Another day, another 20% return for BAD BEAT Investors. You read that right. Check out our alert below sent out a few weeks ago to subscribers. You can join NOW, with our Cyber Week Special for $1.08 per day (at the annual rate).

Hell Yes, Sign Me Up (Click Now To Start Winning)

These are exactly the types of alerts that go out 2-3X a week. GET IN THE GAME.

Lumentum holdings (LITE), which is down about 40% from its recent highs after we hit another homerun on it in August. At the time of this writing, is on our radar as a BAD BEAT once again. The big issue is that it took a bit of a lump with earnings, a bit of a lump with market in October, and now is suffering a bit as a pin action play on with what we are seeing with Apple (AAPL), as well as downward guidance revisions in the space from suppliers. THIS is opportunity and our traders need to get on board NOW.

In short, despite some fuzzy guidance following the quarter and the recent "scare" with Apple, we think the data support a share price that should higher. Seemingly the sweet spot appears to be under $40 entry. While we should always be cautious, we like the play.

So, combined with decent technicals, we believe we have another BAD BEAT brewing with LITE on our hands here. The closer this name gets to $50, the more we believe that Lumentum should be considered for a trade by our members. As always we will keep tight stops, but this one could have legs once again, like we saw with our previous two plays. Recall that we first talked about this play when the Oclaro deal looked like it might fall through. That deal has pluses and minuses of its own. We think Lumentum will be fine with or without it. The company announced its acquisition of Oclaro back in March but the ongoing trade-related tensions between U.S and China have led the market to price in some risk. We also know tariff pressures have hit optical names, but it seems once again overdone.

You may have seen this graphic before, but the deal will benefit both companies, and their customers. We would like to see it close even if Lumentum would be fine without it. We like the consolidation as merging companies yields a balanced firm with nearly equal exposure to both optical transmission and optical transport segments. Don't forget a strong high-speed business that has been growing nicely in the last year. This will be an offering of instant growth. We still have the ZTE exposure risk and Oclaro had generated a sizable portion of its revenue by selling components to ZTE so we hope that there are no more issues with US regulators on that front. Either way, we like Lumentum.

The recent issues in the market as well as the Apple pin action pain along with a nice earnings report is creating opportunity here. Guidance was iffy but we will talk about that in a moment. We think this is a mispricing by the Street, once again. As the name falls, we like what we see technically, and from a value in growth names perspective.

There is a lot going on here, but basically from a technical perspective our read is that there is support at $35-36. We view the <$40 zone as BAD BEAT territory here, and think entry in the name here at 36-37 is warranted. Thus, we are recommending a short- to medium- term play here.

Target entry: $36-37

Stop loss:$32

Target exit: $43-$44

Time frame: Weeks

Fundamental discussion

It is important to keep in mind that earnings BEAT on the top and bottom lines and that guidance was considered iffy, but was still strong. So what kind of numbers are we talking here?

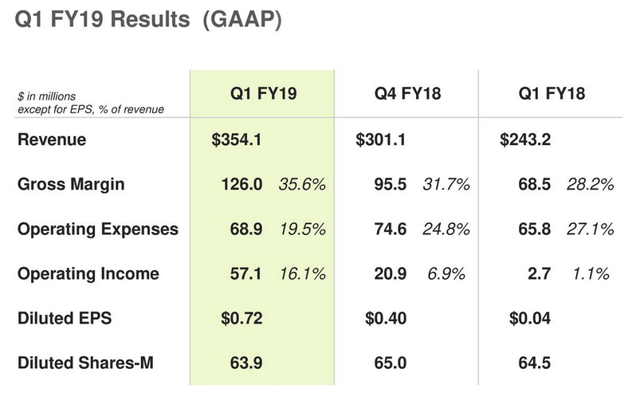

Net revenue for Q1 2019 was $354.1 million, with net income hitting $46.1 million, or $0.72 per share. This is a huge sequential move from Q4 where net revenue was $301 million, and net income was $25.7 million, or $0.40 per share. Compared to last year, revenue was up 45%.

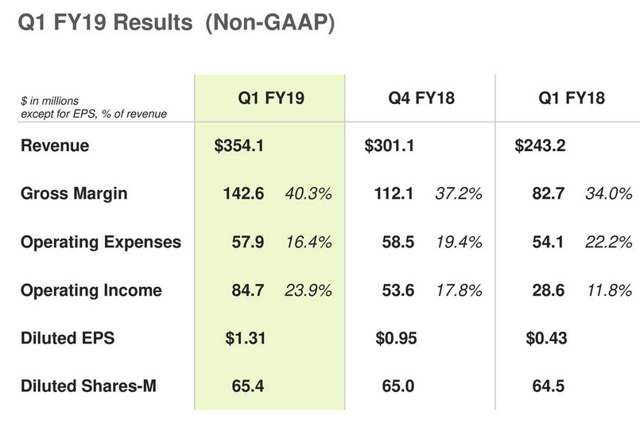

Making some adjustments, we see real strength here, with earnings that were up 40%. Adjusted net income for Q1 2019 was $85.8 million, or $1.31 per share. Adjusted net income for Q4 2018 was $61.9 million, or $0.95 per share. And last year adjusted net income in Q1 2018 was $27.8 million, or $0.43 per diluted share. That is STELLAR growth once again!

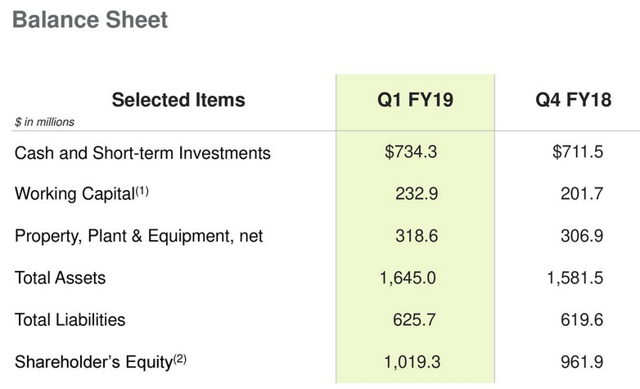

Cash remains solid as the company held $734.3 million in total cash and short-term investments at the end of the quarter. What about that guidance?

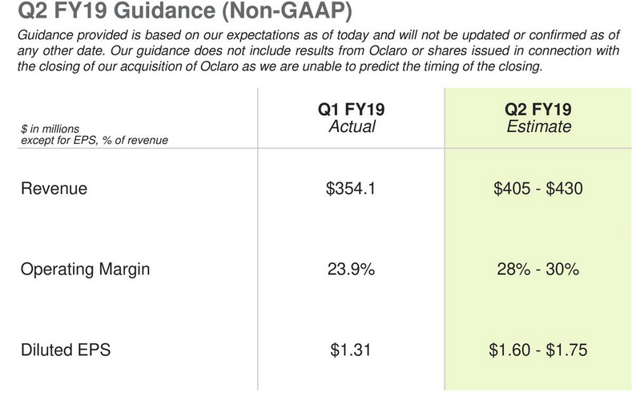

Lumentum forecasts revenue in the range of $405-430 million and EPS ranging from $1.60 to $1.75. The seasonal weakness in Datacom and some growth in fiber lasers will result in sequential revenue up slightly from $354 million. New ROADM products will lead to strong revenue growth in this segment. Admitedly the EPS is wide, but this is once again solid growth. We find it preposterous to see selling at these levels. Even if EPS for the YEAR comes in at a conservative $5, we are just 10 times forward earnings, and frankly we think real earnings will top $6 easily.

Lumentum forecasts revenue in the range of $405-430 million and EPS ranging from $1.60 to $1.75. The seasonal weakness in Datacom and some growth in fiber lasers will result in sequential revenue up slightly from $354 million. New ROADM products will lead to strong revenue growth in this segment. Admitedly the EPS is wide, but this is once again solid growth. We find it preposterous to see selling at these levels. Even if EPS for the YEAR comes in at a conservative $5, we are just 10 times forward earnings, and frankly we think real earnings will top $6 easily.

Folks even with this guidance this would put growth at ~100% again from the prior year.

Bottom line. Shares are cheap, and worth a lot more, we think they can go to $45 in a few weeks.

Be a winner, and get a HUGE Cyber Week discount

Signup now, and pay 60% off the annual rate that other big money traders pay for access to our team.

Literally $1.08 per day. One trade pays for years of the service.

Sign up today, and get information and trades like we provide below several times per week!

Oh, and its FREE to try for two weeks. You in?

YES----> SIGN ME UP BEFORE THE OFFER EXPIRES!

Disclosure: I am/we are long LITE, AAPL.