In The Precious Metals CoT Data It's The Trend That Matters Most

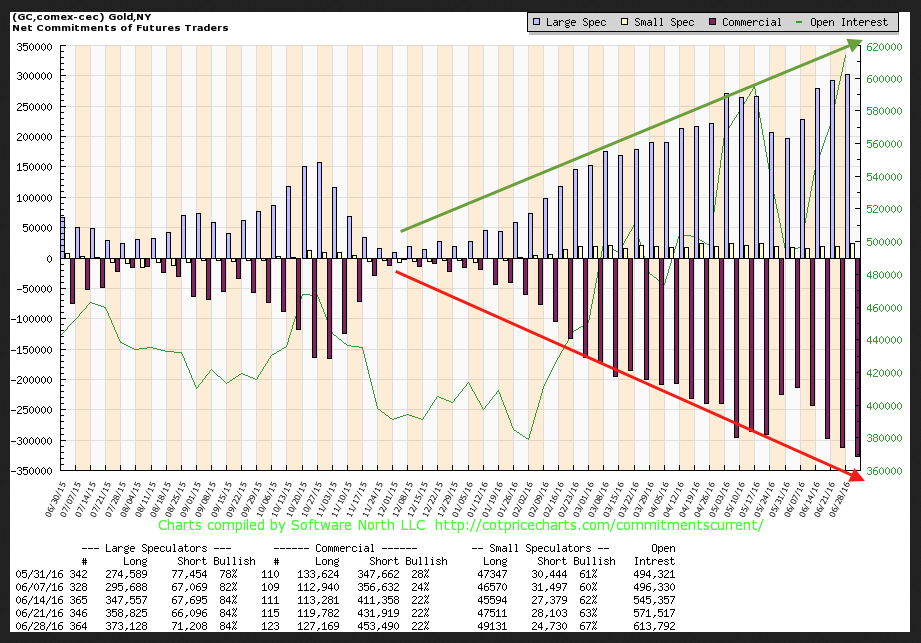

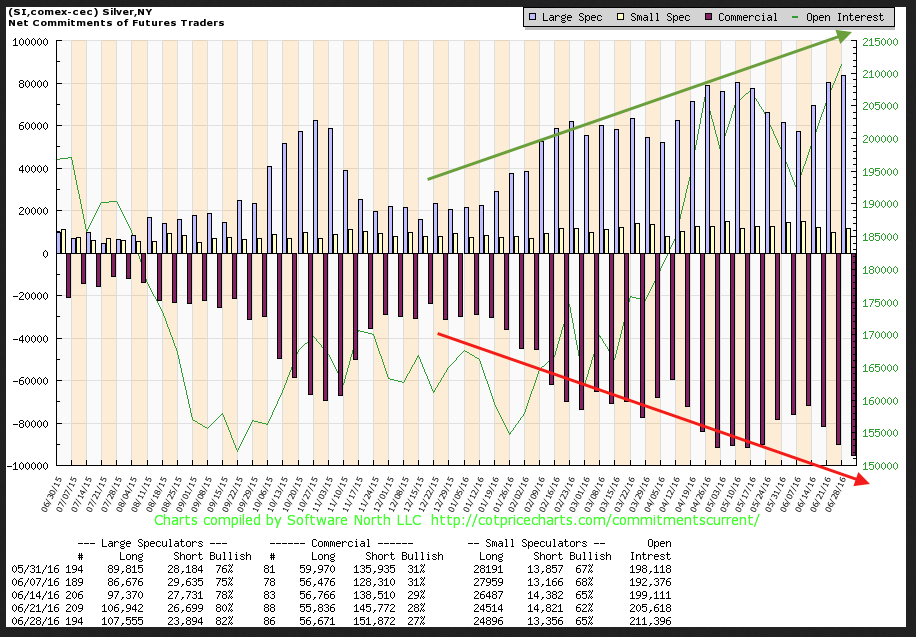

The Commitments of Traders (CoT) structures for gold and silver have been in 'bearish' configurations for some time now. But it is the trend more than the absolute configuration, that matters most to future near-term price activity.

Big negative reactions to the metals only come when when the CoT has finished traveling in its bearish trend. As long as the trend remains intact for increasing speculative net longs and increasing commercial net shorts, the trend is what it is and it remains bullish. Here are the current trends in gold and silver, still intact with large speculators pressing long (top) and commercial hedgers increasing net shorting (bottom). This will always be the case during a bull trend.

Several months ago an article appeared by a well known gold sector 'analyst' with a reference to "30,000 coffins" in the title, meaning that the gold bug community was going to get decimated because the 'all knowing' commercials were bearish. Here's a hint folks; the commercials are not all knowing, they are primarily entities (including gold miners) that hedge the metals for a variety of reasons and to different degrees. It does not pay to chase boogeymen around! These are the financial markets, not a B movie.

Still, the trend continues to march in its bearish direction and then, when the time is right, with CoT at an extreme and sentiment over bullish, we will get our correction; and it could be a harsh one. So when you see the above data begin to reverse, it will pay to avoid listening to cheerleaders who will tout an improving CoT situation (especially the ones touting that evil manipulators are being forced to cover their shorts). That will be the time to prepare for a bearish phase as the CoT begins it new trend in a bullish direction!

Confusing? Sure, a little bit... at first. But think about it.

Disclosure: Subscribe to more