Summary

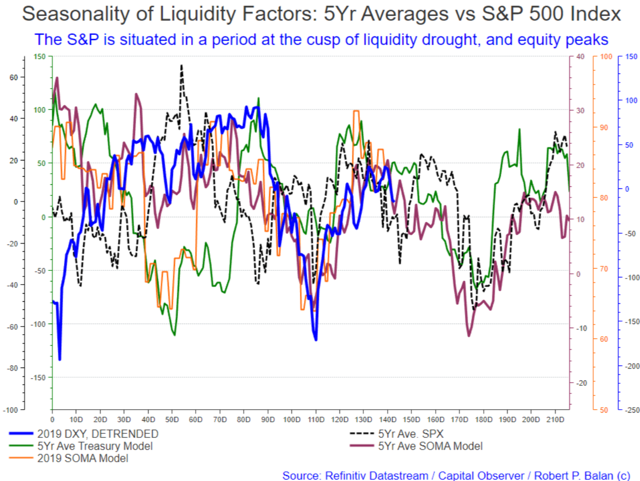

- We expect equities and yields to start a down trend which the models indicate are upon us now or continuing in the next few weeks.

- We are having the upside correction of the first five wave sequence in the SPX futures a few days. It could be the right shoulder of a Head&Shoulder top-out technical pattern.

- PAM expects this sell-off to bottom during the first week of August; followed by two weeks of upside correction, and then finally, further sell-off until the first week of September.

- PAM may get a chance to get into long Gold later today. We expect a move back to at least the trendline of the triangle, as the yield pulls back higher. The DXY is also pulling back higher, as the yields recover some ground lost.

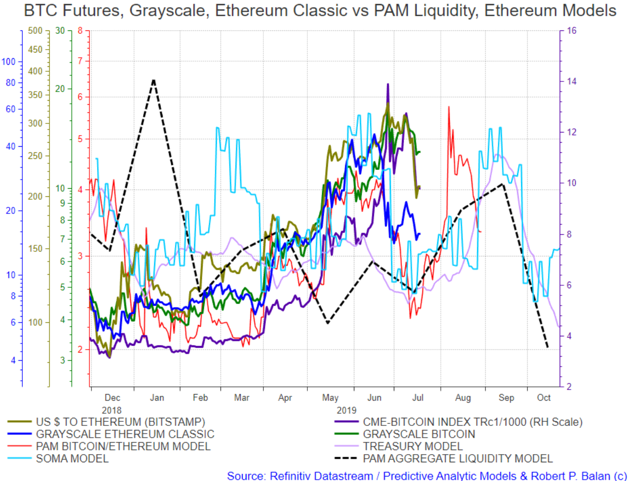

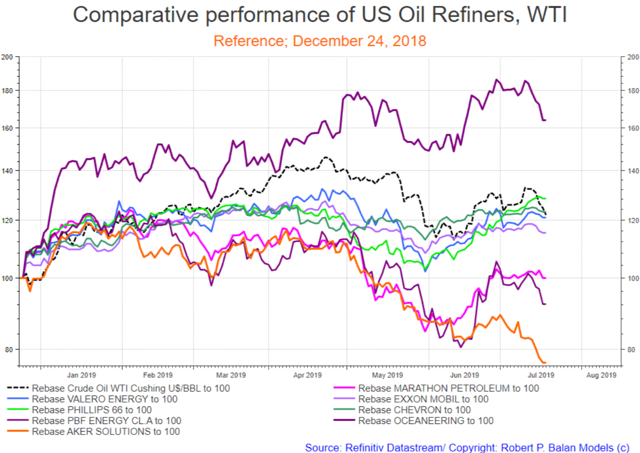

- Looks like WTI and Brent Oil have finally bottomed. We will be looking to add to E&Ps and Refiners -- VLO and XOM have been very resilient. Finally, the cryptos look like testing the lows. If BTCc1 goes over 10,200 today, I will add more 3 tranches to my personal account. Added 3 more PAM tranches to my long BTCc1 futures at 10,329.

(This actual Market Report was written pre-NY market opening, on July 18, 2019, and was updated until the NY market closed. Seeking Alpha has been encouraging SA service providers to become more transparent, and show actual reports and interaction between providers and subscribers. We are providing this report to showcase what PAM provides to the members of the community).

Why not take a free two-week trial subscription, have a look at us and see if this community of veteran investors is a good fit for you?

Please go here

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 2:39 PM

GOOD MORNING

Market Report At The Chat, July 18, 2019

We expect equities and yields to start a down trend which the models indicate are upon us now or continuing in the next few days at the latest.

We are probably having the upside correction of the first five wave sequence in the SPX futures seen for some time. It could be the right shoulder of a top out Head and Shoulders pattern.

Multiple evidence coming from price action -- PAM will not miss this "opportunity" to sell equities.

PAM expects this sell-off to bottom during the first week of August; followed by two weeks of upside correction, and then finally, further sell-off until the first week of September.

We see those timing elements from the liquidity models.

PAM may get a chance to get into long Gold later today. We expect a move back to at least the trendline of the triangle, as the yield pulls back higher (inverted in the chart below).

The DXY is also pulling back higher, as the yields recover some ground lost. The DXY also corrects a small five wave sequence, and with this correction higher, levels are improved for DXY shorts.

PAM also buy bonds, both as trades and as overhedge for existing bond short positions.

The main thrust lower for bond yields bottoms on July 26, followed by a two week bounce, then another decline until late August.

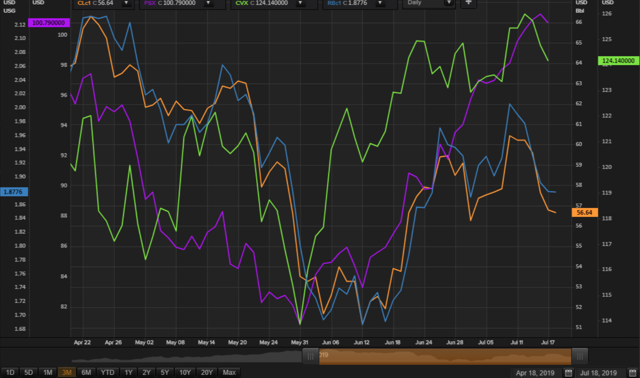

Looks like WTI and Brent Oil have finally bottomed. We will be looking to add to E&Ps and Refiners -- VLO and XOM have been very resilient.

My graphics server is very slow today. Sorry.

The Refiners are doing well, relative to oil and gasoline prices. We also like PSX and CVX.

Natural Gas futures have likely bottomed as well. We like going back further, as in the NGc6 -- which will likely outperform the front contract c1

Finally, the cryptos look like testing the lows. If BTCc1 goes over 10,200 today, I will add more 3 tranches to my personal account at DCC.

Tim has also been looking at other crypto assets, and will likely get into long trades at some point, perhaps today.

NY Market just opened. We will see what develops and hopefully we will get a execute the planned trades later in the day.

Open for discussions.

Monaro @MonaroJul 18, 2019 3:41 PM

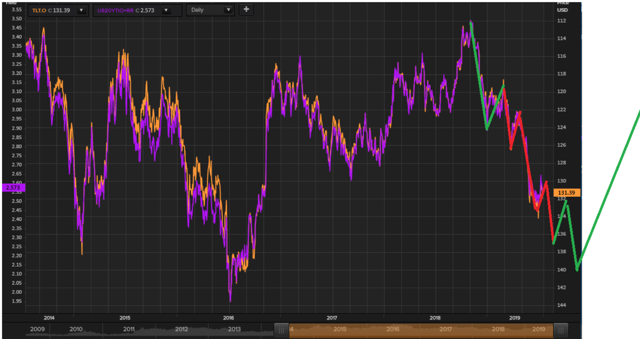

Hi Robert, your big on EW. Today I saw a chart with TLT hitting the top of a channel starting it's decline in 2016. It was at the 0.618 retracement at this top ...any thoughts ? Monaro

There are only 2 points in the channel lines drawn. Frankly, I am skeptical when there are less than three data points in a trendline.

Monaro @MonaroJul 18, 2019 3:49 PM

Ok thank you

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 3:52 PM

Monaro

what makes more EWP sense is completing the five waves from the October 2018 from the point of view of the 20year yield (inverse of TLT).

#EatMoreWalnuts @.eatmorewalnutsJul 18, 2019 3:59 PM

does the 20 yr affect gold as much as the 10?

Not much difference in the covariance aspect, @eatmorewalnuts

OK, Gold (XAU) is just about to break out from an expanding triangle. Time to look for levels to buy Gold and Miners.

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 4:30 PM

UGLD (Velocity 3x Long Gold ETN) UGLD

USLV (Velocity 3x Long Silver ETN) USLV

NUGT (3x GDX Bull Miners) NUGT

JNUG (3x GDXJ Bull Miners) JNUG

AG (First Magestic Silver Corp) AG

@all PAM buys 2 tranches of each of the instruments stated above.

Trade details;

UGLD - 122.17

USLV - 76.30

NUGT - 32,19

JNUG - 74.43

AG - 122.17

I just uploaded this email:

PAM Buys Into Precious Metals: UGLD, USLV, NUGT, JNUG And AG

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 4:52 PM

PAM is preparing to add Refiners and select E&Ps.

PSX

CVX

XOM

VLO

@all PAM is adding select refiners to our long oil portfolio: PSX, CVX, XOM, VLO

Trade Details:

PSX - 100.87

CVX - 124.61XOM - 75.06

VLO - 82.84

PAM buys 3 tranches of each of these equities.

I just uploaded this email:

PAM Adds Select Refiners To Our Long Oil Portfolio: PSX, CVX, XOM, VLO

Cryptos are exploding higher.

Added 3 more PAM tranches to my long BTCc1 futures at 10,329.

vjapn @vjapnJul 18, 2019 5:48 PM

Robert, Will PAM buy bonds today?

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 5:51 PM

That depends if yields get to the levels we are looking for. But we are looking at it closely -- trying to understand how much higher a pullback will go.

Maybe we will have one more upside try

Acetaia @acetaiaJul 18, 2019 6:00 PM

can you provide a potential bottom for CLc1?

I thinks we are already there.PAM will buy BNO -- Brent Oil to start with

@all

PAM buy 3 tranches of BNO -- Brent Oil ETF

Trade Details:

BNO - 18,28

@allPAM also buys 3 tranches of OILU -- 3X long WTI oil ETF

Trade Details

OILU - 18.50

I just uploaded this email:

PAM Adds To Long Crude Oil Positions By Buying BNO, OILU

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 8:40 PM

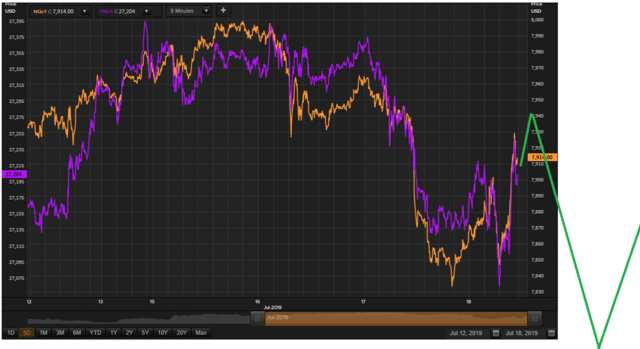

ESc1 is coming close to what would be attractive levels to sell equities.

We hope we see that before the trading closes, and before the yields fall further.

These are the instruments PAM will use, buying bear equity ETFs.

DXD -2x DJIA DXD

SDS -2x SPY SDS

QID -2x NDX 100 QID

TWM -2x Russell2k TWM

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 8:52 PM

Meanwhile, we are getting some traction on the new PM long trades.

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 8:55 PM

@all

Time to watch the e-mini futures very closely. We are very close to ideal SELL levels.

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 9:22 PM

@all For many of the indices that we are tracking, the levels PAM desires has been met.We are buying the instruments indicated above -- bear equity ETFs.

DXD -2x DJIA DXD

SDS -2x SPY SDS

QID -2x NDX 100 QID

TWM -2x Russell2k TWM

wc.happy @wc.happyJul 18, 2019 9:23 PM

My opinion - VVIX is dropping like crazy, not too good for shorting, volatility is collapsing, as well as the call spreads on it.

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 9:25 PM

@all Trade details:

DXD - 25.42

SDS - 26.90

QID - 29.54

TWM -2x Russell2k - 14.91

PAM buys 3 tranches for each of these instruments.

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 9:32 PM

I just uploaded this email:

PAM Turns Bearish Equities, Buys Bear ETFs DXD, SDS, QID, And TWM (3 Tranches Each Instrument)

Robert P. Balan @robert.p.balanLeaderJul 18, 2019 9:36 PM

The corrective rally may have another wave 5 uptick left on it, but it could happen overnight, and may be gone by the time NY opens tomorrow -- so PAM is buying the bear ETFs now. You may wait further if you wish.

Looks like oil bull ETFs are bid as well, but we need to see this sustained overnight.

The equity market corrective rally may have another wave 5 uptick left on it, but it could happen overnight, and may be gone by the time NY opens tomorrow -- so PAM is buying the bear ETFs now. You may wait further if you wish.

Too late to sell the DXY -- but we get other chances when the yields correct back higher during the rest of the week.

Precious Metals and Miners getting a tailwind at the NY close.

MARKETS CLOSED

Predictive Analytic Models (PAM) provides REAL-TIME trading advice and strategies using guidance from US Treasury, Federal Reserve and term market money flows. PAM also provides LIVE modeled tools to subscribers in trading equities, bonds, currencies, gold and oil -- assets impacted by ebb and flow of systemic money. Sophisticated LIVE models to trade and invest in the oil sector are provided as well. PAM's veteran investors and seasoned traders can use PAM's proprietary tools 24X7 via PAM's SA service portal.

Try us for two-weeks, free. Please go here