Summary

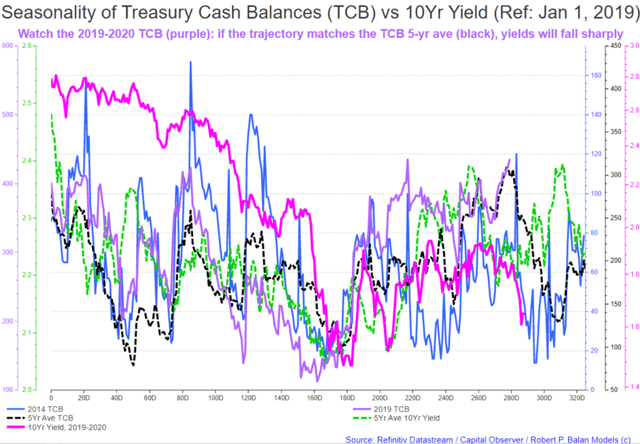

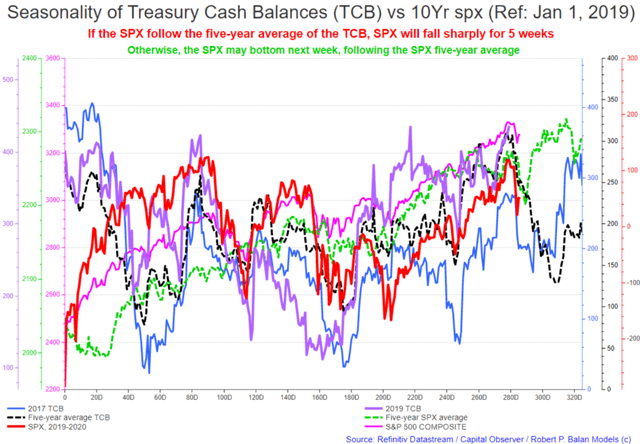

- Bond yields leading markets lower today. TCB has not keeled over yet, but may finally peak tomorrow. If historical averages and liquidity models are correct, it's TIME to SELL equities.

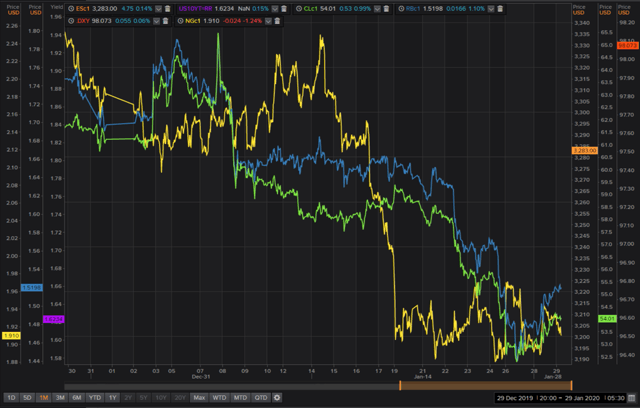

- Crude oil, gasoline prices were higher overnight; NatGas (UGAZ) should rise in NY trade. Look to sell Crude Oil and the rest of the Energy Sector, as bonds, equities fall.

- Another important development is DXY followed the TCB higher today, but if we get a peak in TCB today as expect, then DXY could be a short today or tomorrow.

- The front run on the SPX has been reduced from 7 TDs to just 5, meaning that changes in yields will likely be ahead of SPX by at least one day. We can use that for timing trades in equities. Look for the day change in yields then finetune short SPX entry.

- If yields will continue lower today as we expect, then SPX is ripe for selling --LARGE-- TODAY. We still have to confirm this, but that seems logical -- events and newsflow is assimilated into bond price quicker than in SPX; bond models are telling us: BUY bonds, SELL equities.

Original title:

Market Report At The Chat (Jan 29, 2020): FOMC Day, Dovish Fed Very Likely; Buy Bonds And Gold; Sell Equities, The US Dollar (DXY)

----------------------------------------------------------------

robert.p.balanLeaderJan 29, 2020 10:06 AM

GOOD MORNING

Very early version of the Market Report at the Chat, January 29, 2020

robert.p.balanLeaderJan 29, 2020 10:09 AM

Bond yields leading the market lower today. If yields will continue lower today as we expect, then SPX is ripe for selling--LARGE-- TODAY.

The TCB has not keeled over yet -- but may finally peak after today. That will add to the pressure on equities and bond yields; and will undercut the US Dollar (DXY).

If historical averages and liquidity models are correct, there is still a lot of leeway to the downside for equities -- probabilities of a low in March increasing each day. The countertrend recovery is fading. If yields will continue lower today as we expect, then SPX is ripe for selling--LARGE-- TODAY. We still have to confirm this, but that seems logical -- events and newsflow is assimilated into bond price quicker than in SPX, bond models telling us: BUY bonds, SELL equities.

Crude oil and gasoline prices were higher overnight, NatGas (UGAZ) should rise in NY trade. We will exit the long UGAZ trade at that time.

Look to sell Crude Oil and the rest of the Energy Sector, as bonds, equities fall.

pa292Jan 29, 2020 11:18 AM

Robert : not convinced to buy UWT ?

robert.p.balanLeaderJan 29, 2020 11:28 AM

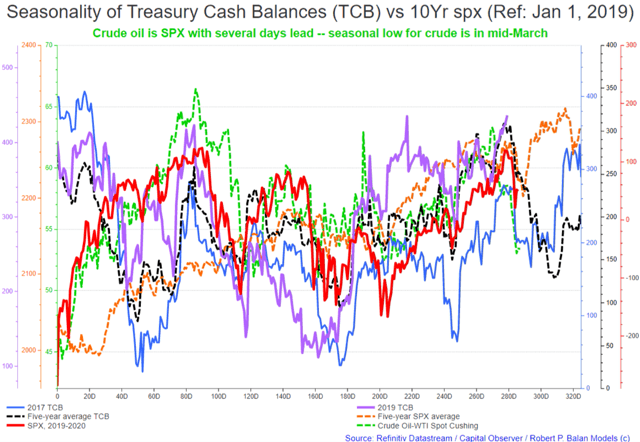

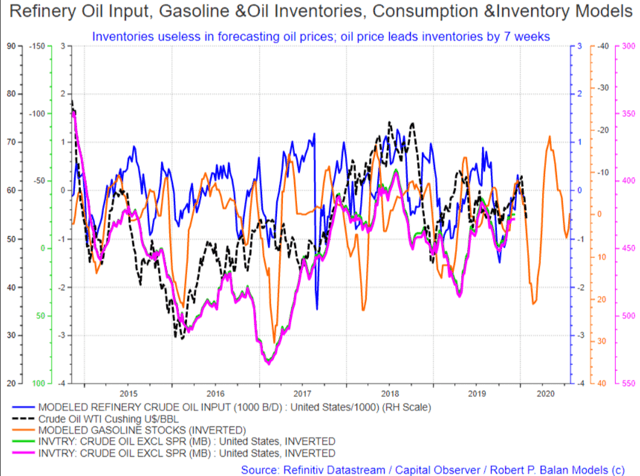

Not at all -- Crude oil is SPX with several days lead (see chart below) . . .

. . . and seasonal low for crude is in 3rd week of February (see chart below).

robert.p.balanLeaderJan 29, 2020 11:43 AM

Resume updates at 9 am NY time

robert.p.balanLeaderJan 29, 2020 2:34 PM

I just uploaded this report:

robert.p.balanLeaderJan 29, 2020 3:20 PM

looks like the chat is having a fit again.

Anyway, 10yr yield is marking time, and we will likely see more action only after NY trade opens. It is FOMC today, no fireworks in the announcement are expected, but it will very likely be a dovish Fed.

Expect Fed Chair Powell to make a gesture towards the CV contagion and talks dovish if the contagion hurts the economy -- but no hints of FFR rise and he will say, they continue to increase bank reserve levels.

Going back to this SPX chart which was shown earlier:

robert.p.balanLeaderJan 29, 2020 3:32 PM

Can't upload graphics.

But anyway, the front run on the SPX has been reduced from 7 TDs to just 5, meaning that changes in yields will likely be ahead of SPX by at least one day. We can use that for timing trades in equities. Look for the already several days change in yields, therefore we can finetune entry for SPX TODAY.

So if yields will continue lower today as we expect, then SPX may be ripe for selling later today, following the previous inflection lower in bonds yields. That opportunity to sell may come later in the day, just after Chair Powell is done with the Q&A session.

We still have to confirm this, but that seems logical -- events and newsflow is assimilated into bond price quicker than in SPX, as equity retail investors are now focusing on the Fed's stimulus schedule.

gpbowen24Jan 29, 2020 3:42 PM

WHO announcement planned for 11am.

robert.p.balanLeaderJan 29, 2020 3:45 PM

Thanks gpbowen24 -- so ahead of the FOMC, I don't see a chance of having fireworks in the market. Another important development is DXY followed the TCB higher today, but if we get a peak in TCB today as we expect, then DXY could be a short latere today, or tomorrow.

Too bad I could not upload graphics. But if you look at the 10yr yield model chart I posted earlier, TCB peak is late with respect to its five-year average.

This chat hiccup is awful, I will resume updates when the fix is in. I was emailed by SA that they are trying to fix the missing icon bug, but why do they have to do it now? Could have done it last night.

NatGas has not risen as we hoped. PAM may have to BUY DWTs to temporarily protect the 3 tranches on long UGAZ. PAM will sell 6 tranches of DWTs at a proper time when the ETFs have settled down properly.

@all

PAM buys 6 tranches of DTWs to hedge the 3 tranches of long UGAZ

TRADE DETAILS -- 5.076 DWTs 6 tranches as hedge for 3 tranches of UGAZ

I just uploaded this email:

PAM Buys 6 Tranches Of DWTs To Hedge The 3 Tranches Of Long UGAZ NatGas ETF

If you are wondering how I can post comments despite the Chat having a fit -- it is an old trick from Computer Engineering lessons of reusing existing threads when there is problem with latency. The server will prioritize these updates relative to new posts.

@all

10 Yr Yield falling hard and SPX, RTY not far behind it. PAM is looking for a small price rebound to sell on. Will inform you further.

ippy04Jan 29, 2020 4:09 PM

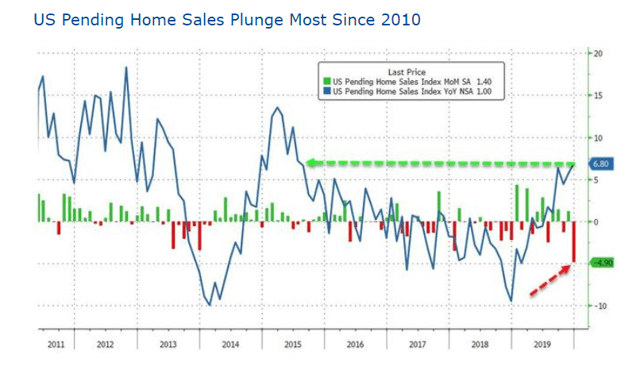

Economic data not good this am... trade deficit and home sales

US Pending Home Sales Plunge Most Since 2010

The state of housing in 2020 will depend on whether home builders bring more affordable homes to the market,

robert.p.balanLeaderJan 29, 2020 4:15 PM

hey Chat is OK now?

ippy04Jan 29, 2020 4:20 PM

Seems ok for me

professor.hindsightJan 29, 2020 4:25 PM

Yes ok for me too

flamarkJan 29, 2020 4:27 PM

Robert this may be an odd question..if you weren't long UGAZ do you think you would be buying DWT? I'm no longer in UGAZ..

robert.p.balanLeaderJan 29, 2020 4:28 PM

We wanted days ago to be long DWTs -- but we were caught unawares by the sharp fall -- Lookup Market Report dated Jan 27 and 25.

Triple.F.FredJan 29, 2020 4:55 PM

still don't know as have seen no PAM charts get posted

User.12932881Jan 29, 2020 5:50 PM

Will be interested to see what excuse FOMC comes up with to continue LSAP to match deficit spending. 165B treasuries hit in March and not enough buyers. if PAM is right and TNX goes down to 1.5% by March then maybe Fed doesn't need to monetize all of them because they can let 10y rise up to say 2%

robert.p.balanLeaderJan 29, 2020 6:31 PM

My take -- Not QE was to help tide over the repo market issues until they have studied properly implemented a permanent repo facility. I do believe Not QE will end in March, if not, very soon. If the Fed reaffirms that, the markets will tank, LARGE. Hence, we are selling risk assets, buying safe haven.

Triple.F.FredJan 29, 2020 6:52 PM

Just saw a blurb run across where flights into and out of China are being significantly reduced?

professor.hindsightJan 29, 2020 6:53 PM

How does higher levels of repo market activity increase equity prices?

ippy04Jan 29, 2020 8:45 PM

woah did powell say something? #TNX

robert.p.balanLeaderJan 29, 2020 8:49 PM

Powell says balance sheet will reach Fed's goal of 'ample' size sometime in Q2

Powell says Fed plans to gradually reduce Treasury bill purchases once 'ample' reserve level is reached

professor.hindsightJan 29, 2020 6:53 PM

Is that what you generally thought would be the outcome today? I’m not that great at interpreting what the FED says in their speeches.

robert.p.balanLeaderJan 29, 2020 8:52 PM

This is what I said a few comments, higher:

" My take -- Not QE was to help tide over the repo market issues until they have studied properly implemented a permanent repo facility. I do believe Not QE will end in March, if not, very soon. If the Fed reaffirms that, the markets will tank, LARGE. Hence, we are selling risk assets, buying safe haven. "

tico.trader Jan 29, 2020 8:54 PM

what is "ample"?

professor.hindsightJan 29, 2020 6:53 PM

Congratulations on predicting what the outcome of the FEDS meeting would be. Impressive.

ippy04Jan 29, 2020 8:59 PM

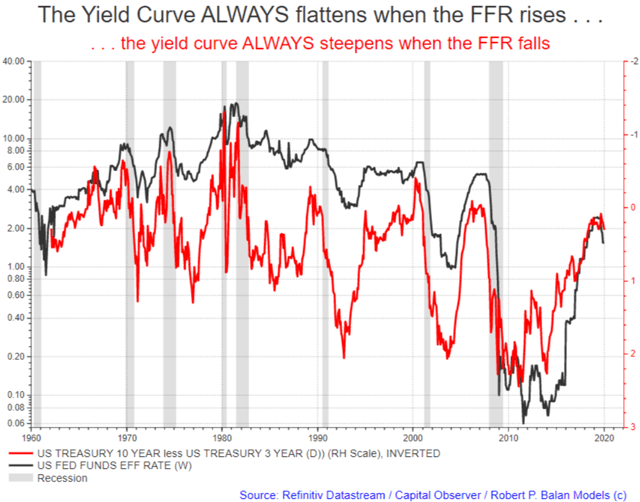

then they start cutting rates as 3m-10y will be inverted again...

robert.p.balanLeaderJan 29, 2020 9:00 PM

Thank you professor.

Not quite ippy04 . Have a look at this.

But before I do that:

@all

PAM buy 12 tranches of TMF when we get a price, doing it now.

DETAILS - TMF -- 30.96 FOR 6 TRANCHES EACH FOR ALGO AND SWING PORTFOLIOS. WE MAY DO MORE IF WE GET MORE PULLBACKS.

PAM buy 12 tranches of TZA when we get a price, doing it now.

DETAILS - TZA -- 38.86 FOR 6 TRANCHES EACH FOR ALGO AND SWING PORTFOLIOS. WE MAY DO MORE IF WE GET MORE PULLBACKS.

You gotta see this ippy04; very educational about the yield curve.

The Yield Curve ALWAYS flattens when the FFR rises . . . . . . the yield curve ALWAYS steepens when the FFR falls

flamarkJan 29, 2020 9:10 PM

tmf

robert.p.balanLeaderJan 29, 2020 9:10 PM

TMF up like a rocket

robert.p.balanLeaderJan 29, 2020 9:16 PM

TMF pulling back. PAM buys more TMFs.

ippy04Jan 29, 2020 8:59 PM

agreed - but do you think we are going to bear steepen again after march?

robert.p.balanLeaderJan 29, 2020 9:17 PM

@all

PAM BUYS ANOTHER 6 TRANCHES OF TMF

TRADE DETAILS - 31.03 FOR 6 ADDITIONAL TRANCHES EACH OF TMF FOR ALGO AND SWING PORTFOLIOS

jdefpJan 29, 2020 9:18 PM

"Valuations are high" .... I love it.

lrsinvJan 29, 2020 9:47 PM

TCB pattern in 2018 is an exception caused by the big deficit funding need due to unprecedented tax cut. The normal pattern is drop in spring until March. TCB correlates especial well with bond yields, which corrects well with WTI and XLE. Corona virus has great impacts on transportation that hurts oil. WTI and XLE bounced from great oversold yesterday and this morning. XLE reverse down again. Bearish. SOXX reverse down in spite of great earning from AAPL, down leg likely resume. SOXX was extremely over brought already. Now big semi factories in China are curtail operations because threat of corona virus and expected lower sales in at least first half of 2020. Corona virus can transmit silently and proven rapidly. The only method is quarantine and stop the traffic until vaccine available. Or this fast mutating RNA virus becomes less harmful. So far, it has become more harmful in each generation.

Corona virus pandemic is a horrible event. I hope that it will be contained quickly. And China and Asia will outlaw the sales of wild animal in wet markets. Take care.

jdefpJan 29, 2020 9:56 PM

robert.p.balan - Sorry, you may have covered this over the past couple of days, but how many days of continuing decline do you see in your models before maybe a more meaningful corrective rally in equities?

robert.p.balanLeaderJan 29, 2020 9:57 PM

I just uploaded this email:

PAM Adds To Long Bond Holdings, Buys TMFs For Algo And Swing Portfolios

lrsinv -- thanks for the cogent summary and welcome to PAM. Corona Virus is a game changer, I agree. Thanks again.

vjapnJan 29, 2020 10:02 PM

Robert, Is it still your view that corona virus is likely not to have a global impact, however markets will fall regardless of that?

robert.p.balanLeaderJan 29, 2020 10:04 PM

"The more that I eyeball it, the more that I am convinced that the 2017 TCB (blue line, chart above) is the correct template for this year 2019-2020 SPX (red line).

Or it we get our wish, current year SPX will hew close to the 5-year average of the TCB (dashed black line) for a bottom in March,

That means bottoming out period extends to Trading Day 309. Compare that to the designated TD for SPX today at 287 (after allowances for the frontrun of the IBs and HFs). I will leave it to you to work out the calendar date -- I don't have to do all the lifting.

Now, lets use the Fed's bank reserves and do the same work out we did for the TCB,

As I said in the yesterday's Market Report, the negative impact of falling FedGov budget outlays has (so far) extended the putative market trough to sometime in March. If the outlays keep on falling, we will also continue to extend the putative time for a bottom, accordingly.

There are some intermediate dates when we should be on watch: February 4 to February 12. The first major low for SPX is supposed to happen during that period. Then we get a large recovery which peak February 17. The last date in the falling Bank Reserve is February 21.

PAM will give the markets chance to break identified price barriers, but if it looks like the effort is going to fail, PAM will exit the long TQQQs/TMVs purchas

gpbowen24Jan 29, 2020 10:06 PM

FB getting hammered

Bringing QQQ and SPY down with it

jdefpJan 29, 2020 10:08 PM

robert.p.balanLeaderJan 29, 2020 10:10 PM

"Robert, Is it still your view that corona virus is likely not to have a global impact, however markets will fall regardless of that?"

I never said that vjapn. I m looking for a very large decline and it would be stupid of me to say that Corona virus has no impact "no matter what"

gpbowen24Jan 29, 2020 10:12 PM

Google temporarily shutting down all China offices: The Verge

Alphabet Inc's Google is temporarily shutting down all its offices in China...

If the contagion continues, I would expect more headlines like this.

ippy04Jan 29, 2020 10:26 PM

TSLA will save us all. Parabolic.

vjapnJan 29, 2020 10:32 PM

Robert, I seem to have a hard time expressing my thoughts. I believe it is your view that stock indices falling is independent of corona virus.

flamarkJan 29, 2020 10:33 PM

Agree regarding Corona, Things appear much worse than what we are seeing. Huge lines waiting too see a doctor, and few visits. Going to the Doctor/Hospital may be worse than staying home since you wont be seen by the doctor and will be around hundreds of infected persons. With thousands waiting in lines, they have no clue what the actual counts are. but they are clearly undercounted.

robert.p.balanLeaderJan 29, 2020 10:38 PM

vjapn

the markets started falling ahead of the CV contagion and the triggers were based on liquidity issues. But to claim that I said stock indices are falling independently of the contagion is stuffing garbage in my mouth. I never said that. Show me where that was said, and if true, I will genuflect to you.

User.12932881Jan 29, 2020 10:46 PM

I'm reading that dealers loaded up on long duration (e.g. TLT) about 2-3 weeks ago. If I had to guess, they knew that Fed would never allow yields to breakout above 2%, and also saw the TCB projection with low treasury issuance (e.g. Jan 15th tax date) in Jan/Feb and continued Fed 80B buying. treasury supply flat, excess cash/demand - bond prices up, yields down.

robert.p.balanLeaderJan 29, 2020 10:51 PM

User.12932881 -- that's why the "TCB front-runners" are the real "Masters of the Universe" not the McElligott quant types who report to Sales (and never traded to boot). Even us at PAM know what is in store as early as weeks ago.

lrsinvJan 29, 2020 11:35 PM

Long Bond: Wind is in the sail. In additional the TCB seasonal pattern, long bonds are benefited by i) German 10 year going deeper to negative AGAIN coupled with strong USD. ii) The 30% SPX gain in 2019 gives pension managers a great re-balance task towards bond; iii) Corona virus pandemic invalidates the growth rebound and interest rate up bet on bonds. iv) Bond trades are highly leveraged. Gamma flips negative around 1.7% to 1.68 area; so bond bears are now forced to deleverage. v) FED said that it will keep its plan to reduce the NOT QE balance expansion (for current market condition). Robert's move on tmf is brilliant and timely, which help me to execute my trades better. Looking ahead, the big gain comes from stock market correction since stocks are so over brought. It is likely a correction. Around 10-15% down, FED may cut rate and resume QE. I initiated SOXS position: i) fundamental: semi factory operations are curtailed because of corona virus and expected slow down in sales, at least in first half 2020. ii) technical: after first big sell off on Monday, bounced on Tuesday and this morning, SOXX reverses down. Bearish. WTI/XLE has same short term pattern but the down leg is very extended. But corona virus stops transportation big time, it looks like lower for longer. I keep my stops tight.

robert.p.balanLeaderJan 29, 2020 11:41 PM

Thats a brilliant summary lrsinv -- thanks. I hope you don't get tired doing this stuff for PAM.

lrsinvJan 30, 2020 12:02 AM

Thanks, Robert. I get good information from many sources and I do my homework. PAM helps me to optimize my trade execution better than other sources. I am impressed by your work. But not sure if this is the place for in-depth discussion. I will see.

MARKETS CLOSED

------------------------------------------------------------------

PAM's PERFORMANCE at Seeking Alpha

PAM's results are, by a mile, the best portfolio performances of any Marketplace service provider at Seeking Alpha, at any time.

2020

January 2020 ended with a huge bang at PAM -- our two portfolios ended the month with stellar performances, as follows:

SWING Portfolio: $21.524.57 gross profit out of $100,000.00 capital -- 258.29% Annualized Profit. This portfolio is liquidity model, algorithm-driven. plus some technical analysis driven trades.

ALGO Portfolio: $19,057,83 gross profit out of $100,000.00 capital -- 228.69% Annualized Profit. This portfolio is solely driven by liquidity-model algorithms.

At the end of January 2020, the ALGO portfolio's open trades are up $2,003.86.

The SWING portfolio's open trades are up $ 1,762.73 at the end of January 2020.

These results are, by a mile, the best portfolio performances of any Marketplace service provider at Seeking Alpha, at any time.

See the SWING portfolio closed trades spreadsheet here.

And see the ALGO portfolio closed trades spreadsheet here.

----------------------------------------------------------

2019

2019 was a good year for SWING and ALGO trading for Predictive Analytic Models' portfolios: among the best results at Seeking Alpha

2019 was a good year for SWING and ALGO trading for Predictive Analytic Models' portfolios. The liquidity models provided excellent guidance, allowing PAM to exceed internal goals of 40% annualized performance.

The ALGO Portfolio, debuting on September 25, 2019 delivered $16,075.57 (gross) income on capital of $100,000.00. Annualized profit was 64.30%. Portfolio had 78 trades, for 8.24% profit per trade.

Here is the performance of the model-driven PAM Portfolio ("ALGO" -- model-driven):

See the spreadsheet here.

The SWING Portfolio, debuting on March 1, 2019 delivered $72,813 (gross) income on capital of $100,000.00. Annualized profit was 97.08%. Portfolio had 360 trades, for 8.09% profit per trade.

Here is the performance of the SWING Portfolio (ALGO plus technical analysis trading):

See the spreadsheet here.

Here's the performance of the so-called "Legacy Trades"which included some day-trading. The Legacy PAM Portfolio, which ran from April 27, 2018 to February 28, 2019 delivered $37,460.96 (gross) income on capital of $100,000.00. Annualized profit was 44.95%. Portfolio had 228 trades, for 6.57% profit per trade.

Here is the performance of the "Legacy" PAM Portfolio (ALGO Plus Intraday Trading):

See the spreadsheet here.

See all PAM Member reviews here

To sign up to PAM's trading and advisory service, please go here

Disclosure: I am/we are long bonds, gold, euros. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.