Summary

- Bond market taking lead as yields fall, while equities roll over. This confirms our thesis that the 10yr yield has peaked, completing a very strong technical signal for a top.

- As bond yields fall, Gold soars, will make new higher highs, and US Dollar (DXY) resumes sharp declines from two weeks ago -- thesis expounded in last two 2019 reports.

- Hence, we have very high confidence of a mini-seasonal pullback in risk assets, as we see evidence in the behavior of the Treasury Cash Balance, which is declining sharply.

- As bond yields fall, Gold (XAU) is soaring, making new higher highs, and the US Dollar (DXY) resumes the sharp decline from two weeks ago. As we said in our last two reports for 2019, Gold should make a new higher high, and DXY should follow the falling yields lower -- unless correspondingly lower equities trigger a sort of safe haven flight, and will moderate DXY's potential losses.

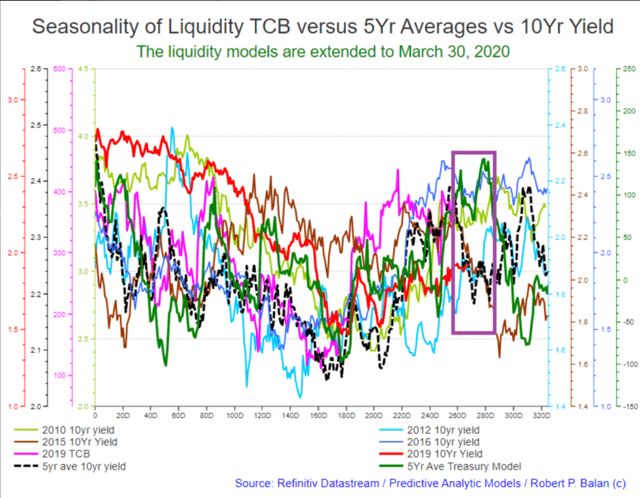

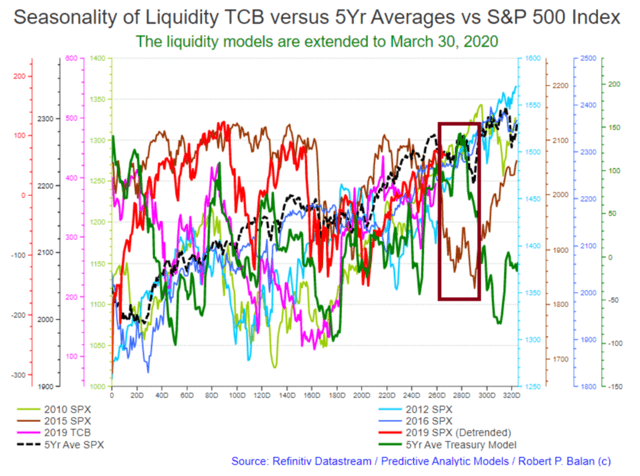

- Bond yields seem to have fulfilled that small uptick seen in the five-year average of the 10yr yield. Yields should go downhill all the way from here for at least a week, even longer, if the 2020 10yr yield hews to its five-year historical average. See provided chart. Ditto for equities. And we see the same mini-seasonal dip in equities at this time of the year in the chart provided. We should see at least a week of equities decline, or even longer, if 2020 SPX hews to its historical 5-year average. That is also illustrated by SPX's 2015 seasonal performance, as shown.

(This actual Market Report was written pre-NY market opening, on January 2, 2019, and was updated until the NY market closed. Seeking Alpha has been encouraging SA service providers to become more transparent, and show actual reports and interaction between providers and subscribers. We are providing this report to showcase what PAM provides to the members of the community).

Rida Morwa, principal at the High Dividend Opportunities, the #1 Seeking Alpha service provider at the MarketPlace, the largest community of income investors and retirees with +3000 members and ranked #1 in dividend,income and retirement, has this to say about Predictive Analytic Models (PAM):

Rida Morwa • Dec. 14, 2019 10:28 PM

Best Predictive Analysis!

"I have followed Robert on Seeking Alpha for a long time and decided to subscribe. He is one of the best analysts out there in his predictive models. You will get much more value out this membership than its cost. Robert talented with a very strong track record. Highly recommended. Take a 2-week free trial and see it for yourself!"

See all PAM Member reviews here

Why not take a free two-week trial subscription, have a look at us and see if this community of veteran investors is a good fit for you?

Please go here

-------------------------------------------------

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 3:07 PM

GOOD MORNING

Market Report At The Chat, January 2, 2020

wc.happy @wc.happyJan 2, 2020 12:15 AM

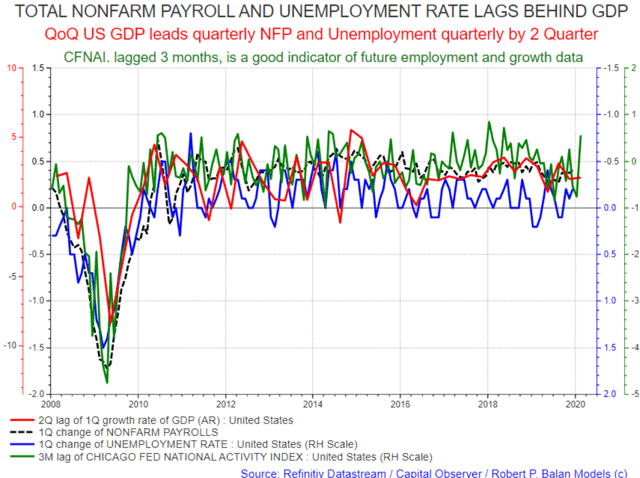

At unemployment rate of 3.5% who is out there left to be hired? Fresh graduates?

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 12:48 AM

Even lower Unemployment Rate and higher NonFarm Payroll data in early Q1 2020. So we will know soon how the US workforce will respond to this situation.

Zoomed In View

Pre-New York market opening, it is now the bond market taking the lead as yields fall, and equities are rolling over. This confirms our current thesis that the 10yr yield has completed a so-called "quadruple top" -- a very strong technical signal for an interim peak.

And the members of the Bond Trilogy are responding correspondingly.

As bond yields fall, Gold (XAU) is soaring, making new higher highs, and the US Dollar (DXY) resumes the sharp decline from two weeks ago. As we said in our last two reports for 2019, Gold should make a new higher high, and DXY should follow the falling yields lower -- unless correspondingly lower equities trigger a sort of safe haven flight, and will moderate DXY's potential losses.

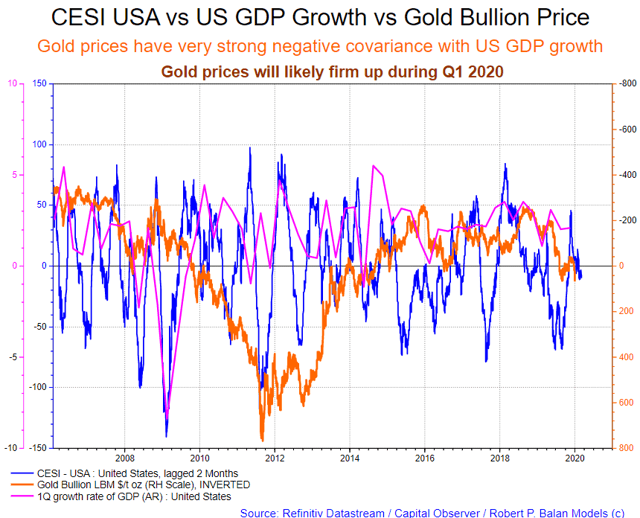

This is how we see destination of the gold rally (see chart below). We will soon see an intermediate top, follows by period of sideways consolidation. Then another sustained period of strong price rally going into Q1 2020. This is consistent with the US GDP growth outlook being signaled by the Citi Economic Surprise Index (CESI) -- Gold prices firm up when the outlook for US GDP growth weaken (see chart below):

Bond yields seem to have fulfilled that small uptick seen in the five-year average of the 10yr yield. See details inside that purple rectangle in the chart below. Yields should go downhill all the way from here for at least a week, even longer, if the 2020 10yr yield hews to its five-year historical average.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 3:22 PM

And we see the same potential mini-seasonal dip in equities at this time of the year in the chart below (details inside the brown rectangle). Equities had been in an inflection point, and are rolling over, lower. We should see at least a week of equities decline, or even longer, if 2020 SPX hews to its historical 5-year average. That is also illustrated by SPX's 2015 seasonal performance (brown line, in the chart below).

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 3:26 PM

Hence, we have very high confidence of a mini-seasonal pullback in risk assets, as we see that feature in the behavior of the Treasury Cash Balance (see that in the two charts above), and of the five-year averages in both 10yr yield and the SPX.

If yields continue to fall, and equities will decline to some degree, then the energy sector follows lower (see chart below).

NatGas turned back from the strong down trend line (see chart above) as expected, and should continue to lead the energy pack's decline, with new lower lows over the next few days.

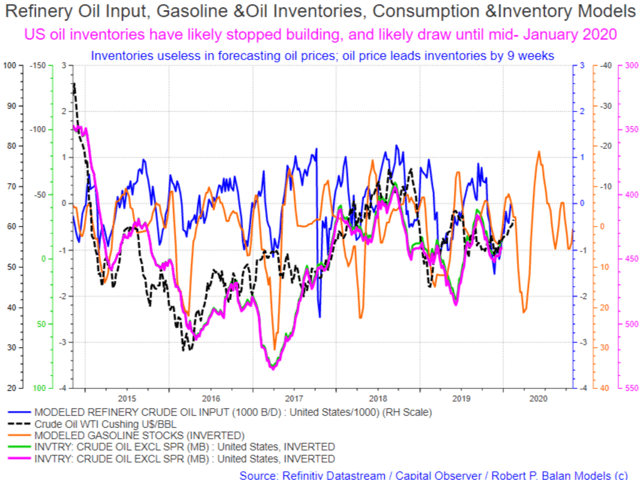

Oil and gasoline fundamentals are also turning price-negative.

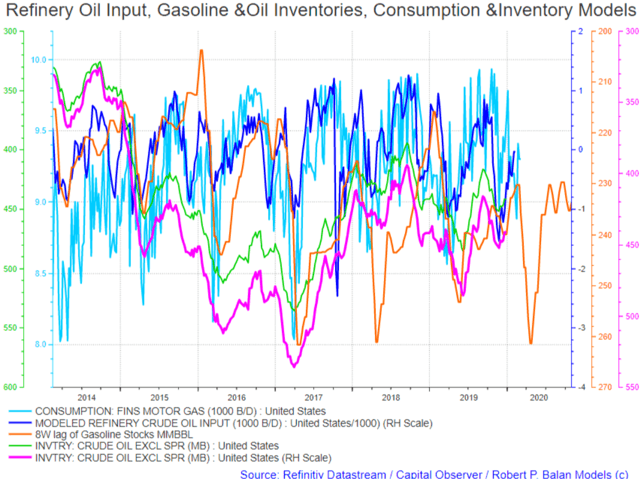

As modeled, gasoline stocks should start building from here, as gasoline demand wanes, and refineries stock up for the expected spring demand (see charts above and below).

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 3:37 PM

Here is the complete picture of gasoline demand, gasoline production, gasoline inventories in the chart above.

So as in both yields and equities, there is a short term outlook for lower prices before a seasonal, spring rally in energy prices.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 3:40 PM

Yields continue to fall hard, and equities seem to be following suit to the downside, so lets see what NY trading has to offer for us later today (see chart below).

Open to discussions.

JdEFP @jdefpJan 2, 2020 4:17 PM

Looking like Wave 1 of 3 may just be coming together on equities.

User 12932881 @User.12932881Jan 2, 2020 5:02 PM

Robert, what's your thoughts on Primary Dealers' leverage to the bond market? if TNX spikes higher will they be forced to reduce risk and sell equities? especially in light of the amount of new treasury paper that will hit them this year with a 1.2T budget.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 5:11 PM

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 5:14 PM

With the front end in yields, for all intents and purposes, collapsing and flattening the yield curve once again due to deteriorating manufacturing data, small caps are leading the equity market decline. The Russell 2000 c1 futures is falling hard, pacing the 10yr yield (see chart above).

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 5:20 PM

User.12932881 -- I suggest that you do not worry too much about the capability of the Primary Dealer's (PDS) capacity to handle whatever the US Treasury has to deal out to them.

As I explained several times before, the Fed LENDS the PDs funds to buy paper issued by the Treasury. That is what the humongous TOMO's are all about -- the PDs are making money over fist on these trades. They are capitalized by the Fed, then the Fed buys the Treasury paper from them, and leaves them a small haircut -- a commission, so to speak.

What could be more profitable than that? No need to worry about the PDs. Why do you think every commercial bank operating in the US (domestic and foreign) wants to become a PD?

User 12932881@User.12932881Jan 2, 2020 6:30 PM

So we just monetize 1.2T federal budget every year from now on and this cycle just continues?

JdEFP @jdefpJan 2, 2020 6:40 PM

Until the bond market takes the keys away.

Triple F Fred@Triple.F.FredJan 2, 2020 8:57 PM

jdefp I guess the old golden rule applies here "He who has the gold makes the rule" or in this case those who run the "printing presses" make the rules... Or in our way of thinking, we learn how to adapt to what comes at us... Happy New Year sir!

JdEFP @jdefpJan 2, 2020 10:06 PM

Triple.F.Fred - No doubt, Fred. ... case in point, today's equities close. This is simply not healthy and will not end well, IMHO.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 5:51 PM

NatGas breaking is down

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 6:40 PM

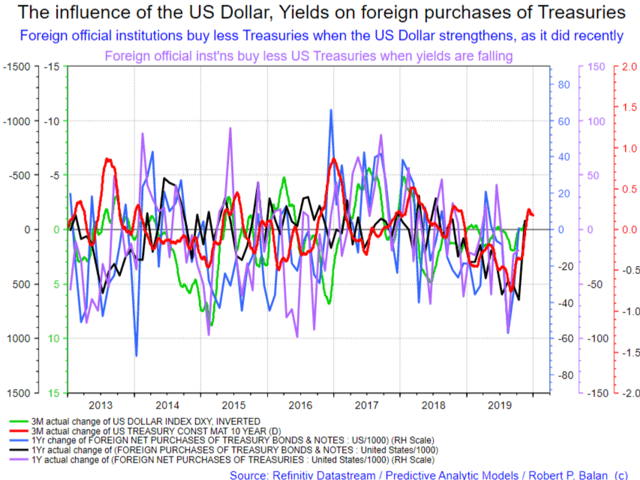

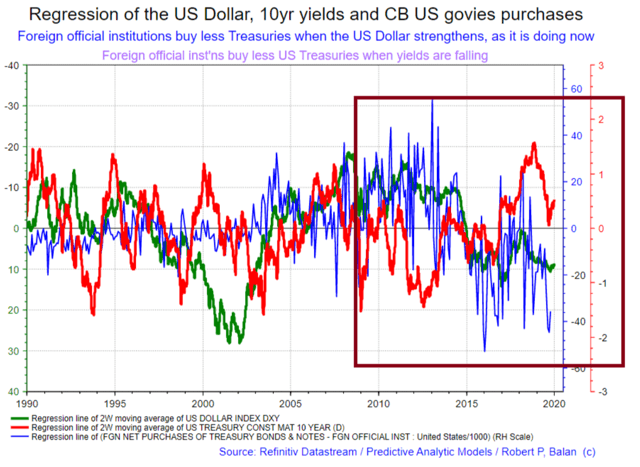

Maybe some external help is coming. The reason why foreign investors (global central banks and large institutions) have not been buying much US Treasuries is because the US Dollar has been strong, and US yields have been historically low. That was primary reason for the so-called "strike" of foreign buyers of US govt paper. Let me show you that in a few charts, below.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 6:49 PM

The influence of the US Dollar, Yields on foreign purchases of Treasuries

Foreign official institutions buy less Treasuries when the US Dollar strengthens, as it did recently

Foreign official inst'ns buy less US Treasuries when yields are falling

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 6:50 PM

US Dollar is inverted in the chart above.

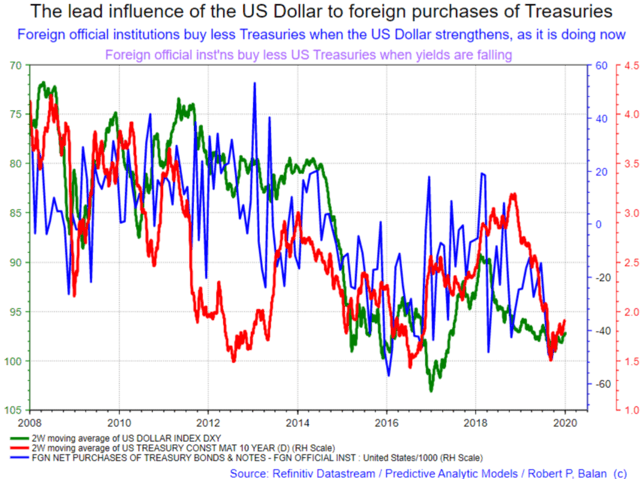

This is the behavior of central banks relative to the levels of the US Dollar (inverted) and 10yr yield (raw data, no change rate);see chart below.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 6:56 PM

With yield rising and the US Dollar (DXY) starting to show signs of weakening, foreign central banks should be coming back to buy US government paper again (at the long end). They have been recently buying mostly short end (like today) -- threatening to invert the yield curve, again.

User 12932881 @User.12932881Jan 2, 2020 6:58 PM

So if Fed is monetizing the largest ever federal budget this year, and bond yields don't spike, then be leveraged long equities because the PD's 'risk budget' will continue to grow causing equity grind higher. is it really that simple? hmmm?

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 7:00 PM

So many assumptions, uncorrelated ones: (1) "if Fed is monetizing the largest ever federal budget this year, and bond yields don't spike" -- why not? (2) "be leveraged long equities because the PD's 'risk budget' will continue to grow causing equity grind higher" -- what's the linkage?

User 12932881 @User.12932881Jan 2, 2020 7:01 PM

fair point

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 7:07 PM

"They have been recently buying mostly short end (like today) -- inverting the yield curve" -- N.B. -- the global central banks are not buying the global reflation theory being advanced by optimists.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 7:22 PM

Alright -- no one is asking the question, so I will ask it myself:

Question:

"Given the influence of the level of US Dollar and of US bond yields in influencing central bank purchases of US govies, and given also that purchases of US govies, once done, makes yields fall, and the US Dollar firmer -- what should be be true correlation of the US Dollar, and yields?"

User 12932881 @User.12932881Jan 2, 2020 7:28 PM

Isn't "Foreign and International Accounts" around 35B which is nothing compared to the 1.2T we're about to issue in 2020? I guess need to dig into treasury website and lookup the actual numbers

Robert P. Balan @robert.p.balanLeader

Jan 2, 2020 7:37 PM

Answer:

The broader correlation has been NEGATIVE, especially after QE started in November 2008. A flood of money tends to raise yields, and weaken the US Dollar due to to the Quantity Theory of Money. (I will ask that you look that up, so will know, if you don't know it yet).

And that loose relationship will "color" the way we should think about the DXY and yields in a broader sense (not on day to day). See chart below-.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 7:42 PM

User.12932881 -- You are absolutely correct. A significant amount of that 1.2T will be financed domestically, but foreign buyers as a whole would probably account for a third.

Robert P. Balan @robert.p.balanLeaderJan 2, 2020 7:49 PM

This is how the Fed "funds" Treasury purchases through the Primary Dealers "legally":

Helicopter Money Is Here: How The Fed Monetized Billions In Debt Sold Just Days Earlier

This is how the Fed monetized billions in T-Bills sold just days earlier by the US Treasury.

User 12932881 @User.12932881Jan 2, 2020 8:18 PM

Any idea how much markup the PD did in the example they show? now that would be interesting . . .

FlatCoated @flatcoatedJan 2, 2020 11:28 PM

robert.p.balan - RE: Quantity Theory of Money. Are we saying reflation is still on?

Robert P. Balan @robert.p.balanLeaderJan 3, 2020 7:05 AM

flatcoated --- that's a flood of money debasing the Dollar, but pushes up risk asset prices.

MARKETS CLOSED

Predictive Analytic Models (PAM) is the sole advisory service at SA which provides REAL-TIME trading execution, and investment analyses / commentaries.

Join us for a free, two-week trial today!

Please go here

Disclosure: I am/we are long bonds, euros.