Economists Reveal Massive Market Forces In Bonds Before And After QE

The debate over Market Monetarism and long bond demand continues. The problem is that few economists, including market monetarists, address the issue of massive demand for long government bonds that I have written about more than once on TalkMarkets. Economists are technicians, and it is often difficult to get them to think outside their boxes.

But there are a few encouraging signs that economists are at least starting to think about massive bond demand and/or the roll of clearinghouses in the new normal system we face. And with the new LCR requirement for banks for short duration bonds and notes, studies, like one cited at the end of this article, from Gary Gorton and Tyler Muir, are now being done. The study by Gorton and Muir that shows some bond yields declining arises from the need for better and better collateral by BIS rule and requirement.*

David Beckworth (another Market Monetarist like Scott Sumner) appears to understand most if not all of the history behind the concept of massive market forces in the bond market. Mr Beckworth said this:

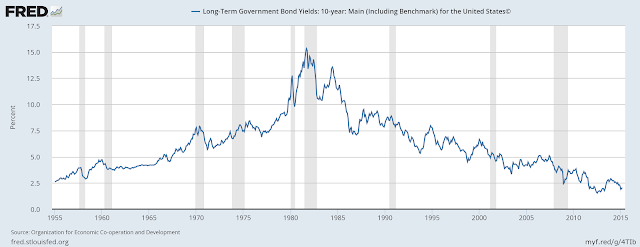

“This downward march of interest rates has occurred prior to and after QE programs and is therefore not the result of central bank tinkering. Rather, it is the result of far bigger global market forces. One interpretation of this movement (based on the expectation theory of interest rates) is that the market expects future short-term interest rates to be increasingly lower. As Tim Duy notes, the Fed is fighting against this force and is unlikely to win. Put differently, interest rates are being suppressed by market forces despite the Fed’s best efforts. The Fed will not be able to raise interest rates this year and maybe even next year”

And, Ari Blask describes what George Selgin, of the Cato blog, Alt-M, has said:

George Selgin discussed clearinghouses' role in the pre-Fed American financial system, which came to include providing liquidity during panics. After the failure of the Ohio Life and Trust Insurance Company in 1857 led to a system wide suspension of specie payments in New York, the recently formed New York Clearing House issued temporary loan certificates to member banks for use in settling transactions...

...Selgin closed by noting the advantages of the 19th century’s spontaneous and private clearinghouses relative to today’s government imposed and run versions. In addition to the Fed, Dodd-Frank’s mandated central clearinghouses for OTC derivatives will socialize risk and create moral hazard, removing an incentive for the private sector innovation that might actually improve payments and settlement in the derivatives market.

So, we know that because of the clearinghouses, and need for collateral, why bond demand is now so intense after QE. But it must be asked why bond demand was so strong absence recessions in the mid 1980's way before modern QE. The Fred chart shows this decline in yields in non recessionary times.

|

The Relentless Decline in Bond Yields Took Place in the Absence of Major Recessions from the Mid 1980's |

Clearly around 1985, bond demand picked up fairly consistently and yields declined in an almost relentless manner.The appointment of Alan Greenspan as Fed Chairman soon after the S&L crisis (August, 1987), coupled with structured finance coming into its own through Salomon Brothers collateral risk management program appears to be related to this increasing demand for bonds.

See my articles about Structured Finance and Salomon bond hoarding and also why bonds were not affected by the ending of QE, at the end of this article for a more detailed history.

Unfortunately, some prominent market monetarists have not chosen to comment on the massive forces driving bond yields down with or without QE being operational.

Here is a background to this tension between market monetarism and massive market forces in the bond market.

1. You do not have to be an economist to understand Market Monetarist NGDP Targeting. Inflation was targeted by the Fed, missing the drop in nominal GDP in 2007-2008.

However, now, NGDP targeting will not be permitted by the Fed since this massive demand for bonds which is a market force that cannot be stopped, and raising rates even a little, unsettles that force of demand for bonds as collateral.

So, if you have a 1 percent GDP growth, and your NGDP target is 5 percent, you would have the Fed generate 4 percent inflation to reach your target. But clearly, being strapped to NGDP targeting could result in the Fed, and central banks everywhere, destroying the collateral. We can't have the collateral destroyed, or the deck of cards could fall. At the very least the yield curve would be inverted grotesquely and banks would be weakened.

2. You do not have to be an economist to know that while NGDP targeting would have helped in 2008 as the Fed flew blind just targeting inflation, it will not be permitted in this low rate environment. We have the market monetarists to thank for pointing out the truth of the Fed's mistakes in 2007-2008, as GDP crumbled.

But, in this clearinghouse environment where systemic risk is now held by those clearinghouses, NGDP targeting is dead as a concept, in my opinion. Stability has been achieved unless systemic risk creeps into the system.

There are three main ways I see that systemic risk could upend the system, throwing risk back onto the financial system:

1. There are not enough bonds to use as collateral in the clearinghouses. Banks do not have enough bonds for LCR requirements.

2. The bonds that are used as collateral lose their value with yields rising.

3. Counterparties do not meet their margin calls in the event yields did rise putting the clearinghouses in financial danger.

* This is from Gary Gorton and Tyler Muir:

The LCR is a very significant policy change. It requires that short-term bank debt be backed dollar for dollar with “high-quality liquid assets.” In essence, all repurchase agreements, or repo, would have to be financed with Treasuries, one for one. This policy will tie up a lot of Treasuries, a potential problem because they have a convenience yield. This means that the interest rate on Treasuries is lower than it would otherwise have to be because part of the demand for Treasuries comes from their use as safe debt – a way to safely transfer value through time. Convenience yield is the basic property of money, so Treasuries are essentially money. The LCR then requires that government money (Treasuries) must be used to back bank money – i.e., short-term debt, a kind of narrow banking...

...The second problem is that the LCR may result in a shortage of safe debt because too much of the Treasuries is tied up in backing repo. When there is a shortage of government-produced safe debt, the private sector steps in to produce close substitutes, asset-backed securities. But the private sector can’t produce riskless debt. [Emphasis Mine]

It is clear that central banks are looking for, and finding new ways to tie up sovereign bonds, whether in bank capital regulations or through regulations governing clearinghouses. It is also clear that this means bonds do not necessarily react to other market forces. They have their own demand, which, because of a mistrust of asset backed securities, is growing ever stronger.

For further reading:

Hoarding the New Gold, Early History about Structured Finance

Everyone Said Treasury Bond Yields Would Go Up After QE Ended

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.