Bakken Update: Eagle Ford Hedges May Provide Downward Oil Price Pressures

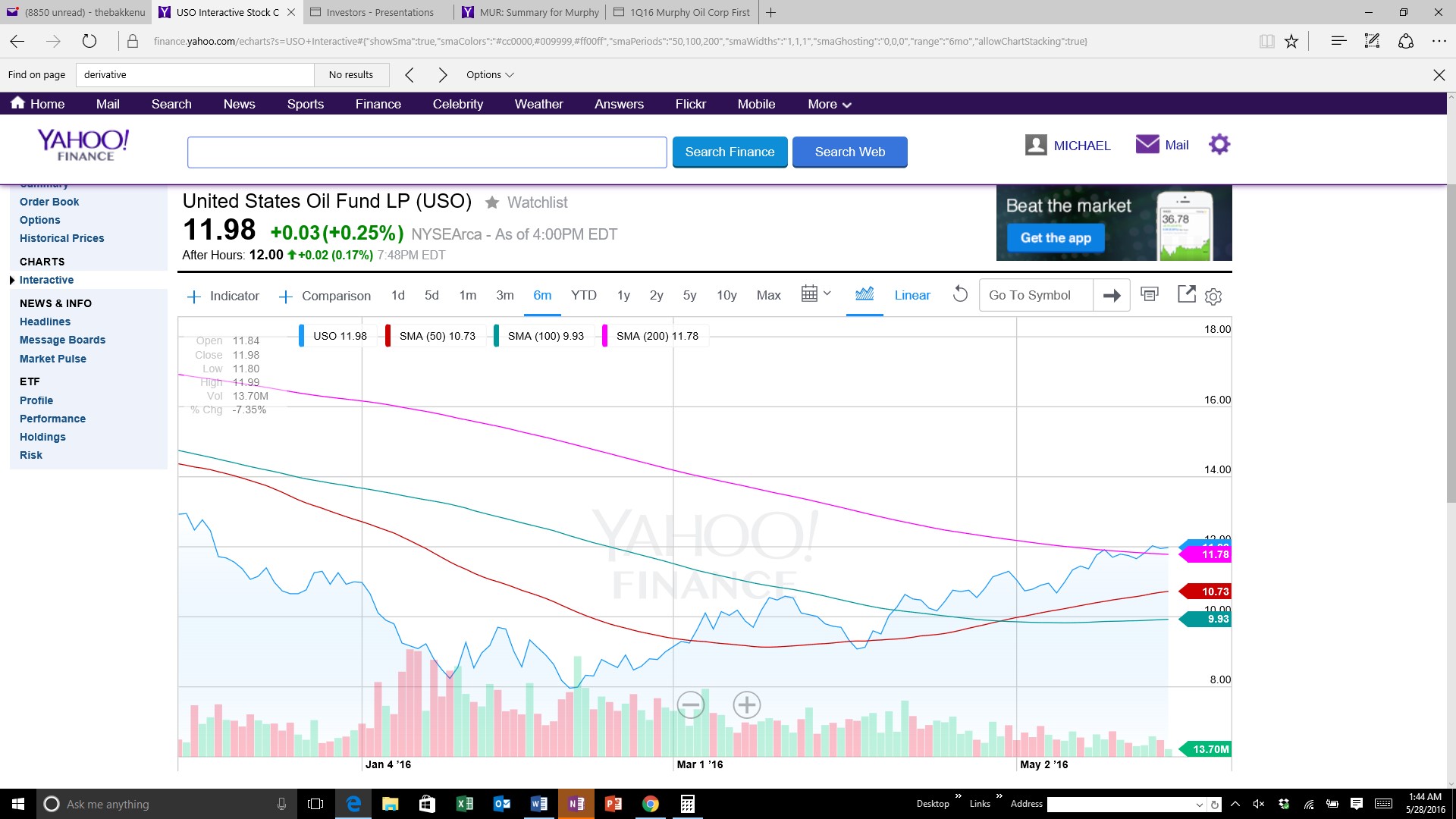

There are significant discrepancies among oil analysts as to the price of oil and its direction.Many investors are stuck in “no man’s land” after a run that has almost seen the price of WTI double since its low in February.This has created some fairly impressive gains in the US Oil ETF (USO).

(Source: Yahoo Finance)

Contango has dampened some of the gains in the USO when compared to the price of WTI, but it has still seen a healthy move. We are currently well over the 200-day moving average. If we use this as our guide, it is possible to see a considerable pull back. If the price retraces, we could see $40/bbl oil for at least a short time. We are currently following the bulls, as this run will continue until it doesn’t. Be prepared, as a pullback could translate to a 20% move to the downside.

There are a host of reasons to be bearish, but we mainly focus on world inventories. It could take a while before we see more normal levels, but supply disruptions have been positive. Nigeria and Canada have seen production decrease significantly. Goldman (GS) believes we moved to a supply deficit in May. This isn’t surprising, given the decreases in the US, OPEC and Brazil. The main questions surround the transient nature of disruptions, and a refinery maintenance season the could cause inventories to increase substantially.It looks like Nigerian production could take a while to bring back on line, but Canada is already beginning to recover from its wildfires.Demand for refined product has been much better than expectations, and we continue to believe current estimates are still below reality.It is important to watch crack spreads.Refiners are already talking about a tightening.This could continue, as refineries have been very active in this low oil price environment.

The current ceiling could be tough to break, as commodities love whole numbers.$50/bbl could be significant for other reasons, as it is a level that incentivizes operators to lock in revenues.Don’t get me wrong, many operators cannot make it at these levels.Since many operators do not have decent volumes hedged this year and in many cases close to nothing in 2017, low cost producers will have to scramble for protection.Operators know the markets will be volatile.So operators will purchase swaps, collars and three-way collars in providing short term security.Since there is a possibility of a pullback later this year, we could find operators looking to hedge around $50/bbl. This depends on geology, as breakeven can differ significantly from one section to the next. It wouldn’t be unheard of, as some operators began hedging around $40/bbl.

Geology may be one of the most important factors influencing whether an E&P will survive the downturn.Some operators do a much better job with respect to well design, but for the most part there isn’t a large difference in results if geology were to remain constant.This is why valuations are fairly close when looking at operators with similar acreage. Acreage in the Permian Basin seems to offer the quickest payback times.With lower breakeven prices, many operators began hedging at $40 to $50/bbl. We expect that hedging for core players in differing basins will occur at varying levels. While the Permian and SCOOP operators began to hedge first, as prices go up we will start to see Eagle Ford and Bakken players enter as well. This could mean we see a more staggered entry with emphasis on $50 but additional names getting in at $55 and $60/bbl.

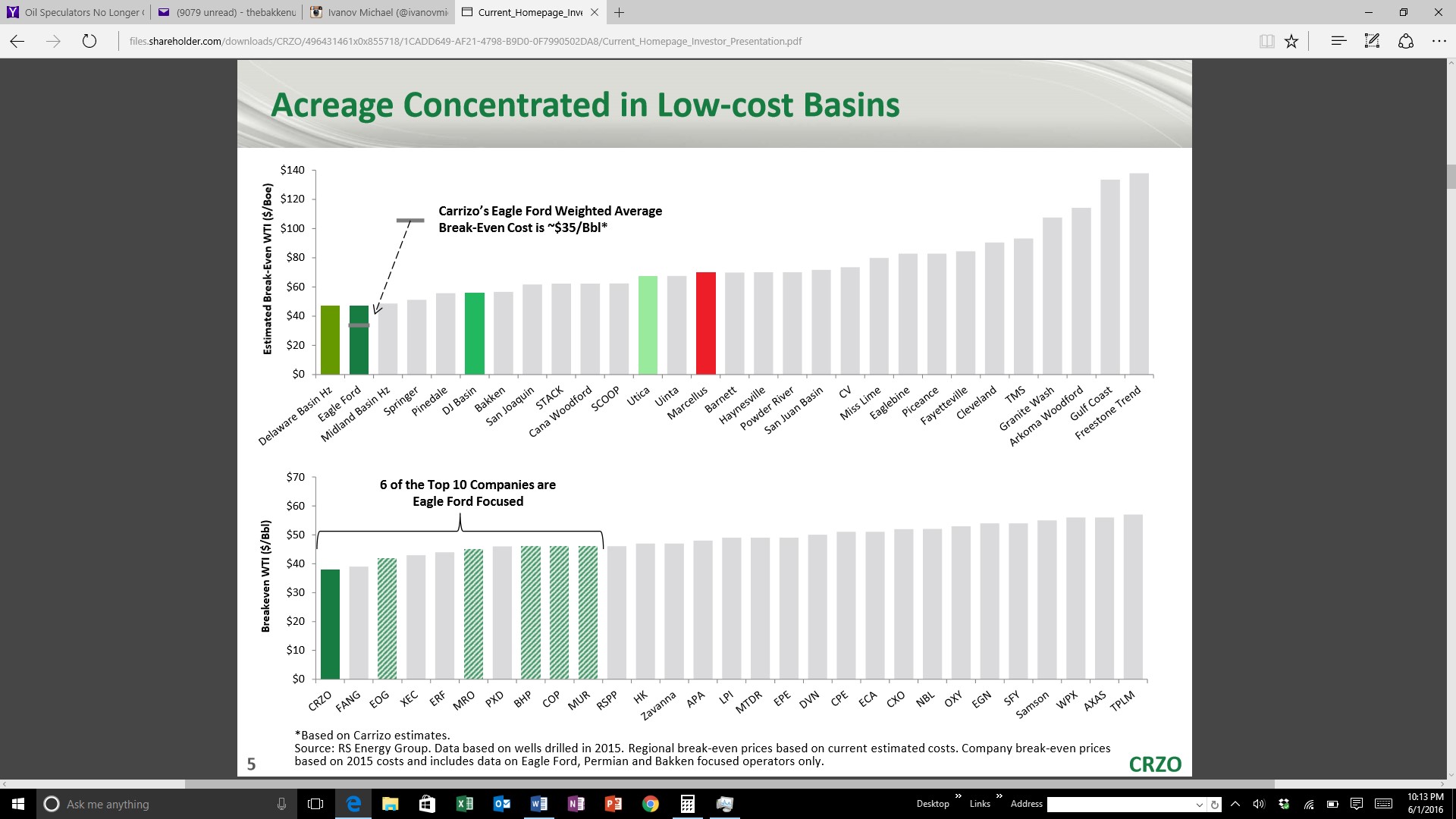

The above slide provides estimated breakeven prices for major US plays. We don’t generally like these types of slide because one never knows what data is used to create it. This is why there are several slides out there at any one time from different analysts, and none are identical.This isn’t to say the analysts aren’t doing a good job, there is just so much data to crunch. Although the Delaware and Midland basins seemed in the right place on this list, the Eagle Ford to have a much lower breakeven than expected. The SCOOP and STACK seemed to have a higher breakeven.Like I said, there are going to be differing opinions on play economics.The main play is so important in a low price environment.Operators generally move rigs and completion crews to its best areas. A company like Matador (MTDR) has switched activity the Delaware Basin from the Eagle Ford. Halcon (HK) moved dollars from the Eaglebine to the Bakken core.This has been the case for most names that had the ability to push activity to better areas. Some operators like Emerald (EOX) didn’t have the ability and filed for bankruptcy.

Anadarko (APC) has acreage in several major plays.The majority of its US onshore capital is spent on the Delaware and DJ basins.It represents $1 billion of the $1.2 billion total.In 2016, it will spend $2.6 to $2.8 billion if international and the Gulf of Mexico is included.

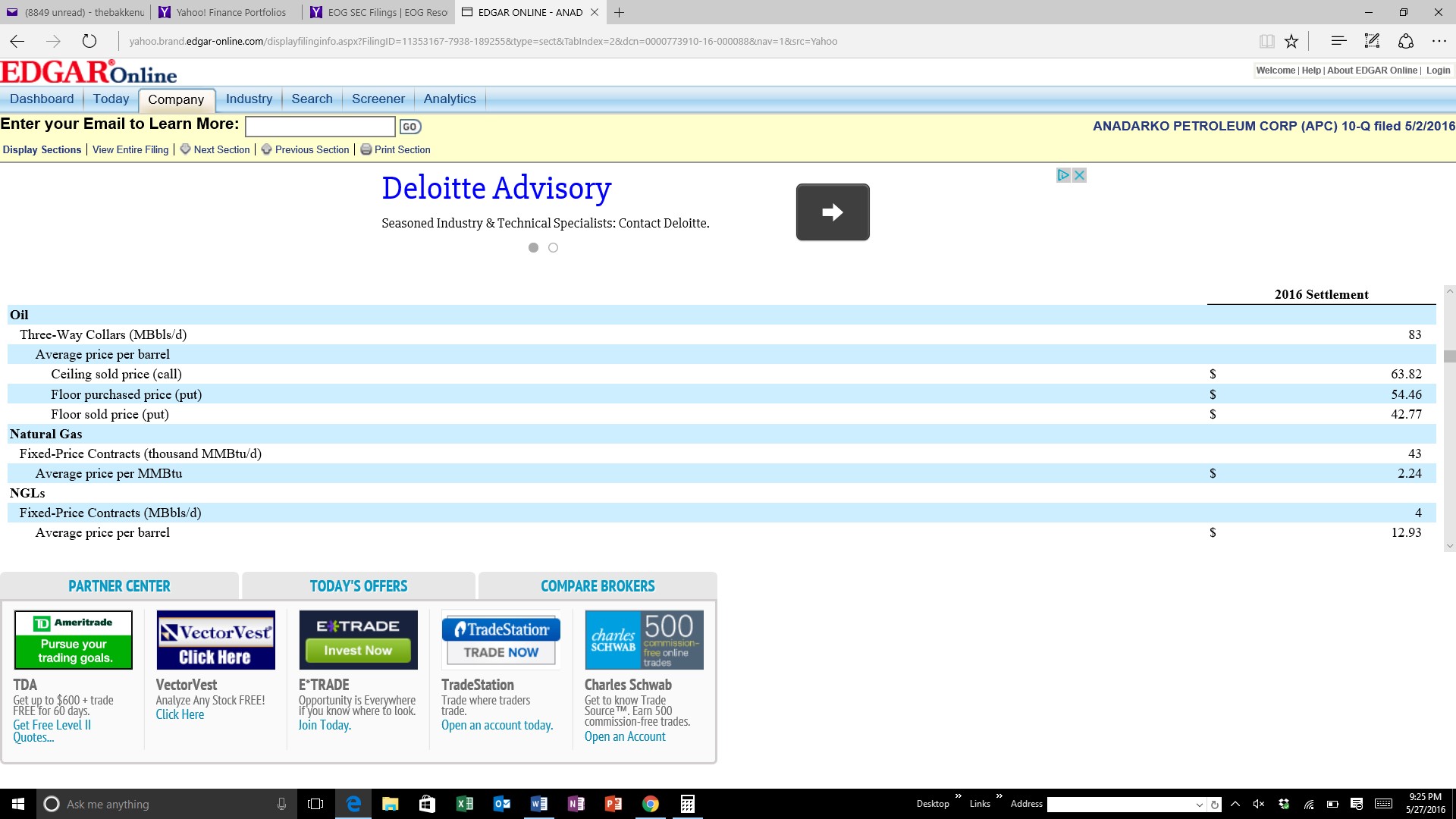

(Source: Anadarko 10-Q)

The majority of its DJ Basin acreage is located in the core of Wattenberg Field.Although these wells aren’t huge producers, it has some very low well costs.In 2016, APC estimates it is at $2.4 million per well.Its best acreage is probably in the Delaware Basin.Loving County may be the core of the play.Its acreage has higher well costs, but several intervals have shown promise.APC currently has 83K bbls/d hedged this year.All are three-way collars.The average ceiling is $63.82/bbl.The floor is $54.46 and subfloor $42.77.Three-way collars are a very interesting way to hedge barrels.APC cannot assume more than $63.82/bbl.In exchange for selling upside it added protection for oil prices below $54.46/bbl.If this was a standard collar it would be pretty straight forward, but the subfloor in this three-way collar allows for downside below the floor price.The difference between the floor and subfloor adds $11.69/bbl to the realized oil price when below the floor price.This means if we retest the lows in oil of approximately $27/bbl, APC will still receive $38.69/bbl.This seems appropriate as APC’s DJ Basin new drills have a BTAX PV-10 breakeven of $30/bbl WTI. In the Delaware Basin, the average is $35/bbl.APC’s cap ex move out of the Eagle Ford to the Delaware and DJ Basin seems to show breakeven is higher there. Keep in mind, APC has been in the DJ Basin for a while now and has much of the infrastructure already in place.This is part of the reason its breakeven is lower.

Marathon (MRO) has acreage in three main plays.This includes the Bakken, Eagle Ford, SCOOP and STACK.The purchase of its Eagle Ford leasehold was a landmark deal.At the time, it was thought to be some of the best geology in the country. Things have changed, as the Permian and Oklahoma resource plays have emerged. This is why it acquired acreage in the SCOOP/STACK. It is now MRO’s best acreage, but it spends a little over 60% of its cap ex in the Eagle Ford.It has 5 rigs in the Eagle Ford, 2 in the SCOOP and shares a rig in the Bakken. The SCOOP has provided some of the best EURs in MRO’s inventory. XL locations have modeled over 3000 MBoe.This has provided an excellent alternative to its Eagle Ford leasehold.

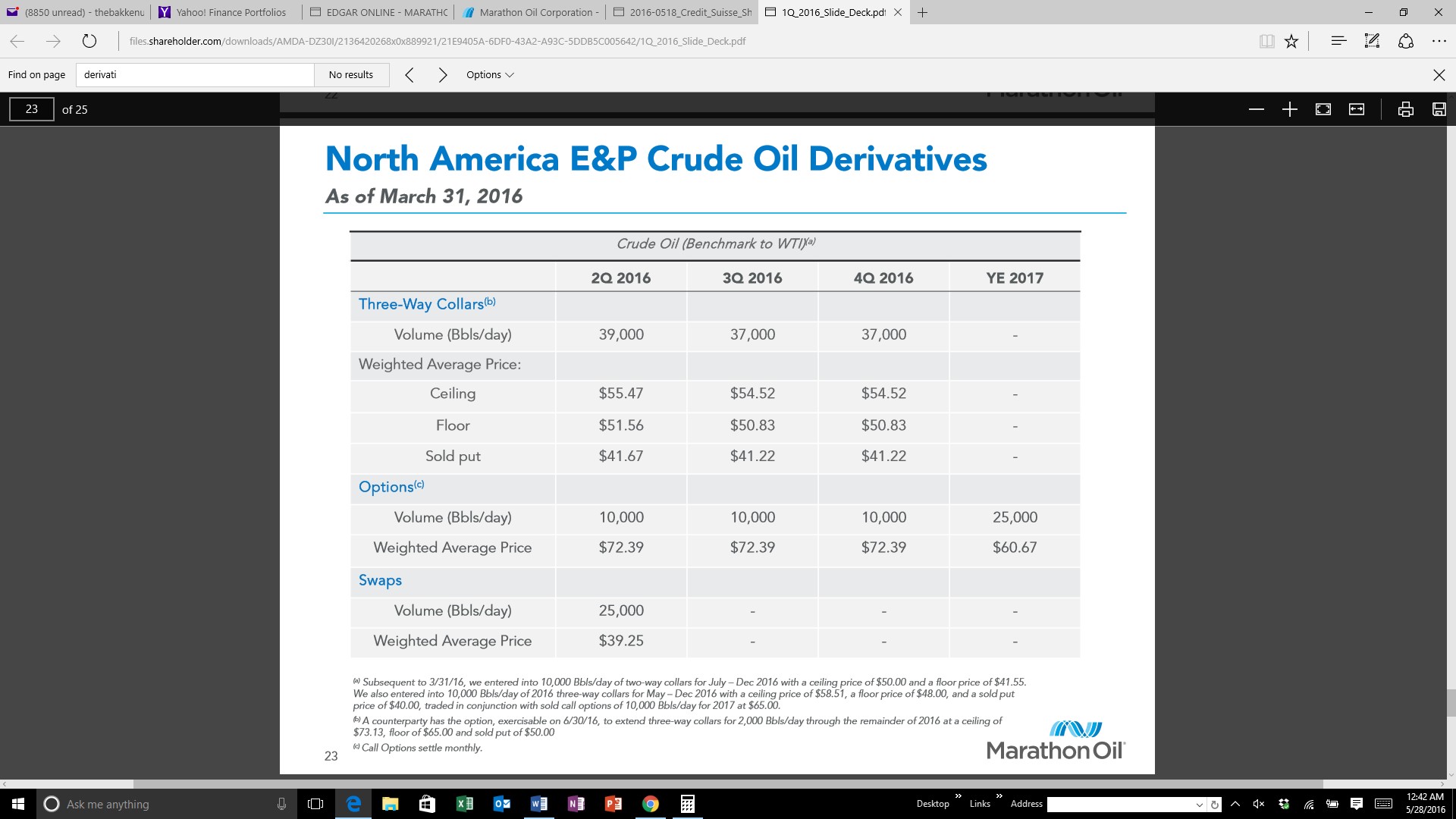

(Source: Marathon)

In 2Q16, MRO has 74K bbls/d hedged.Company production was 388K Boe/d in Q1.204K Boe were from US plays. It estimates Q2 oil production will be 171K to 179K Bo/d from North American resource plays. Marathon seems to need at least $39.25 to cover its cap ex obligations. This is a fairly low level for a swap position, and could have been a “fear” trade given the price environment in February. Its three-way collars are the most telling. MRO thinks oil prices will not exceed $55.47 this quarter, but settled at $54.52 for 2H16. The floor and subfloor have a difference of $9.89/bbl this quarter. This changes to $9.61 in 2H16. Since most believe the bottom is in, there is a good chance MRO believes it can hang on somewhere between $37 and $40/bbl.

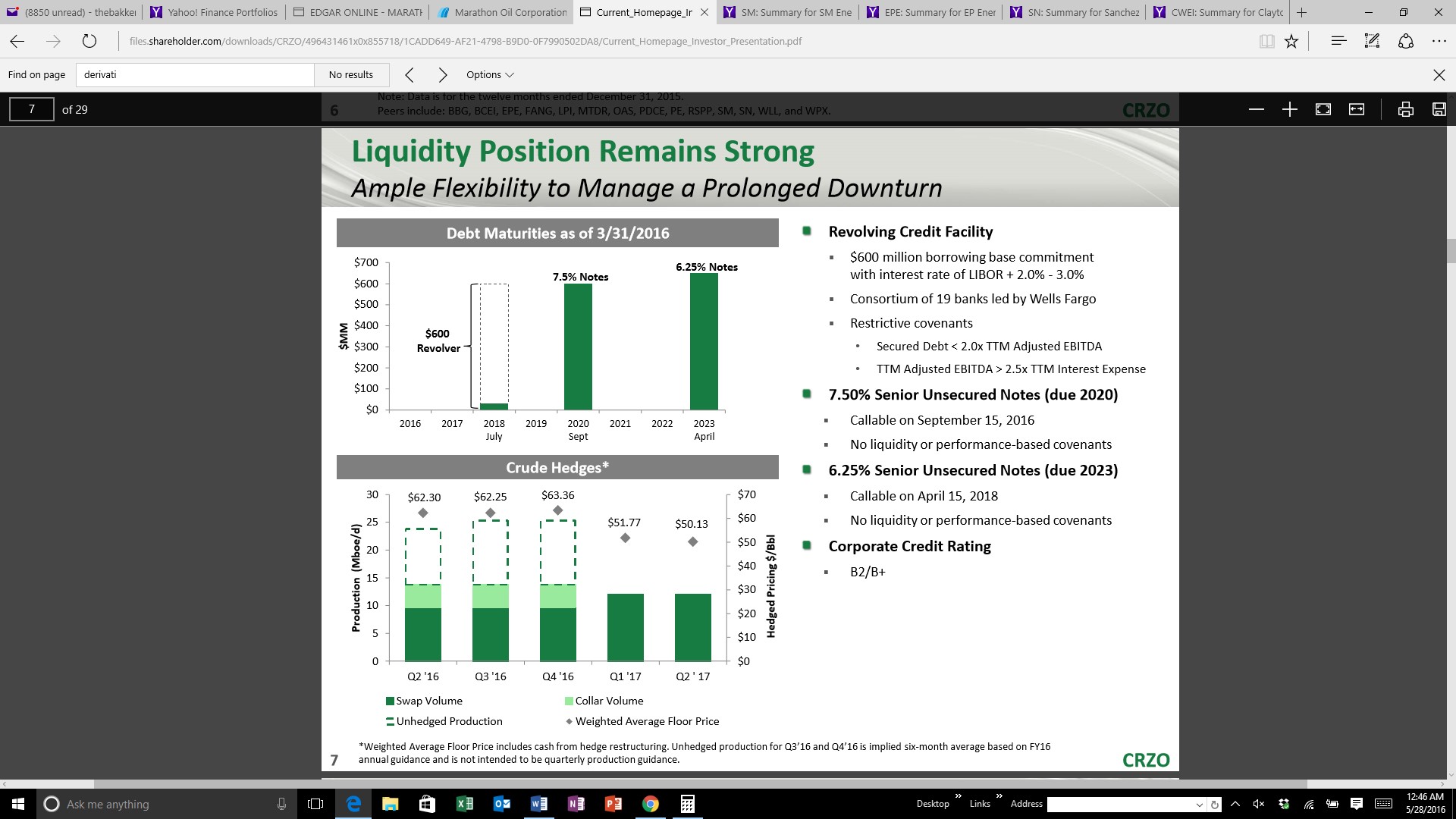

Carrizo (CRZO) is a low cost Eagle Ford focused producer. It has done a very good job of creating very good economics in its specific areas. CRZO has been able to decrease well costs in a low cost area of the Eagle Ford.CRZO claims to have an average Eagle Ford breakeven cost of $35/bbl.

(Source: Carrizo)

Keep in mind, breakeven costs provide a bottom of the barrel number. Oil investors aren’t interested in breaking even, but it does provide an idea of upside as prices normalize.

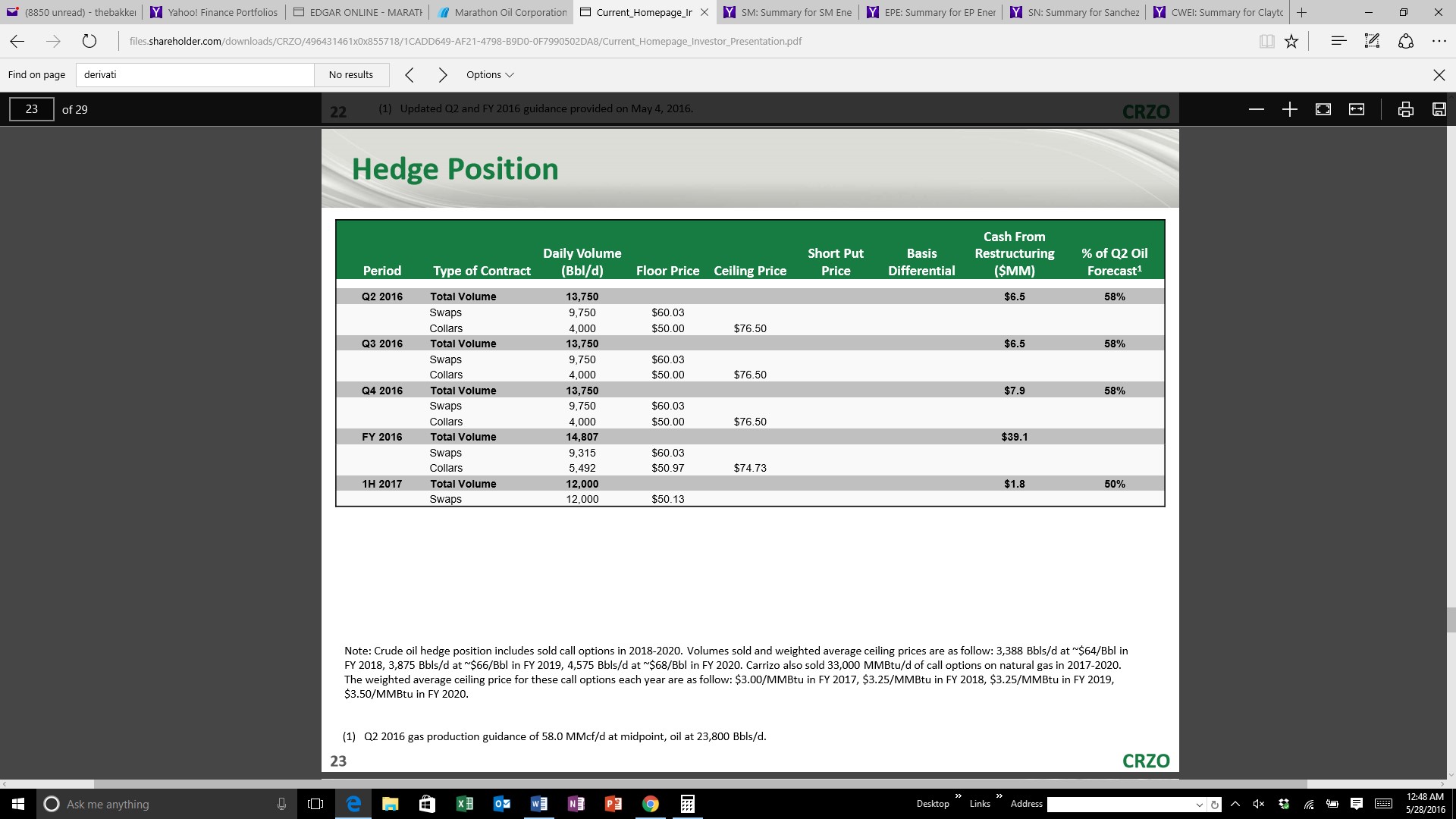

(Source: Carrizo)

CRZO’s hedge position is interesting as it backs the assertion operators will hedge at $50/bbl. More importantly, hedge positions provide an operator’s idea of possible prices going forward. It may also conceptualize the oil producer’s fear. For the remainder of 2016, CRZO has an average weighted floor price of $62.25 and $63.36/bbl. In 2017, this number moves to $51.77 and $50.13. This most definitely shows CRZO has worries oil prices could fall below $50 next year. At 12,000 BO/d, it represents roughly half of production. More than likely, CRZO is positioning for a worst case scenario, and lends little to its estimated average oil price for next year.

(Source: Carrizo)

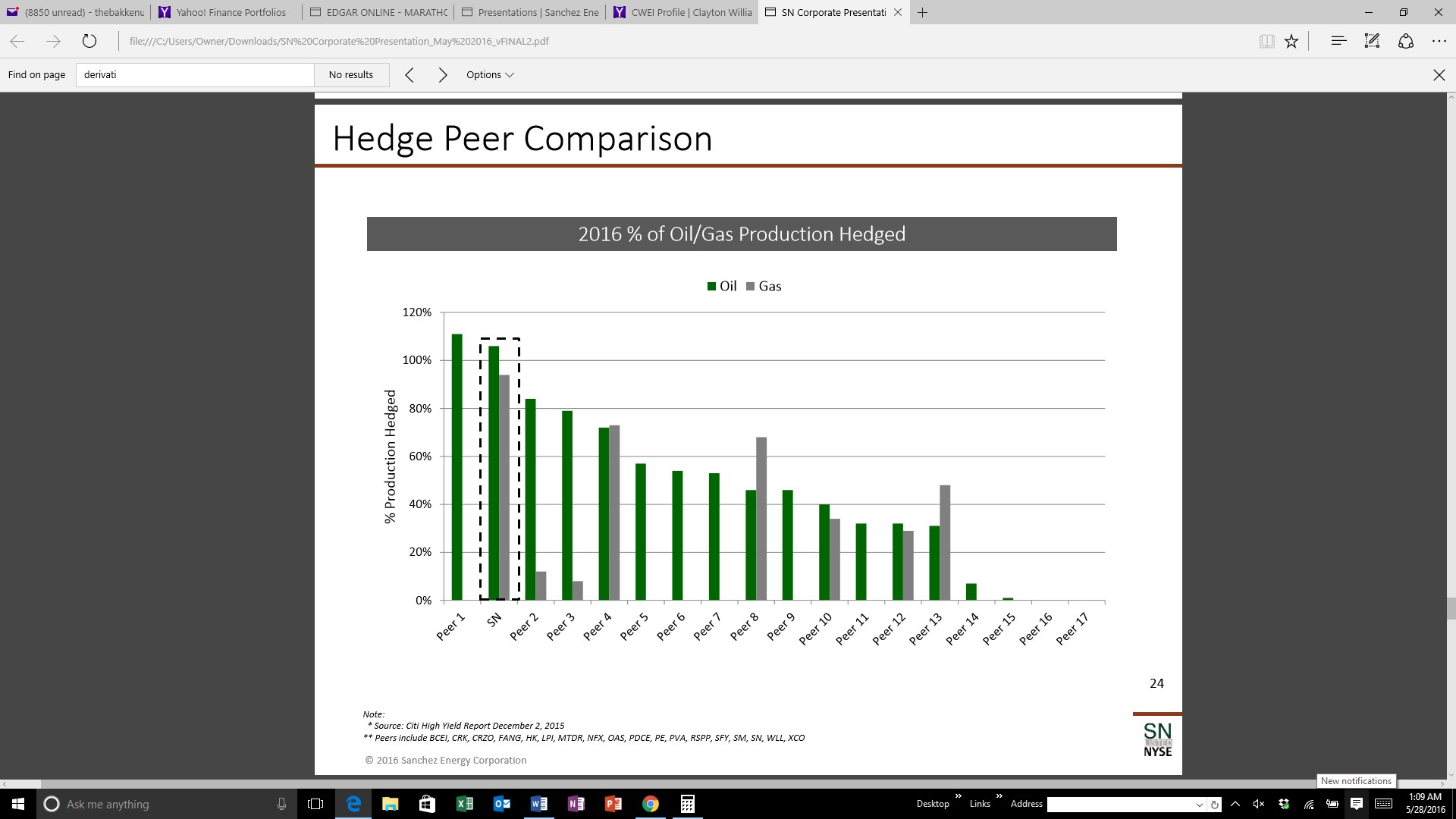

Sanchez (SN) is in a little better position than many Eagle Ford names. More than 100% of 2016 production is currently hedged.

(Source: Sanchez)

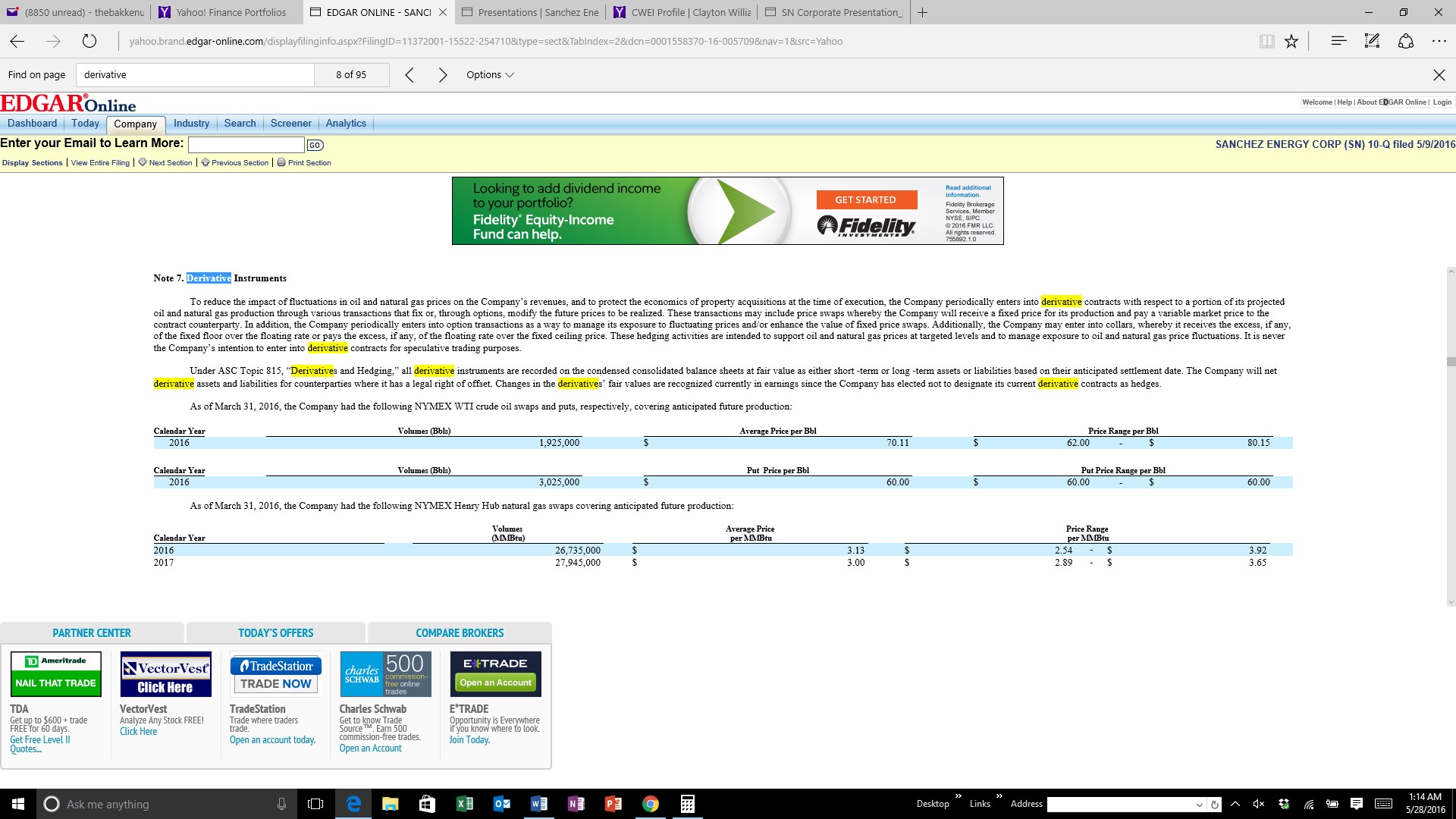

Approximately 60% of production is hedged at $60/bbl. The remainder of its derivative positions range between $62.00 and $80.15/bbl. Sanchez was able to get positions in early, and did an excellent job of planning for a lower price environment.

(Source: Sanchez)

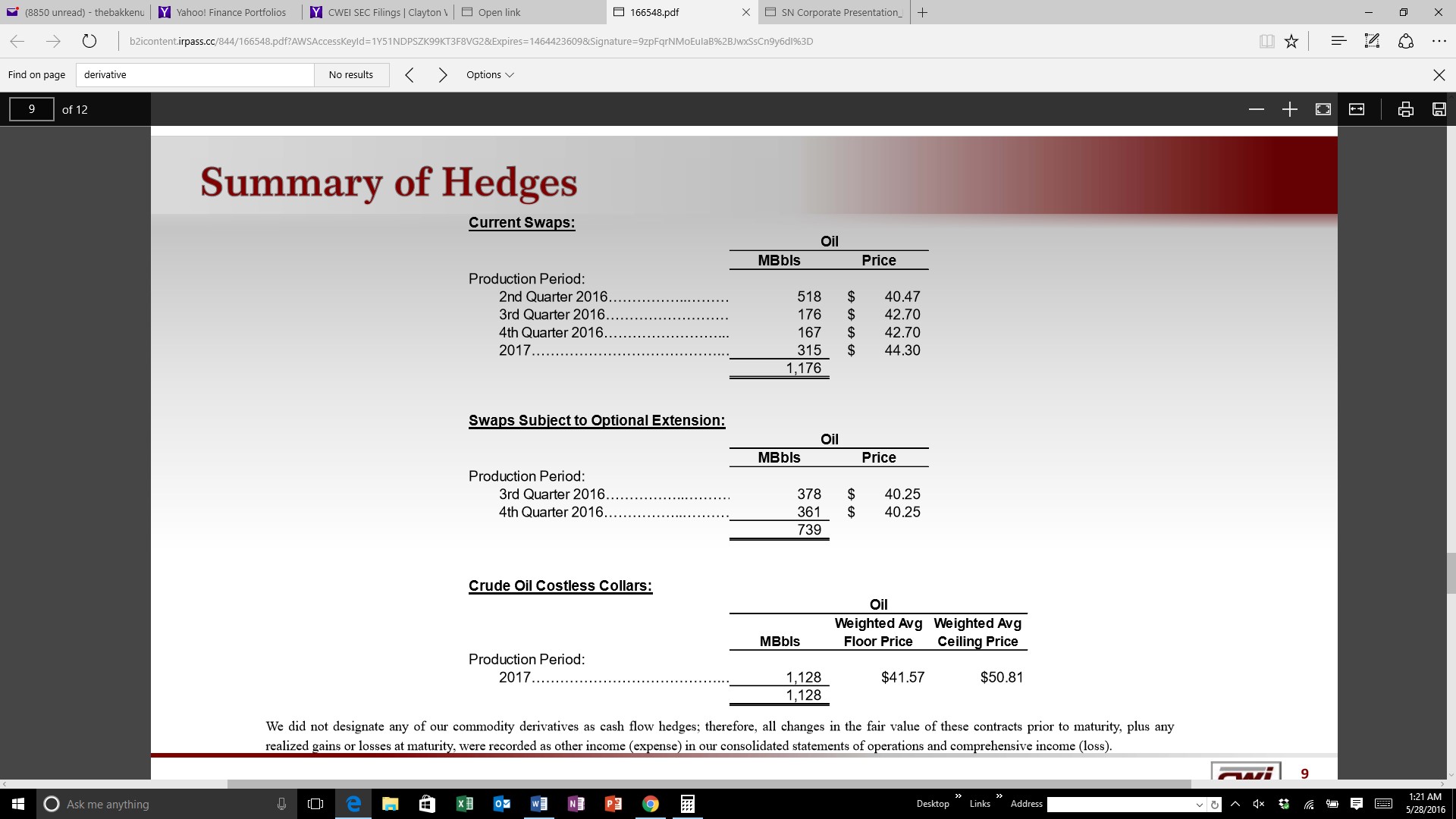

Although Clayton Williams (CWEI) isn't located in the Eagle Ford, I did add here for Eaglebine exposure.It also has Delaware Basin assets, which is probably the main reason it has 2016 swaps between $40.47 and $42.70/bbl.In 2017, this increased to $44.30/bbl. CWEI’s costless collars have an average floor of $41.57 and average ceiling of $50.81/bbl.

(Source: Clayton Williams)

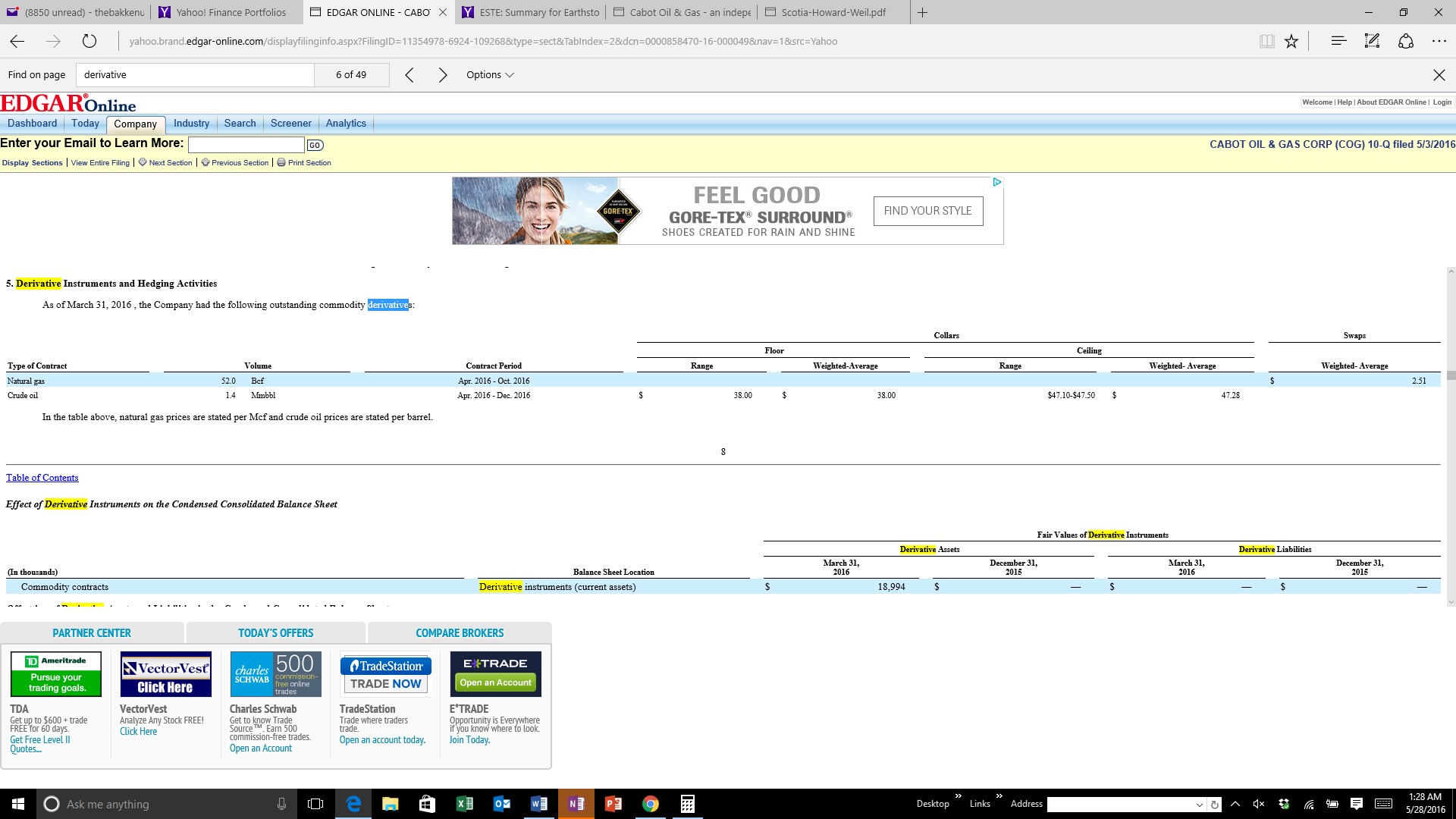

Cabot (COG) has used collars to hedge its 2016 oil production. The average floor is $38.00 and average ceiling $47.28. It is focused on the Eagle Ford, but also a player in the Marcellus. Although oil revenues are important, so are its northeastern assets which produce significant volumes of natural gas.

(Source: Cabot 10-Q)

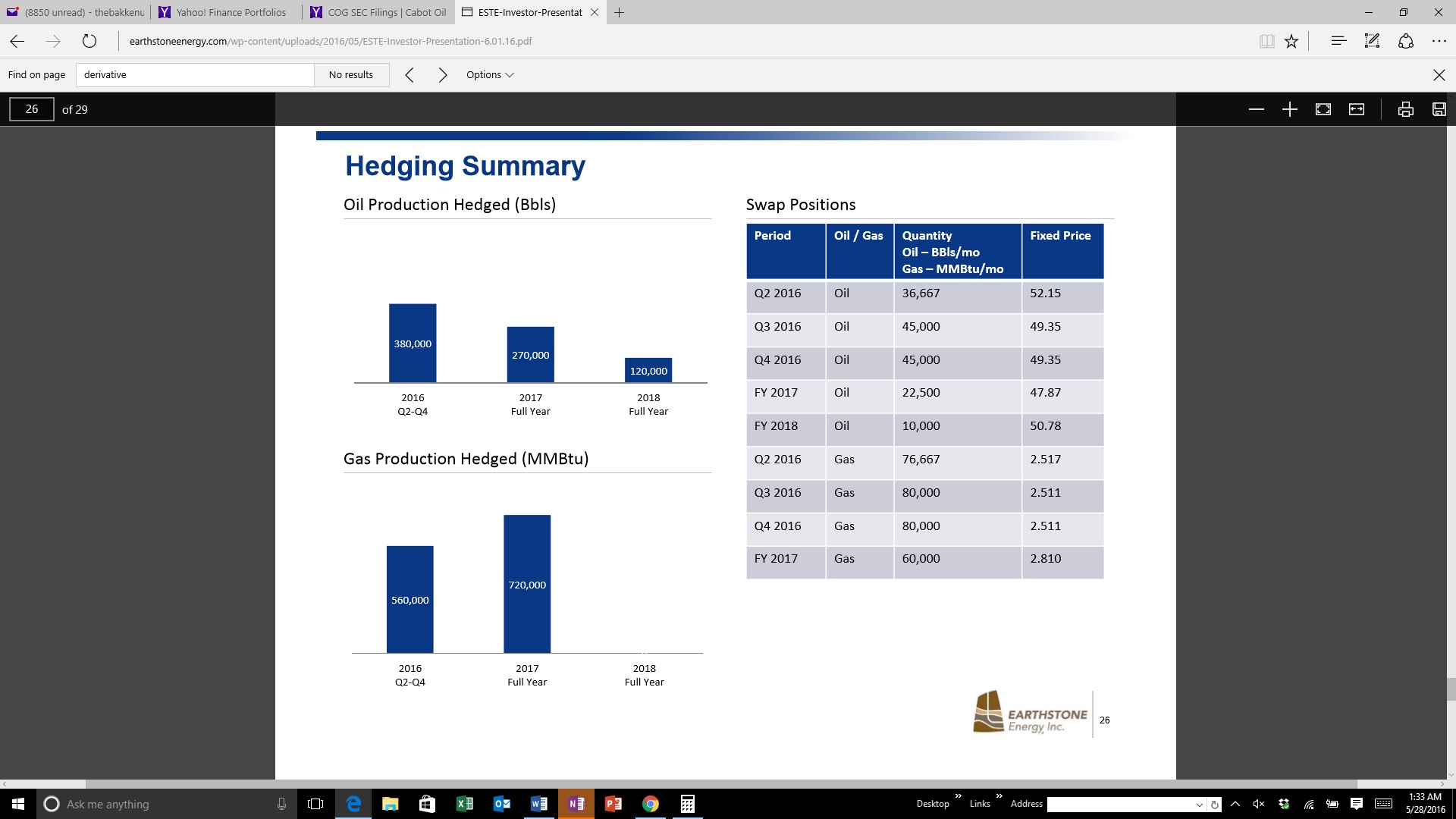

Earthstone (ESTE) has leasehold in several major US plays.This includes the Eagle Ford, Bakken and Permian. Its Permian acreage is on the fringe and Bakken is non-op.The Eagle Ford is currently its core, and located in some of the deepest of the oil window. It has targeted swaps for its derivative positions. In 2016, these range from $49.35 to $52.15/bbl.In 2017, the average is $47.87.2018 swaps average $50.78/bbl.

(Source: Earthstone)

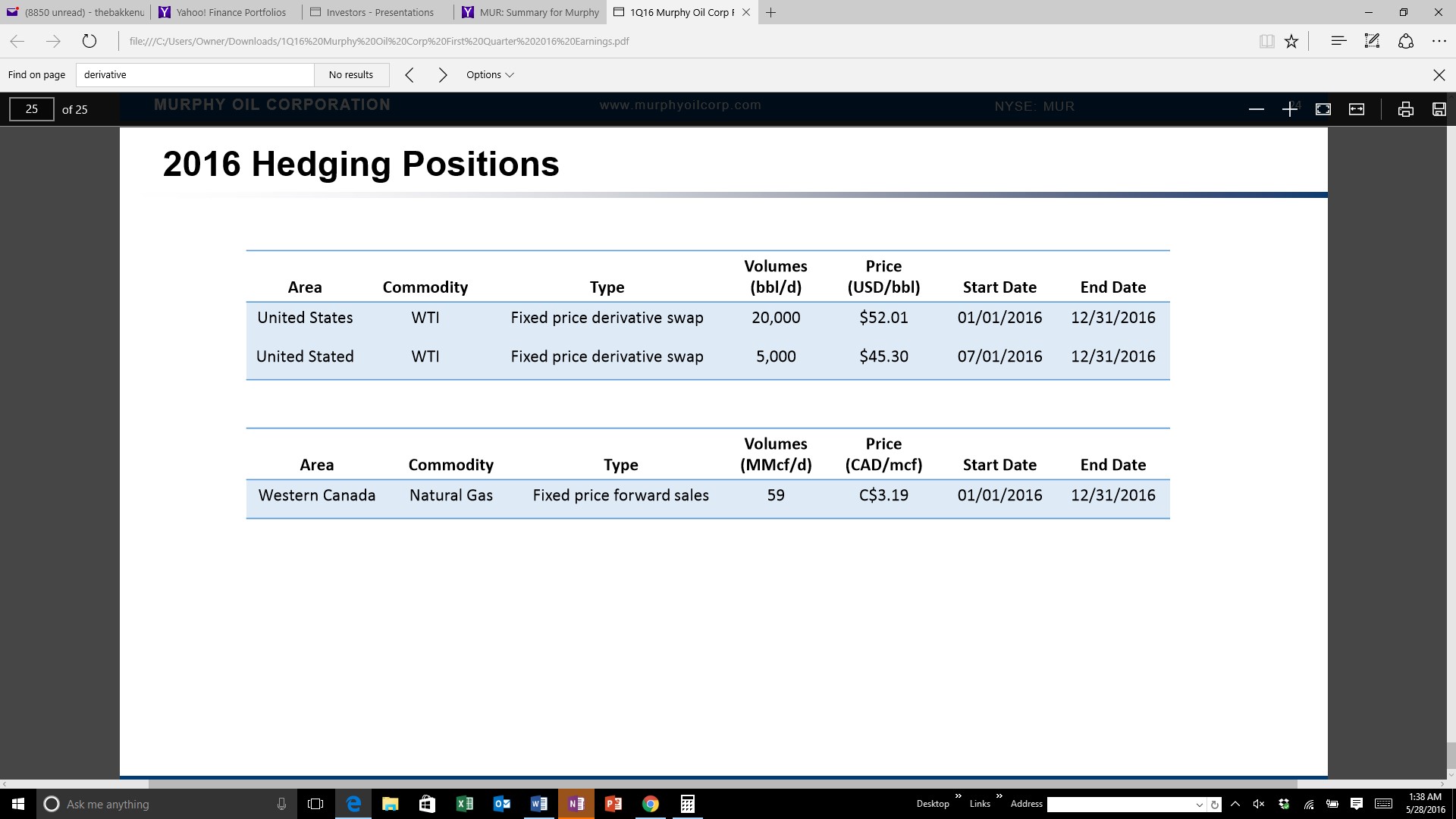

Murphy Oil (MUR) has hedged 20,000 bbls/d of crude in 2016. Last year it was able to add swaps at $52.01. This year, an additional 5,000 bbls/d were added at $45.30.

(Source: Murphy Oil)

In summary, operators continue to hedge production at low oil prices. Although short term, it could resist higher oil prices. We have seen many operators hedge in the low $40s, and continued participation as prices have risen. Although plays differ significantly from core to fringe areas, core areas are in focus. Operators continue to dump the bulk of cap ex on core plays, in hopes of waiting out this low price environment. Hedges are also focused on the economics of these areas. E&Ps must hedge production in order to keep banks happy. As oil prices rise, we will continue to see hedges added. Although many began hedging in the low $40s, it is motivating to add as opportunities arise. We think this will continue through 2016. Not everyone is in this camp.

Since many analysts have oil prices higher in Q4, it is possible E&Ps will hold off. Although we see higher oil prices this year, it is possible the fear of volatility will coerce hedging. We continue to see an enormous overhang in world oil inventories. This is another point of contention, but we see this as a continued issue this year. The upcoming Brexit may not dent demand in any significant way, but could cause the dollar to move higher. The upcoming refinery maintenance season is always problematic, and this year could be more so. We are seeing crack margins tighten, which could motivate refiners to decrease throughput. We may see the Fed tighten in July (Brexit, probably, has taken June off the table). I am not saying all or any of this will occur, but it is important to note there are a large number of variables that can move this market in a big way.

Although we think oil prices will be higher in Q4, the route in which we get there may be a mystery. The current supply/demand situation isn’t dire, but we have spent a long period of time filling inventories. Operators will look at all of these opportunities and issues, and may decide to take a more conservative approach. Sometimes survival is more important than trying to make what looks to be the obvious more productive trade.

Disclosure: None.