Draghi And Germany Have A Secret Plan To Save The Eurozone

Draghi, of the ECB, and Germany must have a secret plan to save the Eurozone. One cannot make sense of their actions without contemplating this plan.

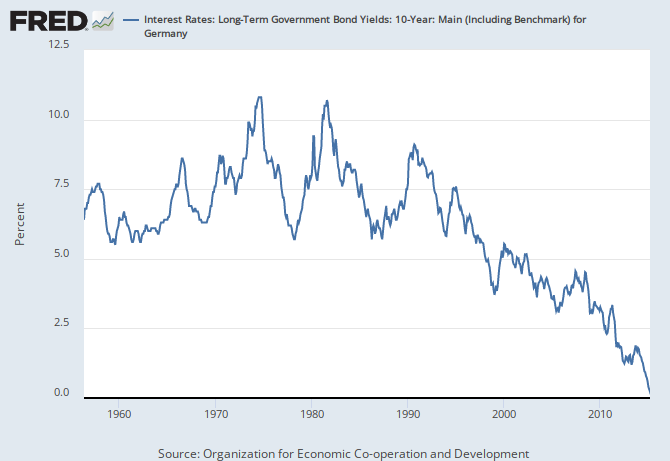

After all, Germany introduced a plan to weigh bonds, with bondholders potentially taking a haircut before bailout money can be approved for periphery banks. On the surface that would seem to indicate that Germany and the central bank are seeking to weaken bond prices in the weaker nations and destroy the Eurozone. This is causing a flight to safety, with German bonds being the primary beneficiary. See articles regarding this plan here and here. The chart is a bit out of date but trust me, yields are even lower after a short bump, and are going to go negative even on the long term bond:

Main Economic Indicators - complete database", Main Economic Indicators (database),http://dx.doi.org/10.1787/data-00052-en (Accessed on date)

Copyright, 2014, OECD. Reprinted with permission.

So, yields are even closer to negative now. Draghi is buying German bonds, making the scarcity of these bonds that are already in massive demand even more scarce. That will push yields down even more.

So, what is going on? Surely Germany and the ECB do not want the Eurozone to fall apart. I believe that there is a plan, and that secret plan is the goal to fund Germany through getting people to buy German bonds for safety, even if they have to pay the ECB and ultimately the German government for those bonds.

So, why would Germany and the ECB want to weaken the periphery? Well, it is all about discipline. The Germans want two things, 1) they want discipline in the periphery (formerly known as PIIGS), and 2) they want the ability to bail out nations with a large war chest of cash derived from getting people to pay them to hold their bonds!

Germany must appear to be at least as safe, and probably more safe, than the United States. With growth stumbling in Germany, that is becoming hard to do. Yet converting Treasury bonds into Euros can mean a loss for investors. They may as well hold German bunds, at negative rates. Why not? Return of capital is becoming crucial to these bond buyers.

I wrote about Kocherlakota's plan to bring bond yields to negative, and using the windfall for massive government spending and stimulus. That must be the plan of the Eurozone and Germany right now. Germany does not want to be as weak as the weakest link. It wants to be iron strong, and maybe that will translate to stimulus although one cannot be sure when speaking about Germany. Regarding Kocherlakota, I said this:

It is clear that former Fed president Narayana Kocherlakota wants government to spend a lot of money through the use of negative nominal rates on Fed funds rate. This is different than negative IOR. He realizes, as I have noted in past articles, that there is massive demand for treasury bonds, and that more could be issued than are issued now. Projects could be financed by this issuance. Only problem is we aren't quite negative here in the USA, yet. Negative bonds could be a bad idea.

That is why Kocherlakota wants more government spending, to force the creation of more treasury bonds. That would help drive long bond yields up, which would be more normal, but at what cost? There could be unintended consequences. He switched from being a libertarian to some Keynesian and Monetarist ideals, especially with regard to fiscal spending. He and his Freshwater school was embarrassed when inflation did not go crazy as QE was implemented.

But Kocherlakota and some central bankers seem to want the big money paying government. It would seem that negative IOR is not enough for them. They are way more ambitious than that. Negative IOR would help but would not be a massive windfall for governments, but negative bond rates would be a massive windfall.

The German proposals and Draghi's moves make no sense unless this Kocherlakota-like plan is the plan for the Eurozone as well. While the chart above does not show it, but the Bloomberg article I linked to does, there was a surge in mid 2015 for German bond yields. That indicates weakness in the world of the Eurozone when strength is based upon how low you could go. But yields are moving lower again, as Germany seeks to exert its power, even if the rates become negative.

There is always a risk that investors could sell the German bonds, but rising yields on German bonds would likely destroy the Eurozone, if this negative yield goal is the plan to save it! I am sure that idea is not lost on investors.

It is funny that raising rates is considered a show of strength on the part of the central bank in the USA, while lowering rates is considered a show of strength by the ECB in the Eurozone. Forgive me if I don't get it. You probably all do, but don't worry, I will figure it out someday!

Kocherlakota believes that bond yields would go up if more bonds were issued in the USA. Well, that could be true except that the supply of the bonds is way lower than the demand and the banks have bet on low rates. Same for the Eurozone. I think they all have a secret plan for permanently negative rates, a tax on investors to keep their money safe. This could be the extortion scheme of the millennium.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.

A long delayed correction. Kocherlakota was seeking negative rates not an increase in yield. Negative rates force investors to finance a government. That seems to be Draghi's goal and not only for the ECB but also for the German Central Bank. A strong Germany could mean that Germany does not fear that its banks are weak.