With the growing interest in VIX and VIX related products, we have seen significant interest and questions regarding our VIX ETFs.To be clear, we do not try to predict future VIX values, as we offer funds to provide either long or short exposure.However, we do feel a duty to educate.Educate on volatility, on VIX weekly & monthly futures, structurally on how our funds work and how they are different from other VIX ETPs.We regularly receive some version of the below three questions from investors and traders that are kicking the tires on our funds. In addition, we’d like to highlight a recent interview with our CEO/Founder, Greg King, by Cynthia Murphy from ETF.com reviewing Greg’s deep history in this space and how Vol products are being utilized:http://bit.ly/2h8jOQR

How are your funds structured?Are they ETNs/Do they kick off K-1’s?Are they really ‘40 Act Funds?

The VolMAXX Funds (both VMIN & VMAX) intend to qualify as “regulated investment companies” and are structured as ETFs, as defined in the Investment Company Act of 1940. Regulated investment companies are pooled investment vehicles that are managed by an investment advisor and are not subject to entity-level taxation. The Funds will not be structured as publically traded partnerships and will not distribute K-1s.They are not issued by a bank and therefore are not subject to credit risk like an ETN issuer is.

How do the weekly VIX Futures differ from the monthly VIX Futures?What is the benefit to holding them in your funds?How and why is your duration lower than all other VIX ETPS?

Prior to July 23, 2015, VIX futures contracts were listed such that one futures contract tracking the VIX index expired each month. Beginning on July 23, 2015, the CBOE Futures Exchange (CFE®) began listing VIX futures contracts with additional expiration dates, such that one VIX futures contract would expire each week. These VIX futures contracts with weekly expirations supplement the VIX futures contracts with monthly expirations.Our funds invest primarily in VIX Futures Contracts with less than one month to expiration.In general, futures contracts converge to the spot price of the asset or index they track as they near expiration. Research by the CBOE has demonstrated that VIX contracts which have shorter terms to expiry have historically exhibited a closer relationship to the level of spot VIX than contracts with a longer term to expiry. Information on this relationship is available at http://www.cboe.com/micro/vix-weeklys/.

What is duration?What is the duration of your funds?How can I follow this?

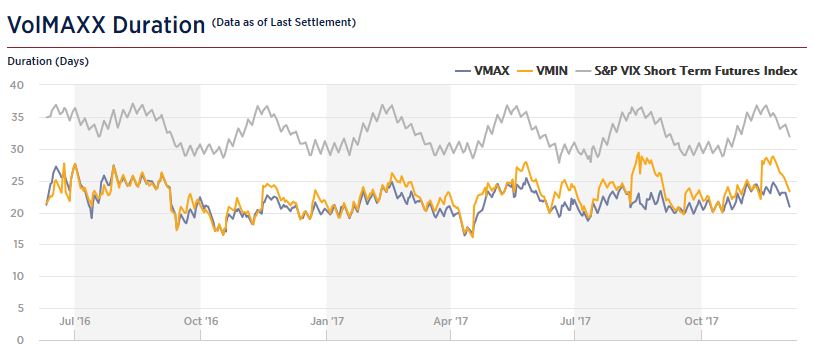

When we discuss “duration” for VIX products, we are talking about the average time to expiration for the VIX futures contracts that are included in the product. Our funds expect to invest primarily in VIX Futures Contracts with less than one month to expiration (i.e. duration less than 30 days). The funds’ duration, as well as the duration of the benchmark VIX futures index and a detailed explanation of the calculation, are all available at www.volmaxx.com. We’ve also included the most recent graph of this duration below. If you are interested in seeing duration and the futures curve, you can follow us on Twitter @REXShares where we post this information daily.

Carefully consider the Funds’ investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Funds’ prospectus, which may be obtained by calling 1-844-REX-1414. Read the prospectus carefully before investing.

Investing involves risk, including the possible loss of principal. These Funds are actively managed and there are no guarantees investments selected and strategies employed will achieve the intended results. Active management may also increase transaction costs. The Funds expect to invest primarily in VIX futures contracts, which are considered commodities.

The use of derivatives, such as futures contracts, swap agreements and options, presents risks different from, and possibly greater than, the risks associated with investing directly in traditional securities.

The VIX Index is not directly investable. The settlement price of a VIX Futures Contract is based on the calculation that determines the level of the VIX Index. As a result, the behavior of a VIX Futures Contract may be different from traditional futures contracts whose settlement price is based on a specific tradable asset.

The Funds are non-diversified.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. VolMAXX NAVs are calculated using prices as of 4:00 PM Eastern Time. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange.

The CBOE Volatility Index (the “VIX”) is a product of S&P Dow Jones Indices LLC (“SPDJI”) and is based on the CBOE VIX methodology, which is the property of Chicago Board Options Exchange (“CBOE”), and has been licensed for use by REX Shares, LLC (“Licensee”), the sponsor of the REX VolMAXX™ Long VIX Weekly Futures Strategy ETF and REX VolMAXX™ Short VIX Weekly Futures Strategy ETF. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); CBOE® and VIX® are registered trademarks of the CBOE. The CBOE VIX methodology and the trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Licensee. The REX VolMAXX™ Long VIX Weekly Futures Strategy ETF and REX VolMAXX™ Short VIX Weekly Futures Strategy ETF are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, or CBOE and none of such parties make any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the Index.

Exchange Traded Concepts, LLC serves as the investment advisor and Vident Investment Advisory serves as sub advisor to the fund. The Funds are distributed by SEI Investments Distribution Co., which is not affiliated with Exchange Traded Concepts, LLC or any of its affiliates.