Economic Implosion On The Horizon - Part IV

<< Read More: China/Asia Economic Implosion On The Horizon? - Part III

<< Read More: China/Asia Economic Crash Is Starting - Part II

<< Read More: China/Asia Economic Implosion On The Horizon?

Within our previous posts, we attempted to disclose what we believe to be one of the most critical and potentially damaging economic events in our future. We urge all readers to review (Part I, Part II, Part III) of this multi-part research report to bring everyone up to speed with our thinking. Please take a moment to our earlier posts before continuing.

In this section, we are going to explore the ongoing relationship between debt levels, shadow economic functions, global equity price levels and global economic activity all coincide at this very unique time to present a potentially massive and unprecedented event in human history – a massive economic collapse across dozens of nations and resulting in a potentially cataclysmic economic outcome. We are certain you might be asking, “how could this happen again?”. Well, in some ways the recovery process in the US, Europe and other areas could have prompted a very unique and dangerous setup in China, India and the general Asian region. Why are these areas uniquely at risk? The reason is because China has become a major economic driving force in the region and has become responsible for much of the areas economic advancement. This has been the case since the late 1990s.

In the previous section, we hinted that a downturn in the Chinese property market between 2015 till 2016 in combination with an equity price decline in excess of -15% to -20% and an outflow of capital from the Chinese economy resulting in a massive, $1 trillion, decrease in the Chinese capital reserves. How could something like this result in a total of $1 trillion in reserves to be depleted? The answer is that pressures on the economy at that time resulted in a number of general and corporate debt failures that, if left alone, would have pressured the entire Chinese financial/banking system into a possible crisis. Therefore, the Chinese had to make the problem go away and they did this by diving into their reserves to wash away the debt issues while continuing to prop up their economies and banking institutes. This $1 trillion reserve decrease was the “patch” that was needed to make sure the economic collapse was averted.

We have been watching the news and related investment research for years attempting to stay on top of these moves and keep our members aware of the potential for a market correction/reversal. Part of our research is now warning us that we need to begin to prepare for the eventual crumbling of the economic footing of the global markets and we believe China/Asia will play a massive role in the next big move.

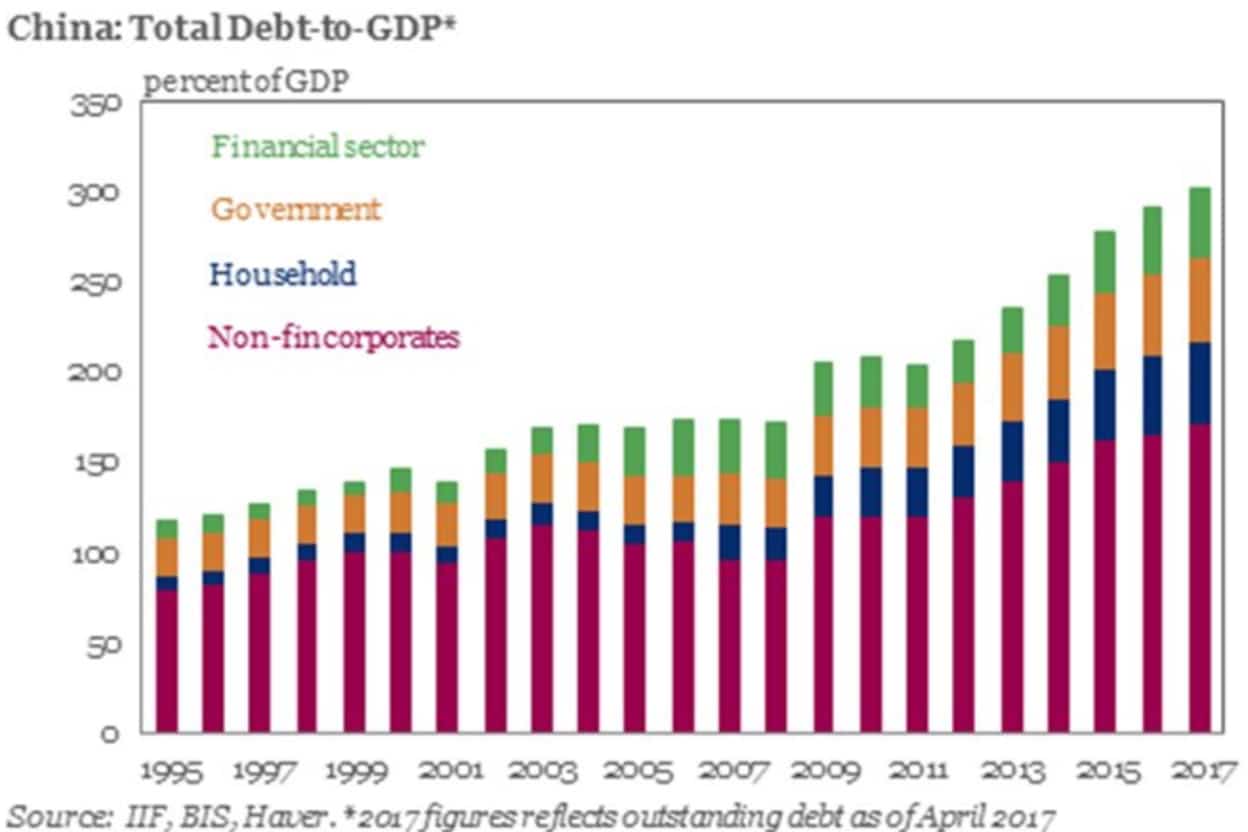

Chinese debt to GDP is massive compared to the US or other developed nations.

And China’s debt just keeps rising…

By our estimates, the current Chinese debt to GDP levels have increased by nearly 100% (to somewhere above 350% of total annual GDP. Additionally, current levels are well in excess of 200% to 300% of levels found near 2005 to 2007. If we consider 2014 levels alone, the time just before the massive $1 trillion reserve decrease, debt levels today are nearly 45% larger than debt levels in 2014. Therefore, the fragility of the Chinese economy in terms of debt constrictions related to any proposed property market price rotation and/or any capital/equity market price correction, particularly if they happen at the same time (like before), could present a very unique collapse event. It is our opinion that the current debt levels make the fragility of the Chinese economy even more sensitive to property market and/or equity market disruptions.

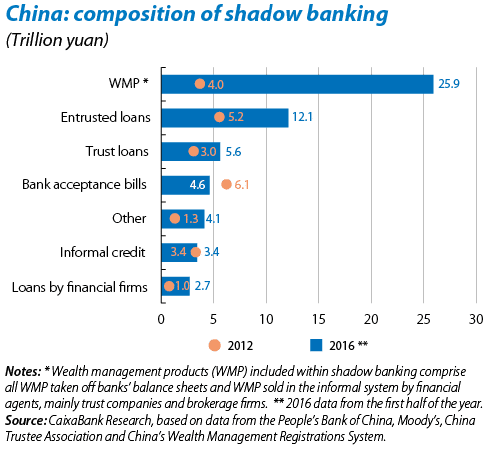

China’s shadow banking, particularly WMP (Wealth Management Products), Entrusted, Trust and loans by Financial Firms present a huge issue in regards to stability of the Chinese credit markets. Over 4~5 short years, over $30 Trillion Yuan in these types of loans have been originated – a massive 400% increase on average. The individual component levels range from a 100% increase to well over 650% increase.

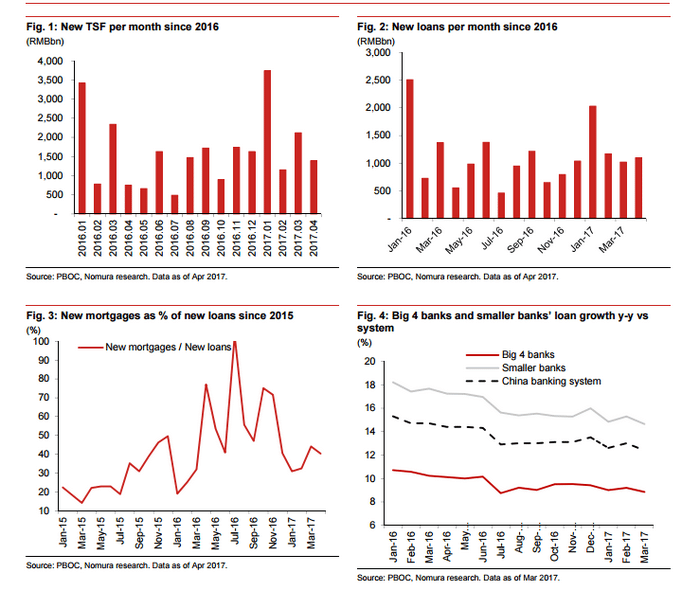

Remember, these financial (credit) instruments are rooted in the projections that borrowers have the ability and capability to repay these loans, or that the projects they back will result in substantial real value at some point. The loan origination data, below, shows a decent increase just after the US Presidential elections and we are certain this recent rally in the US and global markets has eased some pressure away from the Chinese and other Asian markets. Yet, the recent price rotation (February and March 2018) could be “just enough” to crush the floor in the Chinese/Asian markets waiting for that last pin drop to start the crumbling process.

It is our belief that any contraction in any single market, Chinese property, Chinese equities or Chinese debt could likely be contained as long as the contraction range is less than 15~25% from the most recent highest valuation points. Our range of 15~25% is just that, a range that should be considered extremely dangerous for the Chinese and Asian markets. Should two or more of these market react in a similar manner, decreasing by 15~25% over an extended 12~24 month period, we believe the pressures of this type of move could be catastrophic for China and parts of Asia. The simple fact that two, or more, capital markets that experience this type of valuation decline would likely put an additional $1 to $2.5 trillion (or more) in reserve pressure on the Chinese and local markets.

Additionally, this type of valuation pressure would likely result in liquidations of foreign assets at near fire-sale prices to move these asset into cash as quickly as possible. This type of market action is called a “death spiral” for a reason. As panicked sellers dump assets to get into cash, they are driving the property and equity valuations even lower in the process – causing others to become panicked sellers and perpetuating the cycle. A death spiral event is one that sparks up overnight, causes runs on banks as people try to get as much cash as possible and causes wildly unreasonable price valuations simply because people are desperate to unload assets that could destroy their balance sheets. It is better to sell it for X than to hold onto it and watch it destroy any existing capital I may currently have.

Disclosure: If you want to know where the market is headed each day and week, well in advance then be sure to join my Pre-Market Video Forecasting service which is: more