Summary

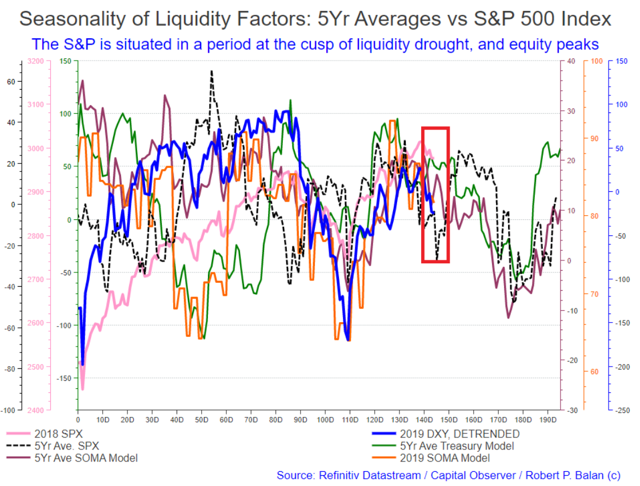

- The SPX model is looking for the final upticks in the equity futures starting today. The Liquidity Model for 10yr yield is also looking for similar uptick to a top.

- EWP is telling us the same thing; both ESc1 and 10yr yield are doing Wave 2 corrections. If the analysis is right, both equities and yields will subsequently fall together.

- Upticks in both yields and equities should have a positive spin on the DXY. A final uptick in yields however could mean further downticks for Gold (XAU), and the Miners.

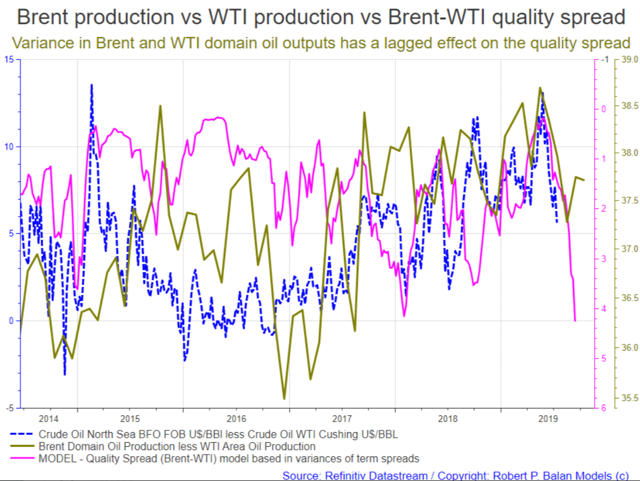

- Crude oil price is responding positively to the "happenings" in the Strait of Hormuz, and Brent is leading the charge higher. If there will be stoppages in crude oil transit in the Strait, Brent oil will be directly impacted. If this view is correct, Brent will outperform WTI in the Brent-WTI quality spread.

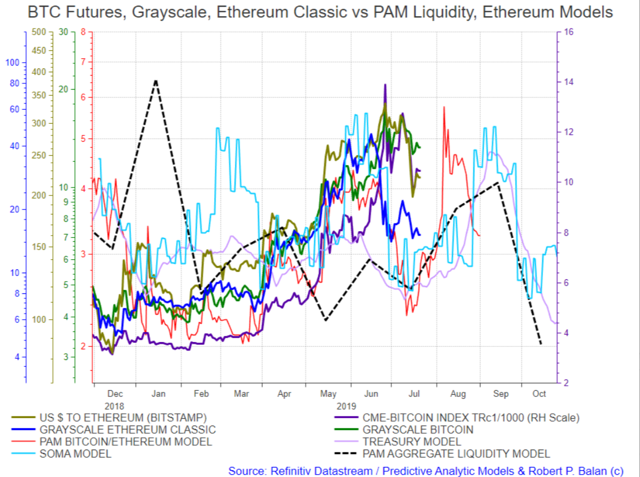

- Finally, cryptos are in various stages of "testing the lows" over the next day or so. Once done, we expect cryptos to move significantly higher. We expect the first hump to appear by early second week of August. But we are fixated on a possible higher top by the 3rd week of September. Then a huge consolidation until early second week of October.

(This actual Market Report was written pre-NY market opening, on July 22, 2019, and was updated until the NY market closed. Seeking Alpha has been encouraging SA service providers to become more transparent, and show actual reports and interaction between providers and subscribers. We are providing this report to showcase what PAM provides to the members of the community).

Original Report (here)

Why not take a free two-week trial subscription, have a look at us and see if this community of veteran investors is a good fit for you?

Please go here

Robert P. Balan @robert.p.balanLeaderJul 22, 2019 2:15 PM

GOOD MORNING

Updates from the Liquidity Models:

The SPX model is looking for a one day uptick in the equity futures today.

The Liquidity Model for the 10yr yield is also looking for a similar one-day uptick.

This is what EWP construct is telling us as well. Both the ESc1 and 10yr yield are doing proper Wave 2 corrections. If we are correct in the analysis, both equities and yields will be falling together later in the week.

If the Wave 2 analysis is correct, a subsequent Wave 3 decline should be fairly impressive for both SPX and the 10yr yield.

PAM will be looking to go long bond (and hedge the previous short bond positions). We may also add to short equity positions.

The the upticks in both yields and equities should have a positive spin on the DXY, as we have been saying for a few days now. It is also a Wave 2 situation for the DXY, in the same manner as in the 10yr yield.

PAM will also look for sell levels in the DXY.

That means Gold and the PMs will likely continue some blood-letting. A final uptick in yields could mean further downticks for Gold (XAU), and the Miners.

Yields are shown in the inverse in the chart above.

Crude oil price is responding positively to the "happenings" in the Strait of Hormuz, and Brent is leading the charge higher. If there will be stoppages in crude oil transit in the Strait, Brent oil will be directly impacted.

Brent should outperform WTI in that scenario.

If this view is correct, Brent will outperform WTI in the Brent-WTI quality spread. The variance is now extremely narrow, and as the PAM model for the spread shows, it is just about time for the spread to widen again in favor of Brent.

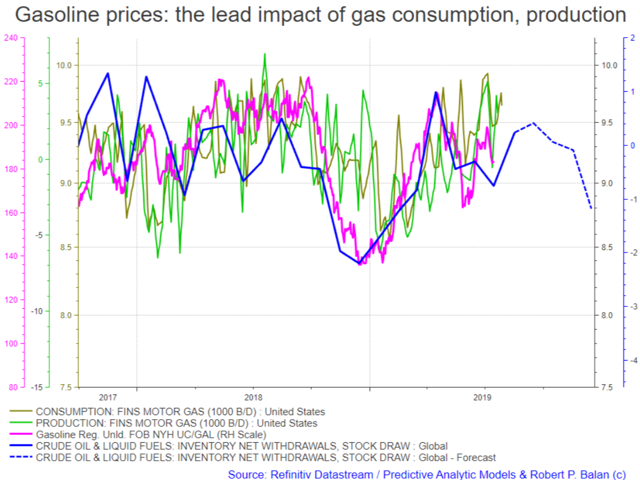

Product consumption and production-usage is also leading the price structure of gasoline (RBOB), and we should see gas prices responding to those factors over the next few days.

NatGas prices are also due for an upturn. PAM just wants to make sure that the worst to expect is a final dip.

Finally, cryptos are in various stages of "testing the lows" over the next day or so. Once done, we expect cryptos to move significantly higher.

We expect the first hump to appear by early second week of August. But we are fixated on a possible higher top by the 3rd week of September. Then a huge consolidation until early second week of October. Let's see if the models deliver what they are promising.

We will resume the market narrative once we see what the New York brings. Open to discussions.

pa292 @pa292Jul 22, 2019 4:17 PM

Robert, are you long GBTC ?

Robert P. Balan @robert.p.balanLeaderJul 22, 2019 5:57 PM

Only in BTCc1 futures pa292

vjapn @vjapnJul 22, 2019 8:34 PM

Robert, Is it a good time now to add index shorts?

Robert P. Balan @robert.p.balanLeaderJul 22, 2019 8:46 PM

ESc1 has not risen enough yet vjapn. Maybe closer to the NY close.

Robert P. Balan @robert.p.balanLeaderJul 22, 2019 8:48 PM

Or probably tomorrow in Europe.

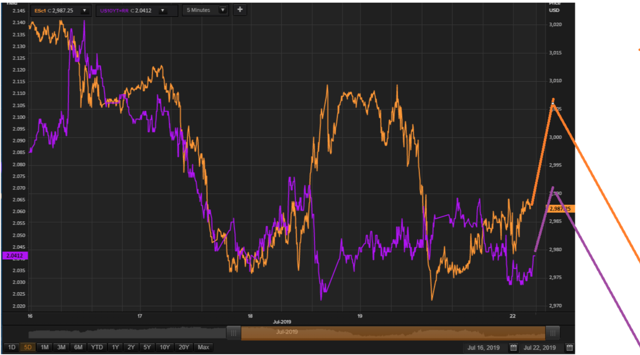

This is probably the scenario for Gold (XAU) if the 10yr yield perform as we expect it to overnight.

Robert P. Balan @robert.p.balanLeaderJul 22, 2019 10:19 PM

And this may be the scenario for the DXY overnight.

Robert P. Balan @robert.p.balanLeaderJul 22, 2019 10:20 PM

Hopefully, levels will still be attractive by the time we get the NY trade opening.

Acetaia @acetaiaJul 22, 2019 7:26 PM

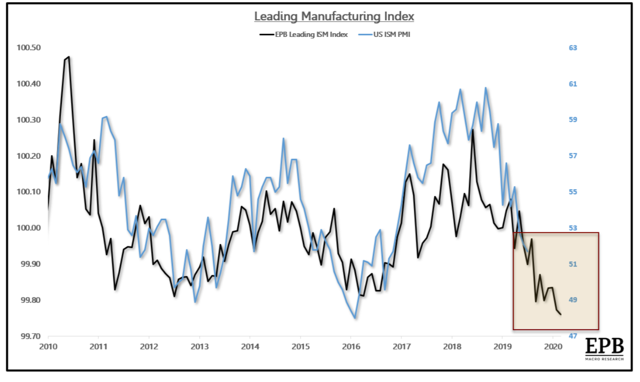

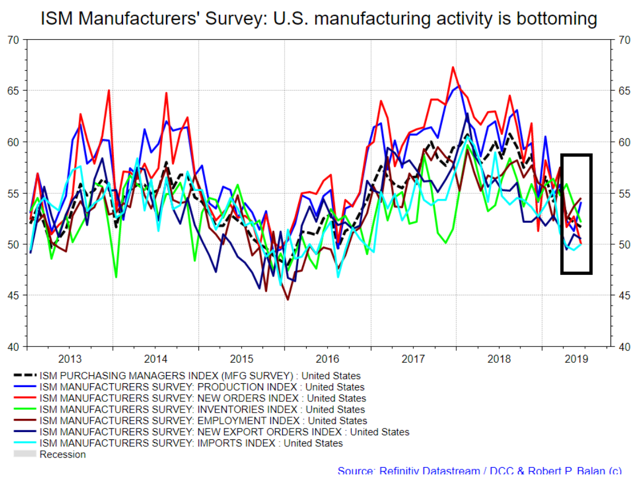

Eric Basmaijan which is the best macro contributor on SA see no uptick on Global PMI for 2019. Does this affect global GDP as PAM thinks it will restart in q3 or 4?

Acetaia @acetaiaJul 22, 2019 7:26 P

Acetaia @acetaiaJul 22, 2019 7:28 PM

Even At All-Time Highs, The Economy Is Still Slowing - Here's Why It Matters

Robert P. Balan @robert.p.balanModeratorLeaderJul 22, 2019 8:20 PM

acetaia "best macro contributor" -- is a judgment. The reality may be different.Growth looks solid except for manufacturing; but the rest of the economy is not, and manufacturing accounts for only about 12% of GDP.Even in manufacturing, a bottoming-out is now underway.Robert P. Balan robert.p.balanLeaderJul 21, 2019 10:41 PMClipboard - July 21, 2019 10:39 PM

Robert P. Balan @robert.p.balanModeratorLeaderJul 22, 2019 8:22 PM

These charts, are by the way original -- not copied from somewhere else.

Eric is good, no question about it -- but you do not base your argument on a sector of the US economy which just comprise 12% of GDP. What the 78% is doing counts a lot, lot more.

Acetaia @acetaiaJul 22, 2019 8:27 PM

thanks for clear up.

Robert P. Balan @robert.p.balanModeratorLeaderJul 22, 2019 8:29 PM

#No uptick on Global PMI for 2019. Does this affect global GDP as PAM thinks it will restart in q3 or 4?#general Even the IMF says we will have 3.6% Global GDP growth in 2020. I would like to see Eric muster the counter-argument to that.

JdEFP @jdefpJul 22, 2019 8:47 PM

robert.p.balan , Alan.Longbon - Thoughts on this line of reasoning?: The Debt-Ceiling Impasse Has Meant Mini-QE Since May - Will Mean QT When Resolved

...when the debt ceiling impasse is finally settled, and it seems imminent, Treasury will need to build back up its balance at the Fed... The extra issuance of debt is kind of like QT in that it removes liquidity from the system.

Robert P. Balan @robert.p.balanModeratorLeaderJul 22, 2019 9:34 PM

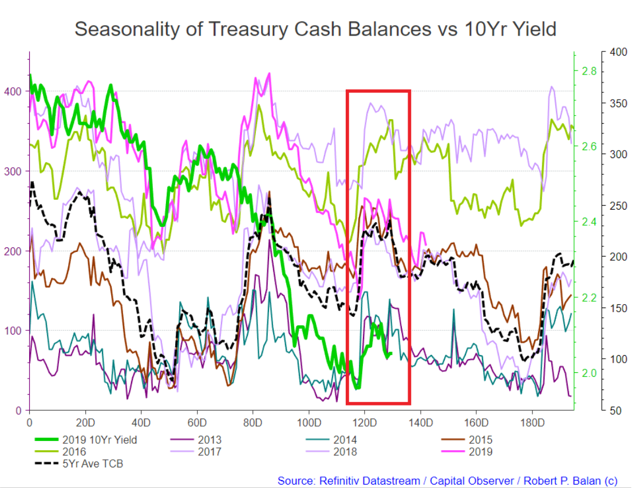

jdefp

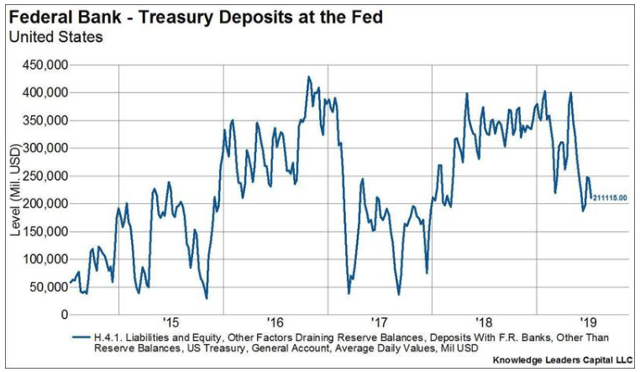

Here is a 14 yr history of the Treasury Cash Balance (TCB) -- the account of the US Treasury at the Fed.

Juxtaposed is the 5yr average of 10yr yields (orange line).

Robert P. Balan @robert.p.balanModeratorLeaderJul 22, 2019 9:39 PM

When the TCB declines, yields fall (bond prices go up). Its the Quantity Theory of Money at work. Lower amount of cash/liquidity chasing an asset pushes up its price, and vice versa.

#The act of the Treasury drawing down its account at the Fed is kind of like a mini version of quantitative easing in that it adds liquidity to the system that otherwise would not have been there#The TCB is the conduit through which the Treasury pays its obligations to the world at large. It tells the Fed which accounts to credit and by how much. All done through computer keystrokes.

As the TCB is drawn down, bond yields fall (bond prices rise), and vice versa.Obviously the liquidity that matters here to the bond market is the amount of liquidity in the TCB, not the amount that was disbursed.

Robert P. Balan @robert.p.balanModeratorLeaderJul 22, 2019 9:50 PM

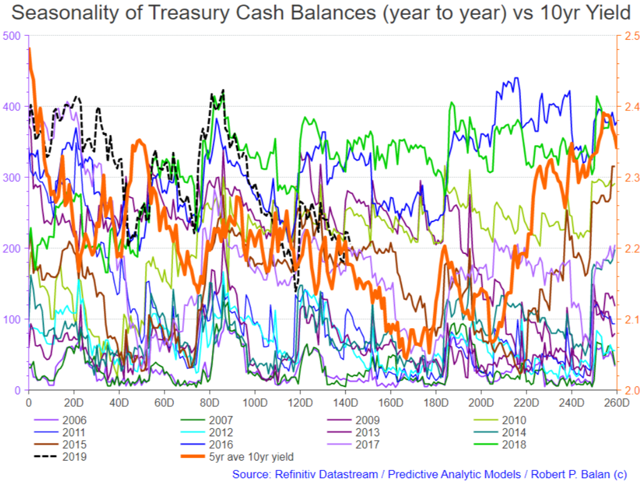

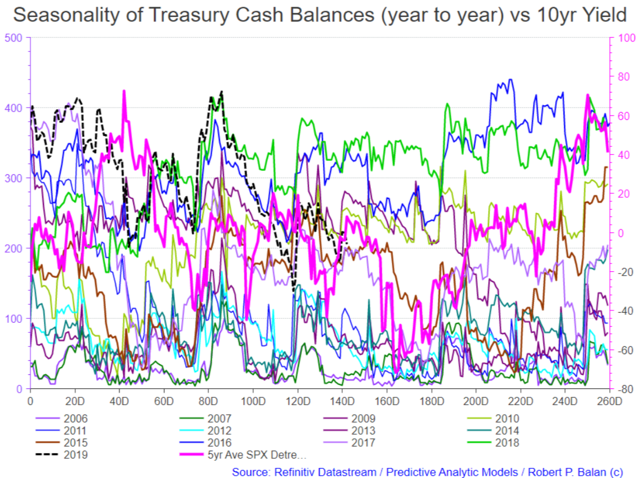

Same background data on TCB -- this time I juxtapose the 5yr average of the SPX

Same phenomenon -- TCB levels draw down, SPX values fall, and vice versa-

The guy was looking at it from the point of view of the general economy, which is beneficiary of the TCB draw down. But that is not the financial systemic liquidity that matters to risk asset prices. What counts is the level of TCB while in the process of drawing down, or stocking up the TCB.

That is why you get such a good fit between the ebb and flow of TCB with both yields and equities.And it is the change rate, not the change in the level of the nominal TCB, that matters.

JdEFP @jdefpJul 22, 2019 10:03 PM

Thanks, Robert.

MARKETS CLOSED

Predictive Analytic Models (PAM) provides REAL-TIME trading advice and strategies using guidance from US Treasury, Federal Reserve and term market money flows. PAM also provides LIVE modeled tools to subscribers in trading equities, bonds, currencies, gold and oil -- assets impacted by ebb and flow of systemic money. Sophisticated LIVE models to trade and invest in the oil sector are provided as well. PAM's veteran investors and seasoned traders can use PAM's proprietary tools 24X7 via PAM's SA service portal.

Try us for two-weeks, free. Please go here