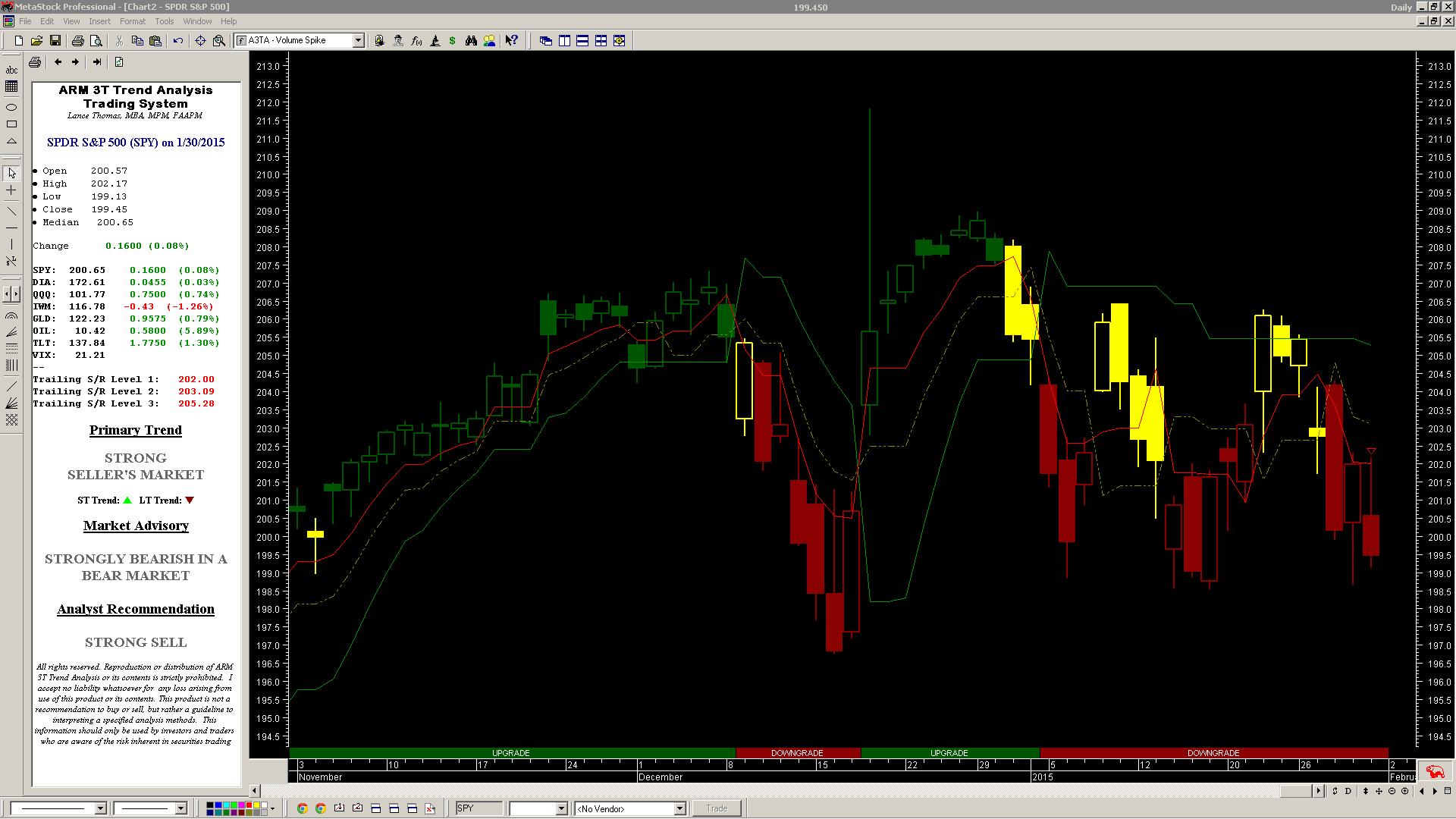

SPDR S&P 500 (SPY) has been a recommended downgrade since 1/5/15 and battling against one of its resistance level of $205 for nearly four weeks when considering its daily price chart.

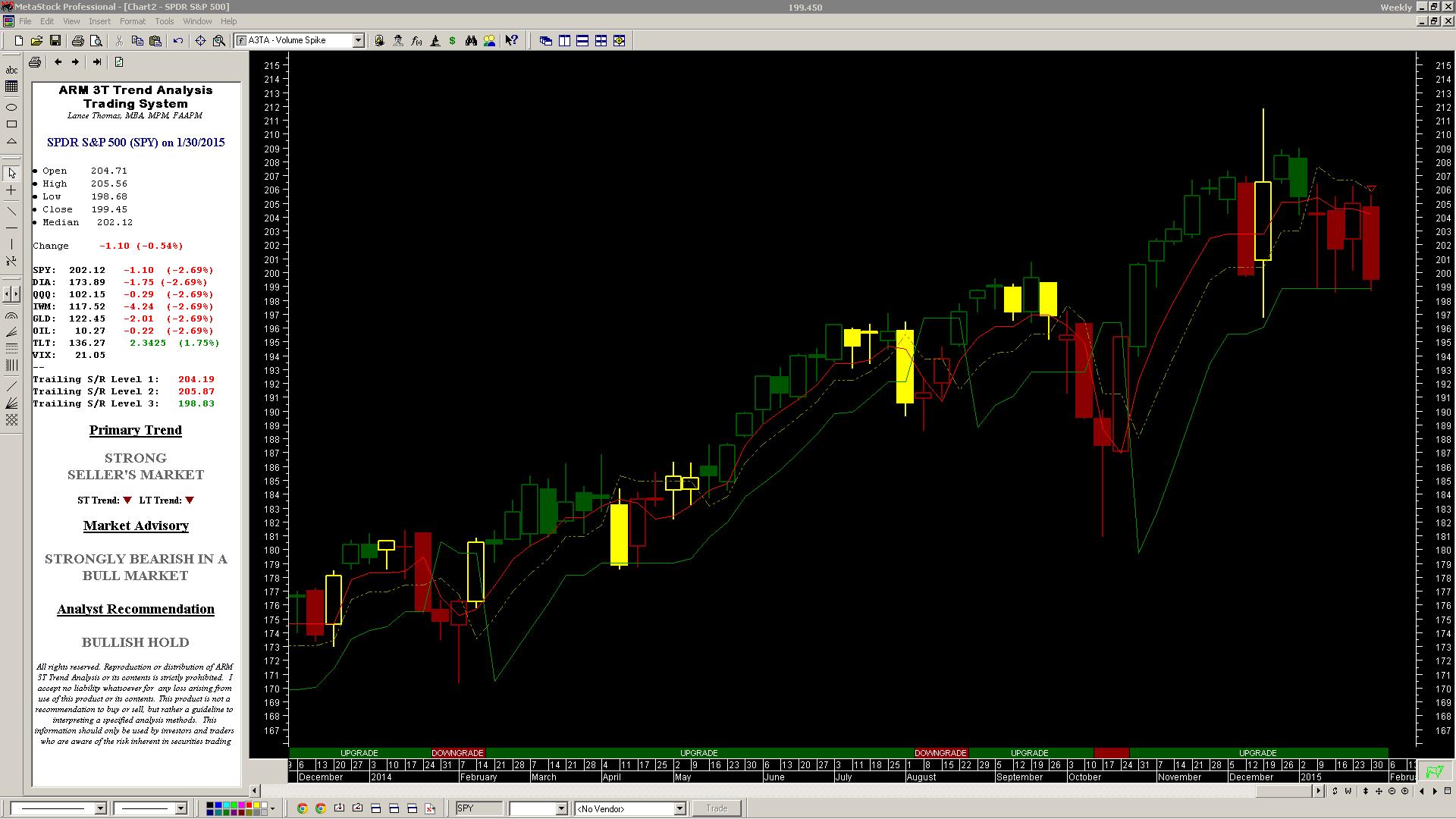

Coupled with its weekly chart, some hope prevails with finding support once again at $198.83 in order to remain a bullish hold for the coming weeks ahead:

Hopefully SPY will continue its upward march despite the daily and weekly sentiments as highlighted within its quarterly chart. Albeit, still a strong buy for those who believe that SPY will find support at roughly $198. If it breaks support at this level, then I would argue the potential of SPY finding it once more at roughly $193 (and roughly $186 if it falls even lower within the prevailing quarter).

Note: Calendar View of ARM 3T Trend Analysis highlighting the short-, medium-, and long-term trends in a perpetual calendar: