Summary

PAM exiting legacy short equity positions; tracking the bottom of oil to exit short positions and go long oil.

Tracking the bottom of the equity market sell-off to initiate equity longs, and bond short trades. PAM also looking to exit short US dollar trades and go long DXY.

Copper looking to extend losses, providing indications that the equity sell-off could last slightly longer than PAM expected

(This actual Market Report was written pre-NY market opening, on Monday, May 13, 2019, and was updated until the NY market closed. Seeking Alpha has been encouraging SA service providers to become more transparent, and show actual reports and interaction between providers and subscribers. We are providing this report to showcase what PAM provides to the members of the community).

Why not take a free two-week trial subscription, have a look at us and see if this community of veteran investors is a good fit for you?

Please go here

Robert P. Balan @robert.p.balanLeader May 13, 2019 12:38 AM

Market Report At The Chat, May 13, 2019

GOOD MORNING.

Markets are pummelling US equity futures, in Asian trading, as expected.

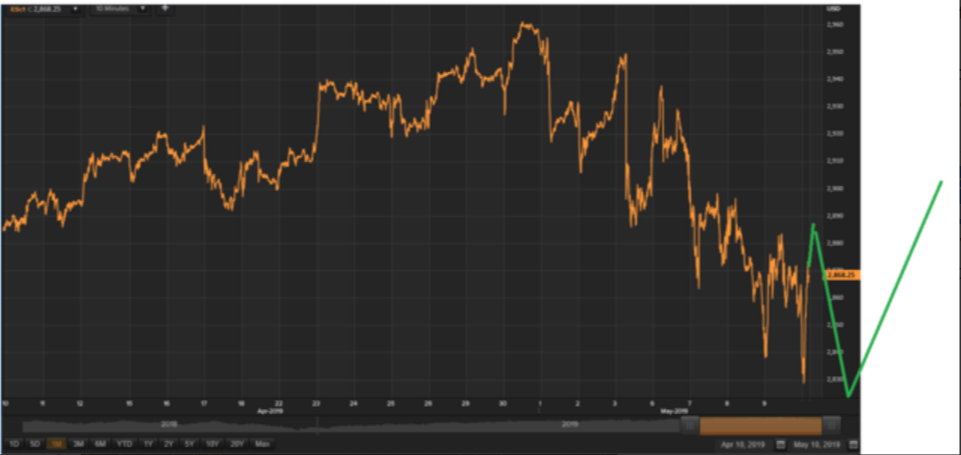

On Friday close, this is what we were expecting to happen by Monday.

Looks like we were spot on. Hopefully by the time NY opens, we are close to making a trough.

This is where we are close to mid-day in Europe (chart below). The sell-off should accelerate as we go into NY open in four hours.

We are looking for a trough in the equity decline sometime today, or at the latest, tomorrow. And we expect a hiatus of two to three weeks, which may even allow equities to recover some of their losses of recent days.

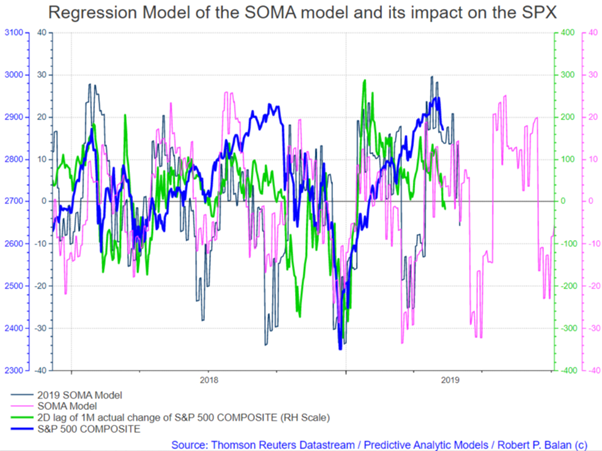

The liquidity models are signalling that a trough is due today (tomorrow at the latest). Based on the above chart, we could be looking for a small recovery soon -- the top of that recover being flagged is May 23, but since the data is interpolated from a weekly series, the top may spill-over into the last week of May (see chart below).

Here are some newsflow narratives which we should parse carefully:

Goldman: Tariffs Will Be Increased Tonight... But Here's The Good News“

However, in fodder for optimists, Phillips then notes that details in the notice implementing the tariff hike indicate that exports that have already left Chinese ports before May 10 will not be subject to the increase as reported earlier today. This, according to Goldman, creates an unofficial window, potentially lasting a couple of weeks, in which negotiations can continue and generates a “soft” deadline to reach a deal. As a result, given this detail, Goldman believes that downside to sentiment might be slightly more muted than if the tariff increase came with a “hard” deadline, suggesting that even a "no deal" headline today won't throw markets into a tailspin. It also "leaves an opportunity for the two sides to reach an agreement in the next couple of weeks, though challenges remain" Goldman concludes.”

But I don’t believe we will have a deal anytime soon. On the US side, the hardliners (Larry Kudlow and Robert Lighthizer) are taking over now that Sec. Steven Mnuchin negotiating style with the Chinese (collegial, play nice) did not work.

And China's vice premier Liu He said that China is planning how to retaliate and listed three core concerns that must be addressed, and on which it wouldn't make concessions, ahead of any deal including:

- the complete removal of all trade-war related tariffs,

- set targets for Chinese purchases of goods in line with real demand and

- ensure that the text of the deal is “balanced” to ensure the “dignity” of both nations.

Commenting on this list, the Editor in Chief of the Global Times, Hu Xijin, who has become a real-time translator for Chinese unspoken intentions on twitter, explained that "from perspective of China's politics, there is little room for compromises. They will insist. This political logic won't be changed no matter how much additional tariffs the US will impose."

Trump cannot back down now. The rest of China’s exports to the US that have not been “tariffed” will be hit as well in two to three weeks’ time. And this time, China is almost certain to answer with tariffs of their own.

In fact that may be the catalyst for a Wave 3 event shortly before the month ends -- where PAM expects sharp losses in equities and sharp declines in yields, as well as the DXY in due time. Gold should soar.

There will be an unofficial window, potentially lasting a couple of weeks, in which negotiations can continue and generates a “soft” deadline to reach a deal

A trough in equities also borne out by the outlook in USD/JPY and in the bond yields -- and this is highly visible in the JPY.

USD/JPY needs to complete a five-wave sequence. The yields need to complete a three-wave sequence. We should see those lows today or tomorrow at latest.

The Precious Metals have radically diverged from developments in the bond yields, especially silver.

And if the yields rise (yields inverted in the chart above), PMS should be depressed further. We have spoken of a wedge structure developing in the gold outlook, and a pullback in yields higher could bring gold down to the base of the wedge.

Like what I said last week, we need to get some protection for a likely sell-off in PMs, then remove those hedges once a Wave 3 decline begins in equities and in yields.

That further, prospective decline in the PMs completes the wedge structure, then a subsequent Wave 3 event in which equities and yields fall sharply, should cause a breakout from the wedge and kicks up a strong surge in the PMs.

We are waiting for a last dip in DXY, alongside a last decline in yields. We should see those lows later today, or at latest tomorrow.

PAM is getting set to cover/exit short Dollar positions later in the day, if we judge that a putative low could happen overnight. We want to avoid that if possible.

The stories of sabotage on oil takers at the Hormuz Strait is putting a bid on oil prices. We may see a slight dip in those prices, if equities fall in NY trade as we expect -- not by much for oil, but probably to levels we saw in Asian trading today. Equities, however, may make new intermediate lows.

PAM will exit some of the oil sector shorts at that point and protect the remaining shorts, on the outlook that oil prices may be rising over the next two to three weeks.

As I mentioned at the Nexus Chat today is response to a query of bruce.gibbs these sabotage events may continue, and fundamentals may not weigh upon oil prices temporarily.

There will be resumption of the oil sell-off by late May, which corresponds to the expected sharp decline in equities by then. The best fundamental conditions for oil will come in late June-early July. We will by that time position for broad gains in the oil sector until mid-2020.

So on top of a hiatus in the equity sell-off for perhaps two to three weeks, those sabotage events at the Hormuz Straits will tend to push up oil. How much higher, I have no idea yet. That may depend on how robust an equity recovery will be over the next two to three weeks,

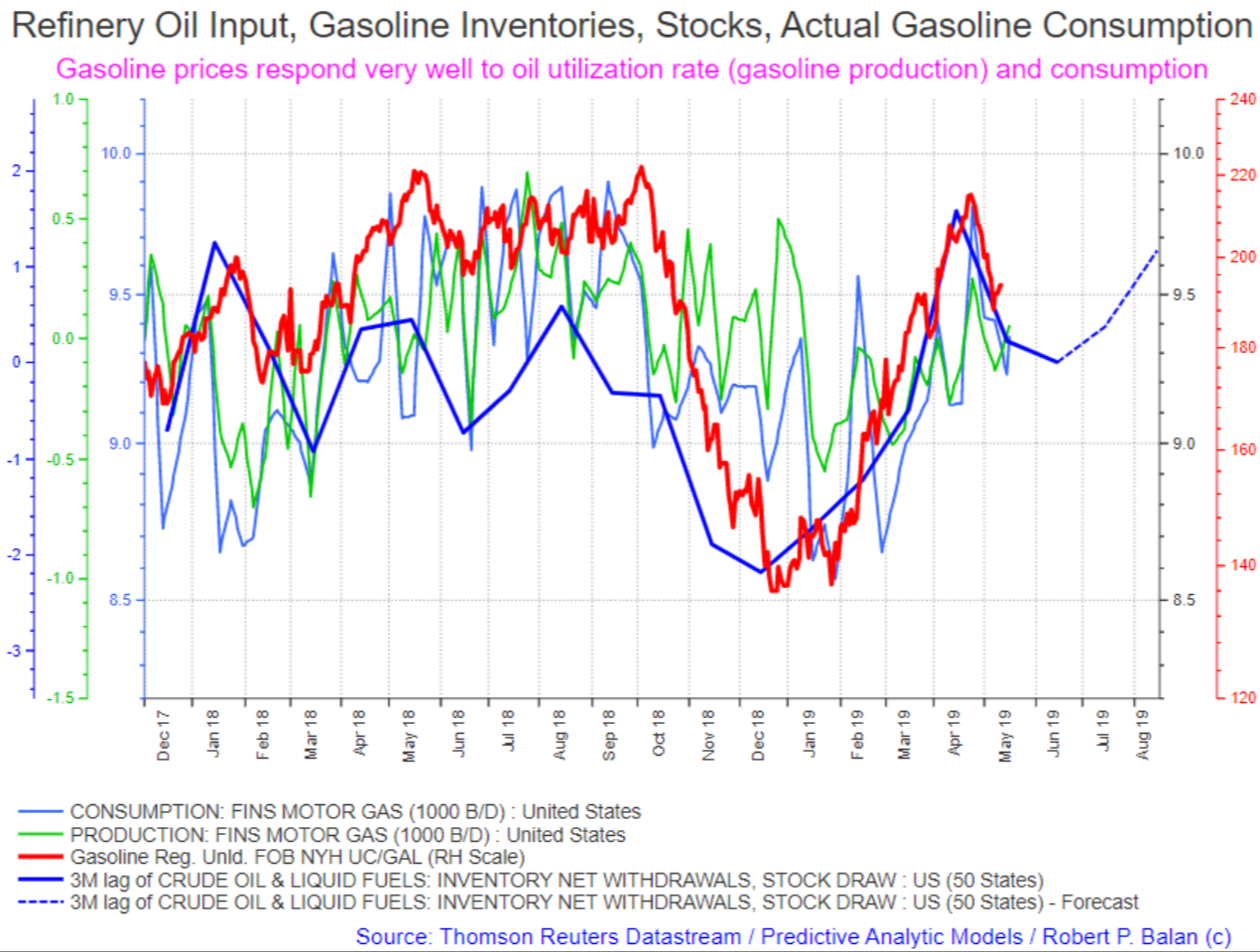

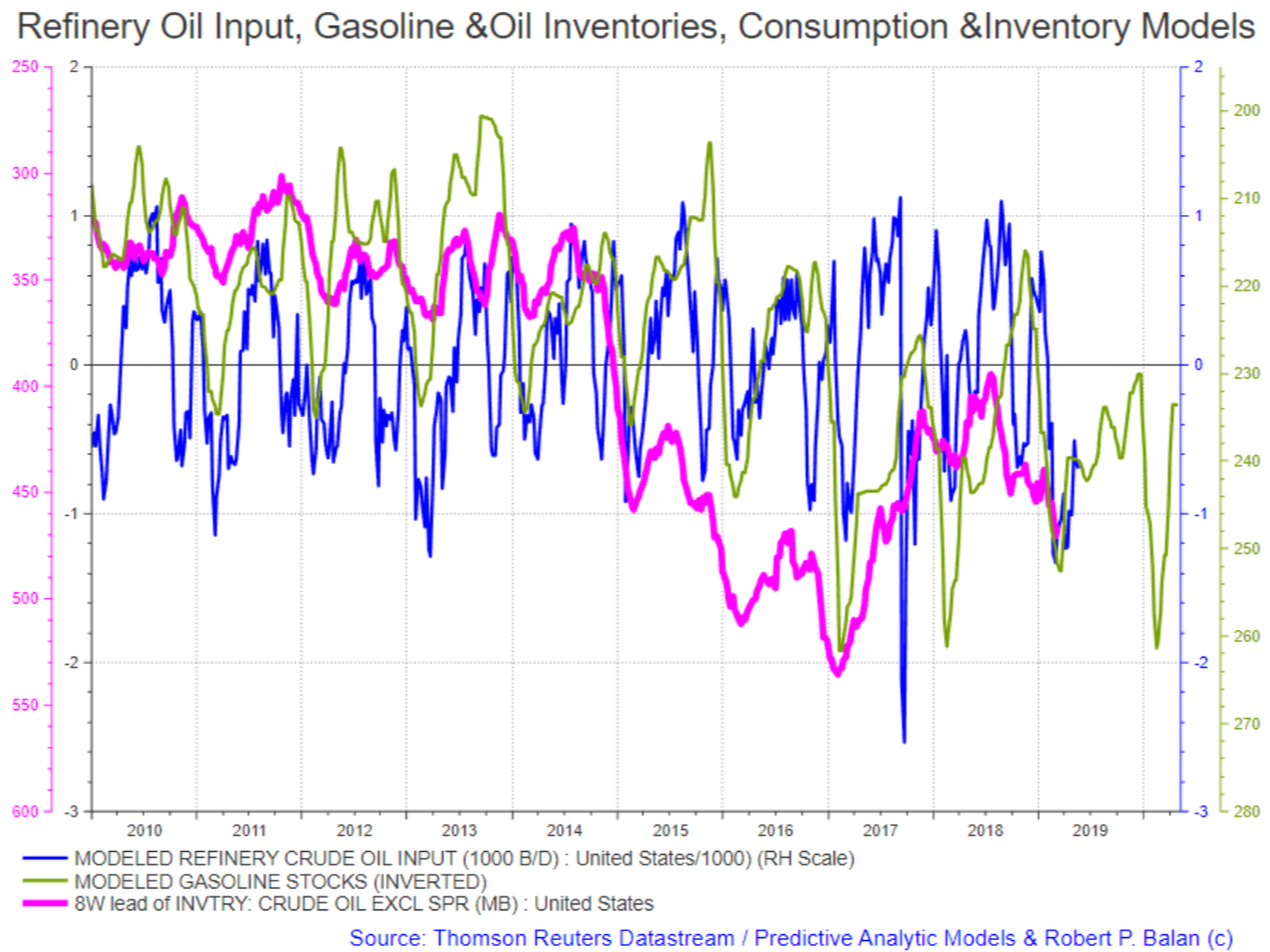

Gasoline consumption and demand (for gasoline production) are starting to recover although there should be another sell-off close to end of the month.

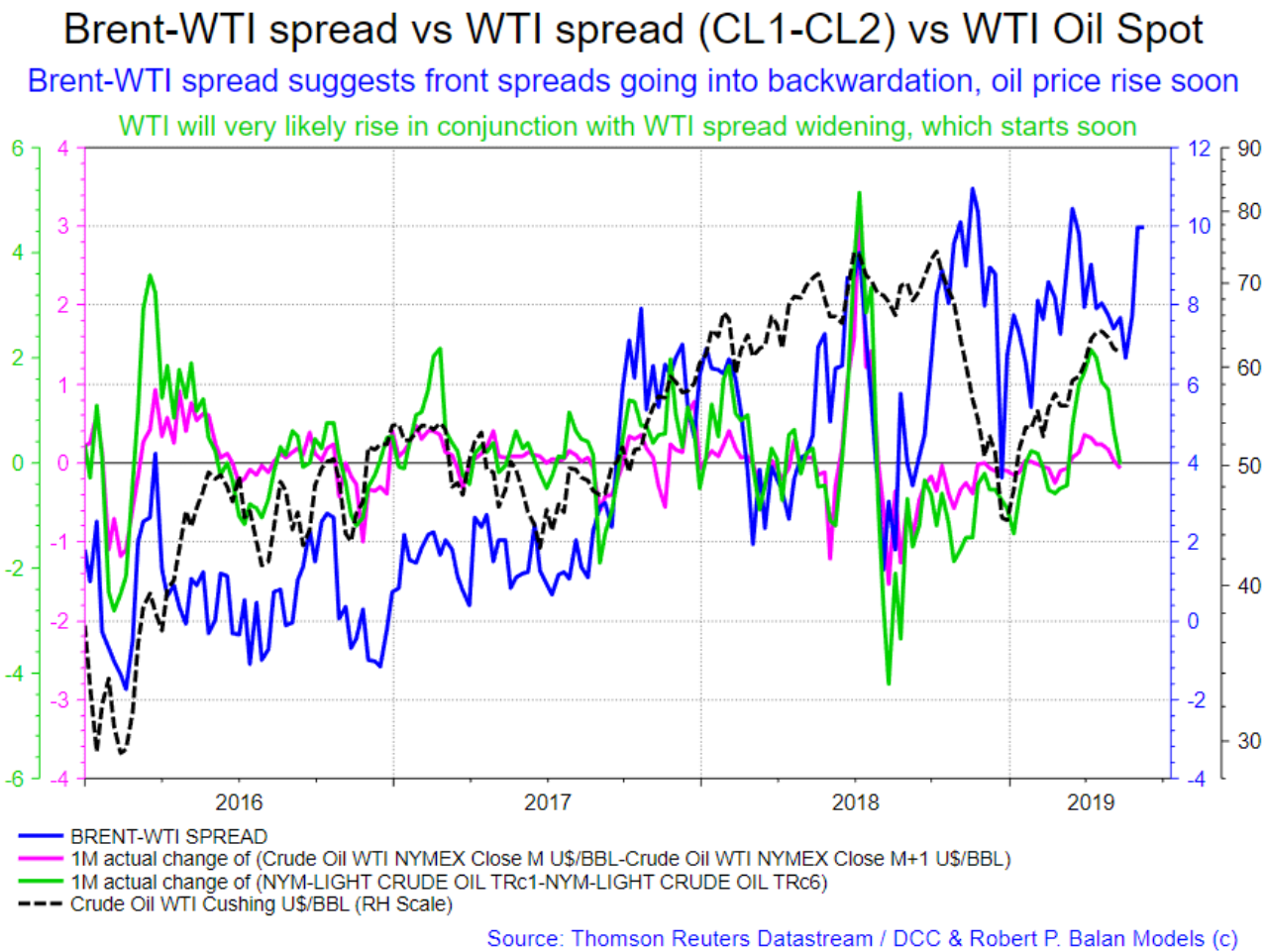

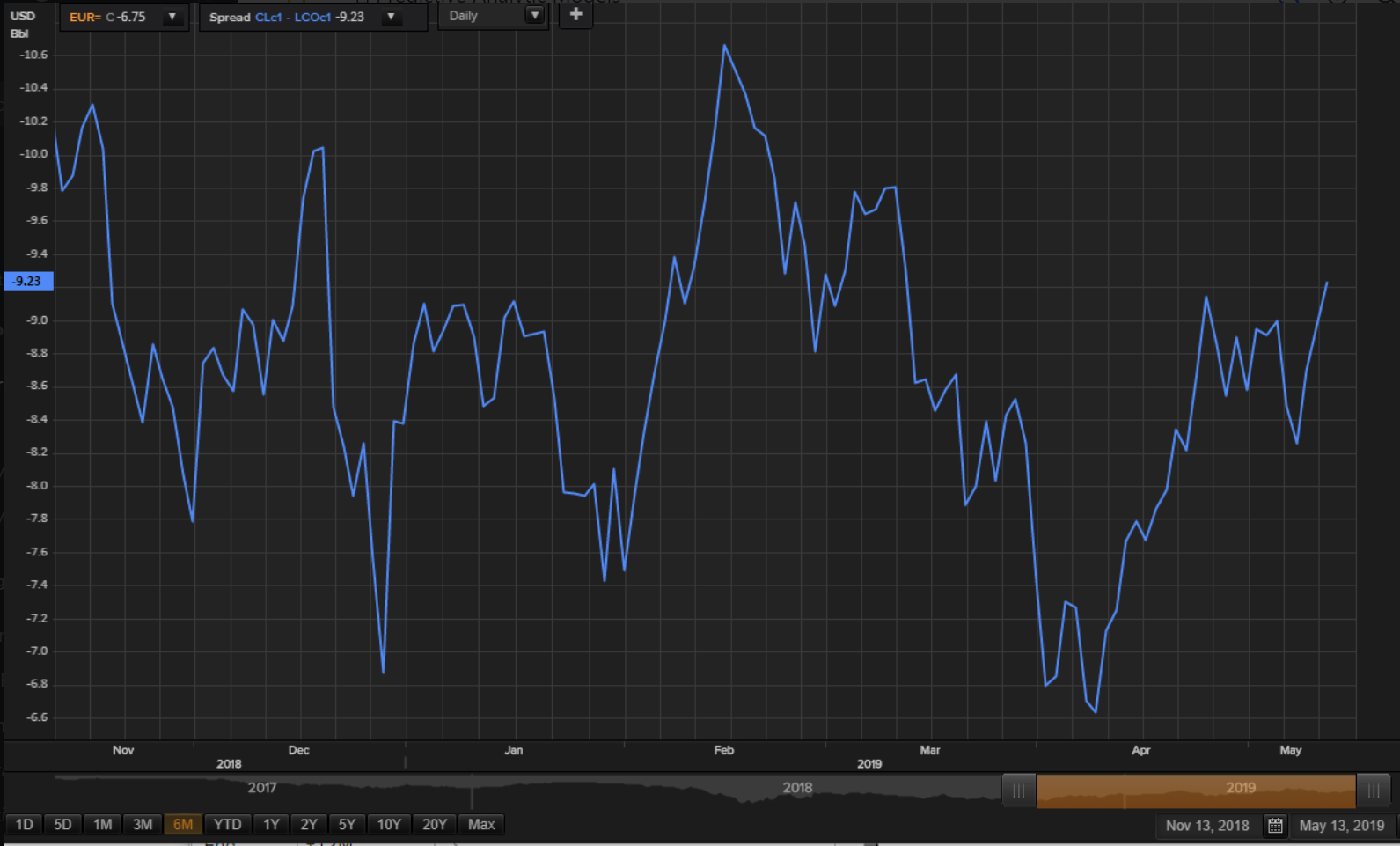

The Brent-WTI quality spread has widened sharply, and is usually followed by a rise in oil prices, especially Brent Oil

And oil inventories which lag behind refineries oil input and gasoline stocks may start drawing significantly soon.

We will finetune levels and exit most oil shorts sometime today (or tomorrow at latest, depending on the stock market sell-off we are expecting).

Jozsef Pengel @jozsef.pengelMay 13, 2019 2:25 PM

robert.p.balan Hello Robert, forgive me for intruding with a newbie question. What symbols/tickers are used for calculating Brent/WTI spread?

2 repliesMay 13, 2019 6:01 PM

pa292 @pa292May 13, 2019 2:31 PM

Hi Robert, any view on silver ? Are you stil long USLV ?

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 2:37 PM

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 2:38 PM

jozsef.pengel

My Reuters Eikon system only has it at CLc1-LCOc1, so I inverted the chart I am showing above.

I cannot get the Brent to be ahead. In my Datastream app, I have no such problem.

I am using the cash prices for Brent and WTI so it might look a little different from the futures quality spread.

But the differences are very slight, just due to the basis skew in the futures.

pa292

I have a long discussion on Precious Metals in the report I am writing. Please scroll up a little bit. We still have USLV.

The equity mini futures are going down again. Looks like we are just past the mid-way of the expected decline today. There will be more haemorrhaging before we see the trough later today.

I hope someone in PAM is selling the stuffings of out this decline.

1 replyMay 13, 2019 3:15 PM

Nice. USD/JPY is selling off like there is no tomorrow. More moderate declines in yields. We should see a blow-off selling in USD/JPY and then saner heads prevail. Nice, can't complain.

DXY taking the cue. Plunging yields, taking the lustre off the US Dollar. But we should also see the trough later today.

Falling yields and falling DXY -- what more can possibly be better for Gold and Silver. But the laggards are not rising up to the occasion. If the situation turns around -- yields rise, and the DXY recovers, the PMs will quickly get into trouble. We should do that hedging sometime late in the day when equities stop the bleeding.

PAM have issues with trades that do not last for 48 hours. Kudos to you guys/gals who sold.

Copper and HBM are also part of the general carnage taking place in the markets. If you look closely, Copper (HGc1) is almost done with the 3rd wave of its 5th and final decline. It is slightly behind the wave evolution of the equities; or maybe not.

Copper could make an intermediate bottom today, then bounce for a day or so, then make a final decline and an important trough. That is probably why Silver is depressed so much because in its heart of hearts, Silver is an industrial metal, and industrial metals are being hammered across the board.

Just to be on the lookout, we will look closely if mini equities are going to do the same thing as well.

We will watch the market and add to the report narratives as we go along. Open for discussions.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 4:36 PM

@all

I think we will likely see the trough of the equities selling later today.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 4:37 PM

We will buyback the following;

SDS -2x SPY; QID -2x NDX; 100DXD -2x DJIA; TWM -2x Russell2k; DXD - 2X DJIA

If you remember, these are the legacy short equity trades which we did in March that gave PAM so much heartburn. I am happy to report that all of them except QID (2X NDX) are making some profits. QID has a small loss which may be erased later today if equities fall further as Tim and I expect.

For the way up, we intend to do these leveraged bull ETFs. We expect the upside to last only two to three weeks, so we lever to the hilt.

FAS (FINANCIAL 3x BULL ETF); SPXL (SPX 3x BULL ETF); TNA (SMALL CAP 3X BULL ETF); SOXL (SEMI 3X BULL ETF); URTY (3X Bull Russell 2000); EDC (3X Bull EEM ETF)

The market is in a lull -- so maybe we can get good prices for those trades. Tim and I are more than happy to break even on these trades, and so it is with some great relief and tremendous pleasure that practically all of the trades made enough to pay interest cost for the capital used.

Mr. Tim Kiser says it is time to get rid of the stuff, and start a new slate -- no point in trying to squeeze the positions further to try make a few more bps.

So, we will exit those trades listed above. We will look at levels to set up new equity long positions. But first, get rid of the old stuff.

Trade details:

SDS -2x SPY -- 33.71; QID -2x NDX 100 - 34.51; DXD -2x DJIA - 29.41; TWM -2x Russell2k - 15,62; DXD - 2X DJIA - 29.41

I will prepare the email to make this official.

I just uploaded this email:

PAM Exits The Equity Short Trades To Clear The Slate; We Initiate Long Equity Trades Today Or Tomorrow

Maybe oil prices will respond some more to the fall in equities, and go back where they were before the Hormuz Strait shenanigans happened. If we do not get to those levels today, we can opt for tomorrow to exit short oil trades.

We will watch closely; we still have four hours to go.

FlyTight @flytightMay 13, 2019 5:31 PM

@Robert GUSH at same lows as Wed. Thur. Fri. and again today. Resistance at $9.00 holding up so far. Watching for buy signal, but none yet.

Sorry, meant support not resistance.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:34 PM

We might just see a quick spike down in prices. We will try not to miss that if it happens.

FlyTight @flytightMay 13, 2019 5:37 PM

@Robert On a big down day like this are you looking for a 3 wave correction or a mini 5 wave correction? Why do you think we are still in for another downwave. I need to learn this from you two.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:37 PM

which asset is this?

FlyTight @flytightMay 13, 2019 5:38 PM

Today, all the indices I guess.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:38 PM

Meanwhile, DXY is acting on its own. This rally is not yet sustainable. It should come down at least a bit; when that happens, we will exit the short DXY positions.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:40 PM

I can't exactly visualize what you are asking for but we had this as the EWP schema for the SPX, which should be true for all the majors.

FlyTight @flytightMay 13, 2019 5:43 PM

@Robert Yes, on Friday you mentioned that you believed the 4th wave was completed, and we still needed to see a downside 5th wave. What we are seeing today, is obviously that 5th wave. That is a great call Robert and Tim. I sold my long positions at the end of the day based on that very call, so was very happy when I looked at the futures this morning. I owe you two!

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:44 PM

When it is time to exit the Dollar short trades, we will exit the following trades:

UDN (1x Bear USD etf)UDN (1x Bear USD etf) X 3 tranchesULE (2x long EUR)FXA (1x long AUD)YCL – ProShares Ultra Yen ETF.FXA - (1x long AUD

That will wipe the FX trade board clear.

FlyTight @flytightMay 13, 2019 5:45 PM

My question relates to that explicit wave 5 to be more specific. When we have a major correction like this what is likely the wave count for such a significant wave? I wish I knew more about EWP on days like this, but I hope to learn.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:49 PM

I can't explain it here, now, FT. After we have done these impending trades, I will DM you and answer your questions. I will ask Tim to give you a link for the book I wrote. You can download it free from the internet. You will need a little background read so we can have a sort of back and forth -- that is the easiest way to learn it. You have to know some of the EWP tenets to be able to ask cogent questions.

FlyTight @flytightMay 13, 2019 5:50 PM

Thanks Robert. I do have your book and I have read it from cover to cover. I will do it again.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:50 PM

PAM will hedge the following long trades in Precious Metals:

UGLD (3x Long Gold ETN)USLV (Velocity 3x Long Silver ETN)USLV (Velocity 3x Long Silver ETN)NUGT (3x GDX Bull Miners)JNUG (3x GDXJ Bull Miners)AG (First Majestic Silver Corporation)

And we will use these ETFs to hedge the long PM exposures on a 2X1 basis -- we will overhedge with GLL (-2x Gold ETF)DZZ - (-2X Gold ETN)DGLD - 3x Inverse Gold ETNDSLV - Velocity -3X Silver ETNDUST - Direxion Gold Miners Bear 2x ETF

Good luck FT. Just a little bit of patience. Took me a while to get the hang it. But once learned, it will not go away -- like riding a bicycle. You may get a little wobbly after a long hiatus, but it will quickly come back quickly.

PAM will exit these short oil trades:

XOMCVXCRAKDUG - Bear -2x Oil & Gas ETFDRIP (Bear -3X E&P ETF)UGA (US GASOLINE FUND)DRIP (Bear -3X E&P ETF)

We will hedge this underwater trade:

DWT (Bear -3x WTI oil etf)

These are the instruments that we will use to hedge and take several punts of long oil trades when it is time to close the oil bear trade.

USO (US OIL FUND, WTI)UCO (2X WTI ETF)UWT (long oil 3x etn)XOP (SPDR Oil & Gas E&P ETF)GUSH (3x XOP, S&P E&P Bull 3X Shares)

Jozsef Pengel @jozsef.pengelMay 13, 2019 2:25 PM

robert.p.balan Hello Robert, forgive me for intruding with a newbie question. What symbols/tickers are used for calculating Brent/WTI spread

BZ1!-CL1!

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 5:54 PM

That's nice FC. I will program that in Eikon.

FlyTight @flytightMay 13, 2019 5:56 PM

Thanks Robert. You’re a good man!

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 6:11 PM

Wave 3 is doing extensions -- the trough could be lower than I previously thought.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 6:32 PM

USD/JPY clearly does a fourth wave -- need another couple of iteration of the fourth and then another fifth. We may see the actual trough in Asia/Europe overnight for USD/JPY and the bond yields.

RM13 @RM13May 13, 2019 6:33 PM

Well 280 should be at least minor support.. after that 277

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 6:33 PM

Not good. If we see a breakdown of the current small consolidation, we bail out of the short DXY trades.

RM13 I think that a good summation of what to expect. I just don't know if 277 is seen in Asia/Europe tomorrow.

wave 3 is doing extensions -- the trough could be lower than I previously thought.

FlatCoated @flatcoatedMay 13, 2019 6:39 PM

Yes, I was going to say. Nice catch!

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 6:36 PM

Thanks FC!

flatcoated It is strange how the outlook in Copper with its extended 5th tallies with the "new" extended outlook in equities, eh?

FlatCoated @flatcoatedMay 13, 2019 6:49 PM

They both got caught on the wrong end of the trade deal. Copper just diverged an hour ago. And now I'm concerned about picking it up before 2.54. Will the Chinese keep buying, is inflation going to creep?

In other words, Copper is creeping up on the minute chart over the past hour. And the short term is up, and intermediate (daily) is oversold, but longer term (weekly) is starting a down trend.

FlatCoated @flatcoatedMay 13, 2019 6:55 PM

robert.p.balan - That is exactly what I see. I think the best answer for me is to wait out the seasonality trough in equities.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 6:56 PM

Cuidao FC. This could be an extended wave 5 or more likely just a wave 3.

FlatCoated @flatcoatedMay 13, 2019 6:56 PM

I think sentiment could even take it a bit lower. But either way, that and oil are my yearlies, as Alan would say.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 6:57 PM

It also has implications in equities, since the ESc1 is starting to do extensions.

FlatCoated @flatcoatedMay 13, 2019 6:59 PM

robert.p.balan - They want lower. PM's are hedged and want rate cuts to go lower, is my opinion.

I plan to short on the wave 2 retrace.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 7:00 PM

# want rate cuts to go higher,# -- typo error?

FlatCoated @flatcoatedMay 13, 2019 7:02 PM

Yes, thanks!

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 7:06 PM

FC, I have trouble wrapping my mind around the idea that the Fed will cut rates to help the equity markets, if the proximate cause of a sell off is a trade deal kerfuffle.

FlatCoated @flatcoatedMay 13, 2019 7:07 PM

robert.p.balan - Market goes down and then the credit market freezes again == Rate cut.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 7:08 PM

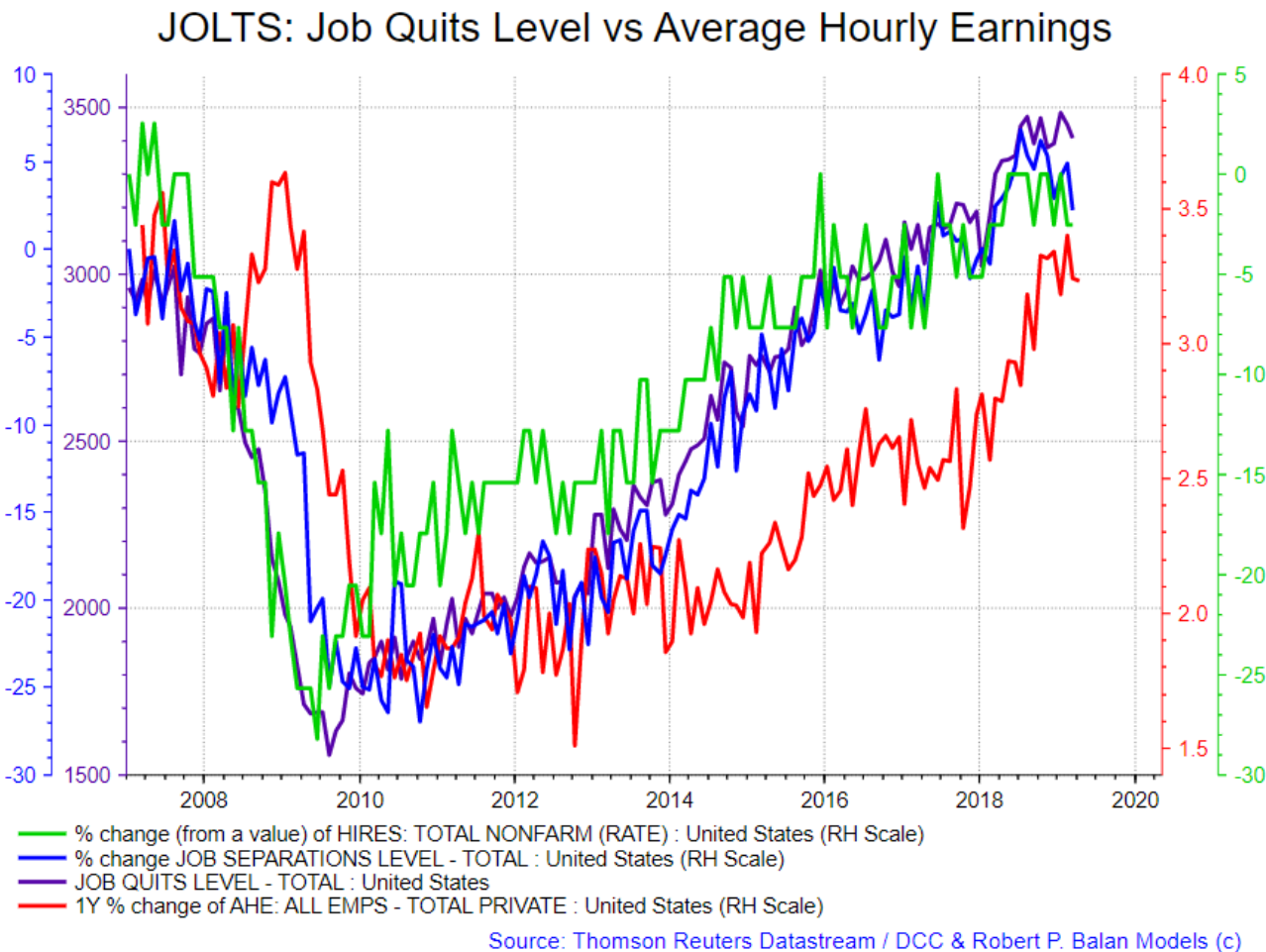

We have a white-hot jobs situation. and we had a qoq reading above 3.00% in GDP. I cannot fathom what kind of abuse that the Fed will get if they do this, especially with Trump urging them to do it in the foreground.

He is not even subtle about it.

FlatCoated @flatcoatedMay 13, 2019 7:11 PM

Trump's never mastered subtle. Lol. But he has a lock on contentious, insulting, although straight forward.

1 replyMay 13, 2019 8:47 PM

Alan Longbon @Alan.LongbonMay 13, 2019 8:17 PM

The jobs situation is not as good as the headline number makes it look. It was achieved via a lower participation rate so the denominator was smaller making for a larger divisor in you get my drift. I read somewhere that each drop of 1% in the participation rate is about 500K jobs lost. Probably in Prof. Mitchells Blog. NZ just dropped and Australia is thinking about it as is Canada and the reason is their stock of private debt is higher and more fragile than that of the US, they are the canaries in the coal mine.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 8:25 PM

With due respect, I need not look at the headline number, These are the internals that tell exactly what the job situation is. The quits rate is very important -- when workers feel very confident to quit jobs and look for something else (that attitude is also supported by the sharp wage growth), then I don't see any reason to doubt that the jobs situation is doing OK.

FlatCoated @flatcoated May 13, 2019 7:11 PM

Triple F Fred @Triple.F.FredMay 13, 2019 8:47 PM

Trump will definitely rear back and punch right between the eyes...As we say in the southern US as subtle as a brick bat!

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 8:47 PM

# Market goes down and then the credit market freezes again == Rate cut.#

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 8:51 PM

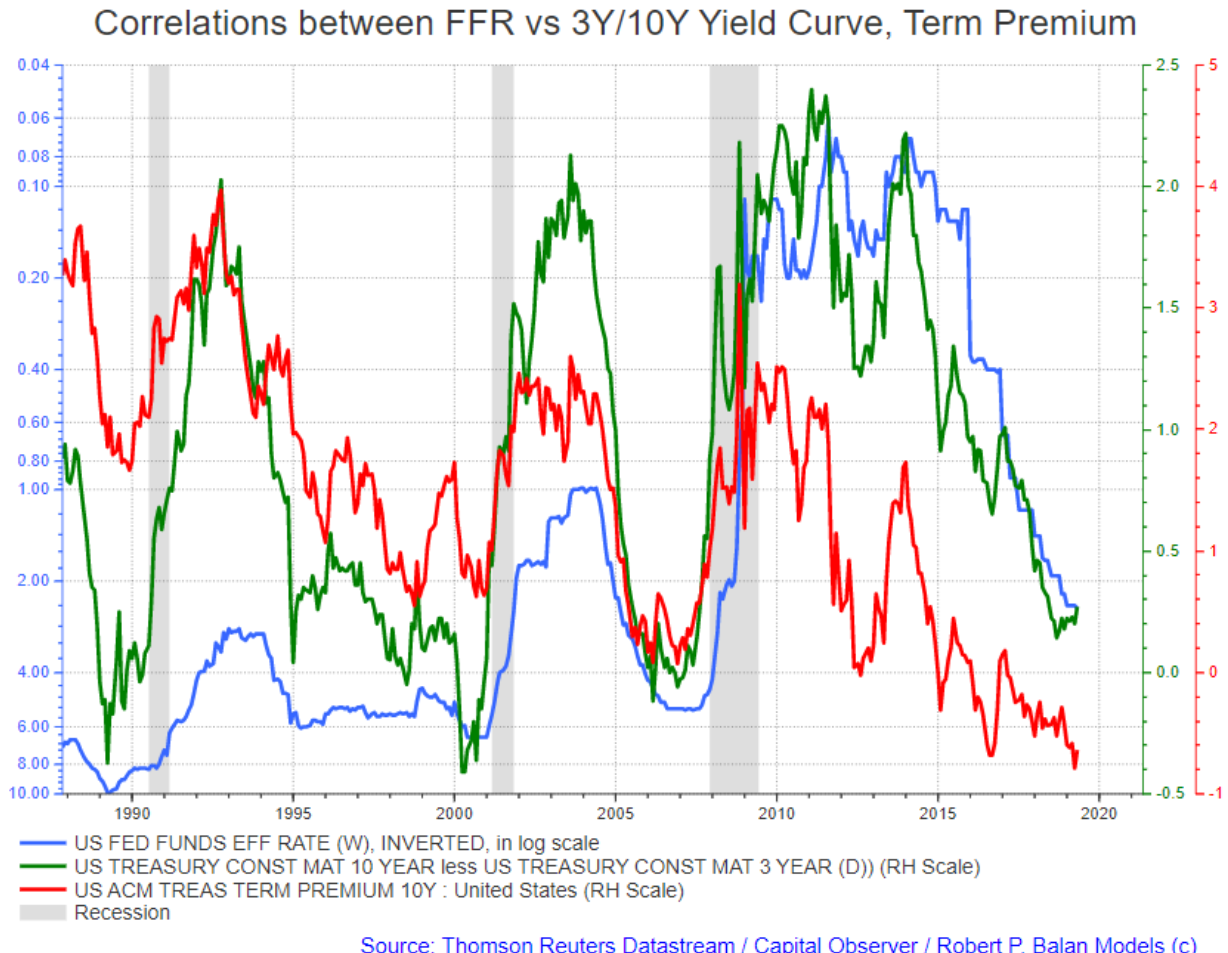

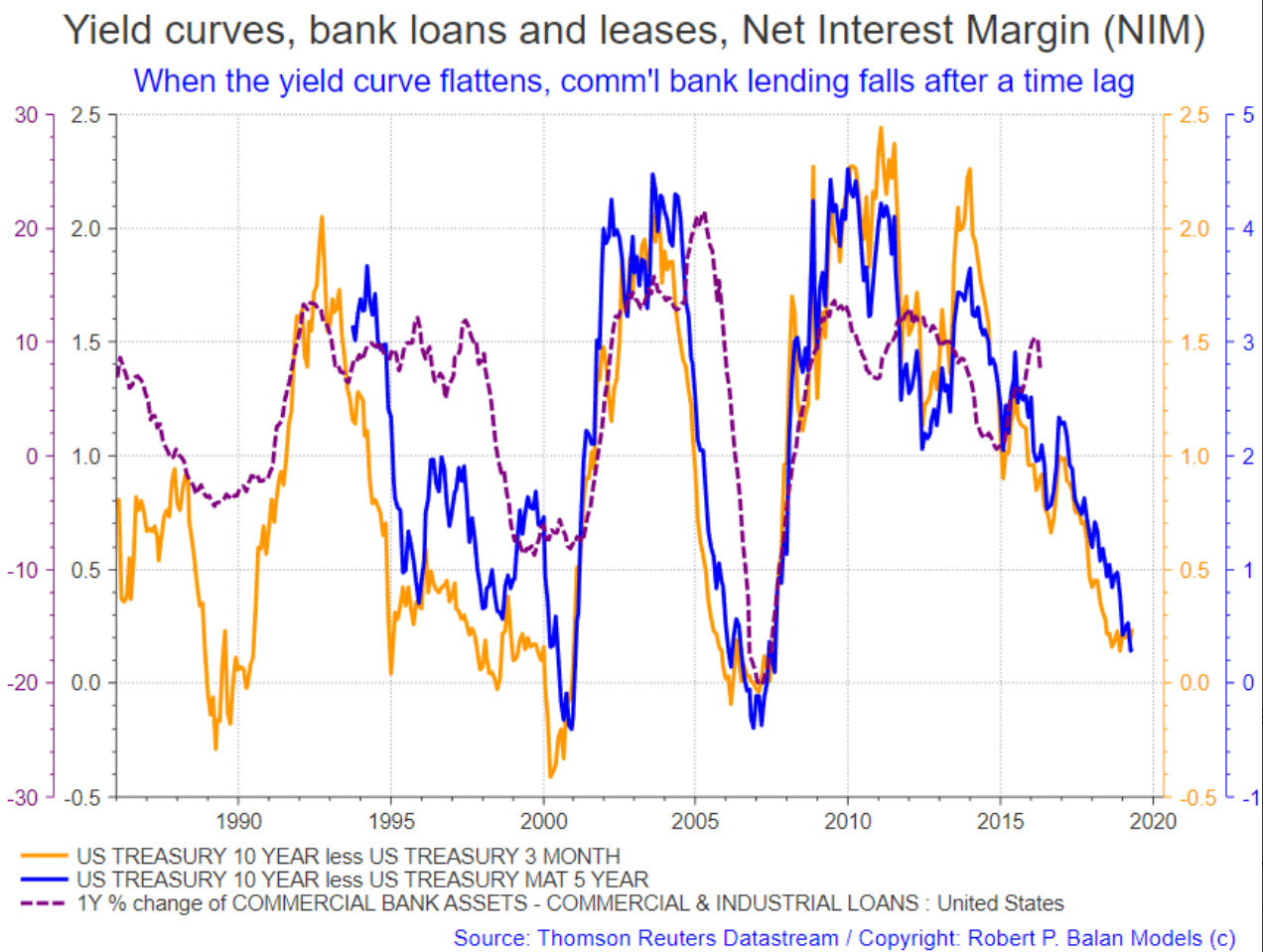

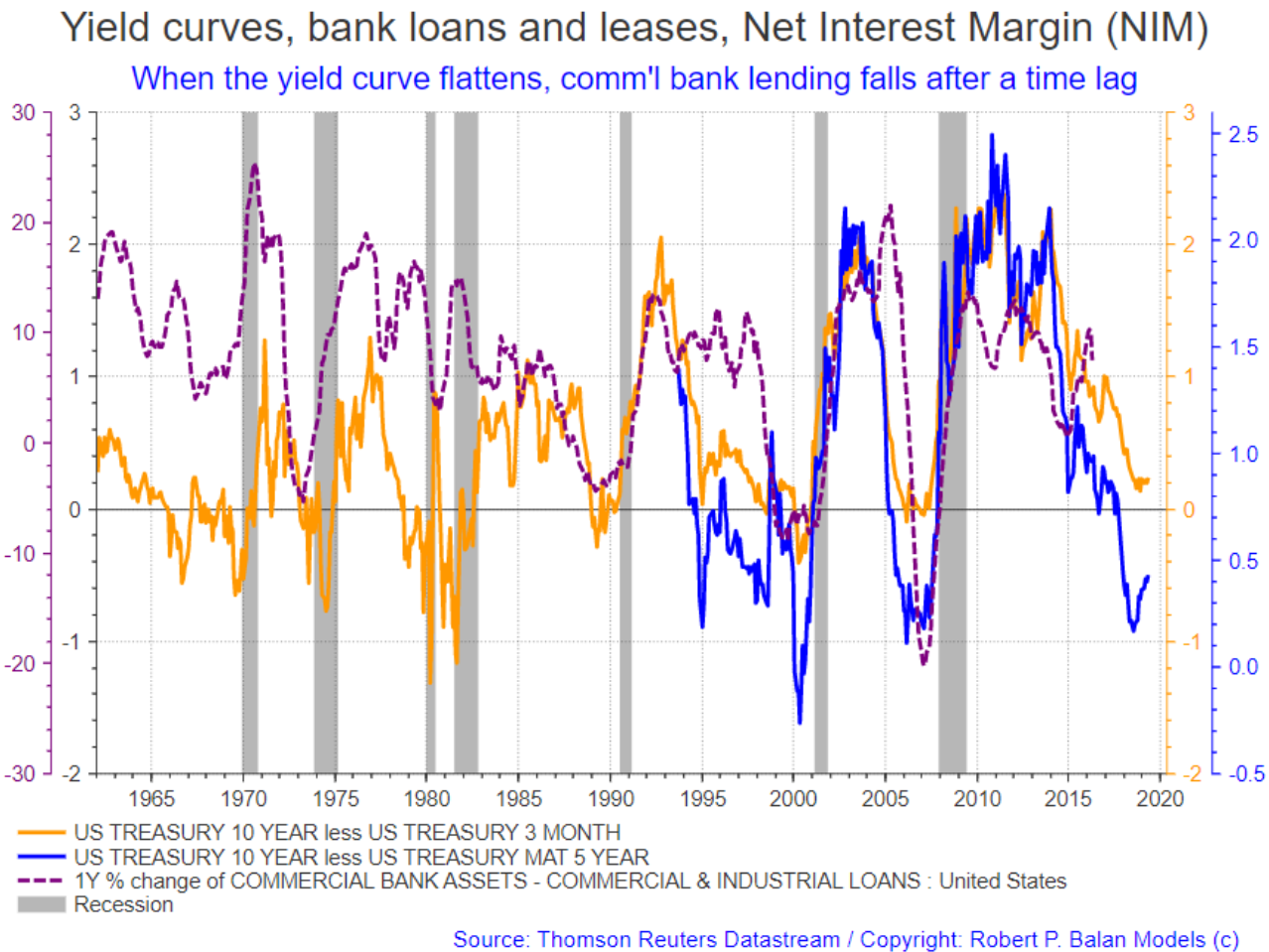

Lower FFR (due to rate cuts) will further flatten and invert the yield curve via the bond term premium.

Flatter yield curve means banks will further curtail lending -- now that will be a real credit crunch.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 8:51 PM

Lower FFR (due to rate cuts) will further flatten and invert the yield curve via the bond term premium.

Flatter yield curve means banks will further curtail lending -- now that will be a real credit crunch.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 8:57 PM

This is what will cause a recession in 2020 -- when the decline in loan giving finally catches up with the inverted yield curves. That is why inverted yield curves are so devastating -- this is the linkage between yield curve inversion and a recession 14 to 22 months later. That is how long loan making disappears when the yield curve flattens, or worse, inverts.

Be careful what you ask for!

Here is a longer term outlook .. early 60s, with the recession periods shaded. Reconcile that with inverted yield curves and bank lending lagged ave 18 months.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 9:30 PM

Now we are doing wave 4 in the ESc1.

Unfortunately, my fears are validated. The final wave 5 will probably occur overnight in late Asia or Europe. Hopefully it will happen during NY trade period. Not a problem for me, but perhaps a problem for many at PAM.

We see that in USD/JPY and the bond yields as well.

This is exactly what the Copper terminal wave 5 looks like.

Oil will test the lows/support area overnight, Hopefully, it won't have risen much before NY opens. On the other hand, we can wait a little longer, say 30m minutes before the NY close to cover the Oil short trades. That is what we will do.

1 replyMay 14, 2019 3:28 AM

wc.happy @wc.happyMay 13, 2019 10:00 PM

market is closed

futures are open for another hour

Yes, the equity market sell off has probably another couple of fourth wave and fifth wave iterations.

FlyTight @flytightMay 13, 2019 10:07 PM

We still have four hrs of extended trading time.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 10:08 PM

OK I am just waiting for Mr, Kiser to butt in, and help with planning the trades.

That is what we want to do. Exit the oil short trades if we can.

Robert P. Balan @robert.p.balanLeaderMay 13, 2019 10:10 PM

That Irregular wave 2 is about to hit support area -- the base.

By tomorrow, oil will be higher by the time NY market opens.

FlatCoated @flatcoatedMay 13, 2019 11:52 PM

Thanks!

MARKETS CLOSED

Disclosure: I am/we are long equities, oil, dxy, bonds.