Cryptocurrency hedge funds are still a fairly new investment vehicle, but we’re already getting a pretty good idea of how they stack up against simple passive investments in two common underlying currencies. The bitcoin price and ethereum price have both plunged this year, leaving cryptocurrency hedge funds scrambling for cover.

However, performance data shows that in a down year, investing in those two cryptocurrencies via hedge funds seems to offer slightly better performance than a passive investment in a portfolio consisting of 80% bitcoin and 20% ethereum. Interestingly, cryptocurrency hedge funds were able to generate alpha against all the benchmarks they were compared to.

The year of the cryptocurrencies

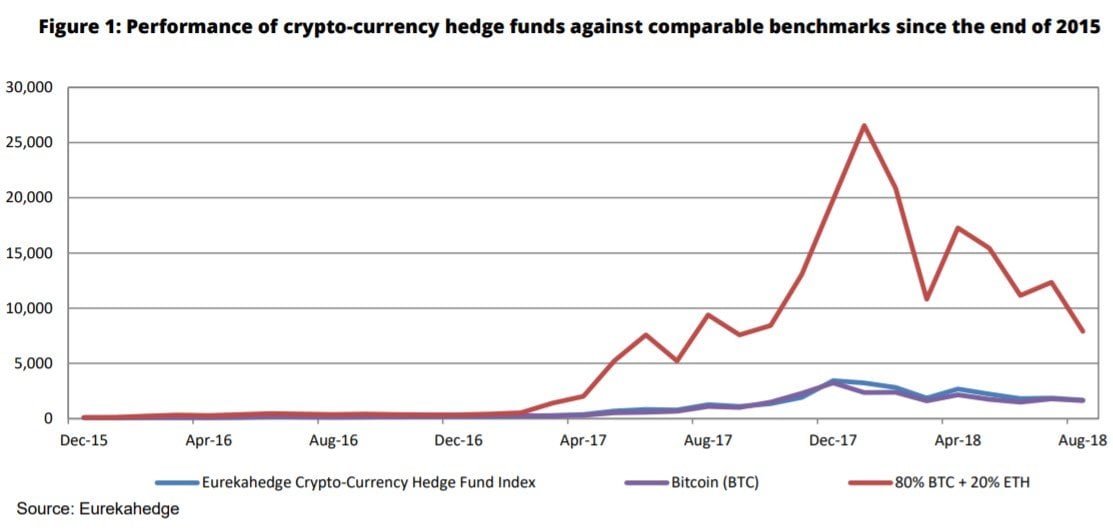

The September Eurekahedge report included detailed data on cryptocurrency hedge funds and how they stack up against key benchmarks. Needless to say, when the bitcoin price skyrocketed in 2017, cryptocurrency hedge funds killed it, raking in massive gains for investors. Now that the bitcoin price has plunged, this hedge fund strategy has struggled as well, but the hedge fund investors did better than investors holding a passive stake in bitcoin and ethereum.

Last year the bitcoin price surpassed $1,000 and then kept right on going. By May, the bitcoin price had reached $2,500, and then it doubled from there in October. The bitcoin price peaked in December at more than $19,000 after CBOE and CME launched their bitcoin futures. Since then, the bitcoin price has come crashing down.

Last year was also the year other cryptocurrencies started to take hold. According to Eurekahedge, the ethereum price gained more than 10,000% in 2017. Last year also brought about a number of new cryptocurrencies, including bitcoin cash, which split off from bitcoin.

Eurekahedge noted that 2017 also brought stable coins, a new type of cryptocurrency which became popular due to their price stability. Stable coins offered less price volatility because they were pegged to gold, fiat currencies, or other stable assets.

Bitcoin price back to earth after a wild 2017

This year it's been an entirely different story for cryptocurrencies. The bitcoin price plummeted earlier this year after South Korean regulators took action against cryptocurrencies. Hackers also breached Japanese crypto market Coincheck, which carried the bitcoin price under $7,000 in February.

It just so happened that February brought a broader pullback across the market, so the bitcoin crash occurred at the same time stocks and some other assets were plunging as well. Some investors saw the bitcoin price crash as an opportunity to short cryptocurrencies, which they could do much more easily via the bitcoin futures offered by CBOE and CME. Eurekahedge argues that the widespread shorting of bitcoin could have exacerbated the selloff that was already going on in the crypto market.

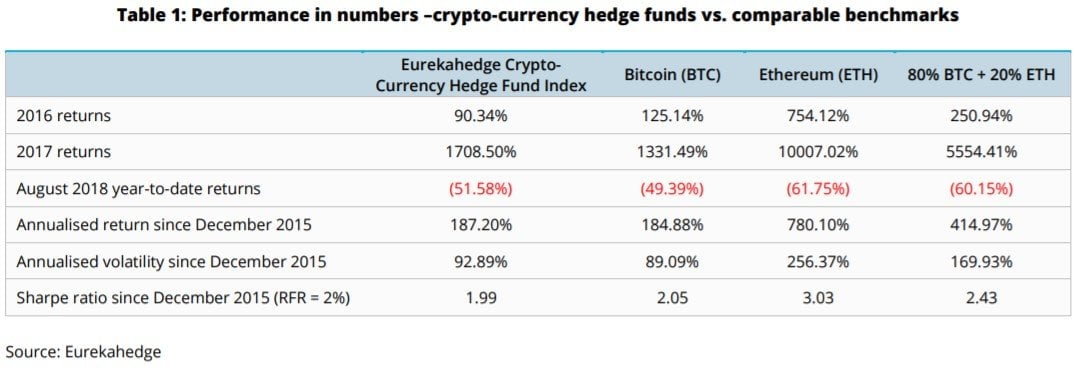

This year the bitcoin price was down about 49% through the end of August, while the ethereum price was down nearly 62%.

Cryptocurrency hedge funds underperformed direct crypto stakes

In 2016 and 2017, when the bitcoin price and ethereum price were skyrocketing, seemingly without end, cryptocurrency hedge funds actually did worse than passive stakes in the two digital currencies, based on data from Eurekahedge.

Using its Crypto-Currency Hedge Fund Index, Eurekahedge compared the performance of cryptocurrency hedge funds with the bitcoin price, the ethereum price, and a passive portfolio containing 80% bitcoin and 20% ethereum.

The Eurekahedge Crypto-Currency Hedge Fund Index gained about 90% in 2016, underperforming bitcoin and ethereum. The bitcoin price soared 125% that year, while ethereum was up 754%. The passive portfolio containing bitcoin and ethereum gained more than 250% that year.

In 2017, the gains were far more dramatic. The bitcoin price surged 1,331.5%, but that was nothing to the skyrocketing ethereum price, which was up more than 10,000% that year alone. The meteoric rise in ethereum boosted the 80/20 BTC/ETH portfolio significantly, as it gained about 5,554% in 2017.

Cryptocurrency hedge fund index generates positive alpha

It's no secret that hardcore crypto fans have had a tough time this year. The bitcoin price was down nearly 50% through August, while the ethereum price was down almost 62%. The passive 80/20 BTC/ETH portfolio compiled by Eurekahedge has lost more than 60% through the end of August. However, looking at the risk returns of each of the four options, we start to see why cryptocurrency hedge funds are generally a safer way to invest in bitcoin and ethereum.

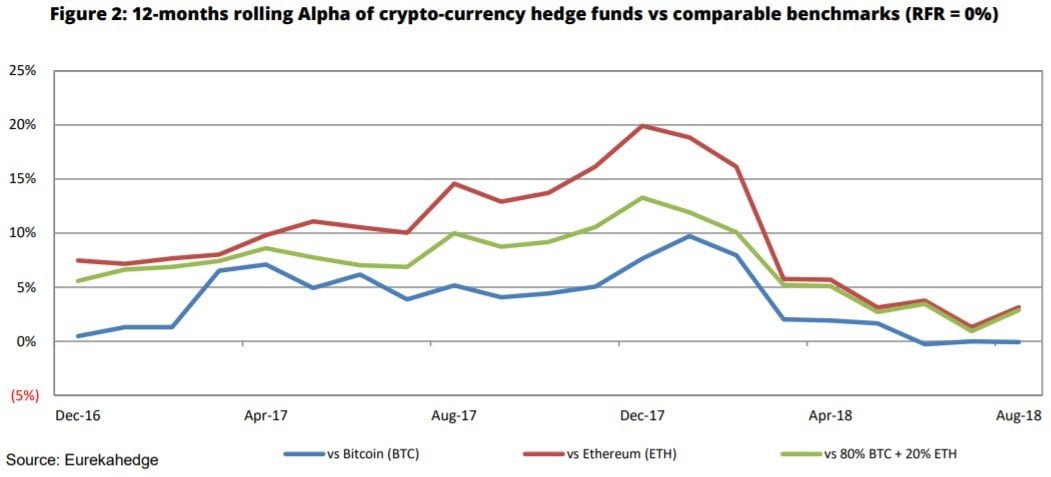

Interestingly, Eurekahedge found that cryptocurrency hedge funds generated positive alpha against all three of the benchmarks over most of the last two years.

Cryptocurrency hedge funds generated 1.36% alpha against bitcoin, 6.2% alpha against ethereum, and 2.93% against the passive 80/20 BTC/ETH portfolio. According to Eurekahedge, cryptocurrency hedge funds managed to generate alpha even against ethereum because they had low beta resulting in "low systematic exposure" against it. The Eurekahedge index generated 0.17% of beta against ethereum and 0.9% of beta against bitcoin.

Eurekahedge spotlights cryptocurrency fund outperformance

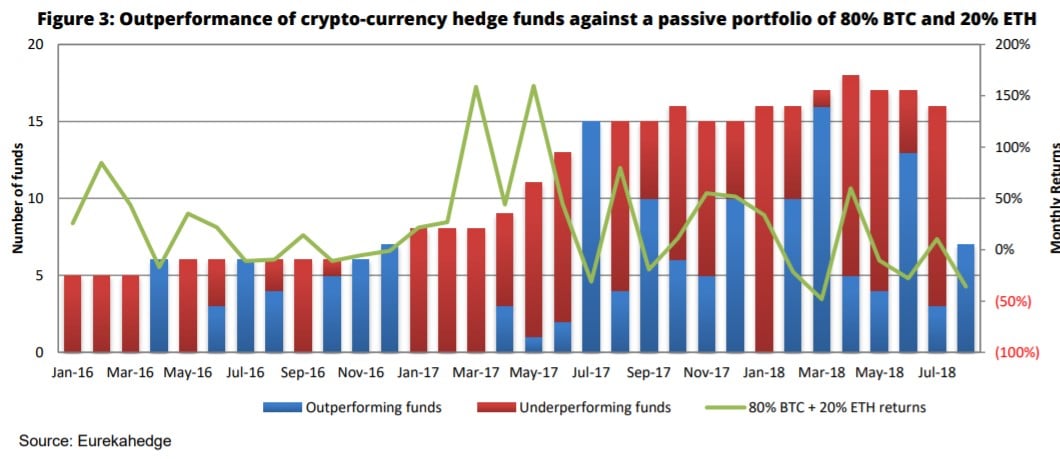

Eurekahedge also broke down further the outperformance of the constituent funds in its Crypto-Currency Hedge Fund Index against the passive 80/20 BTC/ETH portfolio. The firm noted an inverse correlation between the number of cryptocurrency hedge funds outperforming the passive portfolio and the performance of that passive portfolio.

"When the portfolio generates a positive monthly return, most of the crypto-currency hedge fund managers were typically unable to capture the entire upside of the underlying assets," Eurekahedge explained. "On the other hand when the portfolio is down for the month, hedge fund managers were able to provide some downside protection and outperform the passive portfolio."