Trumponomics: Increase Exports, Slow Imports, Bludgeon The New Normal

Trumponomics is further explained by a paper issued by the Donald's economic advisers. While I leave it to others to hammer out the nuts and bolts of the VAT tax debate, a simple analysis of the trade deficit based on common sense is in order. Targeted nations in this Trumpian effort to reduce the trade deficit include Canada, China, Germany, Japan, Mexico and South Korea, accounting for 1/2 the trade deficit.

In a nutshell, these advisers appear to have no real understanding of the New Normal at all. They want well over 3 percent growth per year (with the inflation that accompanies that), when the Fed is seemingly powerless to raise interest rates 1/4 point! In spite of the new normal and the structured finance that drives it, Trump wants to increase exports and limit imports from the targeted nations. Those two partners do not dance that well together! This is probably the least realistic madness of this whole Trumponomics plan. And it is the central point of the plan!

And the Trump advisers say they want lower energy cost, but seek to balance the trade deficit by exporting energy.

These authors, Peter Navarro and billionaire Wilbur Ross, believe that the New Normal is just a political device, created by liberals. They believe it is not permanent:

Most recently, the 2012 South Korea trade deal was negotiated by Secretary of State Hillary Clinton – she called it “cutting edge.” It was sold to the American public by President Obama with the promise it would create 70,000 jobs. Instead, it has led to the loss of 95,000 jobs and roughly doubled America’s trade deficit with South Korea. Corporate America does not oppose these deals. They both allow and encourage corporations to put their factories anywhere. However, Mr. and Ms. America are left back home without high-paying jobs. There is nothing inevitable about poorly negotiated trade deals, over-regulation, and an excessive tax burden – this is a politician-made malaise. Therefore, nothing about the “new normal” is permanent. [Emphasis mine]

This is the only mention of the new normal in the entire article. The authors make no attempt to describe the pitfalls of trying to bludgeon the new normal. Donald Trump wants an inflation/reflation component to his policy through both the trade war and also through infrastructure spending not covered by this report. While we all want to pick ourselves up off the zero lower bound, doing so too quickly will bust open a Pandora's box of dislocations, in my view. Even Jamie Dimon agrees with this assessment.

There is a permanent aspect to the new normal. If you break the conundrum, the nation will pay a heavy price in a credit crisis of monumental proportions. Is Trumponomics prepared to allow all the collateral in the derivatives markets and systemically essential clearing houses to go bad, in order to get past the new normal? Trumponomics has nothing to say about that. That is totally irresponsible to just say the new normal is not permanent and then not comment on the conundrum, the foundation of structured finance.

It is true that hitting main street America hard with economic malaise, when main street carried the world on its shoulders with its purchasing power, was not such a smart policy on the part of big business. Most everyone acknowledges this is a big problem. So the authors of Trumponomics believe in the necessity of structural reforms. But those reforms are certain to start a trade war. The isolation of America could occur if these so called reforms are implemented. These reforms are wanted even though companies are starting to return to the USA to find workers. And the Donald seeks to apply these reforms as the business cycle is coming to a close. Bad idea. Helicopter money done right is a much more fiscally responsible idea.

And Trumponomics wants us to compete in industries where our wages are generally higher than other nations' wages, specifically in China and Mexico. We have not earned the right to complete in those industries. Unless we are prepared to cut wages and cut housing costs and the cost of living to the bone, it makes no sense for us to try to make things that others can make more cheaply. Trump wants to introduce lack of competitiveness into the world economy and also he wants to raise wages at home in industries where we do compete at a technological advantage. We could price ourselves out of the world markets in multiple ways. We would have to subsidize industries that couldn't make it on their own.

And the environment will suffer in doing so. Dirty coal is polluting southern Indiana, home to Mike Pence, at alarming rates. So the Trump energy plan is devised:

To attack those regulations that “inhibit hiring,” the Trump plan will target, among others: (1) The Environmental Protection Agency’s Clean Power Plan, which forces investment in renewable energy at the expense of coal and natural gas, thereby raising electricity rates; and (2) The Department of Interior’s moratorium on coal mining permits, which put tens of thousands of coal miners out of work. Trump would also accelerate the approval process for the exportation of oil and natural gas, thereby helping to also reduce the trade deficit. Numerous other low-level rules that are individually insignificant but important in the aggregate will also be reviewed.

Trump's report does show that one important base of growth, the manufacturing sector, would benefit from deregulation:

More than any other sector, manufacturers bear the highest share of the cost of regulatory compliance. … Manufacturers spend an estimated $192 billion annually to abide by economic, environmental and workplace safety regulations and ensure tax compliance—equivalent to an 11 percent “regulatory compliance tax.”

Unfortunately, manufacturing regulations do happen to protect people. Manufacturing is important in creating 4 jobs for every 1 job created in production, but at what cost? And Trump's desire to lift all restrictions on energy production could result in efforts to drill along the pristine Northern California Coast, endangering tourism and jobs and the exceptional beauty of this area.

Exporting energy, especially oil, will keep us weak and bound by the hip to the Middle East, attendant with all the pipeline wars and turmoil that that policy brought us, unless we diminish our known reserves which are not unlimited, with the gimmick of overproduction.

Trumponomics doesn't look at it that way. Increasing the supply of oil could make prices decline according to the report. But if Trump wants to please Vlad Putin, prices would have to go up, not down.

Trumponomics seeks American production of low cost products, and expects the world, which will no longer be able to dent American markets, to have the prosperity to buy an even more exports from America than they do now. I think it is madness.

About this inflation/reflation push by the Trumpians, Edward Lambert told me by email:

Truly I see strong headwinds to inflation. But if the new government insists upon pushing for strong fiscal stimulus, then the model in my post describes what will happen. High inflation potential and high interest rate potential. It is wiser to go slowly with the fiscal stimulus when this close to the end of the business cycle. I assume Alan Greenspan sees something similar.

Dr Lambert was referring to Alan Greenspan's worry about stagflation. Here is the post he made for reference. It is worth reading and the Fed should be ready for what may happen with Donald Trump as president, as Professor Lambert projects a Fed rate path.

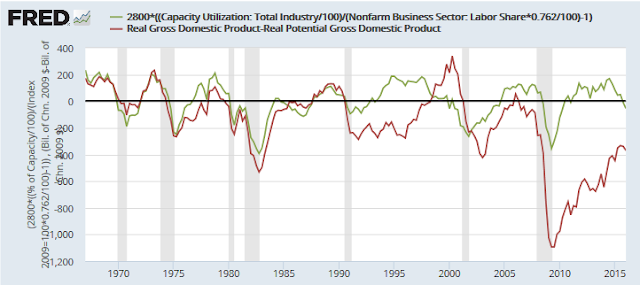

|

| Business Cycle Ending Based on Effective Demand (Green Line) |

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.