As a former shareholder of Fannie Mae (FNMA) and Freddie Mac (FMCC), I've seen rallies stall multiple times over the years. As soon as the stock begins to lift off, a politician steps in an squash the rally in some way or another. Back in 2010, as many companies were beginning to emerge from the financial crisis, FHFA decided to delist the shares of the stock from the NYSE, despite the fact that they traded over the minimum price. In 2012, they introduced the net worth sweep, blind-siding most investors by taking 100% of profits. In 2014, as the common shares touched $6, the Johnson-Crapo-Corker-Warner (you name it) Bill made a reappearance, whopping shares back. Then, it was a sudden and unexpected court ruling against Perry Capital. Each time, the news came out of nowhere and each time money was lost. Maybe this time it is different.

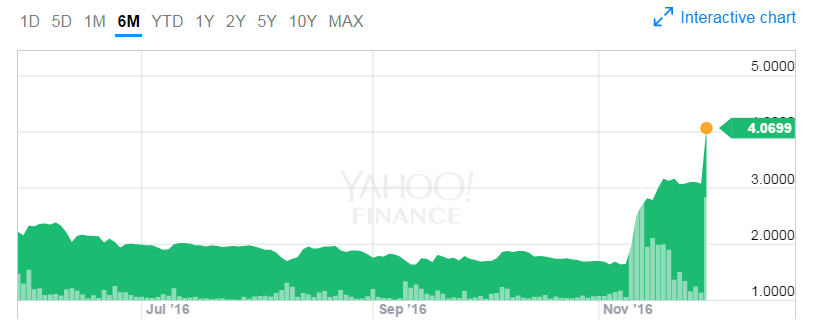

The current rally is driven by the possibility of GSE reform being a priority for the new Trump Administration. This morning, Trump's new pick for Secretary of Treasury, Steven Mnuchin, said that the companies should not be owned by the government. Mnuchin is on the board of Sears Holdings with GSE preferred shareholder Bruce Berkowitz.

There is some question as to what Fannie and Freddie would look like, if not owned by the government. Nobody seems to know how they would get there. FHFA has the authority to release the GSEs from conservatorship, but they must have sufficient capital. The net worth sweep has ensured that the GSEs are operating with almost no capital. If Treasury wants to privatize the GSEs, those warrants with a strike price of less than a penny must be on the table for negotiation. If they were to be issued at a strike price of perhaps $25, the GSEs might have enough capital to be released from conservatorship. The only problem being that this would also be the largest public offering in the history of the world.

Another thing to think about. Some of the chief anti-GSE shareholder members of Congress have been rather quiet recently. Most notably, Senator Corker (R-TN) hasn't mentioned Fannie and Freddie in a while. It might be because he is one of four people currently eyeing that Secretary of State job. If Corker doesn't get the job, what would his next step be? Perhaps he will want to retain his leadership role in the Senate. Stay tuned.