Below is a trade that we recommended two days ago in our exclusive subscriber only service that returned 11% in two days. We have extended a cyber week special of 60% off ($396 a year, $1.08 per day) for new members who sign up. We have opened just three more slots at this price before the price moves back to $924 annually.

CLICK------>Sure, ill give it a shot (its also free for two weeks).

Here is the trade. BAD BEAT Investing is the top performing

The organic and fresh food options offered by Sprouts Farmers Market (SFM) puts the speciality grocer up against many big name threats, but its a growing name at a reasonable valuation. Their store basis is now in just 19 states---there is so much room for growth here. Shares were already attractive, but today they are on sale over the departure of the CEO.

Amin Maredia, the company’s chief executive officer and member of the board of directors, will transition away from the company on December 30, 2018 to pursue other interests. Jim Nielsen, the company’s president and chief operating officer, and Brad Lukow, the Company’s chief financial officer, will serve as the company’s co-interim chief executive officers until a permanent successor has been named. The current CEO will remain available for a period of time in an advisory role to assist with the transition. This uncertainty has led the Street to panic and sell. We think this is a chance to acquire shares at a discount. Still, we will keep a stop on, just in case.

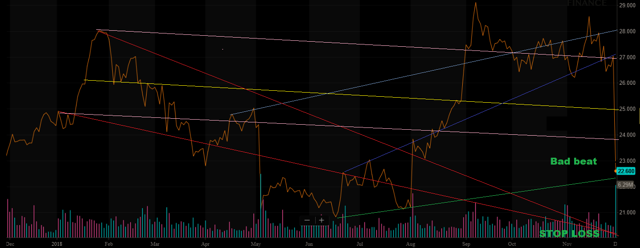

Take a look at the one-year chart:

As you can see there have been several moves higher and lower. With shares looking at a $22 print right now, they are about a point to a point and a half of off the strong support line of $21. We think you can enter here.

As you can see there have been several moves higher and lower. With shares looking at a $22 print right now, they are about a point to a point and a half of off the strong support line of $21. We think you can enter here.

Recommended play

Current price: $22.40

Target entry $21.65-$22.50

Stop loss: $19.95

Target exit: $25-$26

Time frame: days to a week

Fundamental discussion

This is a competitive space but Sprouts has continue to grow. Despite the a ton of competition from much bigger players Whole Foods Market, Fresh Market, and giant grocers expanding their "fresh" offerings, Sprouts has constantly grown comparable sales in the last two years. Not many can sat this. In fact, we saw that lowest comp period was positive 1.1% two years ago.

In Q3, the company delivered a beat versus estimates. Net sales for Q3 2018 were $1.3 billion, a 10% increase compared to the same period in 2017. Net sales growth was driven by strong performance in new stores opened and a 1.5% increase in comparable store sales. We love the growing comps, consistently!

Gross profit for the quarter increased 10% to $382 million, resulting in a gross profit margin of 28.8%, an increase of five basis points compared to the same period in 2017. Net income for the quarter was $38 million while earnings per share was $0.29.

How about so far in 2018? Well, through September, net sales were $3.9 billion, a 12% increase over 2017. Growth has of course been driven by solid performance in the new stores that have been opened and a 2.0% overall increase in comparable store sales. Sprouts opened 30 new stores since the beginning of the year, and plans to continue that pace going forward. Management is also taking into account home delivery when planning new openings. Home delivery is a very small part of the business, but expect this to grow a lot. Net income so far is $146 million and earnings per share are $1.12. Making adjustments, diluted earnings per share was $1.10, an increase of $0.24 or 28%, compared to diluted earnings per share of $0.86 last year. If we stopped there (exclude Q4) the multiple would be 20.5 right now, for 28% growth. But when we factor in Q4, that brings earnings up another $0.16 on a trailing basis, so at $1.26 trailing multiple is 17.8.

Looking ahead? This is where things get interesting. Forget the CEO departure. That matters, but isnt the main driver. SOME firms are saying EPS could be flat in 2019. I do not buy that argument, but the main reason is that the effective tax rate was at about 18% this year and will jump to 25% to 26% next year. The lease accounting rule will require the operating leases to be recorded on the balance sheet with a similar rent expense. The financing leases for 45 stores will be transitioned to operating leases with the reclassification resulting in an increase in rent expense, which is included in EBITDA, and a decrease in interest expense. More importantly, the charges will pull forward expenses. So, in effect, earnings will be hit.

No doubt. But the market KNEW THIS already WELL BEFORE the departure. This was when shares were 28. Now we are at $22.50. Our forecast is for growth beyond 2019. 2019 may see slow 1-2% growth, maybe a little higher. We dont agree it will drop. But even the bears see double-digit growth in 2020. We see growth in 2019 as the company is also expanding its private label offerings.Private label sales represented 12% of revenue, consisting of approximately 2,400 products in 2017. According to commentary in the Q3 call, that number is now 13%, and is only projected to rise. We already know that Q1 2019 will see new stores in Florida, California, and Washington.

We see room for expansion here. Considering that so much of its business is fresh produce, while store brands mainly focus on pre-packaged goods, continued growth will be quite impressive. Not to mention profitable. Private label products come with a higher margin, so that will be a benefit. As 2020 will see double-digit growth, there is a reason to invest, not just trade, though we are targeting the latter.

As such, this selloff is overdone, and we think you can come in and buy the name at $22.45

TRADE RESULT

Be a winner, and at a huge Cyber Week discount. Join a top performing service at 60% off. Just 3 spots left.

Signup now, and pay 60% off the regular annual rate that other big money traders pay for access to our team.

Literally $1.08 per day. One trade pays for years of the service.

What we do for you:

Find beaten-down stocks and profit from their reversals.

Defensive plays discussed in chat in this volatile market

2-3 swing trades a week, monthly deep value plays.

Guided entry and exits.

Oh, and it's Free to try for two weeks.

60% OFF-You Need To Get In The Game!

Are you here to make money? Then what are you waiting for? We are a top performing marketplace service, destroying the averages.

We find beaten down, mispriced stocks, and profit from their reversals. We have several rapid-return trade ideas per week!

Join other winners today. We turn other investor's losses into your gains. Start right now, by subscribing to BAD BEAT Investing.

Join NOW to lock in an annual discount running right now.

Time to get in the game.