We want to share with you a trade that was a homerun, netting 20% in 2 days. But we also see MORE upside. This is what we do at BAD BEAT Investing, and there are now 5 spots left before prices increase to $100 a month. Free trials will also END this month. Act now. Why? You are missing out.

Today we are going to discuss a company many of you probably are not familiar with. It has been one that we have done business with as a firm a while back, but who's stock has been on our radar for some time. We are talking about NV5 (NVEE). Have you heard of them? Well if you have don't make a liar out of us ;-) We are intrigued by a company that has a total addressable market for their various services of over $3.5 trillion, that few have heard of. They have their hands in a lot of sectors:

That said, we are sure this is a company you are not overly familiar with. Basically this is in our opinion an under the radar infrastructure consulting firm. There are only 5 analysts who follow the company. This isn't because there is anything wrong with the company. It is not some kind of dollar or penny stock. But we know that little coverage is likely because big investment banks cannot buy huge stakes in the company for clients without drastically increasing share price due to current trading liquidity. Just part of the game.

So what does this company do?

Well we mentioned it is a consulting firm. And it focuses on infrastructure. But what does that mean exactly?

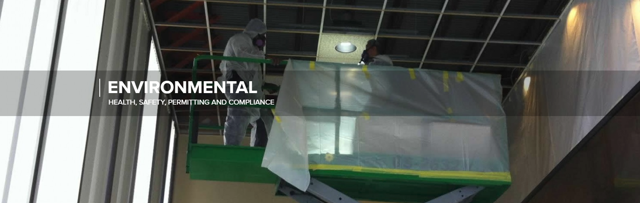

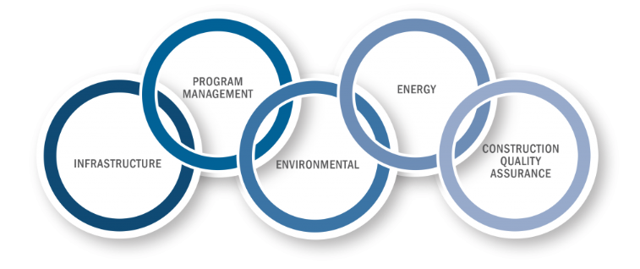

Well NV5 is involved in not just servicing clients in infrastructure, but also offers technical engineering planning for energy, construction, real estate, and environmental markets.

More specifically, the company offers site selection and planning, design, water resources, transportation, structural engineering, land development, surveying, power delivery, building code compliance, and other services.

It also is engaged in construction materials testing and engineering, geotechnical engineering and consulting, and forensic consulting services. It does most of its business in the United States, but does do a bit internationally. The company has two large segments: Building, Technology, & Sciences segments and the Infrastructure division.

All of these combine to form one interactive company that works within and between services to help shape many communities and industries with which they contract. The business model is high demand, and NV5 has been very successful

Despite being involved in designing and building communities all over the place, its flies under the radar. One would not think this is a leading provider of professional and technical engineering and consulting solutions with over a 70-year history. The company has over 100 offices worldwide and more than 2,000 employees.

Education at a substantial discount

Now that you have a basic understanding of what it does, now that it is on a mission for sustainable design of the communities it services across each of the segments and many services it offers. Going forward, as the world modernizes, connects, and becomes more urbanized, firms like NV5 are working behind the scenes to make a huge difference.

So why is it catching our eye?

The stock is on our radar today because we have had it on our watchlist for a long time. But today shares are down nearly 30%, and it is time to bring this to the attention of the BAD BEAT community because we believe the selloff is overdone, and that we have a chance to acquire shares in a wonderful company at a more than fair price. This should appeal both to our traders and our long-term investors who work with us here at BAD BEAT. Take a look at the one-year chart:

John was kind enough to mark up a simple chart highlighting our zones of interest. We believe the stock is already in a BAD BEAT zone and fast approaching a support line of $54.30. We think you can enter now, and again lower should you choose, given that after a big move like this we could see a bit more volatility next week.

The play

Target entry 1: $51-$52

Target exit: 63+ short-term, 80+ medium-term

Stop loss: $44-$45 depending on entries and risk tolerance

Why are shares cratering?

Long story short, shares are cratering because the market did not like earnings growth guidance that was in the teens and was below analysts consensus of about $3.85 for 2019 EPS. Fine. Other investors' losses are our gains. That's how we roll. Let's discuss more.

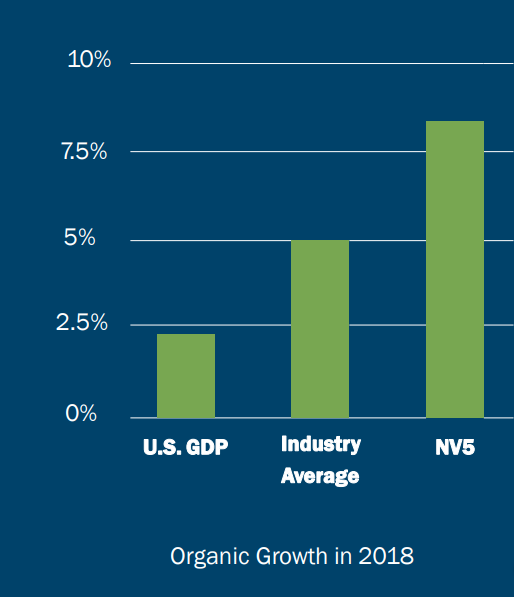

In the most recent quarter, total revenues were $116.1 million, an increase of 22% year-over-year. Organic revenue growth for the quarter was 5%. Organic growth is measured by internal growth of the existing business plus growth from acquisitions from the time of acquisition. Organic revenue growth far outpaces the industry.

We were pleased with EBITDA for the quarter. EBITDA for the quarter was $15.8 million an increase of 34% from $11.8 million in the fourth quarter of 2017. Net Income for the quarter was $7.7 million. Adjusted EPS for the quarter was $0.91 per diluted share. Excluding the impact of the 2017 Tax Reform, Adjusted EPS increased 28% from $0.71 per share in the fourth quarter of 2017. Adjusted EPS, including the impact of the 2017 Tax Reform, was $1.26 per diluted share in the fourth quarter of 2017.

What about for the year? Well, 2018 total revenues were $422.1 million, an increase of 25% from 2017's $337.5 million. Organic revenue growth for 2018 was 8%. EBITDA for 2018 was $53.1 million an increase of 34% from $39.7 million 2017. Net Income was $26.9 million in 2018. Adjusted EPS for 2018 was $3.24 per diluted share.

Cash flow from operating activities increased $17.4 million, or 99% to $35.0 million in 2018 compared to $17.6 million in 2017.

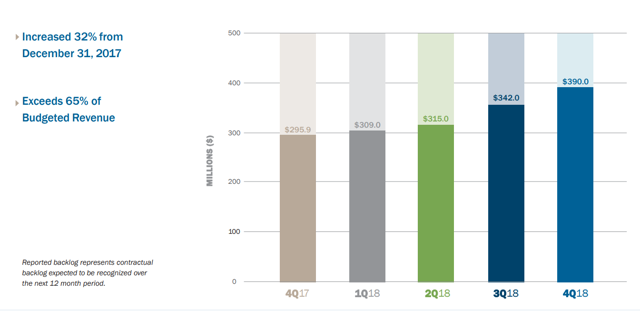

Overall backlog grew. Backlog was $390 million as of December 29, 2018, a 32% increase from $296 million as of December 30, 2017.

This was a stellar quarter and year.

Looking ahead - Strategy and Risks

We believe the company should continue to try and pick off smaller competitors. The consulting market is very competitive with over 100,000 firms in this space. Many are small or boutique style shops. The overall market is highly fragmented thus creating a large opportunity for firms like NV5 to continue and buy up smaller shops and integrate them quickly. Management in the past has focused on small companies who can easily be integrated. This strategy decreases acquisition risks, integration costs, and customer experience. As we move forward, here is the key comment on the conference call that stands out:

"So look for acquisitions that are more subscription reoccurring revenue, acquisitions that will enhance the specific platforms that we have, where we have a specific things that we're doing in technology, specific things we doing in energy and efficiency, both domestic and international. So, I would look for higher EBITDA acquisitions that support our existing platforms. "

That tells us revenue recurrence is a goal, and that means more predictable. We like this going forward. But risks are abound.

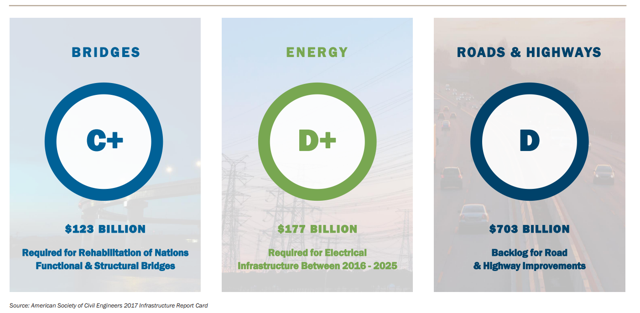

Obviously, if the economy tanks, NV5 along with most other companies are going to get smashed in the face. However, NV5 has particular exposure to two key areas. Government or partial-government contracts account for 2/3 of revenues. Obviously we are dealing with infrastructure so government is at the table. Any significant slow down in government tax receipts or cuts to infrastructure spending. However, this is also a tailwind believe it or not. This is because the infrastructure in the U.S. is absolutely HORRENDOUS.

As such the need to rebuild and revamp the U.S. infrastructure makes any slow down in investment highly unlikely. If anything, government needs to focus spending here and cut elsewhere. That is a winning combo for NV5. We also want to point out that on the commercial side of things, the energy industry is a significant source of revenue. We know it is cyclical. The recent downturn in energy pricing has pin-action hit NV5 because energy companies have to cut their CAPEX and development spending right now. This has impacted NV5’s business. Keep this in mind.

There are also a few initiatives to be aware of. For 2019, NV5 has two specific initiatives that are fully supported operationally. The Energy 2021 initiative is a three-year plan that will capitalize on NV5's core competencies in electrical distribution, gas transmission, and the conversion of natural gas to liquefied natural gas or LNG storage. The acquisition last year of CHI Engineering Services, not only strengthens NV5's competency in this area, but leads to new markets and opportunities. The other initiative for 2019 is a focus on energy optimization. The previous acquisition of Energenz leads to many opportunities in this area. Energenz is a leader in subscription-based services in the area of energy efficiency, and we think this will be a major driver of growth.

Forward expectations

We expect to see another year of growth, however the degree of EPS growth may be below what the Street wanted, at least in terms of the range. Management guided that gross revenues will range from $485 million to $520 million, which represents an increase of 16% to 24% from 2018. In terms of earnings, since the revenue growth lower end looks to be below 20%, which was disappointing to some, we anticipate earnings of $3.60 to $3.90 per share. This is still sizable growth from $3.2 in 2018.

Value

The company need not raise any money any time soon. We know that it did a capital raise recently at $79 buck per share. The market had been punishing the name for that, in conjunction with a weak overall market to end 2018. But with today's collapse, we have a chance to acquire this quality company at a very fair price. All of this has left NV5's share price down 40% from the recent highs. We fully believe that with this new earnings expectation for 2019, the market is really overreacting. We believe this is a compelling risk-reward with NV5 stock now trading a forward p/e of implying a forward P/E of 14.4. These are levels unheard of for forward expectations and is well below the overall market's of 20.5, making it an attractive entry point for the longer term. In the grand scheme of things, the stock has rarely traded this cheaply and last did so in the market breakdown in December. Shares are heading toward support again.

Conclusion

NV5 has plenty of capital following a raise, and has made more acquisitions of late. We believe picking up smaller firms as time goes on is a winning strategy. While government contracts and energy exposure are risky, infrastructure spending is badly needed and the oil markets will turn higher sooner or later. The company guidance disappointed but we believe there is an opportunity to scoop up cheap shares here as EPS will still grow 15%-20%.

Sign up now to take advantage of our 50% discount

Just $38 per month. If you enjoyed reading this column and our thought process you may wish to consider joining the community of traders at BAD BEAT Investing, especially before prices rise.

We pride ourselves on being available all day during market hours to answer questions, and help you learn and grow. If you'd like to learn how to best position yourself to catch rapid return trades, come learn the BAD BEAT Investing philosophy.

- We're a top performing marketplace service.

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

- Start winning today