Economic Evolution

When you become an investor, you gain the freedom to choose. You get to move beyond a life bound by minimum wage, governments & unions, economic classes, nepotism, favoritism and cronyism. You get to move beyond faulty wealth redistribution. You start to see a better way to redistribute wealth: Do it yourself.

A third of Americans think that someday they will achieve wealth. It’s a key selling point for the American dream. In wealth, you find freedom. Having wealth means you no longer depend on a corporate employer or state authority for your ability to live. Wealth is freedom. But it’s freedom a level up from how most Americans experience it currently. It’s like freedom on blast.

It’s self-sovereignty.

A large majority of people under 30 are confident they’ll make it to the top 1%. Younger generations feel optimistic about their future wealth — and increasingly so. And… they should.

This is not based on some of the economic stats you may be familiar with: US wage growth, unemployment rates, or income inequality. Many people would say these things make the future look grim. They argue that things are worse than you think, that our government has failed us, that the game is rigged — that hope is dead. (It isn’t.)

Hope is alive.

Because whatever the state of the US economy or your country’s economy, there are people all across the world, in biology labs and startup garages who are inventing the future. Where innovation persists, there is new wealth to be made.

Investors know this. They invest what they earn into these very companies, startups, people, and ideas. They take matters into their own hands. They give the finger to the gender wage gap and wages pegged in place by unions and governments. They buy themselves a stake in the prospering American, European, and Asian economies, staking their claim in the prosperity of the future.

Considering that you’re being paid to do nothing except continue to exist, investing pays pretty well. Over the last several decades, investment gains have earned some $30 to $40 trillion dollars in new wealth for investors.

American wealth is both rising & concentrating faster than ever. Income, on the other hand… seems to be the trend that’s dying.

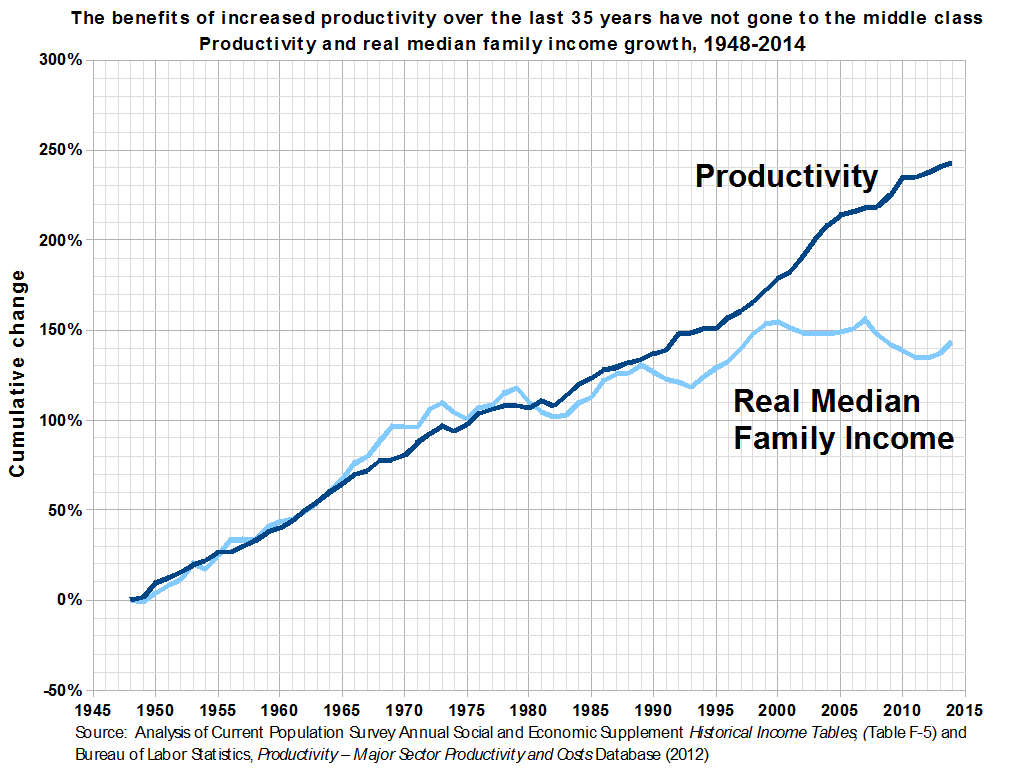

“The income growth of the typical American family closely matched that of economic productivity until some time in the 1970s. While it began to stagnate, productivity has continued to climb. According to the 2014 Global Wage Report by the International Labour Organization, the widening disparity between wages and productivity is evidence that there has been a significant shift of GDP share going from labor to capital, and this trend is playing a significant role in growing inequality.”

To further breakdown this idea:

There are two ways one can earn money. We either pay people for doing things (income), or we pay people for owning things (wealth). And increasingly, the latter.

American GDP is supported by two things:

- income made by Americans in a given year (wages earned)

- wealth gained by Americans in a given year (investment growth)

The income portion of GDP has been flat-lining since the 70’s. But total productivity and total earnings continue to rise. What accounts for the gap? The money made from investments. This used to be a much smaller part of society’s total earnings.

As technology, innovation, and automation have improved our efficiency and ability to produce greater economic value, they’ve simultaneously improved the speed at which your money will grow when its invested in the future of this economy.

As things evolve, they evolve in favor of progress. They optimize for greater efficiency. Automation is proving to be the more efficient choice for many jobs, over human labor. As demand for human labor falls, so does the price of it. (meaning the wages companies are willing to pay)

Investment gains have assumed the trend line that was once a steady rising median income, like a steady passing of the baton among relay racers.

This is not just a trend. It’s not a fad. It’s not a conspiracy. It’s automation. Automation is coming. It’ll take your job, your income, and the incomes of the people you love. Because machines will work for free and forever without stopping. They outcompete us. Some experts argue that there is nothing a robot won’t be able to do. Nothing. By now this idea has become mainstream. Most people have been made aware. Automation is coming and when it arrives, it’ll be here to stay.

It’s a lot like the transition from horses to cars. Why did cars take off? Because they were better than what we had — a horse and buggy system, transporting you at top speeds of 10–15 mph. Cars became the new way of transportation because they were more efficient. This did not mean horses would cease to exist all together. They just no longer existed solely to serve the economy, progress, and industry. Today, having a horse is considered a luxury. A car is just the status quo.

Investing is income 2.0

It gives strength and sovereignty to the individual. It grants wealth and comfort to anyone who invests; regardless of societal injustices towards them or government bias against them.

Investing could help answer two of the worst problems facing modern society right now:

- broken wealth distribution

- and automation taking jobs, rendering people income-less.

Instead of fighting the change, if you’re invested, your interests become aligned with that of profit and progress — and no longer in spite of them.

With progress comes growing pain. The transition is never easy for everyone. There is always a struggle. This isn’t to say all progress is good or right, but just — that it’s unavoidable. We have to see what lies ahead and get ready. The change never happens overnight and if you’re looking you can catch it far enough in advance. You can see it brewing underneath and you can act.

Wherever you stand today, change offers you a chance, to get on history’s better side. More than that, it gives you the choice.

Stock market gains are more volatile than any set salary. But these market gains rise up faster over time. They don’t make for sustainable income until you’ve been investing diligently for decades. Sure, if you’re starting from zero, wealth looks like climbing up mount improbable. Because wealth doesn’t build itself. Money builds wealth, but it won’t unless you tell it to. Then from there, each step on the climb up to wealth is not particularly impressive.

But it’d better not be impressive…because, if It was, getting wealthy would have to be a miracle and we’d no longer understand how to do it. The whole point of evolution is that it gets us up mount improbable — gradually, carefully, and without miracles.

With every step, it only gets easier. The wealthier a household is, the more it’s compensated simply for being wealthy — for owning things. You needn’t be concerned with robots taking your job, so long as you yourself own a robot.

You’re the underdog here. You still have so much to fight for. Get invested.

Disclaimer: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which course of ...

more