Contango Spreads Across ProShares Ultra VIX Short-Term Futures ETF (UVXY)

As the world begins to digest the future state of the Union or the United States of America under a Donald Trump-led administration, an unexpected equity market rally has occurred. Unexpected or not, it has driven the Dow Industrial Average to fresh new highs while driving volatility out of the market…for now at least. But lower volatility was largely expected as I had offered in an article titled “Trading Volatility In A Post-Trump Election”. I’m no genius for predicting the outcome of volatility near-term as the nature of volatility is to display greater complacency over time. It’s for that reason that all VIX leveraged ETFs and ETNs are designed short instruments and should be utilized by investors/traders accordingly. The aforementioned characterization of VIX/volatility is offered as much as a guarantee on VIX leveraged ETF and ETN price movement long-term. My favorite VIX leveraged ETF is ProShares Ultra VIX Short-Term Futures ETF (UVXY). Like the characterization offered regarding volatility, shares of UVXY have done nothing but fall in price since its IPO in 2011. From time to time and during extreme market conditions that produce a spike in volatility, shares of UVXY also appreciate in price, but this appreciation is very short-lived and always leads to all-time trading price lows.

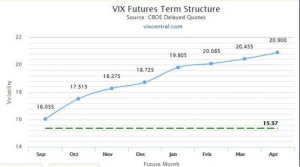

In the Golden Capital Portfolio, I have maintained a core, short UVXY position since 2012 and gladly pay the cost to carry, given the price decay that is ever-present. Besides the construction of the ETF that ensures long-term share price decay, the element of contango adds another layer of certainty for those who short UVXY. Contango is the defined condition occurring when VIX futures that underlie these ETFs are in price/time arrangement and as such contribute to the share price decay. When the level of contango increases it also exacerbates price declines, even during periods where the VIX actually rises. In more laymen terms, when contango takes over a share price death spiral takes place in the VIX leveraged ETF until the share price exhibits a reset. The reset occurs with an authorized reverse split. The chart below displays an example of contango.

Volatility exchange traded products or ETPs like UVXY don’t expire as they hold a mix of VIX futures that are adjusted every day in order to keep the average time to expiration of the portfolio at 30 days. In this daily transaction some of the next to expire futures are sold and longer dated futures are purchased. This is generally called “roll.” Those purchased longer dated futures are now the next to be sold. When the futures are in contango the price of the exchange traded products (UVXY and/or VelocityShares Daily 2x VIX Short-Term ETN (TVIX) exhibit price decay. Authorized personnel are buying futures when they are higher on the curve, at a more expensive price, and selling them when they have decayed to a lower price… contango! As the contango broadens as a percent of price/time futures arrangement, the exchange traded product share price decline continues almost oblivious to the movement in the VIX, spot futures and the market itself, death spiral for share price! And that is what has been presented in these volatility exchange traded products since market introduction. Essentially, that is the only thing that can happen to these products as defined through the nature of volatility. So when I suggest that UVXY is designed/constructed to decay in price, this is literally the case. There is no other possibility on how these instruments behave, but only how long it takes for price decay.

Most investors and traders don’t fully understand the element of contango outlined above. It’s safe to say, given that scope it would be difficult to appreciate what one doesn’t understand. As such, investors/traders continue to believe that just because the VIX is at or near very low levels, it is safe or safer to play these VIX leveraged instruments from the long side. The expectation being that UVXY or TVIX would appreciate in price as the VIX rises. But when contango is present at certain levels this just isn’t the case at all. For all the aforementioned explanation within, it’s generally not advisable to time a long trade with these instruments exhibiting contango of significance, which is presently in place with UVXY and at greater than 8 percent as of November 16, 2016.

Moreover, an underlying issue with how investors/traders relate and use a VIX leveraged instrument such as UVXY is that there’s not a reasonable explanation of contango in the S-1 filing. An investor/trader would have to be able to understand contango in the abstract with consideration of the S-1 definitions of how UVXY and/or TVIX decay in price. Most investors/traders fail to demonstrate an abstract understanding of contango. By no means am I trying to denigrate the intelligence of the average investor, but rather inform with detail concerning the relevancy of understanding the element of contango in these instruments.

I come across such misunderstandings regarding the future or potential price movement of UVXY almost daily. Greater than 75% of the time do I find erroneously positioned longs in the UVXY trade lose capital. One can find UVXY and TVIX bullish sentiment on most any individual stock message board or Twitter (TWTR).

“But Yellen is going to raise rates, markets are at-all-time highs and VIX is just so very low Seth; now is a great time to go long UVXY”. While all but the last phrase may be true, their value or relevancy with regards to expecting UVXY future price appreciation is not the same during periods of contango. If an investor/trader is long UVXY as it enters or is already in contango, expect pressure on that position. If the opportunity presents itself whereby a profit can be extrapolated from that position, it has proven wise to take execute upon that opportunity. At present and post several reverse stock splits since 2012, shares of UVXY are expressing all-time low trading prices, thus validating my previous comment.

Thanks, Seth.

1. Is it not fair to say that such products will always be in contango since future-dated VIX futures are likely to be always more expensive than near-dated VIX futures?

2. What is the contango level below which one should not consider going short such products?

3. I suppose you calculate contango by comparing the 2nd month price with the current month price (17.5-16.05 = 1.45/16.05 = appx 9%). Can you confirm, please?

Thanks, again.