- Current rebalance date is September 20th, 2019. The last rebalance date was August 16th, 2019.

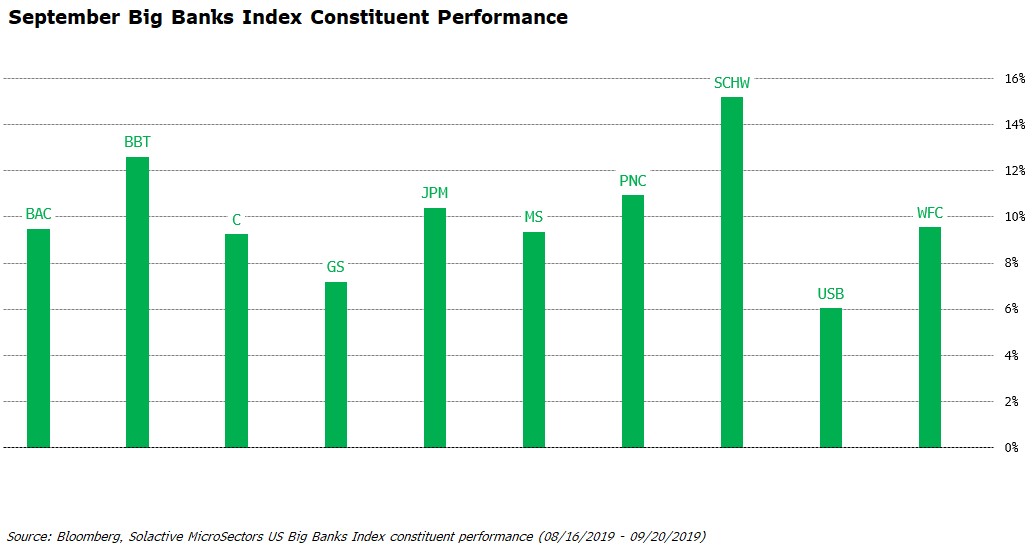

- The best performers within the index since the last rebalance date were Charles Schwab (SCHW), BB&T (BBT), and PNC Financial Services (PNC).

- The worst performers within the index since the last rebalance date were US Bancorp (USB), Goldman Sachs (GS), and Citigroup (C).

- Solactive MicroSectors US Big Banks Index return since the last rebalance is 10.13%.

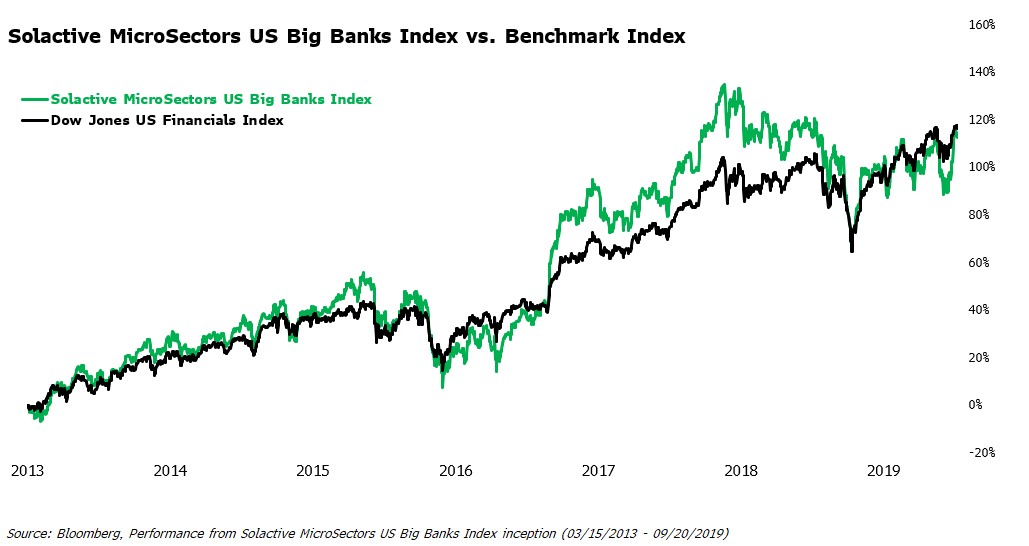

- Solactive MicroSectors US Big Banks Index return year to date is 21.02%.

- Solactive MicroSectors US Big Banks Index return since inception is 112.60%.

Big Banks Spotlight

- Big Banks Index constituent performance since the index last rebalanced after the close August 16th, 2019

- The Big Banks Index vs. the Dow Jones US Financials Index historical total return performance

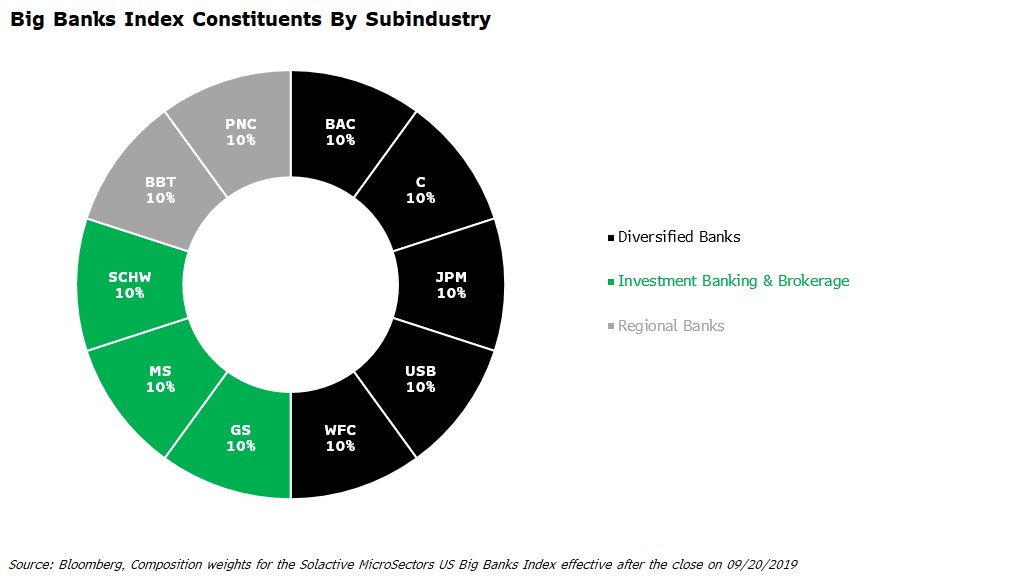

Solactive MicroSectors US Big Banks Index Weightings

- The holdings and weights for the Big Banks Index as of the close on September 20th, 2019

- The Solactive US Big Banks Index rebalances to equal weight effective after the close of the third Friday of every month.

- On the first business day of each month the index constituents are reevaluated for possible replacement in the index.

What is the Solactive MicroSectors US Big Banks Index?

The Solactive MicroSectors U.S. Big Banks Index includes 10 highly liquid stocks that represent industry leaders across today’s U.S. banking sector. The index’s underlying composition is equally weighted across all stocks, providing a unique performance benchmark that allows for a value-driven approach to investing. While the performance of indices weighted by market capitalization can be dominated by a few of the largest stocks, an equal-weighting allows for a more diversified portfolio.

Disclaimer

Source: Bloomberg L.P. Solactive MicroSectors™ U.S. Big Banks Index was launched on 2/25/2019. The Solactive MicroSectors™ U.S. Big Banks Index data prior to that date is hypothetical and reflects the application of the index methodology in hindsight. The hypothetical data cannot completely account for the impact of financial risk in actual trading. Past historical or hypothetical data is not a guarantee of future index performance.

For Institutional use only, this is not intended for retail investors, public viewing or distribution.

Past performance is no guarantee of future returns. The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. All third party links are not sponsored, endorsed, or provided by REX Shares, LLC. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use.

Investing involves risk, including the loss of principal. Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment. The performance of any index herein is not illustrative of the performance of any security.

The Index has limited actual historical information. The Index Calculation Agent may adjust the Index in a way that may affect its level, and may, in its sole discretion, discontinue the public disclosure of the intraday Index value and the end-of-day closing value of the Index. The Index lacks diversification and is vulnerable to fluctuations in the technology and consumer discretionary industries. A limited number of Index constituents may affect the Index Closing Level, and the Index is not necessarily representative of its focus industry. An Index constituent may be replaced upon the occurrence of certain adverse events. The Index uses a proprietary selection methodology, which may not select the constituent issuers in the same manner as would other index providers or market participants.

MicroSectors™ is a registered trademark of REX Shares, LLC (“REX”).

Solactive AG (“Solactive”), as the Index Calculation Agent (as defined in the applicable pricing supplement), may adjust the Index in a way that may affect its level, and may, in its sole discretion, discontinue the public disclosure of the intraday Index value and the end-of-day closing value of the Index. The Index lacks diversification and is vulnerable to fluctuations in the applicable sector. A limited number of Index constituents may affect the Index Closing Level, and the Index is not necessarily representative of its focus industry. An Index constituent may be replaced upon the occurrence of certain adverse events.

Solactive AG (“Solactive”) is the licensor of the Solactive MicroSectors™ U.S. Big Banks Index and the Solactive MicroSectors™ U.S. Big Oil Index. Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the quality, accuracy and/or completeness of the Index; and/or (b) the results obtained or to be obtained by any person or entity from the use of the Index. Solactive does not guarantee the accuracy and/or the completeness of the Index and shall not have any liability for any errors or omissions with respect thereto. Notwithstanding Solactive’s obligations to its licensees, Solactive reserves the right to change the methods of calculation or publication of the Index, and Solactive shall not be liable for any miscalculation of or any incorrect, delayed or interrupted publication with respect to the Index. Solactive shall not be liable for any damages, including, without limitation, any loss of profits or business, or any special, incidental, punitive, indirect or consequential damages suffered or incurred as a result of the use (or inability to use) of the Index.