Gold ETFs Do Not Always Do The Same

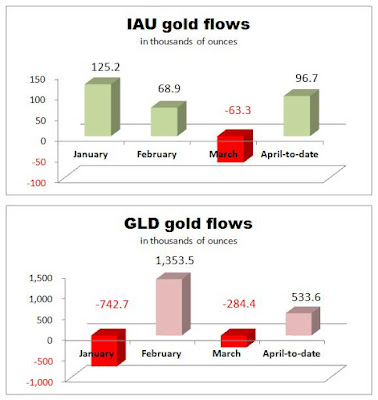

Generally, gold ETFs should behave in the same way. For example, when one gold ETF accumulates gold, the other ETFs should do the same. However, sometimes it is not the case. Look at these two charts:

source: Simple Digressions

Note that in January the first gold ETF, IAU, accumulated 125.2 thousand ounces of gold (its total gold holdings increased by this amount of gold) but its much larger counterpart, GLD, decreased its holdings by 742.7 thousand ounces.

Over the next months both ETFS were doing the same:

- added gold in February and April (up-to-date)

- got rid off the gold in March

Interestingly, gold prices were going down or got stuck only in March, when both ETFs were selling gold.

Disclaimer: This article is not an investment advice. I am not a registered investment advisor. Under no circumstances should any content from here be used or interpreted as a recommendation for ...

more

I often see you making claims on GLD's holdings but I still have not seen any verifiable evidence to support any of these claims. How reliable are GLD's holding reports? GLD does not give retail investors the right to redeem for any of its mystery physical gold holdings. This fact alone ensures the GLD shares to be nothing more than paper at the end of the day. GLD also has a glaring audit loophole in their prospectus that states they have no right to audit subcustodial gold holdings. To this day, I have not heard of a single good reason for the existence of this backdoor to the fund.

I remember there was a well documented visit by CNBC's Bob Pisani to GLD's gold vault. This visit was organized by GLD's management to prove the existence of GLD's gold but the gold bar held up by Mr. Pisani had the serial number ZJ6752 which did not appear on the most recent bar list at that time. It was later discovered that this "GLD" bar was actually owned by ETF Securities.

"GLD, decreased its holdings by 742.7 thousand ounces."

I frequently see you making these claims but I still have not seen any verifiable evidence to support any of these claims. How reliable are GLD's holding reports? GLD does not give retail investors the right to redeem for any of its mystery physical gold holdings. This fact alone ensures the GLD shares to be nothing more than paper at the end of the day. GLD also has a glaring audit loophole in their prospectus that states they have no right to audit subcustodial gold holdings. To this day, I have not heard of a single good reason for the existence of this backdoor to the fund.

For anyone interested but have not heard about CNBC's Bob Pisani's visit to GLD's gold vault, I recommend checking it out. His visit is documented in a segment called Gold Rush: The Mother Lode. This entire segment was organized by GLD's management to prove that their gold actually exists but the gold bar held up by Mr. Pisani displayed a serial of ZJ6752. This serial did not show up on the latest bar list during that time. Cheviot Asset Management’s Ned Naylor-Leyland discovered that this "GLD" bar actually belonged to ETF Securities.