For today's edition of our upgrade list, we used our website's advanced screening functions to search for UPGRADES to BUY or STRONG BUY with complete forecast and valuation data. They are presented by one-month forecast return. Xenith Bankshares and The Gap are STRONG BUY upgrades for today. The other companies are ranked BUY.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

|

XBKS |

XENITH BANKSHS |

33.93 |

18.53% |

35.72% |

1.06% |

12.70% |

14.04 |

Finance |

|

GPS |

GAP INC |

30.98 |

32.06% |

21.59% |

1.04% |

12.43% |

15.26 |

Retail-Wholesale |

|

FII |

FEDERATED INVST |

31.9 |

2.41% |

17.50% |

0.45% |

5.40% |

15.05 |

Finance |

|

JNPR |

JUNIPER NETWRKS |

28.19 |

11.57% |

6.46% |

0.45% |

5.35% |

15.78 |

Computer and Technology |

|

FMNB |

FARMERS NATL BC |

14.8 |

3.81% |

23.85% |

0.43% |

5.20% |

17.01 |

Finance |

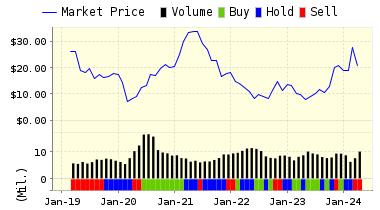

For today's bulletin, we take a look at retailer The Gap (GPS). Gap Inc. is a leading global retailer offering clothing, accessories, and personal care products for men, women, and children under the Gap, Banana Republic, Old Navy, Athleta, Intermix, and Weddington Way brands. Gap Inc. products are available for purchase in more than 90 countries worldwide through about 3,200 company-operated stores, about 450 franchise stores, and e-commerce sites. The company?s products include denim, tees, button-downs, khakis, and other products; and fitness and lifestyle products for use in yoga, training, and sports to women and girls. It also operates Weddington Way, a social shopping platform for wedding parties that provides an online boutique with bridesmaid dresses and various wedding party gifts. The company offers its products through company-operated stores, franchise stores, Websites, third-party arrangements, and catalogs.

We have spent a lot of time recently on trouble in retail, but one bright spot has been The Gap. The firm has enjoyed a nice run over the past few months, and if you consider the recent history, out BUY call from earlier this year was quite timely.

Recent results from the firm were strong, and investors reacted positively to their better-than-expected results posted on November 16th. At that time, the company reported third quarter fiscal year 2017 diluted earnings per share of $0.58. Total company comparable sales for the third quarter of fiscal year 2017 were up 3 percent. Net sales for the were $ 3.84 billion compared with $3.80 billion for the third quarter of fiscal year 2016. The company also raised its reported diluted earnings per share guidance for fiscal year 2017 to be in the range of $2.18 to $2.22.

Company President and CEO Art Peck noted the following about the Q3 results:

we are happy to report our fourth consecutive quarter of positive comps, reflecting the continued momentum in key parts of our business. We continue to make progress against the balanced growth strategy we outlined in September, driving efficiency at our more mature brands, while growing our footprint in the value and active space, and investing in our online and mobile experience.

Since those decent results, the company has also been bolstered by positive initial-sales figures for Black Friday and the 2017 holiday shopping season. Of course, these numbers were not increasing as compared to recent history, but declines in store traffic were smaller than expected. In addition, the company was not seen to be offering quite as many sales and big discounts to drive that traffic as they have in the past.

We are in such a period of turmoil and trouble for retail that even this sort of report can provide investors with enough justification to run up the share price of a company. Of course, we have seen in the past that optimistic initial views of Black Friday sales may not be enough to translate into a strong overall season. We will have to see if this sort of good news holds up for The Gap.

Below is our latest data for The Gap (GPS):

ValuEngine updated its recommendation from BUY to STRONG BUY for The Gap on 2017-11-29. Based on the information we have gathered and our resulting research, we feel that The Gap has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and P/E Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

32.86 | 1.12% |

|

3-Month |

33.57 | 3.30% |

|

6-Month |

34.53 | 6.24% |

|

1-Year |

36.86 | 13.42% |

|

2-Year |

41.99 | 29.21% |

|

3-Year |

45.04 | 38.57% |

|

Valuation & Rankings |

|||

|

Valuation |

38.89% overvalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

1.12% |

1-M Forecast Return Rank |

|

|

12-M Return |

28.76% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

-0.18 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

-6.36% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

34.82% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

7.39% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

13.77 |

Size Rank |

|

|

Trailing P/E Ratio |

16.01 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

14.91 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

2.17 |

PEG Ratio Rank |

|

|

Price/Sales |

0.89 |

Price/Sales Rank(?) |

|

|

Market/Book |

4.55 |

Market/Book Rank(?) |

|

|

Beta |

0.88 |

Beta Rank |

|

|

Alpha |

-0.23 |

Alpha Rank |

|