TM Editors' Note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

On July 5, 2017, U.S. Gold Corp. (USAU) announced that it had completed the acquisition of the Gold Bar North [GBN] claims in Nevada. The acquisition expands on the company's existing claims in the region and represents an important strategic expansion of both mineral rights and potential target deposit size with minimal financial outlay.

In response to the acquisition, here's a look at what the GBN claims mean for US Gold Corp. right now and how they play into the company's development strategy going forward.

By way of a brief introduction to the company, US Gold Corp. is a junior explorer based out of Nevada that is currently working to bring a couple of core projects through to production.

One of these projects is located in Wyoming and is called Copper King. As its name suggests, the project is a copper deposit and – in terms of historical development – is the more advanced of US Gold Corp.'s two projects, with a Preliminary Economic Assessment (PEA) having been completed back in 2012. It's the more advanced, but it is secondary in terms of proportionate representation of forward valuation to the company's second project, a Nevada based district called Keystone.

Keystone is a gold deposit project along the Cortez trend in Nevada, strategically located in and among a range of elephant-size deposits (deposits producing multi-million ounces of gold annually) that are already established and producing gold under the management of some big name owners in the sector and region – Newmont Mining Corporation (NEM), Barrick Gold Corporation (ABX) and more.

Over the past few months, Keystone has generated a substantial amount of attention from the mining and financial communities in the US. The project, which has historically been subject to a very limited amount of drilling and exploration, is the primary benefactor of US Gold Corp.'s financial and operational resources right now. The company is working towards the establishment of a resource estimate for the claims in question and conducted a scout drilling program throughout 2016 that continued throughout the second half of last year. This program, ultimately, will serve to inform (and by proxy, underpin) a full-scale drilling and exploration program during 2018 and beyond.

Early estimates suggest that the current mineable deposit comes in at around 1 million ounces of gold annually and US Gold Corp. is targeting a total production from the project of more than 10 million ounces. These are, of course, rough estimates, based on early-stage drilling. With that said, when taken into consideration against a backdrop of some of the neighboring projects, which are producing more the initial annual target right now, they are far from unreasonable.

So, that's an introduction to the company and its two projects. What about the GBN claims? Where do these fit into the picture?

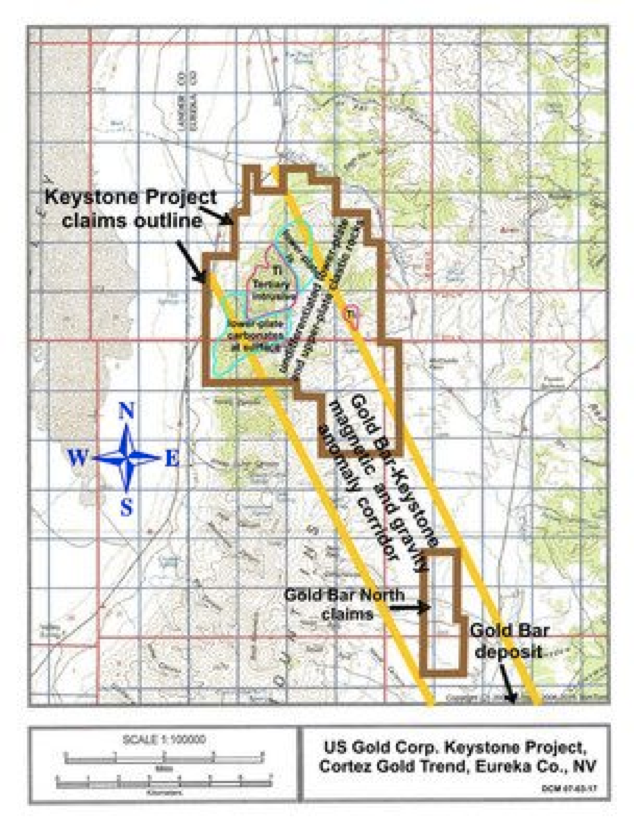

It's probably most convenient to initiate this discussion with the below image:

The image above is a map illustrating the location of the above-discussed Keystone project within Nevada (and along the Cortez trend in Eureka County). As illustrated, the claims to which US Gold Corp. has the rights right now, and specifically, those which relate to the Keystone project in its initial form, are at the northern end of the district illustrated. The GBN claims lie just southeast of the southeastern most tip of the Keystone claims, which, as a side note, represents the portion of the Keystone claims that US Gold Corp. picked up mid to late last year as part of an expansion of the initially acquired claims in the district.

Sticking with the side note for a moment, and before getting into the specifics of the GBN claims, the expansion of the initial Keystone claims (which brought with it 102 new claims across around 2,000 acres of additional land and brings the total claims in the district to 479) came as a result of early-stage exploration data hinting at potentially strong mineralization down towards the southeast region of the primary district.

As outlined above, and as is immediately visible on the map, the GBN claims also lie southeast of the initial district. This suggests that US Gold Corp. is focused near-term on expanding its program in a southeastern direction along the Cortez trend, in line with the data that suggests high mineralization in that direction. As a near-term prediction, therefore, this author wouldn't be surprised to see further expansion (be it through claims count expansion at current projects or the acquisition of fresh claims altogether, as per the GBN acquisition) in the same direction.

Importantly, the further southeast US Gold Corp.'s claims advance, the closer the company gets to the Gold Bar deposit along the Cortez trend. This deposit is owned by McEwen Mining Inc. (MUX) and is expected to start production during early 2018. The Gold Bar deposit shares many of the same geographical and geological features with Keystone and GBN, pointing towards a strong chance of mineralization (and importantly, economically viable mineralization) at the latter.

Looking at the numbers, then, consists of 49 unpatented lode mining claims situated in Eureka County, in Sections 29, 30, 31, and 32, Township 23 North, Range 49 East, and Sections 5 and 6, Township 22 North, Range 49 East, Mount Diablo Base Line and Meridian.

These 49 claims add to the above-noted 479 claims that US Gold Corp. holds at Keystone, bringing the company's total districtwide claims count to 528 along the Cortez trend. The company hasn't reported how much land these claims cover, but based on the outlines in the above map, it's reasonable to assume that GBN totals somewhere in the region of 2 to 3 mi.², or between 1,200 and 1,900 acres.

So what comes next?

Exploration at Keystone is the primary focus right now, with the company working to bring the above-mentioned scout drilling program to completion early this year. The assumption is that, while this program advances, management will also seek to scope out it's additional claims as well as (potentially) expand on the claims it currently holds in this region and along this trend.

If this author's expectations are correct, this expansion will likely involve advance in the southeast direction towards the Gold Bar deposit.

All said, this is a move very much in line with an aggressive expansion strategy and one that suggests US Gold Corp. is confident in the viability of its current claims and – at the same time – is confident that the geology of the current claims expands into the surrounding region along the same trend. The real upside potential for this company will come when it publishes solid mineralization estimates based on the full scale drilling program. Until then, however, the more claims it can establish and the more evidence it can collect to support the viability of these claims (which, as mentioned, is the plan near term), the more it's going to appreciate ahead of estimates hitting press.