output, and also participates in a 50/50 JV, so to Emerald, this could mean an additional 37,500 kg to the existing 4500 kg they can produce in their current facility. This would bring Emerald’s total production of cannabis to 42,000 kg, at which point a revaluation on the company’s market cap will be needed to reflect the additional capacity.

With $40M in the bank, Emerald could develop a significant portion of their planned square feet expansion over the next few years without having to raise capital. This assumes that Emerald is funded for up to 15,000 kg of production; their fact sheet states 15K+ so the actual numbers listed above can vary depending on the progress made with the JV and getting the necessary approvals. The other licensed producers in this chart are funded for their planned expansions in KG and square foot; their numbers for planned expansion in kg may also vary so please keep that mind when comparing them.

We are in the process of gathering current data to add into our ACMPR Licensed Producers Comparison Chart – Canada to get a clearer picture of various metrics to be used in this comparison. Other licensed producers in Canada which are private also have expansion plans that can rival these big producers, for example TGOD made some recent announcements that places them on scale with the large 5. We are still gathering all the data to make a fair comparison on the licensed producers.

Stock Chart and Technical Analysis

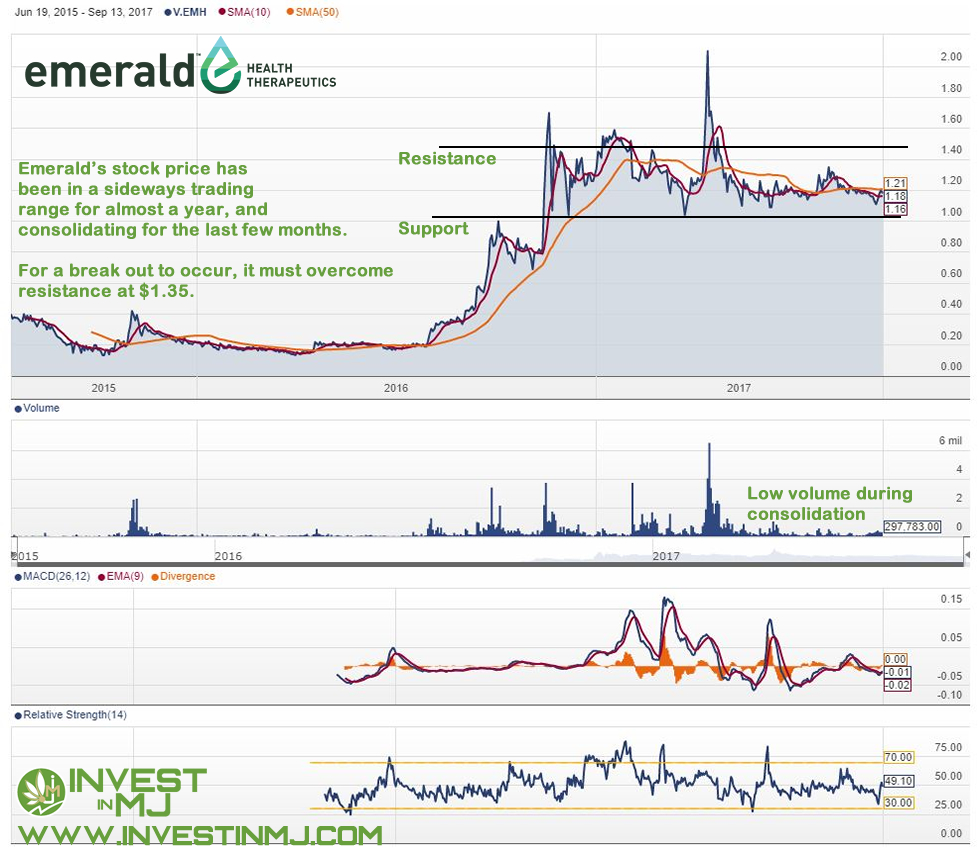

Looking at the stock chart below, Emerald’s stock price has been consolidating over the last few months in between $1.10-$1.30. It has been a good stock for trading the sideways range, the moving averages have flattened and volume is low.

(Click on image to enlarge)

Assuming that the trading range holds, a good entry point to start investing in Emerald would be just above $1.00 where support seems to hold. You can trade out of any position above $1.20 and closer to $1.30. As mentioned above, more than likely we should see the cannabis sector in Canada gain more traction in 2018. For long-term investors, now would be a good time to start acquiring a position in Emerald, then wait for the excitement around the 2018 recreational market to hit and look to sell then. If Emerald is successful in their expansion plans and the JV with Village Farms, then we can expect the market to re-evaluate its market cap similar to its peers, which could be higher a year from now when the recreational cannabis market sales will be allowed.

If you follow the Canadian cannabis sector and the publicly traded licensed producers, then you might be aware that Horizon’s has an Exchange Traded Fund (ETF) called the Horizons Marijuana Life Sciences Index ETF. The Index is designed to provide exposure to the performance of a basket of North American publicly listed life sciences companies with significant business activities in the marijuana industry. The ETF trades on the Toronto Stock Exchange under the symbol HMMJ. We mention this ETF as a way to get invested in the marijuana sector without the risks of any one individual company. Emerald Health Therapeutics is included in this ETF with a 2.17 % weighting as of Aug 30, 2017. Some of the larger licensed producers in Canada mentioned above are also included in this ETF and have a higher weighting.

If Emerald continues to execute their business and expansion plans, it could lead the way to a larger weighting in this ETF or others that will inevitably come. A larger weighting or inclusion into other cannabis-related ETFs would bring additional buying for Emerald stock, which would drive demand and possibly a higher stock price.

Summary and Risks

Emerald does present an interesting opportunity for investors, but like any company there are risks to consider. In a highly regulated market like cannabis, rules and regulations imposed by government does make the cost of operating a commercial cannabis company an expensive proposition. Emerald must compete with about 50 other companies for customers, in a market where margins could easily get squeezed. Without a solid marketing and customer acquisition plan, Emerald could have a difficult time competing in a space where other licensed producers have already captured a significant market share.

Margins in the future may also get squeezed for these licensed producers as their business model of selling direct to customers will change next year. The distribution model for cannabis in the recreational market is still up in the air and must be decided by the individual provincial governments in Canada. Ontario, for example, will be opening retail stores which will be controlled by the LCBO and selling direct online. This will force licensed producers to sell at wholesale which would reduce their overall margins.

Emerald's expansion plan under the JV does add lot of square feet of greenhouse grow space, but there are risks in any JV. They will have to get the facility approved and then invest capital for the retrofit, which means they have a need for future funding. Village Farms has never grown cannabis and may find it difficult to grow in it in greenhouses as there is a learning curve to growing cannabis and it is something both parties will have to endure. As with any agricultural product, crop loss or contamination is always a concern and growing top-quality cannabis on scale has been a challenge for many large-scale commercial facilities.

As with any stock investment, there are some risks and Emerald is no different. With the stock price consolidating over the last few months at a price the market seems to be happy with, the down side could be limited. The stock has been trading on low volume during the consolidation so you may want to wait for volume to pick up and see if the stock price starts to rise. If you see the stock price start to rise on higher volume, most likely the stock will be under accumulation, which could lead to higher prices. If volume starts to rise and the stock sells off, then we could see the price drop, but I don’t suspect that will be the case unless we see a complete sell-off in the overall markets.

At the moment, I don’t see why Emerald would sell off significantly unless the overall markets run into trouble much like they did in 2008, which is always a possibility given the lofty nature of the markets in general. Given that the valuations for many of the licensed producers in Canada are already at lofty levels, especially based on earnings, there is a significant risk that investors look for opportunities or other sectors that are undervalued.

While the retail investing crowd may not have a significant impact on stock prices, the institutional and fund manager surely do. Over the last few years many of the licensed producers in Canada were funded by brokers at much cheaper prices than today. With significant profits already, they may decide to pull the plug on the overvalued companies and invest that capital in other companies or other areas of the industry that are emerging or undervalued. Broker and institutional selling will move the stock price, and stock rotation by these entities is inevitable and something to watch for as that will impact company valuation and market capitalization.

Some will also argue that the cannabis sector is in a bubble given the lofty valuations for these companies. We are already starting to see investor appetite subside over the last four to six months, which explains the stock price retracement and consolidation. The sell-off and consolidation could last for some time which means upside potential would be limited, you could be sitting on “dead money” until the excitement comes back to the sector. Earlier in the spring we could argue the Canadian cannabis sector was in a bubble but since then it has somewhat deflated. While I don’t believe we are in a bubble at the moment, I suspect the bubble could get reflated next year, so there is no guarantee that Emerald or any of the other LPs' stock price will rise significantly until we see the next bubble in MJ stocks.

Our outlook on the cannabis sector in Canada remains bullish going into 2018. The stocks in the sector may consolidate in a trading range for some time still, but once the sector gains more attention and buying pressure, the better MJ stocks in Canada should appreciate in value. We remain optimistic about the sector and Emerald’s potential. It is a company worth paying attention to now and in the future.

Disclosure: This article is part of a new “UnderCovered” series of exclusive articles featuring companies with limited coverage. Authors are compensated by TalkMarkets for their time, and ...

more

What would you say are the top five cannabis stocks to invest in?

Hi Joe, you can sign up for our newsletter, we review and discuss opportunities there. Soon, we will be starting a subscriber based paid newsletter where we will provide more coverage on the sector.

Sounds like this could be a profitable investment. Will be taking a closer look at #EmeraldHealth $EMHTF.

I have been curious about this space but am too old to learn new tricks easily. What are some trust worthy sources to learn more about investing in cannabis (in addition to TalkMarkets and your own site of course). And what other marijuana stocks would you recommend besides $EMHTF?

We have many of the Canadian Licensed producers list in our Grower directory on our site, many of the are publicly traded... see http://www.investinmj.com/directory/growers for more details. We are starting to build out a comparison chart so visitors can evaluate the various companies, see www.investinmj.com/.../licensed-producers-comparison. Our focus at #IMJ has been on the Cnd side because of federal support, but we will be providing more coverage on US opportunities soon, sign up for our newsletter. To learn more about the industry, you may want to attend conferences, webinars and meetups, check out http://cannabisconference.ca As for recommendations, we are research analysts and provide coverage on the sector, we are not financial advisers. We will be starting a subscriber based newsletter soon, it will be a paid newsletter that will share opportunities and more in depth coverage.

Thank you.

I never understood the craze for investing in #cannabis companies. It has to be one of the riskiest investments there is. Too new with too much uncertainty.

Yes, investing in #cannabis can be risky, just like any other investment. But I think we can all agree that this space as a whole will benefit from increasingly greater demand and interest, making the investment less risky than you'd think.

What I find encouraging is that Emerald not only has plans to aggressively expand, but with $40 million in the bank, they actually have the money to do it. That coupled with their unnecessarily low valuation makes this company particularly attractive to me. I'm bullish on $EMHTF.

Agreed.

In Canada, the risks are greatly reduced as the Federal Govt is moving towards legalization, the US can be risky given the Govt stance on #cannabis. The risk in Canada is more on the company valuations being so high, competition and the increase in the number of licensed producers expected in the coming years.

Thanks for the clarification. I admit I am not familiar with the Canadian market nor factored the differences in the two government's stances.

Yes, but the greater the risk, the greater the rewards.

Thanks for a great article Vin. I had no idea there were 50 competing companies in this space though! Do you expect this number to drastically decrease over the next few years and will #EmeraldHealth be one of the last such companies standing?

There are over 50 licensed producers (LP) of marijuana in Canada, many of them in various stages of licensing. I believe that the number of LPs will increase over the coming years as we move towards legalization next year and demand increases. While we see more LPs coming into the market, the companies with newly issued producer status may find it difficult to compete with the established ones and raising capital at high valuations could be more challenging for them. Over the next few years, I expect a lot of mergers and acquisitions in the MJ space and the sector will end up with a few big leaders and many smaller producers. Emerald is on my watch list and if the JV progresses and can build scale in the greenhouses, then they could have a good chance of being one of the larger producers. You can visit our site and sign up for our newsletter for updates and opportunities in the cannabis sector, www.investinmj.com

How does the #marijuana outlook differ in the US vs. Canada?

#EMHTF sounds very promising.

Good read. Keeping my eyes on $EMHTF.