Summary:

FOMC Day -- testing parameters provided by the liquidity models on tops; troughs. This is a chance to see how the models perform even as monetary policy is promulgated.

Models say yields and equities fall today; that presumably means it happens after the FOMC meeting. It may take until late NY trade for assets to get sorted out.

There is impending asset rotation presumably after the FOMC decision, but we believe the model inflection points will eventually prevail. Note the that most inflection points will occur next week.

The oil sub-sector is on the verge of collapsing. Crude, product and equity shares are impacted to a large degree by the trends in the net inventory withdrawals of crude and fuel oils. The aggregate demand has already keeled over, and EIA forecasts that it will probably fall until July.

Why not take a free two-week trial subscription, have a look at us and see if this community of veteran investors is a good fit for you?

Please go here

Robert P. Balan @robert.p.balan Leader May 1, 2019 3:01 PM

GOOD MORNING

Here is the Market Report At The Chat for May 1, 2019

Its FOMC decision and statement day. I will spare you what I believe will happen -- every Tom, Dick, and Harry and their dogs have it covered, so I will not add to the cacophony. Instead, I will do a presentation style exposition of the status of the liquidity models at this time. There are interesting dynamics that are going on with regards to the asset rotation and the lead and lags, and I thought that is important for us to know.

BOND YIELDS

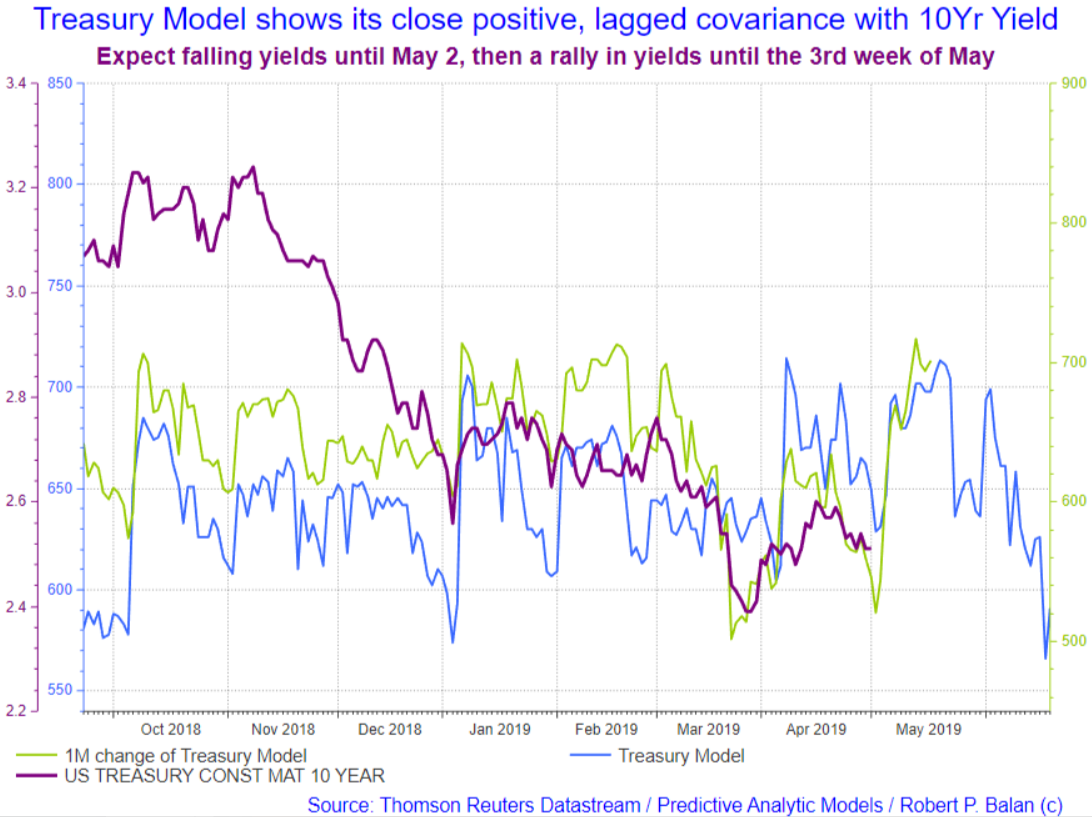

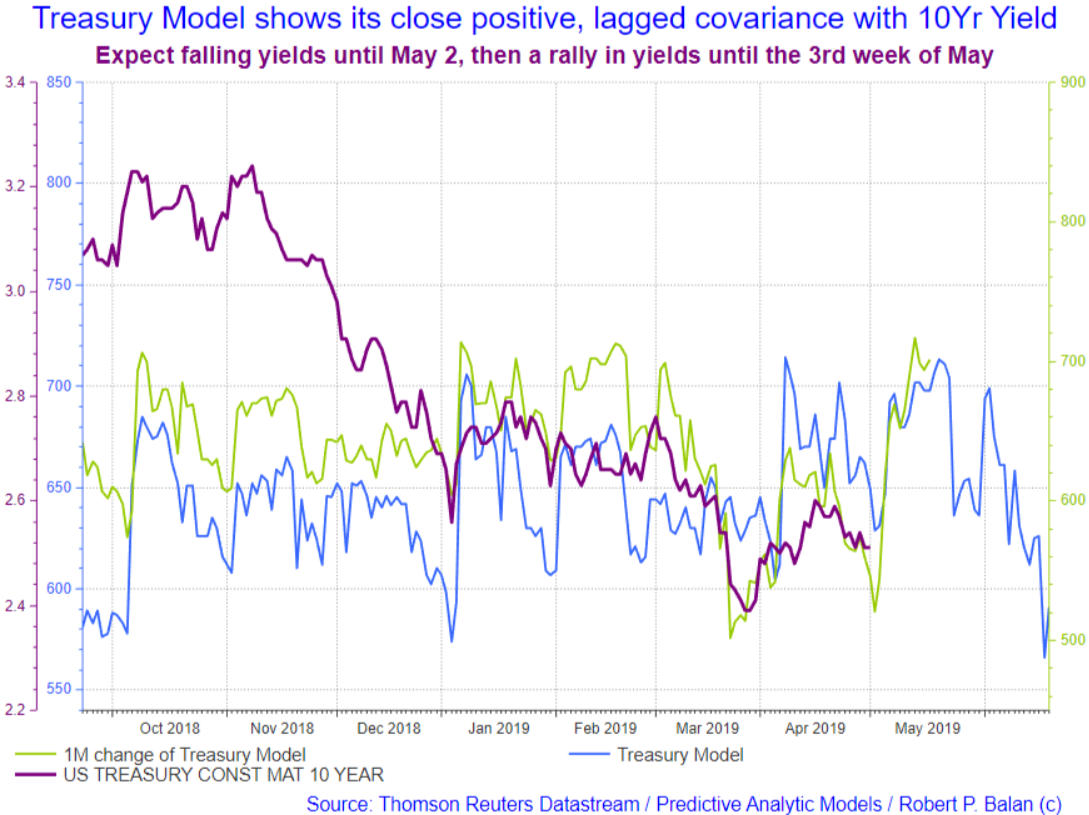

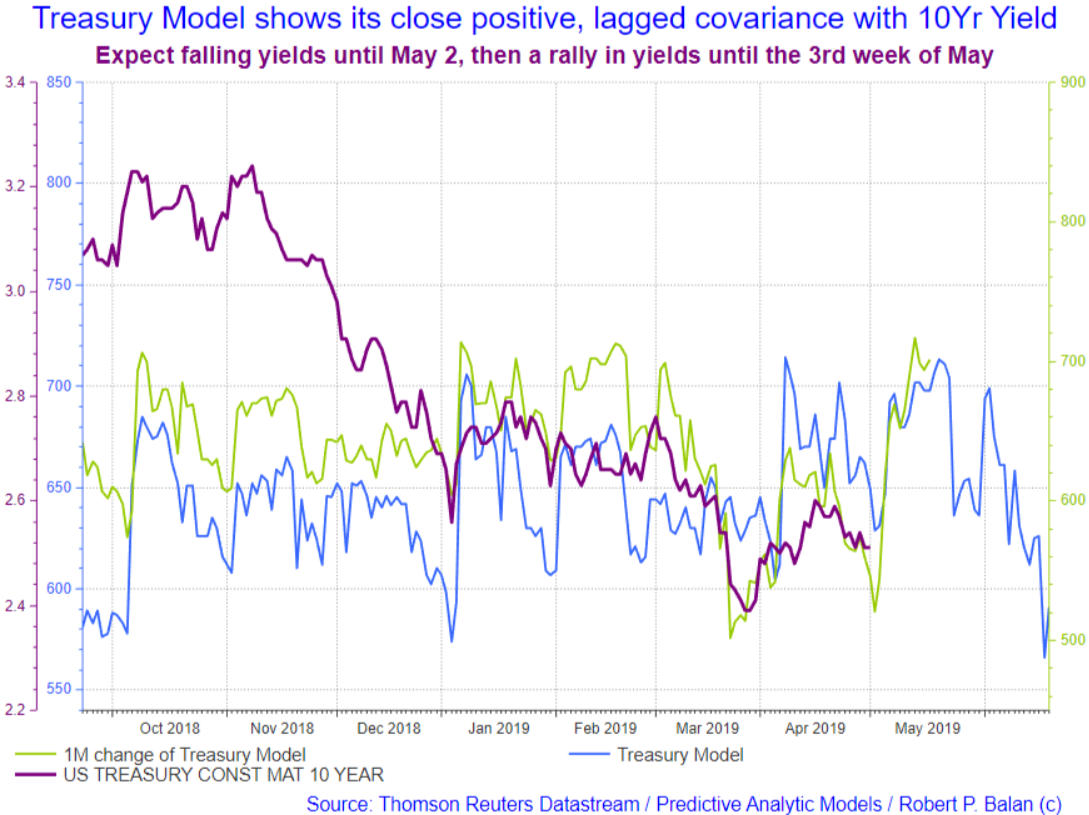

I start with yields. I have been refining the correlation between models and the US yields, and the results tell me yields should continue to fall today, and likely bottom tomorrow.

As we indicated before, yields should thereafter rise, probably with a high amplitude, and a top may be seem sometime in the 3rd week of May.

This is how Tim Kiser (my partner at PAM) and I envision the development in the 10 yr yield from here. We believe this outlook has good chances of happening.

PAM will look to exit the long bond positions tomorrow (or even as late as Monday), and then shift to shorting the bond bull ETFs, or buying the bear ETFs, depending on which instruments provide maximum leverage.

CURRENCIES

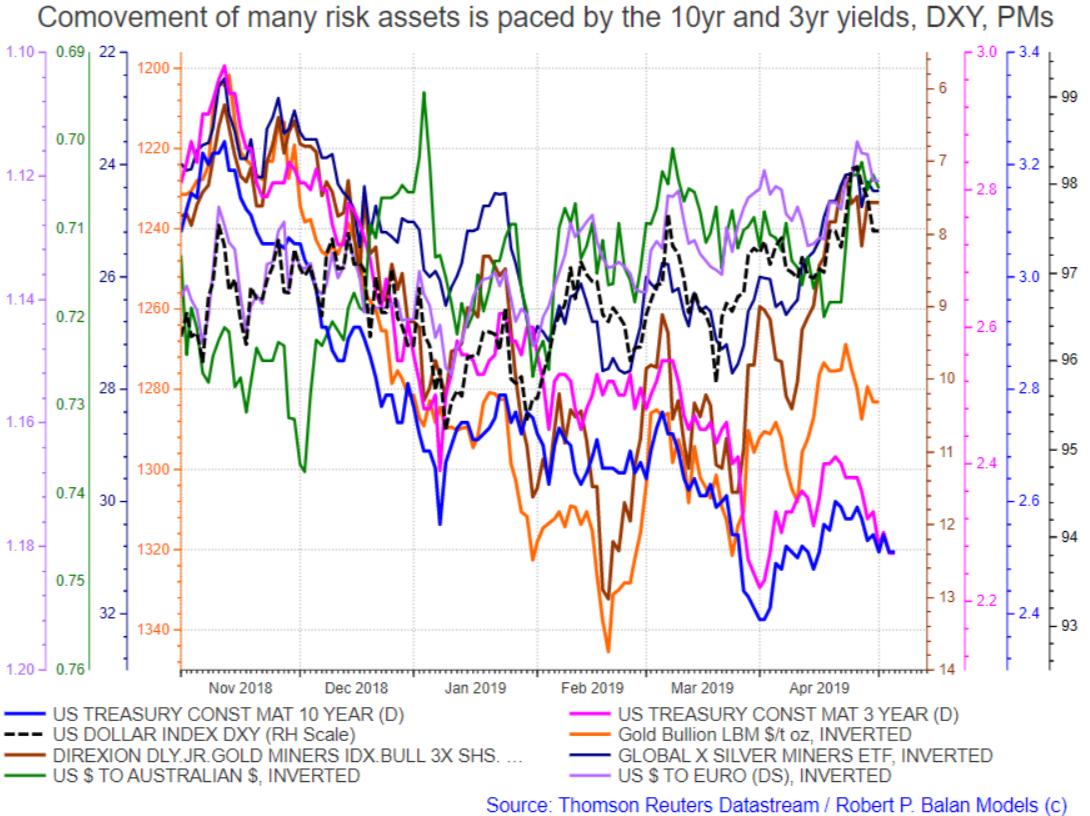

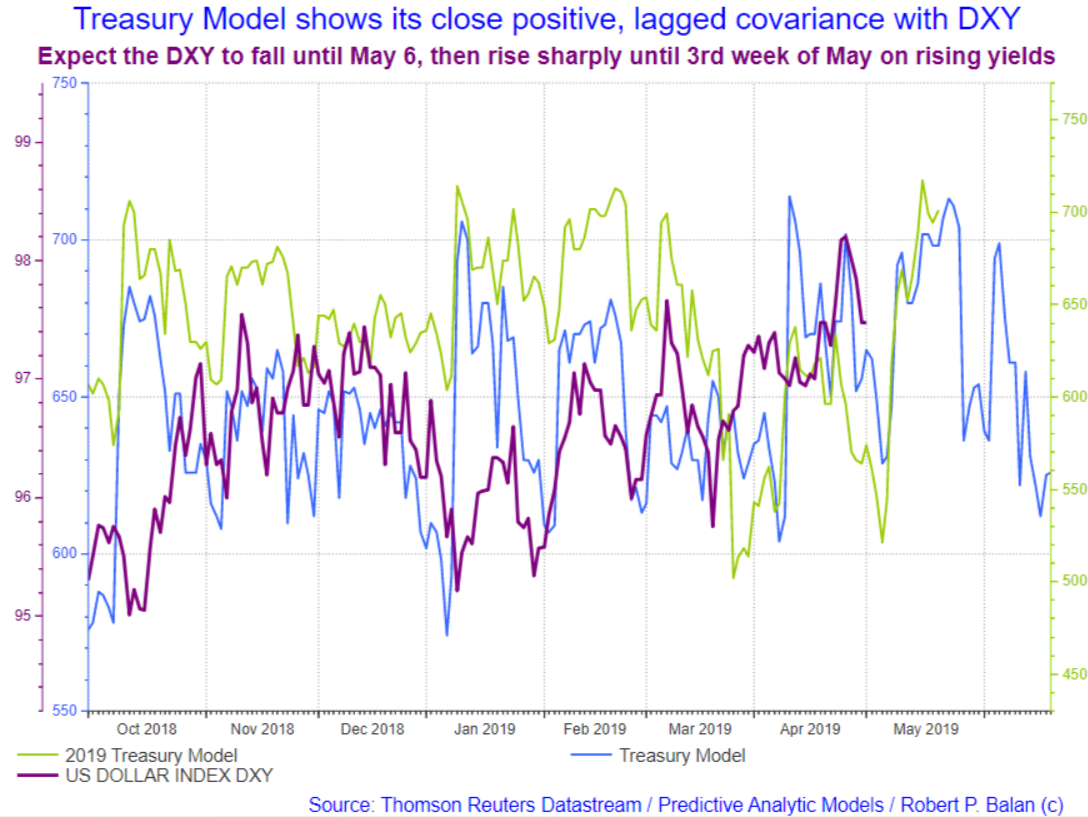

With the bond yield outlook provided, the DXY view should not be too complicated. The lagged, positive covariance model working again (now that DXY and yield are in a similar down phase), so we work off that relationships.

The liquidity models still call for falling DXY over the next few days, based on the lagged response of DXY to the recent decline in yields. This is how it looks like in the liquidity models.

A trough on May 6 then a sharp DXY recovery in the wake of rising yields.

PAM will wait until May 6 to exit short DXY trades, and then shift to the DXY upside, using maximum leverage.

Here is how Tim envisions the DXY fall, and I agree the rising trendline will be difficult to breach. Not too sure though if it will go as low as that.

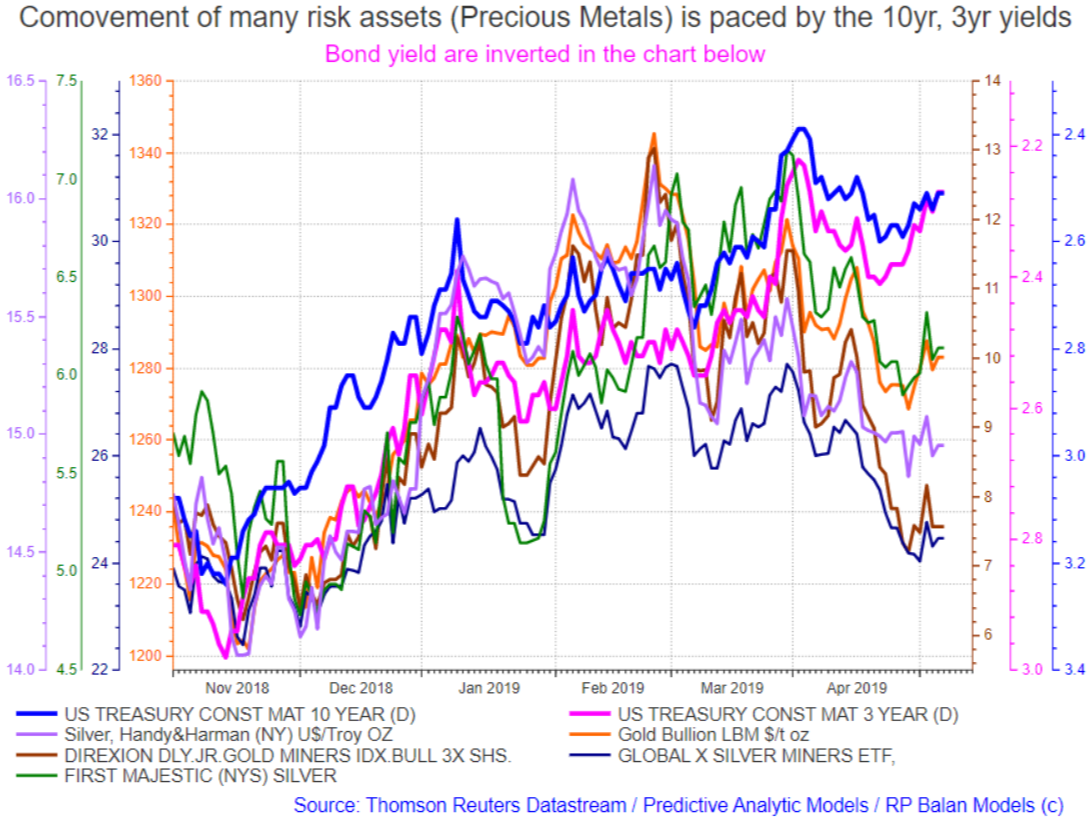

PRECIOUS METALS

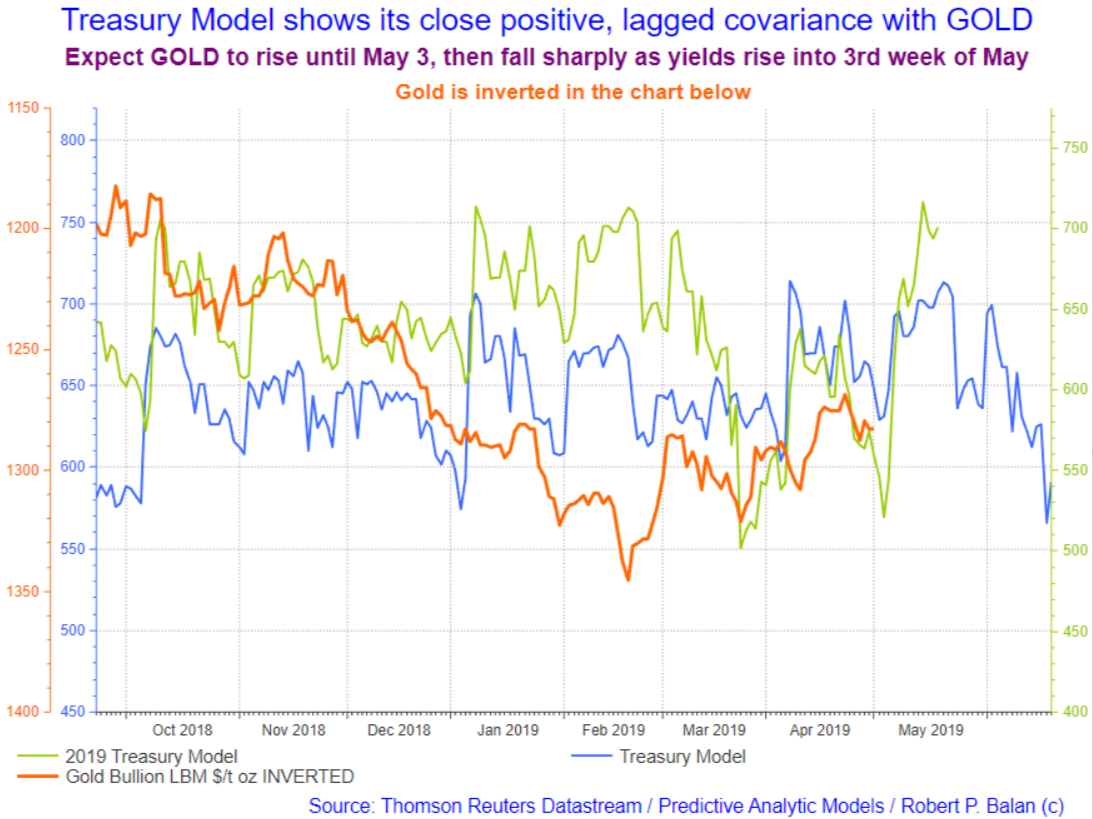

Lower gold, and yields still falling another day or so -- Gold should perform well under those conditions.

A top on circa May 3, followed thereafter however by a massive de-rating of the Precious Metals, due to forecast surge of DXY and sharply rising yields. The lagged negative covariance between yields and gold is operative again. So falling yields for another day or so will likely translate into a rising precious metals.

We will schedule the exit of Long PM positions on May 3, but we will first see what happens to the DXY. However, it is unlikely that any PM outperformance will go beyond a day after May 3 -- it is just a matter of a global view which includes the actual performance of yields at that time, and whether the DXY is still falling or not.

With the yields lower and DXY weaker, the PMs are in a silly situation of underperfoming their potential. But Gold tends to do this sometimes, and hopefully if can get going before it runs out of time.

EQUITIES

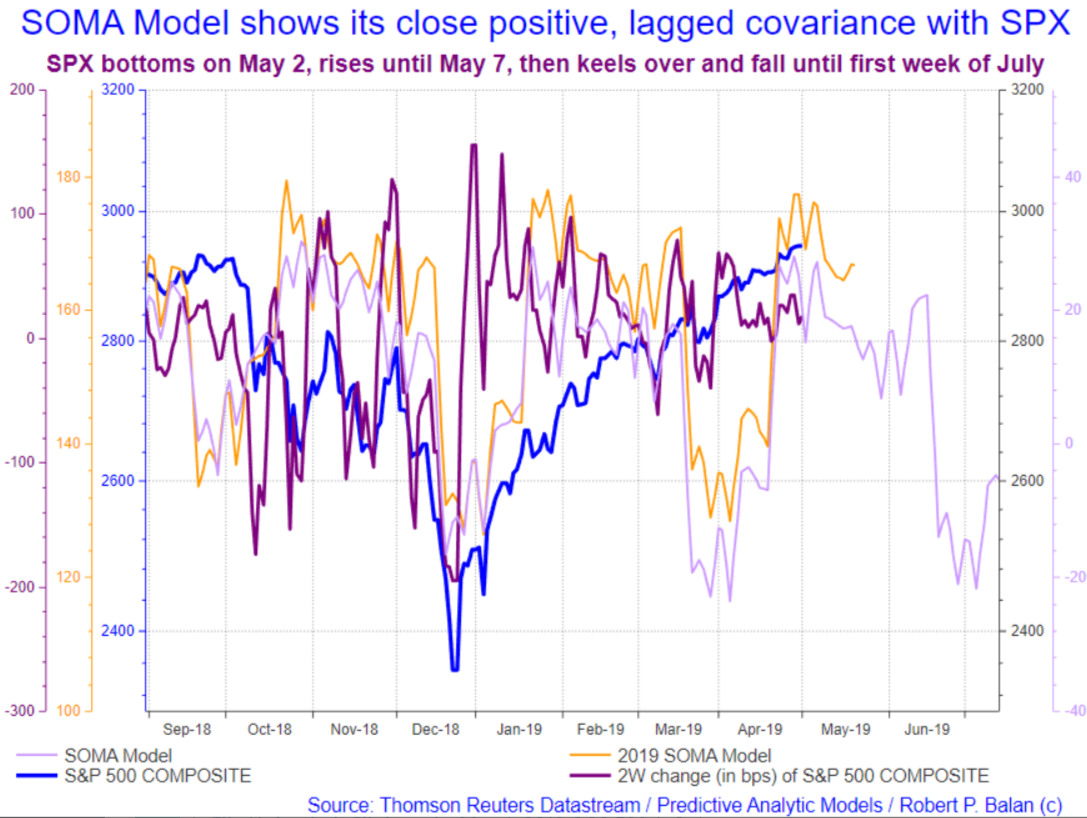

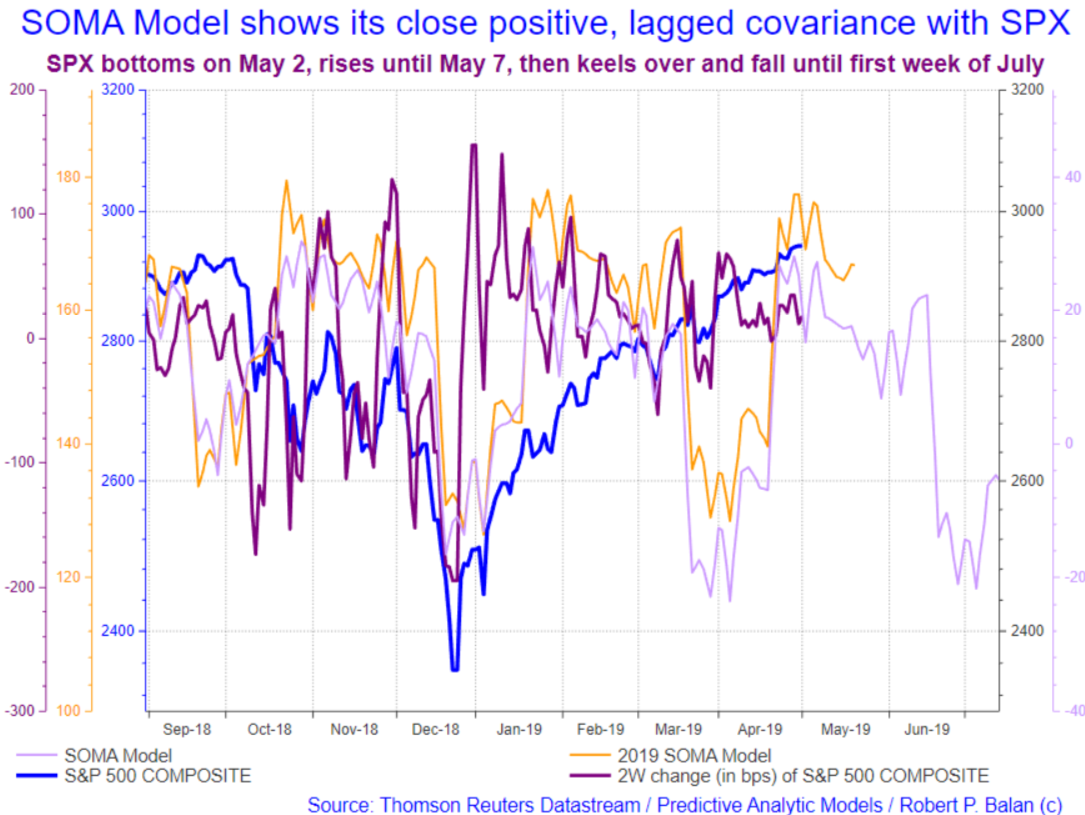

And that brings us to the equities. We have looked at the situation again, and Tim's opinion is that we can not be equivocal with the stock market analysis. We have to live or die by our tools, that is what he believes.

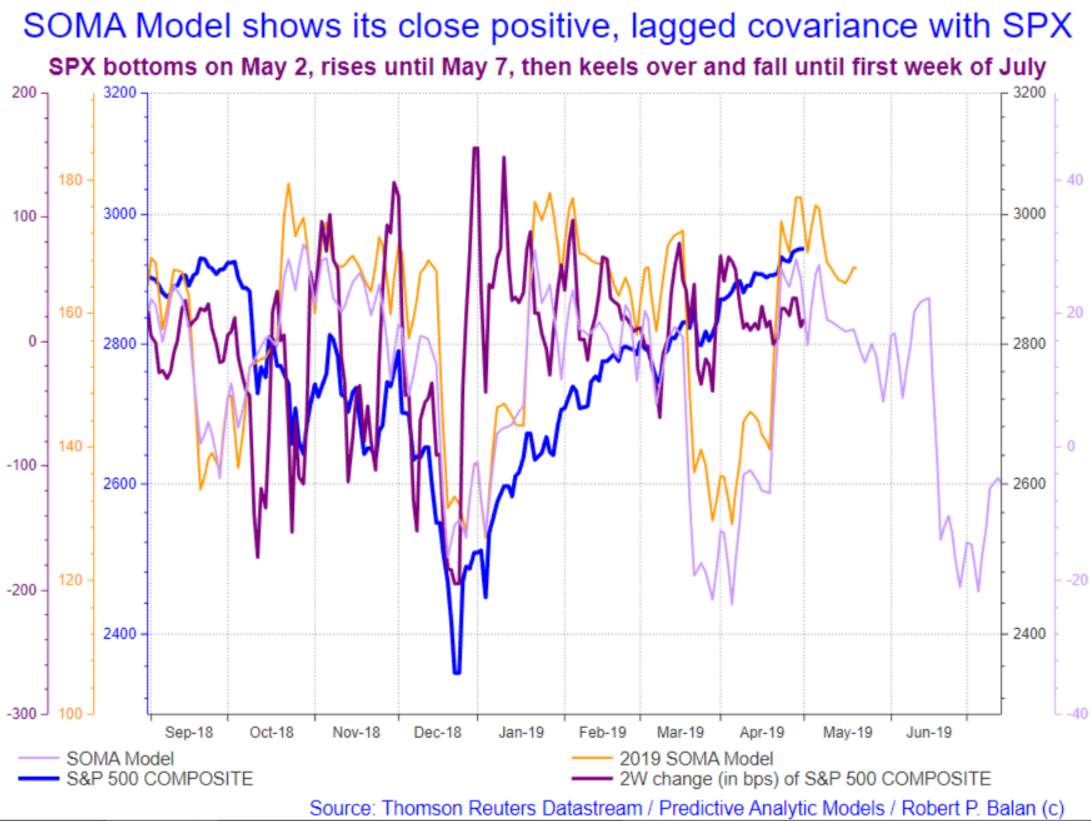

And the tool we decided to go with in the equity analysis is the SOMA model. To refresh memories, we said that the Treasury model is superb in correlating with yields (and therefore the DXY and Gold), but has less stellar R>2 with equities. The SOMA Model (after accounting for the the negative drag from banks' reserve balances) has actually correlated a lot better with equities. We stopped trying to shoehorn the SPX to the Treasury Model and developed a bespoke version of the SOMA Model. The result is what I show below.

I ran this model through to early 2009, and it looked good. Why 2009? The financial world changed dramatically after the central banks implemented QE and its LSAPs, causing Monetary Bases across the globe to balloon. Pre-2009 is distinctly Jurassic compared to the conditions that we have after the advent of QE programs.

The new model suggests that we could see a fall in equities until tomorrow, but after that there might be a final rally until May 6.

Whether or not we make a new high, or that final rally is a wave 2 type of correction is not known yet. But if I look at the EWP schemas that should fit the projection of the new model, these are what I get.

SPX

DOW

Therefore, it makes sense to anticipate that a run up from May 2 to May 6 may indeed make new highs on some of the indexes with higher momentum. Those with lower momentum may merely have Wave 2 type of corrections.

CRUDE OIL

In the oil subsector, we also started creating trading tools for E&Ps and products.. Some of those I have shown late yesterday.

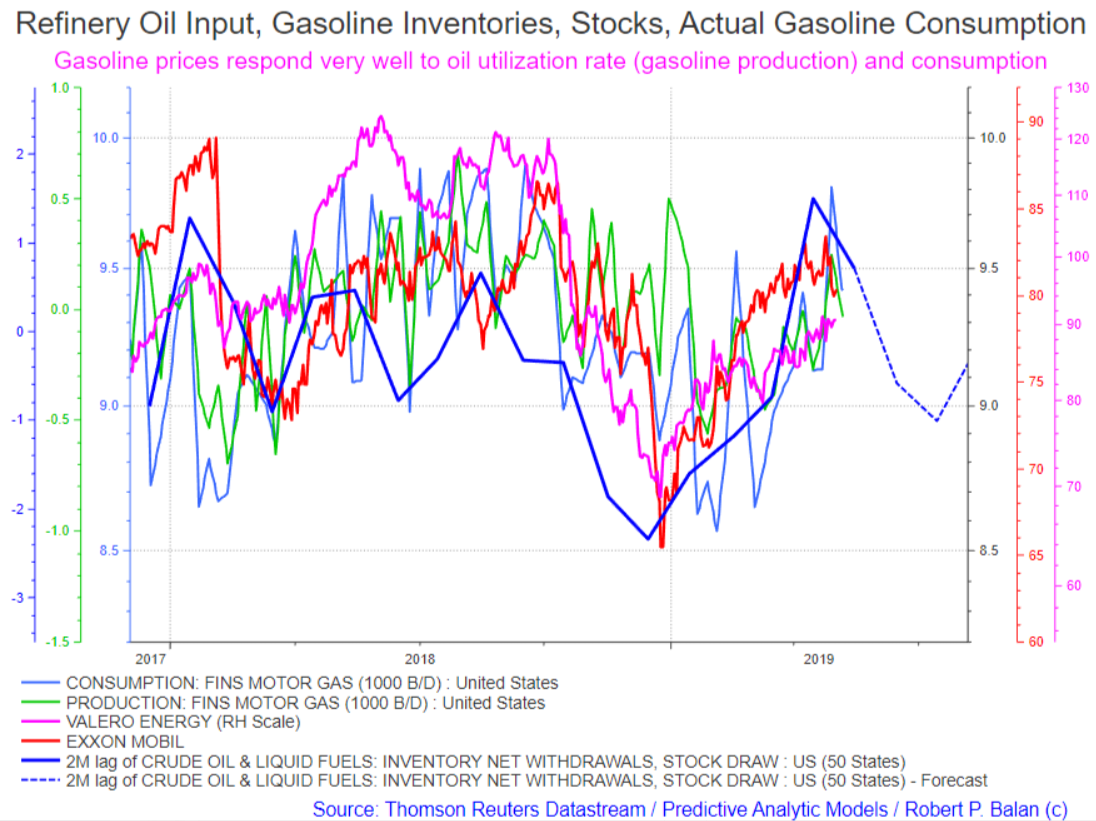

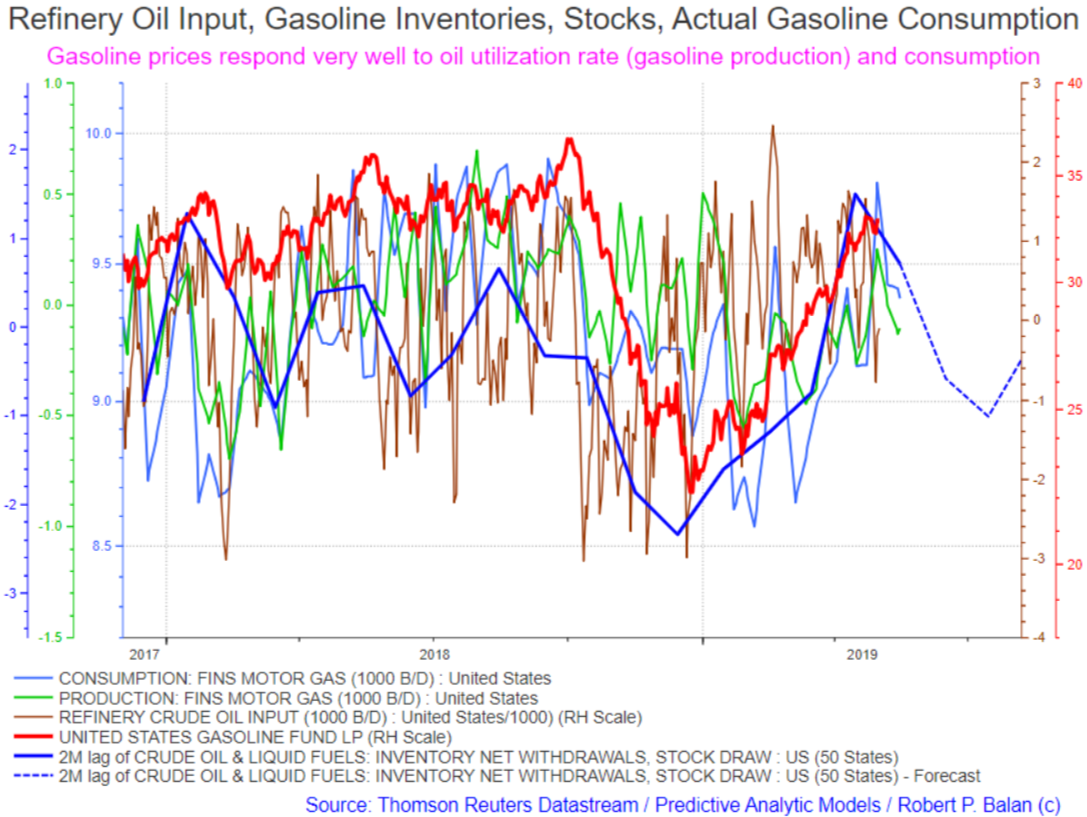

The oil sub-sector in on the verge of collapsing. The equity shares of refiners are impacted to a large degree by the trends in the net inventory withdrawals of crude and fuel oils. The aggregate demand has already keeled over, and EIA forecasts that it will probably fall until July. The building blocks of that aggregate demand are product (proxy: gasoline) consumption, and stock usage in connection with gasoline production. The shares of the refiners are very sensitive to the the fluctuations of these two factors. And those factors, in turn, are governed by the cyclical trends in aggregate demand

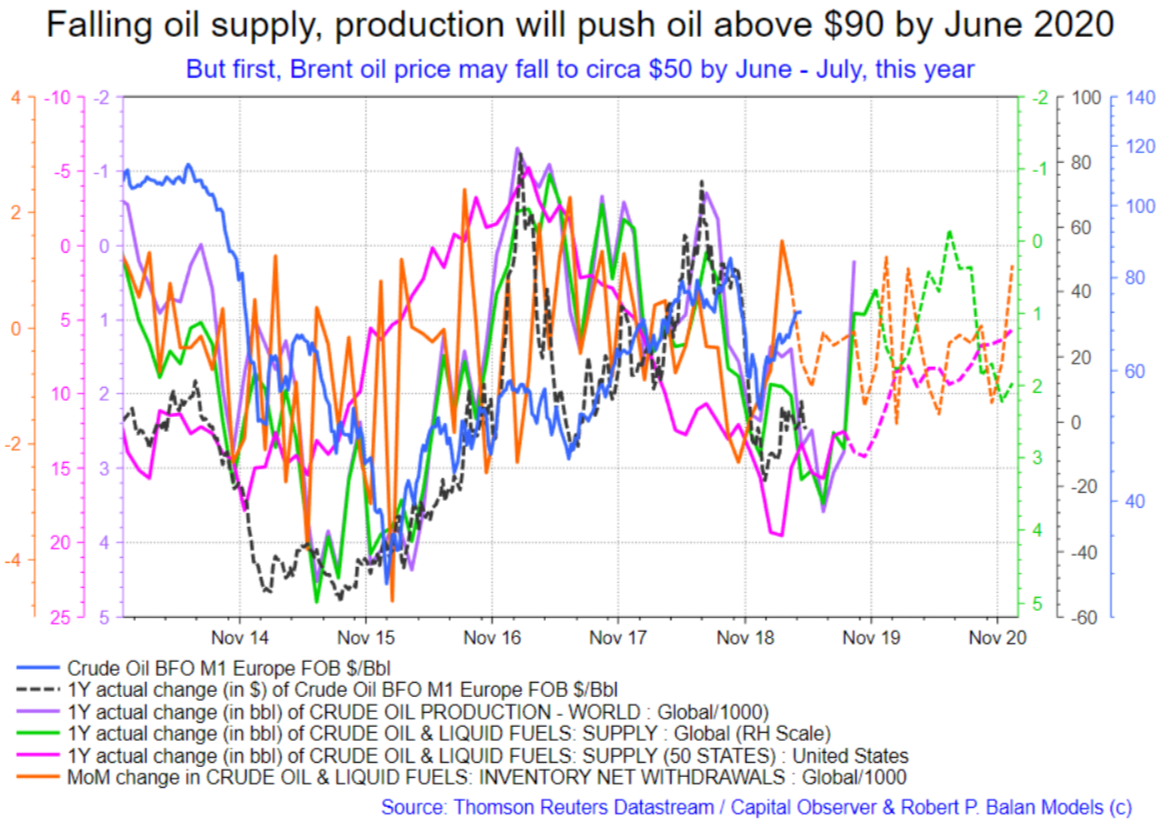

This outlook of oil equities weakening into July is a familiar refrain in the general schematics of global oil demand relative to output and supply (see chart below). We have shown this chart before -- it guides our thinking, and has become out template for at least $90.00/bbl oil price by mid-2020. But first, Brent oil may have to fall to $50.00/bbl by June-July this year.

On a global scale, demand is also falling and the full impact of the OPEC and NOPEC output cut will kick-in in full only by late June - early July. That is underlined b the fact that oil and fuel demand have already peaked since February in the US (see chart below).

PAM looks to sell another tranche of UGA, but we will time it for later in the week or even Monday. If we do get a new rally in equities as from tomorrow, then it is likely that we could see some upside move in UGA. That we want to sell. See chart below.

We also have interest in selling COP and PSX -- stocks with very weak momentum.

As for the oil ETFs, if we see a brief equity weakness, the ETFs should also continue to fall. Tim is considering lifting the shorts if we see more downside scope today and tomorrow. If the broad equity indices make new highs (or at least make wave 2 types), the ETFs may also benefit, so we shall see. Most likely we will cover the shorts, although that decisions is driven by the stock market outlook.

COPPER

Goodness me -- copper could not wait -- the second wave I was expecting to go slightly higher did not. So I hope someone saw and made a move to sell. Copper will probably keep getting lower an lower.

PAM will just wait for an opportunity to sell in a pullback. If the DXY does rise as much as we believe, and yields do rise by the magnitude implied by the models, Copper will get hammered.

RM13 @RM13 May 1, 2019 5:12 PM

Good morn.. Why GDP number was overstated - basically delayed fuel price reporting' - The Curious Case Of Rising Fuel Prices And Shrinking Inflation

The Curious Case Of Rising Fuel Prices And Shrinking Inflation

With a good amount of digging through the BEA website, we learned that despite the substantial rise in the price of oil and gasoline in the first quarter, the BEA actually reported a decline in fuel prices...

END OF MARKET REPORT

OPEN TO DISCUSSIONS.

RM13 @RM13 May 1, 2019 5:27 PM

Robert P. Balan Who has filled in that 'liquidity gap' in late March and April, that's what I want to know:)

FlatCoated @flatcoated

May 1, 2019 7:12 PM

RM13 PMs I've asked say "all of Europe."

RM13 May 1, 2019 5:27 PM

@robert.p.balan Who has filled in that 'liquidity gap' in late March and April, that's what I want to know:)

Alpha James @Alpha.James May 1, 2019 8:03 PM

Robert...... what is your timing on USLV? I've added the position on both calls to purchase. I'm a bit surprised to see the 4% drop today.

Robert P. Balan @robert.p.balan Leader May 1, 2019 8:17 PM

Alpha James AJ -- Everything is a go for the PMs -- falling yields and a weak Dollar. Gold is starting to wake up, but SLV fell, for no visible reason (to me).

wc.happy @wc.happy May 1, 2019 9:06 PM

Is it time to short bonds or wait till Monday? Friday is a big day apparently

JdEFP @jdefp May 1, 2019 9:19 PM

Robert P. Balan - Does the reducing of QT ... or QT at all for that matter, play into your SOMA model?

Robert P. Balan @robert.p.balan Leader May 1, 2019 9:36 PM

wc.happy we are doing the 4th of wave 5 wc.happy, we should see still lower yields tomorrow., even by Monday.

wc.happy May 1, 2019 9:06 PM

Is it time to short bonds or wait till Monday? Friday is a big day apparently

We may see the low in yields tomorrow, but there is also a case for Monday.

JdEFP - The Fed balance sheet is better tracked through the NY Fed's OMO operations in "servicing" the Monetary Base. The Fed' balance sheet is part of the Monetary Base. But as I explained previously, I had to adjust for the negative impact of the banks' reserves. So yes, QT or QE is part of the SOMA liquidity flow.

This equity sell-off continues until tomorrow (Thursday). That is when we expect a brief stock market recovery to start (see chart below), in conjunction with a rise in yields (see the bottom chart).

SPX

10yr yield

MARKETS CLOSED

Predictive Analytic Models (PAM) provides REAL-TIME trading advice and strategies using guidance from US Treasury, Federal Reserve and term market money flows. PAM also provides LIVE modeled tools to subscribers in trading equities, bonds, currencies, gold and oil -- assets impacted by ebb and flow of systemic money. Sophisticated LIVE models to trade and invest in the oil sector are provided as well. PAM's veteran investors and seasoned traders can use PAM's proprietary tools 24X7 via PAM's SA service portal.

Try us for two-weeks, free. Please go here